Physik Invest’s Daily Brief is read by thousands of subscribers. You, too, can join this community to learn about the fundamental and technical drivers of markets.

Administrative

Your letter writer has returned after a period of travel. Now, there is a lot of content to cover, so we’ll give it a good shot today and fill in some of the missing points over the coming days. Thanks!

Fundamental

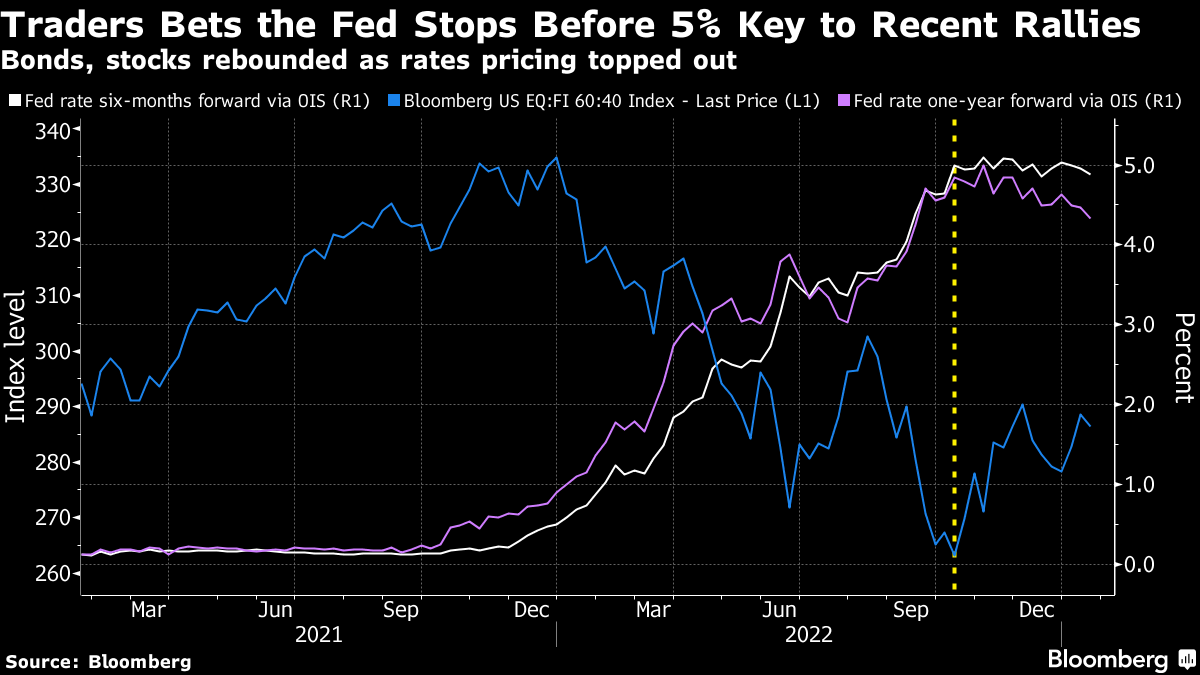

At its core, the expectation is that the US economy will fall into recession in the first half of 2023, and traders are betting policymakers will reverse in the second half of the year. This, in part, has boosted the S&P 500 (INDEX: SPX) over the past weeks.

However, many strategists think there is little reason for the policymakers to reverse course, and that will not be good for the markets.

As a recap, recall our past letters featuring the likes of Kai Volatility’s Cem Karsan and Credit Suisse Group AG’s (NYSE: CS) Zoltan Pozsar. The inflation conversation began when authorities cut rates and bought bonds, while money was sent to people.

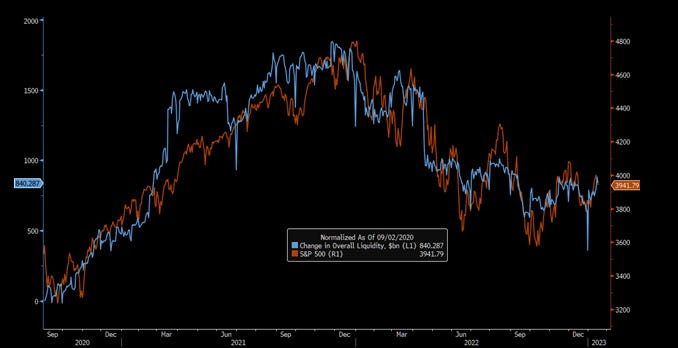

Risk assets were the first to respond; it was easier to borrow and make bets on ideas with a lot of promise in the future. As the economy reopened and demand picked up, supply chains tightened, and prices in the real economy inflated.

