REPORT on the proposal for a regulation of the European Parliament and of the Council amending Regulation (EU) No 575/2013 as regards requirements for credit risk, credit valuation adjustment risk, operational risk, market risk and the output floor

9.2.2023 - (COM(2021)0664 – C9‑0397/2021 – 2021/0342(COD)) - ***I

Committee on Economic and Monetary Affairs

Rapporteur: Jonás Fernández

DRAFT EUROPEAN PARLIAMENT LEGISLATIVE RESOLUTION

on the proposal for a regulation of the European Parliament and of the Council amending Regulation (EU) No 575/2013 as regards requirements for credit risk, credit valuation adjustment risk, operational risk, market risk and the output floor

(COM(2021)0664 – C9‑0397/2021 – 2021/0342(COD))

(Ordinary legislative procedure: first reading)

The European Parliament,

– having regard to the Commission proposal to Parliament and the Council (COM(2021)0664),

– having regard to Article 294(2) and Article 114 of the Treaty on the Functioning of the European Union, pursuant to which the Commission submitted the proposal to Parliament (C9‑0397/2021),

– having regard to Article 294(3) of the Treaty on the Functioning of the European Union,

– having regard to the opinion of the European Central Bank of 24 March 2022,[1]

– having regard to the opinion of the European Economic and Social Committee of 23 March 2022,[2]

– having regard to Rule 59 of its Rules of Procedure,

– having regard to the report of the Committee on Economic and Monetary Affairs (A9-0030/2023),

1. Adopts its position at first reading hereinafter set out;

2. Calls on the Commission to refer the matter to Parliament again if it replaces, substantially amends or intends to substantially amend its proposal;

3. Instructs its President to forward its position to the Council, the Commission and the national parliaments.

Amendment 1

AMENDMENTS BY THE EUROPEAN PARLIAMENT[*]

to the Commission proposal

---------------------------------------------------------

Proposal for a

REGULATION OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL

amending Regulation (EU) No 575/2013 as regards requirements for credit risk, credit valuation adjustment risk, operational risk, market risk and the output floor

(Text with EEA relevance)

THE EUROPEAN PARLIAMENT AND THE COUNCIL OF THE EUROPEAN UNION,

Having regard to the Treaty on the Functioning of the European Union, and in particular Article 114 thereof,

Having regard to the proposal from the European Commission,

After transmission of the draft legislative act to the national parliaments,

Having regard to the opinion of the European Economic and Social Committee[3],

Acting in accordance with the ordinary legislative procedure,

Whereas:(1) In response to the global financial crisis, the Union embarked on a wide-ranging reform of the prudential framework for institutions aimed at increasing the resilience of the EU banking sector. One of the main elements of the reform consisted in implementing international standards agreed by the Basel Committee for Banking Supervision (BCBS), specifically the so-called “Basel III reform”. Thanks to this reform, the EU banking sector entered the COVID-19 crisis on a resilient footing. However, while the overall level of capital in EU institutions is now satisfactory on average, some of the problems that were identified in the wake of global financial crisis have not yet been addressed.

(2) To address those problems, provide legal certainty and signal our commitment to our international partners in the G20, it is of utmost importance to implement the outstanding elements of the Basel III reform faithfully. At the same time, the implementation should avoid a significant increase in overall capital requirements for the EU banking system on the whole and take into account specificities of the EU economy where there is sufficient and robust evidence that the international framework does not capture these specificities, as stressed in the European Parliament resolution[4] of 23 November 2016 on the finalisation of Basel III. Where possible, adjustments to the international standards should be applied on a transitional basis. The implementation should ▌avoid competitive disadvantages for EU institutions, in particular in the area of trading activities, where EU institutions directly compete with their international peers. Furthermore, the proposed approach should be coherent with the logic of the banking union and harmonise the Single Market for banking. Finally, it should ensure proportionality of the rules and aim at further reducing compliance and reporting costs, in particular for small and non-complex institutions, without loosening the prudential standards, in line with the “Study of the Cost of Compliance with Supervisory Reporting Requirements” that the European Supervisory Authority (European Banking Authority) (EBA) published in 2021 which targeted a reduction of reporting costs of 10% to 20%.

(3) Regulation (EU) No 575/2013 enables institutions to calculate their capital requirements either by using standardised approaches, or by using internal model approaches. Internal model approaches, approved by national competent authorities, allow institutions to estimate most or all the parameters required to calculate capital requirements on their own, whereas standardised approaches require institutions to calculate capital requirements using fixed parameters, which are based on relatively conservative assumptions and laid down in Regulation (EU) No 575/2013. The Basel Committee decided in December 2017 to introduce an aggregate output floor. That decision was based on an analysis carried out in the wake of the financial crisis of 2008-2009, which revealed that internal models tend to underestimate the risks that institutions are exposed to, especially for certain types of exposures and risks, and hence, tend to result in insufficient capital requirements. Compared to capital requirements calculated using the standardised approaches, internal models produce, on average, lower capital requirements for the same exposures.

(4) The output floor represents one of the key measures of the Basel III reforms. It aims at limiting the unwarranted variability in the regulatory capital requirements produced by internal models and the excessive reduction in capital that an institution using internal models can derive relative to an institution using the revised standardised approaches. Those institutions can do so by setting a lower limit to the capital requirements that are produced by institutions’ internal models to 72.5% of the capital requirements that would apply if standardised approaches were used by those institutions. Implementing the output floor faithfully should increase the comparability of the institutions’ capital ratios, restore the credibility of internal models and ensure that there is a level playing field between institutions that use different approaches to calculate capital requirements.

(5) In order to harmonize the internal market for banking, the approach for the output floor should be coherent with the principle of risk aggregation across different entities within the same banking group and the logic of consolidated supervision. At the same time, the output floor should address risks stemming from internal models in both home and host Member States. The output floor should therefore be calculated at the highest level of consolidation in the Union. However, to avoid unintended impacts and ensure a fair distribution of capital, a competent authority may submit a capital redistribution proposal to the consolidating supervisor if it deems that this would lead to an inappropriate distribution of capital among the group entities. The notifying competent authority and the consolidating supervisor should then endeavour to make a joint decision on the application of the output floor, and if they do not reach a decision within three months, EBA should have a legally binding mediation role. EBA should assess the level of application of the output floor by 31 December 2027 in light of potential financial stability concerns and the progress in the banking union.

(6) The Basel Committee has found the current standardised approach for credit risk (SA-CR) to be insufficiently risk sensitive in a number of areas, leading to inaccurate or inappropriate – either too high or too low – measurement of credit risk and hence, of capital requirements. The provisions regarding the SA-CR should therefore be revised to increase the risk sensitivity of that approach in relation to several key aspects.

(7) For rated exposures to other institutions, some of the risk weights should be recalibrated in accordance with the Basel III standards. In addition, the risk weight treatment for unrated exposures to institutions should be rendered more granular and decoupled from the risk weight applicable to the central government of the Member State in which the bank is established, as no implicit government support for institutions is assumed.

