The once-every-five-years leadership transition in China’s party-state regularly follows a two-step process — the first occurring in the ruling Chinese Communist Party (CCP) and the second involving the government. This past October, Xi Jinping cemented his strong control over the top echelons of the CCP at the 20th Party Congress. Loyalty to Xi was clearly the first and most important criterion for elite promotion, as demonstrated by the makeup of the Politburo and Politburo Standing Committee.

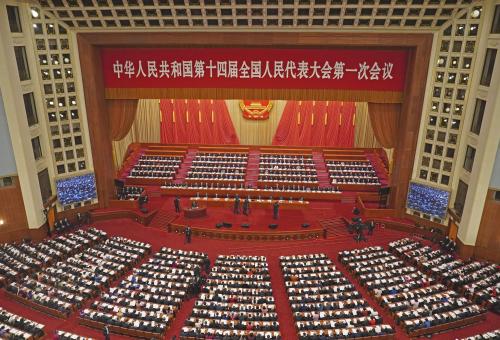

This past weekend, the new National People’s Congress (NPC), China’s legislature, began its first annual session. This eight-and-a-half-day-long meeting will conclude with the announcement of the president and vice president of the People’s Republic of China and appointees to the new State Council, the executive branch of the central government. Xi will serve his third term as president, and Han Zheng, former executive vice premier of the State Council, is expected to become vice president.

Public attention will focus on the composition of the State Council. Led by an “Executive Committee” of 10 officials, the State Council manages 31 provincial-level administrations and 26 constituent ministries. While China’s ultimate decisions undoubtedly rest with the Politburo, the State Council is usually given a certain amount of leeway to determine the implementation of policy, especially in economic matters. It is widely expected that the new Executive Committee will consist entirely of first-timers to this leadership body, marking the largest turnover in its history (See Table 1).

With such a drastic change in the leadership of the State Council, China watchers around the world understandably will be interested in exploring the political and policy implications of this leadership team. Notably, there is some widely circulated “conventional wisdom” regarding personnel trends in Xi’s third term.

Namely, 1) Xi is surrounded by “yes men”; 2) the new leadership is preoccupied with state security and social stability over economic issues; and 3) policy priorities in Xi’s third term focus on the development of state-owned enterprises (SOEs) at the expense of the private sector. These views have truth to them, but they should be subjected to a more balanced and foresighted analysis. A discussion of the new State Council’s composition can shed valuable light on the nuanced and paradoxical nature of Chinese leadership.

Perception #1: Xi Jinping is surrounded by “yes men.”

Loyalty to Xi is a requirement for promotion, and many of the members of the State Council have longstanding ties to him. Li Qiang, the next premier, has worked with Xi for decades. During Xi’s tenure as party secretary of Zhejiang, Li, a native of Zhejiang, was Xi’s aide and chief of staff in the provincial party committee. Similarly, Ding Xuexiang was chief of staff to Xi when he was party secretary of Shanghai. Ding moved with Xi to Beijing and continued to serve as Xi’s top aide. Wang Xiaohong, the current minister of public security, was a high-ranking member of the police bureau in Fuzhou when Xi was a top leader there. Vice Premier He Lifeng’s relationship with Xi dates back four decades to when they worked together in Xiamen. His political advancement over the past decade can be largely attributed to their patron-client ties.

However, other State Council members’ ties to Xi are less direct — some of them are “protégés of Xi’s protégés.” State Councilor Chen Yiqin spent her previous career entirely in Guizhou and worked directly under Li Zhanshu, a former Politburo Standing Committee member and staunch ally of Xi. State Councilor and Secretary-General Wu Zhenglong is notably associated with Li Qiang, who was the party secretary of Jiangsu while Wu was governor. Every member of the State Council will be within Xi’s circle of trust, but each member differs in their degree of loyalty. New factions and new splits between loyalists will arise as they compete to fulfill Xi’s priorities.

Additionally, since Xi has surrounded himself with people whom he considers deeply trustworthy, he is more likely to give them room to maneuver, implement experimental policies, and make their own governance decisions. Moreover, one may argue that elite recruitment in China, while not primarily driven by meritocracy, rarely allows inept officials to reach its highest ranks. Ding Xuexiang, Liu Guozhong, Zhang Guoqing, Wu Zhenglong, and Li Shangfu are all highly capable technocrats who attended China’s most prestigious universities. It is premature to assume these new leaders will not affect major changes in the years to come; after all, Xi himself was once considered a “yes man” before becoming the top leader in 2012.

