To investors,

Inflation skyrocketed to multi-decade highs over the last three years and many people in the financial community have been warning of a persistently high inflation environment for many more years. That may happen, but what if it doesn’t?

What is a likely alternative situation?

I want to explore that answer today. Starwood Capital CEO Barry Sternlicht was on CNBC earlier this week talking about his views of financial markets through the end of 2023. He highlighted three specific ideas that are worth unpacking — some have been widely held by others, but some may be brand new to you.

2023 Recession

The first idea that Barry shared was his expectation for a recession in the second half of 2023. This is not news to anyone who has been paying attention to various data points over the last year. As Barry pointed out, the savings rate is near historic lows, consumers are running out of money, and prices are unlikely to come back down.

I would add in the fact that wage growth has not kept pace with inflation, so many workers are being paid less today than they were 2-3 years ago in purchasing power terms, and we are starting to see an uptick in layoffs across various industries. Also, there is a weird dynamic where an expectation of a recession may actually help to usher the recession in quicker.

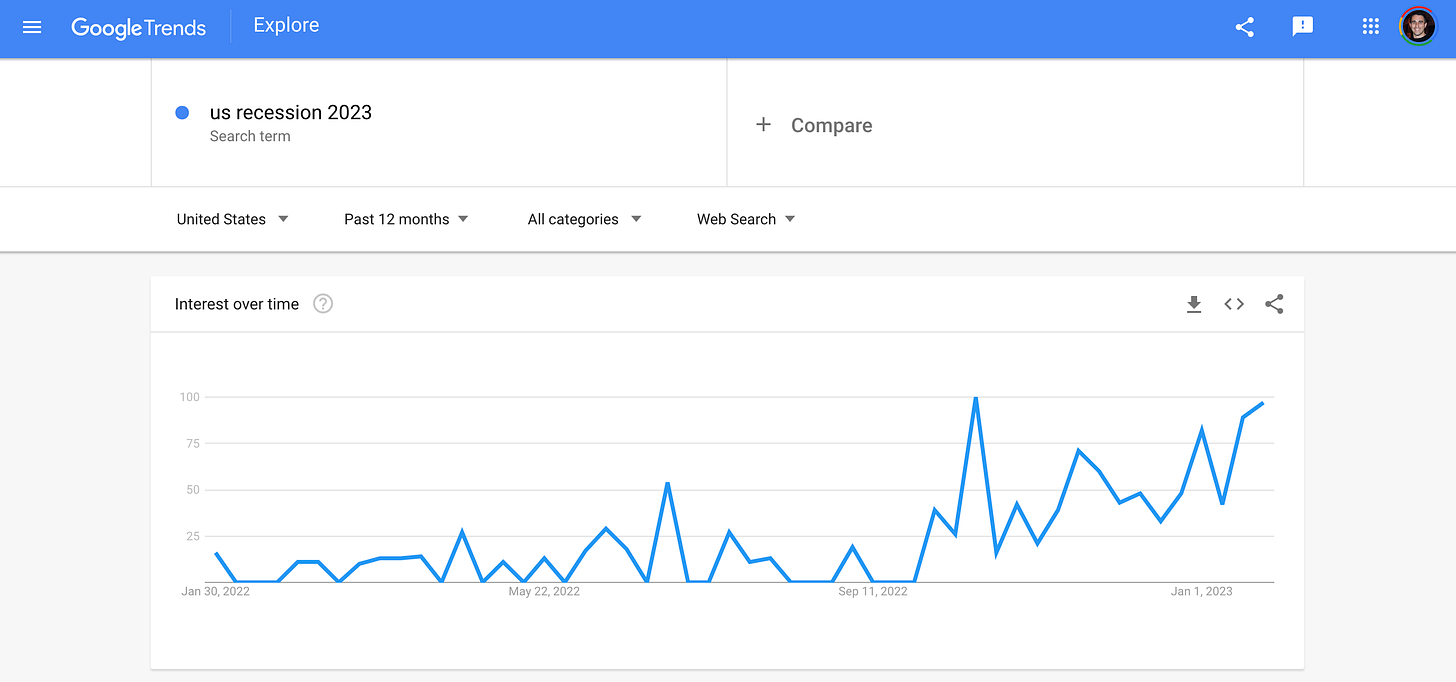

We can see a steady increase in search traffic for “US recession 2023” in recent weeks, which is a proxy for the general awareness of a recession occurring.

The counter-argument is if everyone is expecting a recession, then maybe it won’t happen. I’ll leave it to each of you to decide which camp you are in.

Negative CPI

The second point that Barry made in his conversation was an expectation that inflation would be negative by May or June of this year. My guess is there are few people who have been using this assumption as their base case, so let me unpack what his argument is.

Inflation is the measurement of year-over-year change in the basket of goods measured by the Bureau of Labor Statistics (BLS). Housing (or shelter) makes up about 1/3 of the basket, so it is one of the main drivers of the CPI reading. If house and rent prices go up in a material manner, you can expect CPI to go up materially. The reverse is true as well.

It is important to note that Barry Sternlicht runs Starwood Capital, which has over $100 billion in AUM focused on real estate, so there are few people who are better suited to discuss housing and rent price changes. According to Barry, rents are coming down nationally and he anticipates that metric to look similar to energy prices as they have fallen.

Under that assumption, the falling house and rent prices will pull down the overall CPI number at a rapid pace. His argument that we will see negative CPI by the end of Q2 2023 is dependent on this falling CPI number combined with the high CPI numbers we saw in the summer of 2022. Remember, year-over-year change is much easier to produce volatility in CPI measurements on the upside and the downside. Base effects are a real thing!

🚨 The rest of this letter is only available for paying subscribers to The Pomp Letter. Their support makes this work possible. If you’re not a subscriber, consider subscribing to read the rest of this letter and help us continue to create independent work on financial markets 🚨