(8) For subordinated debt and equity exposures, a more granular and stringent risk weight treatment is necessary to reflect the higher loss risk of subordinated debt and equity exposures when compared to debt exposures, and to prevent regulatory arbitrage between the banking book and the trading book. Union institutions have long-standing, strategic equity investments in financial and non-financial corporates. As the standard risk weight for equity exposures increases over a 5-year transition period, existing strategic equity holdings in corporates and insurance undertakings under significant influence of the institution should be grandfathered to avoid disruptive effects and to preserve the role of Union institutions as long-standing, strategic equity investors. Given the prudential safeguards and supervisory oversight to foster financial integration of the financial sector, however, for equity holdings in other institutions within the same group or covered by the same institutional protection scheme, the current regime should be maintained. In addition, to reinforce private and public initiatives to provide long-term equity to EU corporates, be they listed or unlisted, investments should not be considered as speculative where they are made with the firm intention of the institution’s senior management to hold it for three or more years.

(9) To promote certain sectors of the economy, the Basel III standards provide for a supervisory discretion to enable institutions to assign, within certain limits, a preferential treatment to equity holdings made pursuant to ‘legislative programmes’ that entail significant subsidies for the investment and involve government oversight and restrictions on the equity investments. Implementing that discretion in the Union should also help fostering long-term equity investments.

(10) Corporate lending in the Union is predominantly provided by institutions which use the internal ratings based (IRB) approaches for credit risk to calculate their capital requirements. With the implementation of the output floor, those institutions will also need to apply the SA-CR, which relies on credit assessments by external credit assessment institutions (‘ECAI’) to determine the credit quality of the corporate borrower. The mapping between external ratings and risk weights applicable to rated corporates should be more granular, to bring such mapping in line with the international standards on that matter.

(11) Most EU corporates, however, do not seek external credit ratings, in particular due to cost considerations. To avoid disruptive impacts on bank lending to unrated corporates and to provide enough time to establish public or private initiatives aimed at increasing the coverage of external credit ratings, it is necessary to provide for a transitional period for such increase in the coverage. During that transitional period, institutions using IRB approaches should be able to apply a favourable treatment when calculating their output floor for investment grade exposures to unrated corporates.▌

(11a) After the transition period, institutions should be able to refer to credit assessments by ECAIs to calculate the capital requirements for a significant part of their corporate exposures. EBA, European Supervisory Authority (European Insurance and Occupational Pensions Authority) (EIOPA) and European Supervisory Authority (European Securities and Markets Authority) (ESMA), should monitor the use of the transitional arrangement and should have regard to relevant developments and trends in the ECAI market. The transition period should be used to significantly expand the availability of ratings for European corporates. To this end, rating solutions beyond the currently existing rating ecosystem should be developed to incentivise especially larger corporates to become rated. Next to the positive externality the rating process generates, a wider rating coverage will foster, inter alia, the capital markets union. Avenues to attain this goal should consider the requirements related to external credit assessments, or the establishment of additional institutions providing such assessments, and might therefore entail substantial implementation efforts. Member States, in close cooperation with their central bank, should assess whether a request for the recognition of their central bank as ECAI in accordance with Article 2 of Regulation (EC) No 1060/2009 of the European Parliament and the Council[5] and the provision of corporate ratings by the central bank for the purposes of this Regulation may be desirable in order to increase the coverage of external ratings.

(11b) To inform any such future initiative on the set-up of public or private rating schemes, the European Supervisory Authorities (ESAs) should be requested to prepare a report on the impediments to the availability of external credit ratings by ECAIs, in particular for corporates, and on possible measures to address those impediments. In the meanwhile, the European Commission stands ready to provide technical support to Member States via its Technical Support Instrument in this area, e.g. to formulate strategies on increasing the rating-penetration of their unlisted corporates or to explore best practices on setting up entities capable of providing ratings or providing related guidance to corporates. The transition period should be extended only if necessary and justified and for four years at the most.

(12) For both residential and commercial real estate exposures, more risk-sensitive approaches have been developed by the Basel Committee to better reflect different funding models and stages in the construction process.

(13) The financial crisis of 2008-2009 revealed a number of shortcomings of the current standardised treatment of real estate exposures. Those shortcomings have been addressed in the Basel III standards. In fact, the Basel III standards introduced income producing real estate (‘IPRE’) exposures as a new sub-category of the corporate exposure class which is subject to a dedicated risk weight treatment to reflect more accurately the risk associated with those exposures, but also to improve consistency with the treatment of IPRE under the Internal Rating Based Approach (‘IRBA’) referred to in Part III, Title II, Chapter 3 of Regulation (EU) No 575/2013.

(14) For general residential and commercial real estate exposures, the loan splitting approach in Articles 124-126 of the Regulation should be kept, as that approach is sensitive to the type of borrower and reflects the risk mitigating effects of the real estate collateral in the applicable risk weights, even in case of high ‘loan-to-value’ (LTV) ratios. Its calibration, however, should be adjusted in accordance with the Basel III standards as it has been found to be too conservative for mortgages with very low LTV ratios.

(15) To ensure that the impacts of the output floor on low-risk residential mortgage lending by institutions using IRB approaches are spread over a sufficiently long period and thus avoid disruptions to that type of lending that could be caused by sudden increases in own funds requirements, it is necessary to provide for a specific transitional arrangement. For the duration of the arrangement, when calculating the output floor, IRB institutions should be able to apply a lower risk weight to the part of their residential mortgage exposures that is considered secured by residential property under the revised SA-CR. To ensure that the transitional arrangement is available only to low-risk mortgage exposures, appropriate eligibility criteria, based on established concepts used under the SA-CR, should be set. The compliance with those criteria should be verified by competent authorities. Because residential real estate markets may differ from one Member States to another, the decision on whether to activate the transitional arrangement should be left to individual Member States. The use of the transitional arrangement should be monitored by EBA. The transition period should be extended only if necessary and justified and for four years at the most.

(16) As a result of the lack of clarity and risk-sensitivity of the current treatment of speculative immovable property financing, capital requirements for those exposures are currently often deemed to be too high or too low. That treatment therefore should be replaced by a dedicated treatment for ADC exposures, comprising loans to companies or special purpose vehicles financing any of the land acquisition for development and construction purposes, or development and construction of any residential or commercial immovable property.

(17) It is important to reduce the impact of cyclical effects on the valuation of property securing a loan and to keep capital requirements for mortgages more stable. In the case of a revaluation beyond the value at the time of the loan was granted, the property’s value recognised for prudential purposes should therefore not exceed the average value of a comparable property measured over a sufficiently long monitoring period, unless modifications to that property unequivocally increase its value. To avoid unintended consequences for the functioning of the covered bond markets, competent authorities may allow institutions to revalue immovable property on a regular basis without applying those limits to value increases. Modifications that improve the energy efficiency, and performance on improvements to the resilience, protection and adaptation to physical risks of buildings and housing units should be considered as value increasing.

