Comment

The app for independent voices

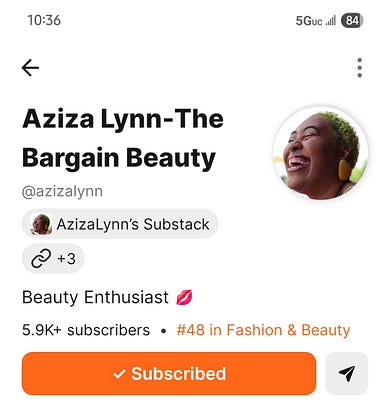

I just released my Sephoria Newsletter yesterday, and this is what I wake up to this morning.

I’m #48 and rising in the Fashion & Beauty space!

I am overwhelmed with all the love and support from each and every one of you! You have no idea how full my heart is!! I can’t wait to give my subscribers the experience of a lifetime!

THANK YOU!!!

Aziza-Lynn

You made it, you own it

You always own your intellectual property, mailing list, and subscriber payments. With full editorial control and no gatekeepers, you can do the work you most believe in.

Great discussions

Join the most interesting and insightful discussions.

Soft doxxing me, hey ;)

And CTC also aussie based. Good group of guys.

2 Likes

Mar 12, 2024

at

3:08 AM