In brief

- Bitcoin-backed Ethereum token tBTC launches today—again.

- Unlike other cross-chain protocol or bridges, tBTC claims to be decentralized, with unprecedented levels of security.

- It aims to offer the safest way yet for Bitcoin holders to access DeFi on Ethereum, and earn on their investment.

We do the research, you get the alpha!

Bitcoin-backed Ethereum token tBTC gets its long-awaited release today. Thesis, the developer of the Keep Network and tBTC, claims it offers the safest way yet for holders of the world’s most popular cryptocurrency to access Ethereum’s $8 million Decentralized Finance (DeFi) sector, and earn on their investment.

The San-Francisco venture studio has taken a polar approach to the live-fast, die-young mantra that’s seen many a promising, young DeFi project fail. Only now—after one failed launch, three audits, and months in development—does Thesis CEO Matt Luongo consider that the project is safe enough to have achieved its most important metric.

“It's really about not just bringing Bitcoin to Ethereum, but also Bitcoiners to Ethereum and doing that in a way that's consistent with their values of decentralization,” he told Decrypt on a recent call.

Some would say it’s an obtainable goal, but Luongo sees it as a huge opportunity to bring more functionality to Bitcoin, without sacrificing security, and to unite two warring tribes—no mean feat.

Bridging the chasm between Bitcoin and Ethereum

As the amount of Bitcoin transferred to Ethereum has increased, so too have concerns regarding centralization, and the role played by the three top transfer solutions.

There are plenty of projects that enable a bridge between Bitcoin and Ethereum, with many people already using them. Over 100,000 Bitcoin, or roughly $1 billion, is locked up in Ethereum, at the time of writing—mainly on wBTC, another so-called cross-chain protocol or bridge.

Ethereum co-founder Vitalik Buterin is among those who have called for better security. “I continue to be worried about the fact that these wrapped BTC bridges are trusted,” he tweeted last month.

I continue to be worried about the fact that these wrapped BTC bridges are trusted.....

I hope that they can all *at least* move to a decently sized multisig

— vitalik.eth (@VitalikButerin) August 17, 2020

Like its rivals, tBTC allows users to “mint,” or exchange Bitcoin, for a replica or wrapped token, pegged to the value of the original coin. The resulting Ethereum-compatible ERC-20 token can be used on DeFi platforms—to unlock lending on Compound and MakerDAO, for instance, or to tinker with high-yield meme tokens.

What distinguishes tBTC from most of its competitors is the lack of third-party custodians, as is the case with wBTC, or a centralized exchange, like HBTC (which is controlled by Singapore based Huobi).

“This is an opportunity to unify our narratives. Bitcoin is hard money, but Ethereum is trying to replace retail banks. Those things go very well together."

Over $24 million is already locked in the network, waiting for the tBTC launch, according to Thesis, and Luongo said the demand for a trustless alternative is huge.

“We don't want to put user funds at risk or hold a wallet that we control and that the team can potentially censor,” he said. Thus, tBTC has funds distributed across many so-called “KEEP signers,” as he refers to those that hold the protocols “work token,” KEEP.

“People are staking and running the bridge and holding small amounts of Bitcoin and they're bonded. And so if there's misbehavior, you have guarantees,” he said. “It’s really important to actually have some economic guarantees beyond just reputation.”

A $193 billion opportunity

Crypto analytics firm Messari is among those who have pointed out the extent of the opportunity at stake. The amount of Bitcoin that’s been tokenized to date represents but a tiny percentage of the dominant cryptocurrency’s $193 billion market cap—even a fraction more would be a major catalyst for an emerging DeFi market.

Thesis and Luongo are no strangers to crypto, and are behind Bitcoin rewards platform, Fold. tBTC has the support of dozens of industry partners, and The Keep project has now raised a total of $22 million to launch tBTC, from investors such as Paradigm and Andreesen Horowitz.

But Luongo is proceeding with caution. tBTC got off to a shaky start when its first launch attempt failed after two days—undone when an untested type of Bitcoin transaction was introduced into the codebase. “We paused new deposits. And so not a cent was lost,” said Luongo, adding that while it was frustrating, he was happy with the result.

Thus today’s tBTC has been designed with initial supply caps—so there’s no expectation of a huge, initial flood of Bitcoin into tBTC. Safety is paramount.