Perception #2: The new leadership is preoccupied with state security and social stability over economic issues.

In his October report to China’s leadership, Xi mentioned “security” 91 times and “economy” only 60 times. In an increasingly unstable international environment, or in Xi’s words, at a time of “dangerous storms,” intelligence and national security have risen in importance given Beijing’s perception that the West is attempting to constrain China.

The makeup of the State Council reflects the renewed focus on state security and sociopolitical stability. Half of its members have a security or military background, including Wang Xiaohong, who spent his entire career in the public security apparatus. The executive vice premier’s portfolio has previously been mostly economic, but Ding does not have extensive experience in economic affairs; rather, he is a member of the National Security Commission.

However, most members of the incoming State Council have extensive provincial-level economic leadership experience. In China, social stability and economic issues are firmly intertwined, and an economic issue can quickly undermine national security. Most protests in China are related to economic situations. For example, there are approximately 117,000 protests against land seizures every year. China’s economic growth rate for 2022 was 3%, a far cry from the 8% to 10% growth to which the Chinese middle class has become accustomed.

Xi recognizes the interconnectedness of these issues — in the past few months, important changes and adjustments have been made to China’s economic policies. In his December speech to the Central Economic Work Conference, Xi called for “stronger support from financial institutions for micro and small businesses.” The government has taken steps to support the crumbling real estate sector, including encouraging local governments in most regions to invest in property development. Additionally, the softening of regulatory oversight of the technology and the private education sectors has also reflected these policy adjustments and the greater need to stimulate the economy.

Perception #3: Xi’s third term focuses on the development of SOEs at the expense of the private sector.

Compared to previous State Councils, this slate of leaders has a strong background in the defense industry. Four of the members of the State Council can be classified as “defense industry technocrats” who have had substantial leadership experience in China’s military-industrial complex or military-civilian fusion. Zhang Guoqing spent most of his career working as a corporate executive at the military SOE Norinco Group. Liu Guozhong and Wu Zhenglong have educational backgrounds in military engineering, and Wu was later head of the General Office of the industrial SOE Sinomach. Moreover, these expected appointees are not only technocrats, but technocrats with management experience who have excelled in SOEs.

However, in addition to defense industry technocrats, the State Council is stacked with appointees with both high-level and substantial experience with the economy, including private sector development. Li, Ding, He, Zhang, and Wu all were provincial leaders in Zhejiang, Jiangsu, Fujian, Tianjin, or Shanghai, coastal economic powerhouses and some of the most private-sector-dominated provinces in the country. These areas’ local and provincial leaders typically make many economic decisions and are well-versed in policy, especially when they are subnational officials.

Li and Ding, the “top two” in the State Council, came to power through the Shanghai party apparatus. Shanghai is known as one of China’s most cosmopolitan and foreign-trade-heavy regions, and leaders from Shanghai typically maintain close relationships with the private sector and foreign firms. While party secretary of Shanghai, Li made a deal with Tesla to open the first foreign car factory in China that was not required to partner with a Chinese company, and he’s been an outspoken advocate for additional foreign investment. The State Council’s balance of leadership experience in both industrial policy and market reform ensures that SOE development, while a priority, may not necessarily come at the expense of the private sector.

Yet Xi’s assumption of full control of the party-state has created a vulnerability: He and his handpicked leaders must deliver on their promises. Xi will be lauded for his accomplishments and blamed for his failures. To escape the middle-income trap, China’s leaders will strive toward the goal of “common prosperity” — primarily to enhance the Chinese middle class. This drive can potentially stimulate China’s “three engines of growth,” namely, investment, consumption, and foreign trade, each of which has recently faced challenges.

The State Council’s new leadership will be vigorously tested in the coming months and years as to whether it can successfully frame “common prosperity” as neither anti-market or anti-growth. Rather, China’s emphasis on domestic economic growth and support for the middle class necessitates market dynamics and openness. There’s more going on in China’s leadership than conventional media caricatures suggest; the outlines of the new State Council may be visible, but the picture has not yet been painted.

Commentary

China’s new State Council: What analysts might have missed

March 7, 2023