TLDR: Yesterday’s decision to extend again the Ukraine War fuel tax cut of 25c/litre was portrayed by the Labour Government as it focusing on ‘bread and butter’ issues to help those most stressed by ‘cost of living’ issues associated with high inflation, which sounds true on the face of it.

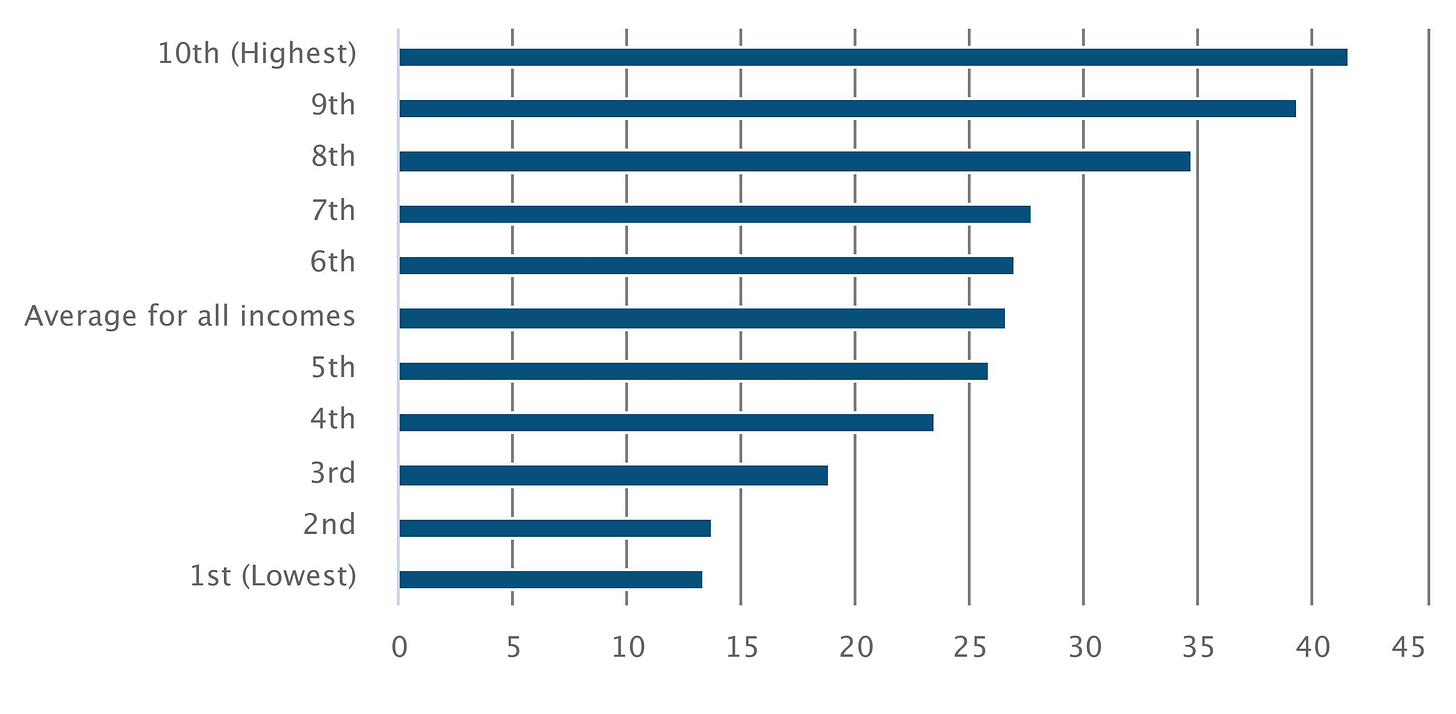

The problem is the $2 billion of cash benefits the policy has now ballooned to are actually distributed mostly to the rich, as Infometrics Economist Brad Olsen pointed out last night in a research note and demonstrated with a chart included below.

PM Chris Hipkins refused again yesterday to consider removing GST on food and was also non-committal on questions about increasing incomes for the poorest by lifting benefits and extending and improving Working For Families to allow more families with children (including beneficiaries) to keep more cash, especially when their working incomes rise to levels where marginal tax rates sometimes approach 100%.