(18) The specialised lending business is conducted with special purpose vehicles that typically serve as borrowing entities, for which the return on investment is the primary source of repayment of the financing obtained. The contractual arrangements of the specialised lending model provide the lender with a substantial degree of control over the assets and the primary source of repayment of the obligation is the income generated by the assets being financed. To reflect the associated risk more accurately, those contractual arrangements should therefore be subject to specific capital requirements for credit risk. In line with the internationally agreed Basel III standards on assigning risk weights to specialised lending exposures, a dedicated specialised exposures class should be introduced under the SA-CR, thereby improving consistency with the already existing specific treatment of specialised lending under the IRB approaches. A specific treatment for specialised lending exposures should be introduced, whereby a distinction should be made between ‘project finance’, ‘object finance’ and ‘commodities finance’ to better reflect the inherent risks of those sub-classes of the specialised exposures class. Like for exposures to corporates, two approaches to assign risk weights should be implemented, one for jurisdictions allowing the use of external ratings for regulatory purposes and one for jurisdictions that do not allow it.

(19) While the new standardised treatment for unrated specialised lending exposures laid down in Basel III standards is more granular than the current standardised treatment of exposures to corporates under this Regulation, the former is not sufficiently risk-sensitive to reflect the effects of comprehensive security packages and pledges usually associated with these exposures in the Union, which enable lenders to control the future cash flows to be generated over the life of the project or asset. Due to the lack of external rating coverage of specialised lending exposures in the Union, the treatment for unrated specialised lending exposures laid down in Basel III standards may also create incentives for institutions to stop financing certain projects or take on higher risks in otherwise similarly treated exposures which have different risk profiles. Whereas the specialised lending exposures are mostly financed by institutions using the IRB approach that have in place internal models for these exposures, the impact may be particularly significant in the case of ‘object finance’ exposures, which could be at risk for discontinuation of the activities, in the particular context of the application of the output floor. To avoid unintended consequences of the lack of risk-sensitivity of the Basel treatment for unrated object finance exposures, object finance exposures that comply with a set of criteria capable to lower their risk profile to ‘high quality’ standards compatible with prudent and conservative management of financial risks, should benefit from a reduced risk weight. EBA shall be entrusted to develop draft regulatory technical standards specifying the conditions for institutions to assign an object finance specialised lending exposure to the ‘high quality’ category with a risk weight similar to ‘high quality’ project finance exposures under the SA-CR. Institutions established in jurisdictions that allow the use of external ratings should assign to their specialised lending exposures the risk weights determined only by the issue-specific external ratings, as provided by the Basel III framework.

(20) The classification of retail exposures under the SA-CR and the IRB approaches should be further aligned to ensure a consistent application of the correspondent risk weights to the same set of exposures. In line with the Basel III standards, rules should be laid down for a differentiated treatment of revolving retail exposures that meet a set of conditions of repayment or usage capable to lower their risk profile. Those exposures shall be defined as exposures to ‘transactors’. Exposures to one or more natural persons that do not meet all the conditions to be considered retail exposures should be risk weighted at 100% under the SA-CR.

(21) Basel III standards introduce a credit conversion factor of 10% for unconditionally cancellable commitments ('UCC') in the SA-CR. This is likely to result in a significant impact on obligors that rely on the flexible nature of the UCC to finance their activities when dealing with seasonal fluctuations in their businesses or when managing unexpected short-term changes in working capital needs, especially during the recovery from the COVID-19 pandemic. It is thus appropriate to provide for a transitional period during which institutions will continue to apply a null credit conversion factor to their UCC, and, afterwards, to assess whether a potential gradual increase of the applicable credit conversion factors is warranted to allow institutions to adjust their operational practices and products without hampering credit availability to institutions’ obligors. That transitional arrangement should be coupled with a report prepared by EBA.

(22) The financial crisis of 2008-2009 has revealed that, in some cases, credit institutions have also used IRB approaches on portfolios unsuitable for modelling due to insufficient data, which had detrimental consequences for the robustness of the results and thus, for the financial stability. It is therefore appropriate not to oblige institutions to use the IRB approaches for all of their exposures and to apply the roll-out requirement at the level of exposure classes. It is also appropriate to restrict the use of IRB Approaches for exposure classes where robust modelling is more difficult to increase the comparability and robustness of capital requirements for credit risk under the IRB approaches.

(23) Institutions’ exposures to other institutions, other financial sector entities and large corporates typically exhibit low levels of default. For such low-default portfolios, it has been shown that it is difficult for institutions to obtain reliable estimates of a key risk parameter of the IRB approach, the loss given default (‘LGD’), due to an insufficient number of observed defaults in those portfolios. This difficulty has resulted in an undesirable level of dispersion across credit institutions in the level of estimated risk. Institutions should therefore use regulatory LGD values rather than internal LGD estimates for those low-default portfolios.

(24) Institutions that use internal models to estimate the own funds requirements for credit risk for equity exposures typically base their risk assessment on publically available data, to which all institutions can be assumed to have identical access. Under those circumstances, differences in own funds requirements cannot be justified. In addition, equity exposures held in the banking book form a very small component of institutions’ balance sheets. Therefore, to increase the comparability of institutions’ own funds requirements and to simplify the regulatory framework, institutions should calculate their own funds requirements for credit risk for equity exposures using the SA-CR, and the IRB approach should be disallowed for that purpose.

(25) It should be ensured that the estimates of the probability of default (‘PD’), the LGD and the credit conversion factors (‘CCF’) of individual exposures of institutions that are allowed to use internal models to calculate capital requirements for credit risk do not reach unsuitably low levels. It is therefore appropriate to introduce minimum values for own estimates and to oblige institutions to use the higher of their own estimates of risk parameters and those minimum values. Such risk parameters’ ‘input floors’ should constitute a safeguard to ensure that capital requirements do not fall below prudent levels. In addition, they should mitigate model risk due to such factors as incorrect model specification, measurement error and data limitations. They would also improve the comparability of capital ratios across institutions. In order to achieve those results, input floors should be calibrated in a sufficiently conservative manner.

(26) Risk parameter floors that are calibrated too conservatively may indeed discourage institutions from adopting the IRB approaches and the associated risk management standards. Institutions may also be incentivised to shift their portfolios to higher risk exposures to avoid the constraint imposed by the risk parameter floors. To avoid such unintended consequences, risk parameter floors should appropriately reflect certain risk characteristics of the underlying exposures, in particular by taking on different values for different types of exposure where appropriate.

(27) Specialised lending exposures have risk characteristics that differ from general corporate exposures. It is thus appropriate to provide for a transitional period during which the LGD input floor applicable to specialised lending exposures is reduced. The transition period should be extended only if necessary and justified and for four years at the most.

(28) In accordance with the Basel III standards, the IRB treatment for the sovereign exposure class should remain largely untouched, due to the special nature and risks related to the underlying obligors. In particular sovereign exposures should not be subject to the risk parameters input floors.