As argued by Pozsar, Andy Constan, and Joseph Wang, inflation likely trends higher for longer. Trends in de-globalization, supply chain chokepoints and restructuring, and a large credit boom in the banking sector are among the factors to blame.

Policymakers will continue generating negative wealth effects. Collateral damages to the economy (e.g., Alphabet Inc [NASDAQ: GOOGL] [NASDAQ: GOOG] and Spotify Technology SA [NYSE: SPOT] layoffs) are expected, consequently.

Moreover, per Andreas Steno Larsen, markets likely bottoms in the middle of 2023.

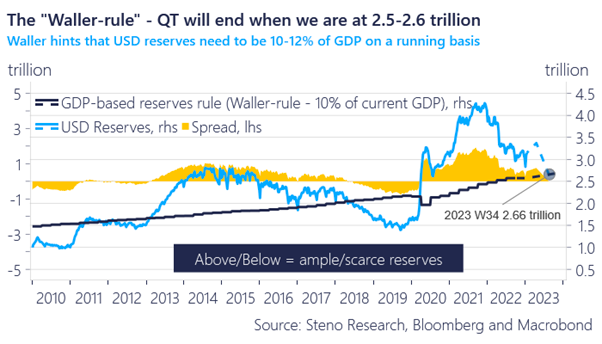

“[Christopher] Waller said that the QT process will either have to slow or come to a complete halt if the amount of USD reserves is equal to 10-11% of USD GDP, which is around 2.5 trillion USDs relative to current GDP (but rising over time obviously).”

Because we have more than $3 trillion USD in the system, and “more to be added due to the debt ceiling, we need a withdrawal of another $5-600 billion before QT will end [or] slow in between weeks 34-40 on our calculations,” Steno Larsen added, noting that if GDP flatlines, that would help keep QT running for longer.

“If the Fed is willing to bring reserves down to 10% of GDP, we should expect S&P 500 to bottom around $3,250.00 in the second half of the year,” Steno Larsen said. “The Waller Rule is not good news ultimately, but for now let’s enjoy the liquidity added in February and March due to the debt ceiling. When a debt ceiling deal is signed, run for the hills.”

Technical

As of 7:15 AM ET, Monday’s regular session (9:30 AM – 4:00 PM ET), in the S&P 500, is likely to open in the middle part of a balanced overnight inventory, inside of prior-range and -value, suggesting a limited potential for immediate directional opportunity.

Our S&P 500 pivot for today is $3,988.25.

Key levels to the upside include $3,998.25, $4,011.75, and $4,019.00.

Key levels to the downside include $3,979.75, $3,965.25, and $3,949.00.

Click here to load today’s key levels into the web-based TradingView platform. All levels are derived using the 65-minute timeframe. New links are produced, daily.

As a disclaimer, the S&P 500 could trade beyond the levels quoted in the letter. Therefore, you should load the above link on your browser for more relevant levels.

Definitions

Volume Areas: Markets will build on areas of high-volume (HVNodes). Should the market trend for long periods of time, it will be identified by low-volume areas (LVNodes). LVNodes denote directional conviction and ought to offer support on any test.

If participants auction and find acceptance in an area of a prior LVNode, then future discovery ought to be volatile and quick as participants look to HVNodes for favorable entry or exit.

POCs: Denote areas where two-sided trade was most prevalent in a prior day session. Participants will respond to future tests of value as they offer favorable entry and exit.

MCPOCs: Denote areas where two-sided trade was most prevalent over numerous sessions. Participants will respond to future tests of value as they offer favorable entry and exit.

About

In short, an economics graduate working in finance and journalism.

Capelj spends most of his time as the founder of Physik Invest through which he invests and publishes daily analyses to subscribers, some of whom represent well-known institutions.

Separately, Capelj is an equity options analyst at SpotGamma and an accredited journalist interviewing global leaders in business, government, and finance.

Past works include conversations with investor Kevin O’Leary, ARK Invest’s Catherine Wood, FTX’s Sam Bankman-Fried, Lithuania’s Minister of Economy and Innovation Aušrinė Armonaitė, former Cisco chairman and CEO John Chambers, and persons at the Clinton Global Initiative.

Contact

Direct queries to renato@physikinvest.com or Renato Capelj#8625 on Discord.

Calendar

You may view this letter’s content calendar at this link.

Disclaimer

Do not construe this newsletter as advice. All content is for informational purposes.