Elsewhere in the news overnight and this morning in Aotearoa’s political economy, geo-politics and the global economy:

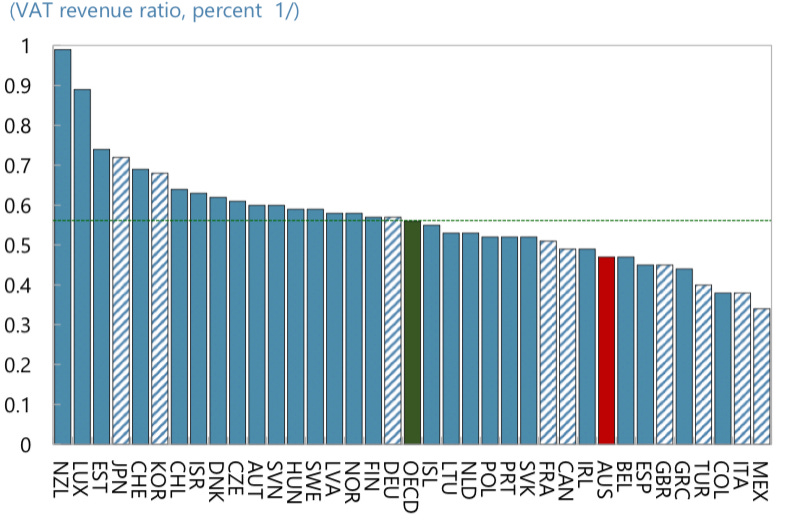

The IMF highlighted Aotearoa’s status as having the most punitive GST rate in the world, covering more products than any other and collecting a bigger share of GST than any other (see more in Charts of the Day below);

Transport and Auckland Minister Michael Wood appeared to waver on his backing for Auckland’s ‘Light’ Rail line from the CBD to Mangere, saying only in an interview the project was part of Hipkins’ review of ‘unnecessary spending right now’ and he was “in general, committed to high quality public transport”;

there was fresh news overnight of easing inflation pressures in the world’s largest economies, with data showing the Eurozone’s annual inflation rate fell to 8.5% in January from 9.2% in December, which was also lower than economists’ forecasts for around 9.0%;

The US Federal Reserve just announced another slowing of its monetary policy tightening with a 25 basis point hike in its Federal Funds Rate (Official Cash Rate) to a range of 4.5% to 4.75% (ahead of NZ now on 4.25%) as inflation pressures in the world’s largest economy are easing back; and,

in another sign of easing pressure on interest rates and a precursor to a potential rebound in house prices after a potential change of Government, ANZ cut its mortgage rates overnight to reflect recent falls in wholesale mortgage rates linked to easing inflation pressures here and overseas. Almost all economists now expect the Reserve Bank to ease its rate hike back to 50 basis points (4.75%) on February 22 from 75 basis points on November 23 last year, with a peak of 5.0-5.25% by the middle of 2023.

Paying subscribers can see more detail and analysis on the fuel tax cuts, the IMF’s GST analysis and Michael Wood’s Light Rail comments below the paywall fold and in the podcast above.

Labour gives cash to the rich, rather than the poor & climate

If anyone is wondering why Governments of both flavours love inventing new forms of middle class welfare (interest free student loans, fees-free tertiary education, KiwiSaver grants, first home buyer grants and tax threshold increases), it’s always, always worth knowing about how they have to appeal to a relatively small group of voters in the middle of the electoral spectrum. This group of ‘median voters’ includes the 10-15% of the electorate who are mostly older homeowners living in stand-alone homes with two cars in the driveways of the outer suburbs of our largest cities and throughout our provincial towns.

Median voters like:

their residential land prices rising, which is how they get rich and save for their retirements, rather than via their jobs and small businesses;

their mortgage rates falling, which give a double whammy benefit because that often drives up land prices too; and,

plenty of cheap petrol and diesel to drive themselves and their families to schools, shops, playgrounds and beaches, preferably in a double cab ute with a jetski in the back.

This cohort:

thinks benefit increases and easier sanctions on beneficiaries are an undeserved reward for those who aren’t ‘hard-working kiwis’ like them and it’s not fair their tax money goes to people who don’t work and haven’t saved hard enough to buy their own homes;

reflexively distrusts suggestions of tangata whenua regaining control or even partial ownership of Government or other assets, let alone having a say over access to beaches, parks and fishing spots;

thinks the Government and the unseen bureaucrats in Wellington are wasteful, overpaid and smug parasites who feed off the real creators of wealth in the suburbs and provincial towns, especially outside of the Auckland and Wellington CBDs, and inside the South Island; and,

just want the Government to stop telling them how fast to drive, where to drive, what to drive, where to live, how to live, whether and where to be locked down, and what type of barbecue they should have, because all they want to do is get on with their lives.

Median voters often loathe:

cyclists using up perfectly good lanes that cars, utes and trucks need;

‘tenants from hell’ who have to be screened out, cleaned up after and insured for;

policy advisers, parking ticket inspectors and ‘losers’ who have to use public transport instead of their own cars, in which plenty of time can be spent listening to Mike Hosking.

Appealing to Ford Ranger Man

In other countries, these target-rich cohorts of swinging voters are given labels such as ‘Mondeo Man’, ‘White Van Man,’ ‘Soccer Moms’ and ‘Little Aussie Battlers.’ Here, the easiest shorthand is ‘Ford Ranger Man’.