(29) To ensure a consistent approach for all RGLA-PSE exposures, a new RGLA-PSA exposure class should be created, independent from both sovereign and institutions exposure classes▌.

(30) It should be clarified how the effect of a guarantee could be recognised for a guaranteed exposure where the underlying exposure is treated under the IRB approach under which modelling for PD and LGD is allowed but where the guarantor belongs to a type of exposures for which modelling the LGD, or the IRB approach is not allowed. In particular, the use of the substitution approach, whereby the risk parameters of the underlying exposures are substituted with the ones of the guarantor, or of a method whereby the PD or LGD of the underlying obligor are adjusted using a specific modelling approach to take into account the effect of the guarantee, should not lead to an adjusted risk weight that is lower than the risk weight applicable to a direct comparable exposure to the guarantor. Consequently, where the guarantor is treated under the SA-CR, recognition of the guarantee under the IRB approach should lead to assigning the SA-CR risk weight of the guarantor to the guaranteed exposure.

(30a) In the context of removing unwarranted variability in capital requirements, existing discounting rules applied to artificial cash flows should be clarified in order to remove any unintended consequences. A mandate should be given to EBA to update its guidelines by 31 December 2025.

(30b) The introduction of the output floor could have a significant impact on own funds requirements for securitisation positions held by institutions using the Securitisation Internal Ratings Based Approach(SEC-IRBA). Although such positions are generally small relative to other exposures, the introduction of the output floor could affect the economic viability of the securitisation operation because of an insufficient prudential benefit of the transfer of risk. This would come at a juncture where the development of the securitisation market is part of the action plan on capital markets union and also where originating banks might need to use securitisation more extensively in order to manage more actively their portfolios if they become bound by the output floor. A mandate should be given to EBA to report to the Commission on the need to eventually provide for a specific arrangement increasing the risk-sensitivity of the standardised approach of the purpose of the calculation of the output floor.

(31) Regulation (EU) 2019/876 of the European Parliament and of the Council[6] amended Regulation (EU) No 575/2013 to implement the final FRTB standards only for reporting purposes. The introduction of binding capital requirements based on those standards was left to a separate ordinary legislative initiative, upon the assessment of their impacts for Union banks.

(32) In order to complete the reform agenda introduced after the financial crisis of 2008-2009 and to address the deficiencies in the current market risk framework, binding capital requirements for market risk based on the final FRTB standards should be implemented in Union law. Recent estimates of the impact of the final FRTB standards on Union banks have shown that the implementation of those standards in the Union will lead to a large increase in the own funds requirements for market risk for certain trading and market making activities which are important to the EU economy. To mitigate that impact and to preserve the good functioning of financial markets in the Union, targeted adjustments should be introduced to the transposition of the final FRTB standards in Union law.

(33) As requested under Regulation (EU) 2019/876, the Commission should take into account the principle of proportionality in the calculation of the capital requirements for market risk for institutions with medium-sized trading book businesses, and calibrate those requirements accordingly. Therefore, institutions with medium-sized trading books should be allowed to use a simplified standardised approach to calculate own funds requirements for market risk, in line with the internationally agreed standards. In addition, the eligibility criteria to identify institutions with medium-sized trading books should remain consistent with the criteria set out in Regulation (EU) 2019/876 for exempting such institutions from the FRTB reporting requirements set out in that Regulation. A derogation is included to allow the banks to classify several types of instruments usually held in the trading book (including listed equities) as banking book positions, subject to the approval of the competent authority and when that position is not held with trading intent or does not hedge positions held with trading intent.

(34) Institutions’ trading activities in wholesale markets can easily be carried out across borders, including between Member States and third countries. The implementation of the final FRTB standards should therefore converge as much as possible across jurisdictions, both in terms of substance and timing. If that would not be the case, it would be impossible to ensure an international level playing field for those activities. The Commission should therefore monitor the implementation of those standards in other BCBS member jurisdictions and, where necessary, should take steps to address potential distortions of those rules.

(35) The BCBS has revised the international standard on operational risk to address weaknesses that emerged in the wake of the 2008-2009 financial crisis. Besides a lack of risk-sensitivity in the standardised approaches, a lack of comparability arising from a wide range of internal modelling practices under the Advanced Measurement Approach were identified. Therefore, and in order to simplify the operational risk framework, all existing approaches for estimating the operational risk capital requirements were replaced by a single non-model-based method. Regulation (EU) No 575/2013 should be aligned with the revised Basel standards to ensure a level playing field internationally for institutions established inside the Union but also operating outside the Union, and to ensure that the operational risk framework at Union level remains effective.

(36) The new standardised approach for operational risk introduced by the BCBS combines an indicator that relies on the size of the business of an institution with an indicator that takes into account the loss history of that institution. The revised Basel standards envisage a number of discretions on how the indicator that takes into account the loss history of an institution may be implemented. Jurisdictions may disregard historical losses for the calculation of operational risk capital for all relevant institutions, or may take historical loss data into account even for institutions below a certain business size. To ensure a level playing field within the Union and to simplify the calculation of operational risk capital, those discretions should be exercised in a harmonised manner for the minimum own funds requirements by disregarding historical operational loss data for all institutions.

(36a) When measuring capital requirements for operational risk, insurance policies should be allowed to be used as effective risk mitigation techniques. To that end, within 24 months after the entry into force of the Regulation EBA shall report to the Commission on a standardised formula, based on specific criteria, to be used for the calculation of operational risk capital requirements. The Commission should be empowered to submit a legislative proposal within the following 36 months, to the European Parliament and Council of the EU taking into account insurance policies for the calculation of capital requirements on operational risk. EBA should identify eligible insurance contracts.

(36b) The severe, double economic shock caused by the COVID-19 pandemic and the Russian-Ukrainian war might have far-reaching impacts on the European economy and disrupt businesses. Institutions will have a key role in contributing to the recovery by extending concessions towards worthy debtors facing or about to face difficulties in meeting their financial commitments. In that respect, EBA should adopt guidelines to specify what constitutes a material diminished financial obligation in the case of distressed restructuring, providing adequate flexibility to institutions. In particular, due consideration should be given to the kind of concession granted, the residual maturity of the exposure and the length of the postponement.

(37) Information on the amount and on the quality of performing, non-performing and forborne exposures, as well as an ageing analysis of accounting past due exposures should also be disclosed by small and non-complex institutions and by other non-listed credit institutions. This disclosure obligation does not create an additional burden on these credit institutions, as the disclosure of such limited set of information has already been implemented by EBA based on the 2017 Council Action Plan on Non-Performing Loans (NPLs)[7], which invited EBA to enhance disclosure requirements on asset quality and non-performing loans for all credit institutions. This is also fully consistent with the Communication on tackling non-performing loans in the aftermath of the COVID-19 pandemic[8].