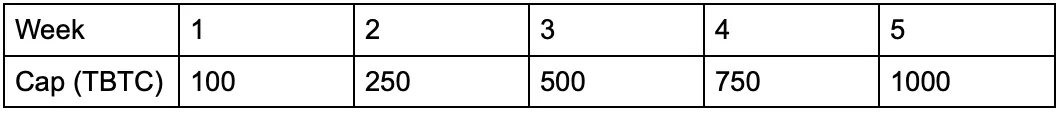

In the first week, there is a cap of 100 tBTC, which gradually increases to 3000 in the ninth week. The cap will then be lifted. Like Bitcoin, there’s a 21 million supply limit.

“Obviously, the market would love to just put in as much Bitcoin as possible. And I get it. I mean, I'm excited. I have my own Bitcoin. I want to get loans against and trade within Ethereum. But I think it's really important that we do this carefully. And that means sacrificing growth for security,” said Luongo.

Bitcoin and its immutable design have been hugely influential, said Luongo. With an immutable release, there are few ways to improve or upgrade the system after launch, he explained.

The project also has limited governance functions, so, unlike many DeFi projects, there will be no team, or multisig holders, who will continue to upgrade the contracts and only later pass control to token holders.

“Allowing this whole system to be governed by a majority token vote, that’s terrifying,” said Luongo. “I don't want the majority to choose what happens with my money. And so for that reason, we really have to get it right.”

To entice users to try the token, tBTC liquidity is being bootstrapped right now. This gives the project freedom to distribute tokens, “as we go,” said Luongo. A stake drop is happening shortly after launch, and will distribute 20 percent of the token supply. Another five percent is going to liquidity rewards, he said.

To complement the safety-first theme, there’s also a built-in insurance component. Insurance provider Nexus Mutual will be onboard at launch, with others invited too. KEEP will be used to incentivize insurance and ensure that users who want cover can get it for a good price, said Luongo.

Built by a Bitcoiner for Bitcoiners

Luongo claims to be a Bitcoiner, “I do lean right with my fiscal philosophy,” he said, while admitting that, like many Ethereans, he’s a technological optimist. But is he up to such an enormous challenge?

“Our industry has been desperate to bring more functionality to Bitcoin without sacrificing its core properties of censorship resistance and trustlessness. After years of failed attempts by other projects, it looks like tBTC has finally unlocked it,” said Spencer Noon, head of investment firm DLT Capital. He credits Luongo as one of only a handful of people with the understanding and technical ability to build tBTC.

tBTC might be the most important project to launch on Ethereum in 2020

If you’re hacking at @EthereumDenver or a crypto curious dev — get your hands dirty with the code!

I can’t wait for #bitcoin to officially join #DeFi, and the ridiculously cool dapps that are about to emerge https://t.co/KOEUbvk4z6

— Spencer Noon (@spencernoon) February 14, 2020

Paradigm co-founder Fred Ehrsam, who also co-founded Bitcoin exchange Coinbase, has called tBTC a credible attempt.

Luongo is all too aware of what he’s up against. As “money maximalists,” many Bitcoiners won’t welcome an asset that competes with Bitcoin as a store of value, he admitted. But he doesn’t believe, like some, that the two blockchains are mutually exclusive.

“This is an opportunity to unify our narratives. Bitcoin is hard money, but Ethereum is trying to replace retail banks. Those things go very well together, so let's align and fight the status quo rather than each other,” he said. “My great dream is to actually see big winners play with this new tech. And maybe we'll all do more together. That's my hope.”

Luongo is also keen to eat his own dog food; he’s happy to put his own Bitcoin into tBTC. “I'm going to put it all in,” he said emphatically. “I want to have skin in the game, like I need to keenly feel user pain. And the best way to do that is to be a user, to be in the same boat.”

It’s undeniable that, with tBTC, Thesis and Luongo have pulled out all the stops. They’ve produced an open-source, decentralized, incentivized, insured, thrice-audited protocol that replicates Bitcoin holdings on Ethereum and spits out liquidity rewards, as well as other benefits.

If it succeeds, tBTC could stand beside Bitcoin—a lasting legacy. Just don’t say anything about blowing up bridges.