You get the picture. This is a broad-brush picture of the group that both main parties appeal to or are afraid of in equal measure.

It’s why the Labour Government has repeatedly refused to carry out all the recommendations of its own Welfare Experts Advisory Group (WEAG) to much-more-significantly increase benefits, remove sanctions and widen accessibility to Working For Families, as well as reforming WFF to make it much more widely available to beneficiary families and updating the Accommodation Supplement to reflect rents now, rather than from five years ago, when they were last adjusted after an 11-year freeze.

It’s the reason why Labour, fearing a loss to Don Brash’s National Party in the 2005 election, pulled interest-free student loans out of the hat just weeks before the election and introduced Foreshore and Seabed legislation to dampen fears beaches would become off limits;

It’s the reason why National doubled grants for first home buyers before the 2014 election to dampen concerns about the effects of the Reserve Bank’s (then) new Loan to Value Ratio restrictions, which reduced the amounts first home buyers could borrow;

It’s the reason why National has never repealed Working For Families, interest-free student loans and has protested only weakly against fuel tax cuts and last year’s one-off ‘cost of living’ payments.

It’s the reason why both parties have shied away from (and are again) massively increasing public investment and subsidies for public transport, largely because that spending comes from the taxes paid by ‘Ford Ranger Man’ on fuel and initially designed to fund road maintenance, rather than busways and rail tunnels;

It’s the reason why National’s ‘Ute Tax’ attack on the clean car fuel rebate was so effective, along with Groundswell’s protests last year against the ‘ute tax’ and co-governance; and,

It’s the reason why both parties have shied away from taxing capital gains on residential land and instead focused tax reform on gathering more from consumption taxes (which hurt the poor proportionally more than the rich) and PAYE taxes, which are also paid mostly by those at the bottom-to-middle ends of the income spectrum, especially after income from capital gains on land and house sales are taken into account.

Pulling up the ladder and kicking down

So what we repeatedly see, especially when under pressure, is National and Labour Governments that default to giving tax cuts and other benefits to middle income earners, and/or keeping them after the other side does them, and which ‘kick down’ at those on the lowest incomes, either directly through action, or by inaction on benefit levels, sanctions and tax credit structures once in power.

That is the context in which to view yesterday’s announcements about another $718 million in spending on fuel tax cuts, increasing the total lost revenue since March to over $2 billion.

Here’s Infometrics Economist Brad Olsen giving the Government both barrels.

“It’s extremely dumb economic policy from the new PM. Extending the fuel tax subsidy gives three times as much help to the top income decile, who don’t need it, compared to the bottom income decile, who need the help the most.” Infometrics CEO Brad Olsen via Twitter.

Here’s the chart to prove it from Brad.

Fuel tax cut distribution favours highest earners

Estimated monthly fuel cost savings per household, by income decile

A very wobbly rail commitment

New PM Chris Hipkins has already previewed that some of the Government’s projects and programmes would be dropped or delay to focus on the ‘here and now’ of ‘bread and butter’ cost of living issues. It appears the Auckland CBD to Airport rail line, which was on the verge of a green light, is in the firing line, as Glenn McConnell reported late yesterday for Stuff.

“We are undertaking a stocktake about how we move things forward. We will be able to confirm the direction in a couple of weeks.” Transport and Auckland Minister Michael Wood

He said he did want to focus on fixing Auckland congestion and said public transport, even if it wasn’t light rail, would be a priority.

“The scale of Auckland in terms of population and economic activity means that if we do well in Auckland, the whole country will be better off. For example, we currently lose about $2 billion worth of economic activity every year because of the congestion in Auckland.”

Asked if he was still committed to Auckland Light Rail, Wood said the Government was “in general, committed to high quality public transport”.

Reading between the (rail) lines, this looks like another delay is coming to focus on debt reduction, taking pressure off inflation and dragging mortgage rates down.

Ironically, they’re already falling. ANZ cut its 18 month to five year mortgage rates overnight by 29-55 basis points, with its main ‘special’ being its 18-month rate at 6.59%, down from 6.84%. ANZ’s move follows cuts to longer term rates by ASB and Kiwibank last week. Here’s the Stuff article reporting on the cuts. It is currently the most popular story on Stuff.

It is music to the well-tuned ears of Ford Ranger Man, through the Android Auto or Apple Carplay.

Charts of the day

Aotearoa’s GST burden - These IMF charts from its review released overnight of Australia’s economy and tax systems shows how NZ has the most comprehensive GST in the world, which collectives the highest share of GST in the world. Australia’s is much lower, in large part because it does not collect GST on food. The IMF would like Australia to be more comprehensive.

Ka kite ano

Bernard

Dawn Chorus: Classic middle class welfare to win 'Ford Ranger Man'