(38) It is necessary to reduce the compliance burden for disclosure purposes and to enhance the comparability of disclosures. EBA should therefore establish a centralised web-based platform that enables the disclosure of information and data submitted by institutions. That centralised web-platform should serve as a single access point on institutions’ disclosures, while ownership of the information and data and the responsibility for their accuracy should remain with the institutions that produce it. The centralisation of the publication of disclosed information should be fully consistent with the Capital Market Union Action Plan and represents further step towards the development of an EU-wide single access point for companies’ financial and sustainable investment-related information.

(39) To allow for a greater integration of supervisory reporting and disclosures, EBA should publish institutions’ disclosures in a centralised manner, while respecting the right of all institutions to publish data and information themselves. Such centralised disclosures should allow EBA to publish the disclosures of small and non-complex institutions, based on the information reported by those institutions to competent authorities and should thus significantly reduce the administrative burden to which those small and non-complex institutions are subject. At the same time, the centralisation of disclosures should have no cost impact for other institutions, and increase transparency and reduce the cost for market participants to access prudential information. Such increased transparency should facilitate comparability of data across institutions and promote market discipline.

(40) To ensure convergence across the Union and a uniform understanding of the environmental, social and governance (ESG) factors and risks, general definitions should be laid down. Assets or activities subject to impacts from environmental and/or social factors should be defined by reference to the ambition of the Union to become climate-neutral by 2050 as set out in the EU Climate Law, the EU Nature Restoration Law, and the relevant sustainability goals of the Union. The technical screening criteria for ‘do no significant harm’ adopted in accordance with Article 17 of Regulation (EU) 2020/852 of the European Parliament and of the Council[9], as well as specific Union legislation to avert climate change, environmental degradation and biodiversity loss should be used to identify assets or exposures for the purpose of assessing dedicated prudential treatments and risk differentials. The exposure to ESG risks is not necessarily proportional to an institution’s size and complexity. Level of exposures across the Union are also quite heterogeneous, with some countries showing potential mild transitional impacts and others showing potential high transitional impacts on exposures related to activities that have a significant negative impact on the environment. The transparency requirements that institutions are subject and the sustainability reporting requirements laid down in other pieces of existing legislation in the Union will provide more granular data in a few years. However, to properly assess the ESG risks that institutions may face, it is imperative that markets and supervisors obtain adequate data from all entities exposed to those risks, independently of their size, including on the pool of loans underlying covered bonds issued by institutions. In order to ensure that competent authorities have at their disposal data that are granular, comprehensive and comparable for an effective supervision, information on exposures to ESG risks should be included in the supervisory reporting of institutions. The scope and granularity of that information should be consistent with the principle of proportionality, having regard to the size and complexity of the institutions.

(40a) Level of exposures across the Union are also quite heterogeneous, with some countries showing potential mild transitional impacts and others showing potential high transitional impacts on exposures related to activities that have a significant negative impact on the environment. The transparency requirements that institutions are subject to and the sustainability reporting requirements laid down in other pieces of Union legislation will provide more granular data in a few years. However, to properly assess the ESG risks that institutions might face, it is essential that markets and supervisors obtain adequate data from all entities exposed to those risks, irrespective of their size. In order to ensure that competent authorities have at their disposal data that are granular, comprehensive and comparable for an effective supervision, information on exposures to ESG risks should be included in the supervisory reporting of institutions. The scope and granularity of that information should be consistent with the principle of proportionality, and should have regard to the size and complexity of the institutions.

(41) As the transition of the Union economy towards a sustainable economic model is gaining momentum, sustainability risks become more prominent and will potentially require further consideration. According to the International Energy Agency, to reach the carbon neutrality objective by 2050, no new fossil fuel exploration and expansion can take place. This means that fossil fuel exposures represent a higher risk both at micro level, as the value of such assets is set to decrease over time, and at macro level as financing fossil fuel activities jeopardises the objective of maintaining the global rise of temperature below 1,5°C and therefore threatens the financial stability. It is therefore necessary to bring forward by 2 years EBA’s mandate to assess and report on whether a dedicated prudential treatment of exposures related to assets or activities substantially associated with environmental or social objectives would be justified from a risk-based perspective. However, only after the completion of this accelerated report and the ongoing climate stress tests would it be justified to potentially propose a dedicated prudential treatment for these exposures.

(41a) To ensure that any adjustments for exposures for infrastructure do not undermine the climate ambitions of the Union, departure from the risk-based approach of the banking framework should only take place when such exposures have shown a positive impact on the climate ambitions as set out in Regulation (EU) 2020/852.

(42) It is essential for supervisors to have the necessary empowerments to assess and measure in a comprehensive manner the risks to which a banking group is exposed at a consolidated level and to have the flexibility to adapt their supervisory approach to new sources of risks. It is important to avoid loopholes between prudential and accounting consolidation which may give rise to transactions aimed at moving assets out of the scope of prudential consolidation, even though risks remain in the banking group. The lack of coherence in the definition of “parent undertaking”, “subsidiary” and “control” concepts, and the lack of clarity in the definition of “ancillary services undertaking”, “financial holding company” and “financial institution” make it more difficult for supervisors to apply the applicable rules consistently in the Union and to detect and appropriately address risks at a consolidated level. Those definitions should therefore be amended and further clarified. In addition, it is deemed appropriate for EBA to investigate further whether these empowerments of the supervisors might be unintendedly constrained by any remaining discrepancies or loopholes in the regulatory provisions or in their interaction with the applicable accounting framework.

(42a) The rapid increase in the financial markets’ activity on crypto-assets and the potentially increasing involvement of institutions in crypto-assets related activities should be thoroughly reflected in the Union prudential framework, in order to adequately mitigate the risks of these instruments for the institutions’ financial stability. This is even more urgent in light of the recent adverse developments in the crypto-assets markets. The existing prudential rules are not designed to adequately capture the risks inherent to crypto-assets. The recently published BCBS standards on the prudential treatment of crypto-asset exposures, to be implemented by 1 January 2025, provide a dedicated prudential treatment that should be implemented in Union law in a timely manner. The Commission should follow up on these developments and, if appropriate, adopt a legislative proposal by 31 December 2024, to transpose the different elements of the BCBS standards into Union law. Until the legislative proposal is adopted, institutions’ exposure to crypto-assets should apply prudent own funds requirements.

(43) The lack of clarity of certain aspects of the minimum haircut floors framework for securities financing transactions (SFTs), developed by the BCBS in 2017 as part of the final Basel III reforms, as well as reservations about the economic justification of applying it to certain types of SFTs have raised the question of whether the prudential objectives of this framework could be attained without creating undesirable consequences. The Commission should therefore reassess the implementation of the minimum haircut floors framework for SFTs in Union law by [OP please insert date = 24 months after entry into force of this Regulation]. In order to provide the Commission with sufficient evidence, EBA, in close cooperation with ESMA, should report to the Commission on the impact of that framework, and on the most appropriate approach for its implementation in Union law.

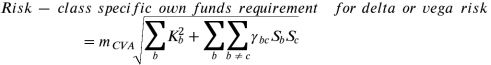

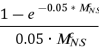

(44) The Commission should transpose into Union law the revised standards for the capital requirements for CVA risks, published by the BCBS in July 2020, as these standards overall improve the calculation of own funds requirement for CVA risk by addressing several previously observed issues, in particular that the existing CVA capital requirements framework fails to appropriately capture CVA risk.

(45) When implementing the initial Basel III reforms in Union law through the CRR, certain transactions were exempted from the calculation of capital requirements for CVA risk. These exemptions were agreed to prevent a potential excessive increase in the cost of some derivative transactions triggered by the introduction of the capital requirement for CVA risk, particularly when banks could not mitigate the CVA risk of certain clients that were not able to exchange collateral. According to estimated impacts calculated by EBA, the capital requirements for CVA risk under the revised Basel standards would remain unduly high for the exempted transactions with these clients. To ensure that banks’ clients continue hedging their financial risks via derivative transactions, the exemptions should be maintained when implementing the revised Basel standards.

(46) However, the actual CVA risk of the exempted transactions may be a source of significant risk for banks applying those exemptions; if those risks materialise, the banks concerned could suffer significant losses. As EBA highlighted in their report on CVA from February 2015, the CVA risks of the exempted transactions raise prudential concerns that are not being addressed under CRR. To help supervisors monitor the CVA risk arising from the exempted transactions, institutions should report the calculation of capital requirements for CVA risks of the exempted transactions that would be required if those transactions were not exempted. In addition, EBA should develop guidelines to help supervisors identify excessive CVA risk and to improve the harmonisation of supervisory actions in this area across the EU.

(47) Regulation (EU) No 575/2013 should therefore be amended accordingly,

HAVE ADOPTED THIS REGULATION:

Article 1

Amendments to Regulation (EU) No 575/2013

Regulation (EU) No 575/2013 is amended as follows:

(1) in Article 4, paragraph 1 is amended as follows:

(-a) point (12) is deleted

(a) points (15) and (16) are replaced by the following:

‘(15) ‘parent undertaking’ means an undertaking that controls, in the meaning of point (37), one or more undertakings;

(16) ‘subsidiary’ means an undertaking that is controlled, in the meaning of point (37), by another undertaking;’;

(b) point (18) is replaced by the following:

‘(18) ‘ancillary services undertaking’ means an undertaking the principal activity of which, whether provided to undertakings inside the group or to clients outside the group, the competent authority is any of the following:

(a) a direct extension of banking;

(b) operational leasing, factoring, the management of unit trusts, the ownership or management of property, the provision of data processing services or any other activity that is ancillary to banking;

(c) any other activity considered similar by EBA to those mentioned in points (a) and (b);’;

(c) point (20) is replaced by the following:

‘(20) ‘financial holding company’ means an undertaking fulfilling all of the following conditions:

(a) the undertaking is a financial institution;

(b) the undertaking is not a mixed financial holding company;

(c) at least one subsidiary of that undertaking is an institution;

(d) more than 50 % of any of the following indicators are associated, on a steady basis, with subsidiaries that are institutions or financial institutions, and with activities performed by the undertaking itself that are not related to the acquisition or owning of holdings in subsidiaries when those activities are of the same nature as the ones performed by institutions or financial institutions:

(i) the undertaking’s equity based on its consolidated situation;

(ii) the undertaking’s assets based on its consolidated situation;

(iii) the undertaking’s revenues based on its consolidated situation;

(iv) the undertaking’s personnel based on its consolidated situation;

(v) other indicator considered relevant by the competent authority;’;

(d) the following point (20a) is inserted:

‘(20a) ‘investment holding company’ means an investment holding company as defined in Article 4(1), point (23), of Regulation (EU) 2019/2033 of the European Parliament and of the Council[10];

(e) point (26) is replaced by the following:

‘(26) ‘financial institution’ means an undertaking that meets both of the following conditions:

(a) the undertaking is not an institution, a pure industrial holding company, an insurance holding company or a mixed‐activity insurance holding company as defined in Article 212(1), points (f) and (g), of Directive 2009/138/EC;

(b) the undertaking fulfils any of the following conditions:

(i) the principal activity of the undertaking is to acquire or own holdings or to pursue one or more of the activities listed Annex I, points 2 to 12 and point 15, to Directive 2013/36/EU, or to pursue one or more of the services or activities listed in Annex I, Section 1 or B, to Directive 2014/65/EU of the European Parliament and of the Council[11] in relation to financial instruments listed in Section C of that Annex to that Directive;

(ii) the undertaking is an investment firm, a mixed financial holding company, an investment holding company, a payment services provider within the meaning of Directive (EU) 2015/2366 of the European Parliament and of the Council[12], an asset management company or an ancillary services undertaking;’;

(f) the following point (26a) is inserted:

‘(26a) ‘pure industrial holding company’ means an undertaking that fulfils all of the following conditions:

(a) the principal activity of the undertaking is to acquire or own holdings;

(b) neither the undertaking nor any of the undertakings in which it owns participations are referred to in point (27), points (a), (d), (e), (f), (g), (h), (k) and (l);

(c) neither the undertaking nor any of the undertakings in which it own participations perform as a principal activity any of the activities listed in Annex I to Directive 2013/36/EU, any of the activities listed in Annex I, Sections A or B, to Directive 2014/65/EU in relation to financial instruments listed in Section C of that Annex to that Directive, or are investment firms, payment services providers within the meaning of Directive (EU) 2015/2366, asset management companies, or ancillary services undertakings;’;

(g) in point (27), point (c) is deleted;

(h) point (28) is replaced by the following:

‘(28) ‘parent institution in a Member State’ means an institution in a Member State which has an institution or a financial institution as a subsidiary, or which holds a participation in an institution or financial institution▌, and which is not itself a subsidiary of another institution authorised in the same Member State, or of a financial holding company or mixed financial holding company set up in the same Member State;’;

(i) the following points (33a) and (33b) are inserted:

‘(33a) ‘stand-alone institution in the EU’ means an institution that is not subject to prudential consolidation pursuant to Part One, Title II, Chapter 2 in the EU, and that has no EU parent undertaking subject to such prudential consolidation;

(33b) ‘stand-alone subsidiary institution in a Member State’ means an institution that meets all of the following criteria:

(a) the institution is the subsidiary of an EU parent institution, an EU parent financial holding company or an EU parent mixed financial holding company;

(b) the institution is located in another Member State than its parent institution, parent financial holding company or parent mixed financial holding company;

(c) the institution has no subsidiary itself and does not hold any participation in an institution or financial institution;’;

(j) in point (37) the reference to ‘Article 1 of Directive 83/349/EEC’ is replaced by a reference to ‘Article 22 of Directive 2013/34/EU’;

(k) point (52) is replaced by the following:

‘(52) ‘operational risk’ means the risk of loss resulting from inadequate or failed internal processes, people and systems or from external events, including, but not limited to, legal risk, model risk and ICT risk, but excluding strategic and reputational risk;’;

(l) the following points (52a) to (52i) are inserted:

‘(52a) ‘legal risk’ means the risk of losses, including, but not limited to, expenses, fines, penalties or punitive damages, which an institution may incur as a consequence of events that result in legal proceedings, including the following:

(a) supervisory actions and private settlements;

(b) failure to act where action is necessary to comply with a legal obligation;

(c) action taken to avoid compliance with a legal obligation;

(d) misconduct events, which are events that arise from wilful or negligent misconduct, including inappropriate supply of financial services or where the institution does not follow the obligation to provide fair, clear and not misleading information to its retail clients in accordance with Article 24(3) of Directive 2014/65/EU;

(e) non-compliance with any requirement derived from national or international statutory or legislative provisions;

(f) non-compliance with any requirement derived from contractual arrangements, or with internal rules and codes of conduct established in accordance with national or international norms and practices;

(g) non-compliance with ethical rules.

Legal risk does not comprise refunds to third parties or employees and goodwill payments due to business opportunities, where no breach of any rules or ethical conduct has occurred and where the institution has fulfilled its obligations on a timely basis; and external legal costs where the event giving rise to those external costs is not an operational risk event.

(52b) ‘model risk’ means the risk of loss an institution may incur as a consequence of decisions that could be principally based on the output of internal models, due to errors in the design, development, implementation▌, use or monitoring of such models, including the following:

(a) the improper set-up of a selected internal model and its characteristics;

(b) the inadequate verification of a selected internal model’s suitability for the financial instrument to be evaluated or for the product to be priced, or of the selected internal model’s suitability for the applicable market conditions;

(c) errors in the implementation of a selected internal model;

(d) incorrect mark-to-market valuations and risk measurement as a result of a mistake when booking a trade into the trading system;

(e) the use of a selected internal model or of its outputs for a purpose for which that model was not intended or designed, including manipulation of the modelling parameters;

(f) the untimely and ineffective monitoring of model performance to assess whether the selected internal model remains fit for purpose;

(52c) ‘ICT risk’ means the risk of losses or potential losses related to any reasonable identifiable circumstances in relation to the use of network and information systems which, if materialised, may compromise the security of the network and information systems, of any technology dependent tool or process, of operations and processes, or of the provision of services by producing adverse effects in the digital or physical environment;

(52d) ‘environmental, social or governance ▌risk’ or ‘ESG risk’ means the risk of ▌any negative financial impact on the institution stemming from the current or prospective impacts of environmental, social or governance (ESG) factors on the institution’s counterparties or invested assets; ESG risks materialise through the traditional categories of financial risks, including credit risk, market risk, operational and reputation risks, liquidity and funding risks;

(52e) ‘environmental risk’ means the risk of ▌ any negative financial impact on the institution stemming from the current or prospective impacts of environmental factors on the institution’s counterparties or invested assets, including factors related to the transition towards the following environmental objectives:

(a) climate change mitigation ;

(b) climate change adaptation;

(c) the sustainable use and protection of water and marine resources;

(d) the transition to a circular economy;

(e) pollution prevention and control;

(f) the protection and restoration of biodiversity and ecosystems;

Environmental risk includes both physical risk and transition risk.

(52f) ‘physical risk’, as part of the overall environmental risk, means the risk of ▌any negative financial impact on the institution stemming from the current or prospective impacts of the physical effects of environmental factors on the institution’s counterparties or invested assets;

(52g) ‘transition risk’, as part of the overall environmental risk, means the risk of ▌any negative financial impact on the institution stemming from the current or prospective impacts of the transition ▌to an environmentally sustainable economy on the institution’s counterparties or invested assets;

(52h) ‘social risk’ means the risk of ▌any negative financial impact on the institution stemming from the current or prospective impacts of social factors on its counterparties or invested assets;

(52i) ‘governance risk’ means the risk of ▌any negative financial impact on the institution stemming from the current or prospective impacts of governance factors on the institution’s counterparties or invested assets;’;

(m) points (54), (55) and (56) are replaced by the following:

‘(54) ‘probability of default’ or ‘PD’ means the probability of default of an obligor over a one-year period, and, in the context of dilution risk, the probability of dilution over a one-year period;

(55) ‘loss given default’ or ‘LGD’ means the ▌ratio of the loss on an exposure related to a single facility due to the default of an obligor or facility to the amount outstanding at default, and, in the context of dilution risk, the loss given dilution meaning the ▌ ratio of the loss on an exposure related to a purchased receivable due to dilution, to the amount outstanding of the purchased receivable;

(56) ‘conversion factor’ or ‘credit conversion factor’ or ‘CCF’ means the ▌ratio of the currently undrawn amount of a commitment from a single facility that could be drawn from a single facility before default and that would therefore be outstanding at default to the currently undrawn amount of the commitment from that facility, the extent of the commitment being determined by the advised limit, unless the unadvised limit is higher;’;

(n) the following point (56a) is inserted:

‘(56a) ‘realised CCF’ means the ratio of the drawn amount of a commitment from a single facility, that was undrawn at a given reference date prior to default, and that is therefore outstanding at default, to the undrawn amount of the commitment from that facility at that reference date;’;

(o) points (58), (59) and 60 are replaced by the following:

‘(58) ‘funded credit protection’ or ‘FCP’ means a technique of credit risk mitigation where the reduction of the credit risk on the exposure of an institution is derived from the right of that institution, in the event of the default of the obligor or on the occurrence of other specified credit events relating to the obligor, to liquidate, or to obtain transfer or appropriation of, or to retain certain assets or amounts, or to reduce the amount of the exposure to, or to replace it with, the amount of the difference between the amount of the exposure and the amount of a claim on the institution;

(59) ‘unfunded credit protection’ or ‘UFCP’ means a technique of credit risk mitigation where the reduction of the credit risk on the exposure of an institution is derived from the obligation of a third party to pay an amount in the event of the default of the obligor or the occurrence of other specified credit events;

(60) ‘cash assimilated instrument’ means a certificate of deposit, a bond, including a covered bond, or any other non-subordinated instrument, which has been issued by the lending institution, for which the lending institution has already received full payment and which shall be unconditionally reimbursed by the lending institution at its nominal value;’;

(p) the following point (60a) is inserted:

‘(60a) ‘gold bullion’ means gold in the form of a commodity, including gold bars, ingots and coins, commonly accepted by the bullion market, where liquid markets for bullion exist, and the value of which is determined by the value of the gold content, defined by purity and mass, rather than by its interest to numismatists;’;

(q) the following point (74a) is inserted :

‘(74a) ‘property value’ means the value of an immovable property determined in accordance with Article 229(1);’;

(r) point (75) is replaced by the following:

‘(75) ‘residential property’ means any of the following:

(a) an immovable property which has the nature of a dwelling and satisfies all applicable laws and regulations enabling the property to be occupied for housing purposes;

(b) an immovable property which has the nature of a dwelling and is still under construction, provided that there is the expectation that the property will satisfy all applicable laws and regulations enabling the property to be occupied for housing purposes;

(c) the right to inhabit an apartment in housing cooperatives located in Sweden

(d) land accessory to a property referred to in points (a), (b) or (c);’;

(s) the following points (75a) to (75g) are inserted:

‘(75a) ‘commercial immovable property’ means any immovable property that is not residential property▌;

(75b) ‘income producing real estate exposure’ or IPRE exposure means an exposure secured by one or more residential or commercial immovable properties where the fulfilment of the credit obligations related to the exposure materially depends on the cash flows generated by those immovable properties securing that exposure, rather than on the capacity of the obligor to fulfil the credit obligations from other sources; the primary source of such cash flows would be lease or rental payments, or proceeds from the sale of the residential property or commercial immovable property;

(75c) ‘non-income producing real estate exposure’ (non-IPRE exposure) means any exposure secured by one or more residential or commercial immovable properties that is not an IPRE exposure;

(75d) ‘non-ADC exposure’ means any exposure secured by one or more residential or commercial immovable properties that is not an ADC exposure;

(75e) ‘exposure secured by residential property’, or ‘exposure secured by a mortgage on residential property’, or ‘exposure secured by residential property collateral’, or ‘exposure secured by residential immovable property’, means an exposure secured by ▌residential property or an exposure regarded as such in accordance with Article 108(3);

(75f) ‘exposure secured by commercial immovable property’, or ‘exposure secured by a mortgage on commercial immovable property’, or ‘exposure secured by commercial immovable property collateral’ means an exposure secured by a ▌commercial immovable property▌;

(75g) ‘exposure secured by immovable property’, or ‘exposure secured by a mortgage on immovable property’, or ‘exposure secured by immovable property collateral’ means an exposure secured by a ▌residential or commercial immovable property or an exposure regarded as such in accordance with Article 108(3);’;

(t) points (78) and (79) are replaced by the following:

‘(78) ‘one-year default rate’ means the ratio between the number of obligors or where the classification as defaulted is applied at facility level pursuant to the second subparagraph of Article 178(1), facilities in respect of which a default is considered to have occurred during a period that starts from one year prior to a date of observation T, and the number of obligors, or ▌where the classification as defaulted is applied at facility level pursuant to the second subparagraph of Article 178(1), facilities assigned to this grade or pool one year prior to that date of observation T;

(79) ‘ADC exposures’ or ‘land acquisition, development and construction exposures’ means loans to corporates or special purpose entities financing any land acquisition for development and construction purposes, or financing development and construction of any residential or commercial immovable property;’;

(u) point (114) is replaced by the following:

‘(114) ‘indirect holding’ means any exposure to an intermediate entity that has an exposure to capital instruments issued by a financial sector entity or to liabilities issued by an institution where, in the event the capital instruments issued by the financial sector entity or the liabilities issued by the institution were permanently written off, the loss that the institution would incur as a result would not be materially different from the loss the institution would incur from a direct holding of those capital instruments issued by the financial sector entity or of those liabilities issued by the institution;’

(v) point (126) is replaced by the following:

‘(126) ‘synthetic holding’ means an investment by an institution in a financial instrument the value of which is directly linked to the value of the capital instruments issued by a financial sector entity or to the value of the liabilities issued by an institution;’;

(w) point (144) is replaced by the following:

‘(144) ‘trading desk’ means a well-identified group of dealers set up by the institution to jointly manage a portfolio of trading book positions, or the non-trading book positions referred to in Article 104b, paragraphs 5 and 6, in accordance with a well-defined and consistent business strategy and operating under the same risk management structure;’

(x) ▌ point (145) is amended as follows:

(a) point (f) is replaced by the following:

‘(f) the institution's consolidated assets or liabilities relating to activities with counterparties located in the European Economic Area, excluding intragroup exposures in the European Economic Area, exceed 75% of both the institution’s consolidated total assets and liabilities, excluding in both cases the intragroup exposures,’;

(b) the following subparagraph is inserted:

‘For the purposes of point (e), an institution may exclude derivative positions it entered with its non-financial clients and the derivatives positions it uses to hedge those positions, provided that the combined value of the excluded positions calculated in accordance with Article 273a(3) does not exceed 10% of the institution’s total on- and off-balance sheet assets.’;

(y) the following points are added:

‘(151) ‘revolving exposure’ means any exposure whereby the borrower’s outstanding balance is permitted to fluctuate based on its decisions to borrow and repay, up to a limit established by the lending institution;

(152) ‘transactor exposure’ means any revolving exposure that has at least 12 months of repayment history and that is one of the following:

(a) an exposure for which, on a regular basis of at least every 12 months, the amount to be repaid at the next scheduled repayment date is determined as the drawn amount or an instalment at a predefined reference date or upon contractual repayment modalities, with all scheduled repayment dates not later than after 12 months, provided that the amount or instalment owed to the lending institution has been repaid in full at each scheduled repayment date for the previous 12 months;

(b) an overdraft facility where there have been no drawdowns over the previous 12 months;

(152a) ‘fossil fuel sector entity’ means a company, enterprise or undertaking primarily active in deriving any revenues from exploration, mining, extraction, production, processing, storage, refining or distribution, including transportation, storage, and trade, of fossil fuels as defined in Article 2, point (62), of Regulation (EU) 2018/1999 of the European Parliament and of the Council*.

EBA shall issue guidelines, in accordance with Article 16 of Regulation (EU) No 1093/2010, to specify the conditions under which the company, enterprise or undertaking is to be considered primarily active in deriving any revenues from exploration, mining, extraction, production, processing, storage, refining or distribution, including transportation, storage and trade, of fossil fuels.

(152b) ‘assets or activities subject to impacts from environmental and/or social factors’ means assets or activities impacting the ambition of the Union to achieve climate neutrality as specified in Article 3, point (69a) of Directive 2013/36/EU.

(152c) ‘shadow-banking-entity’ means an entity that offers banking services or performs banking activities and that it is not subject to prudential requirements similar to those imposed by this Regulation.

________________________

* Regulation (EU) 2018/1999 of the European Parliament and of the Council of 11 December 2018 on the Governance of the Energy Union and Climate Action, amending Regulations (EC) No 663/2009 and (EC) No 715/2009 of the European Parliament and of the Council, Directives 94/22/EC, 98/70/EC, 2009/31/EC, 2009/73/EC, 2010/31/EU, 2012/27/EU and 2013/30/EU of the European Parliament and of the Council, Council Directives 2009/119/EC and (EU) 2015/652 and repealing Regulation (EU) No 525/2013 of the European Parliament and of the Council (OJ L 328, 21.12.2018, p. 1).’;

(1a) in Article 4, the following paragraph is added:

‘4a. For the purposes of point (18), point (c), of paragraph 1, EBA shall issue guidelines specifying the criteria for the identification of activities by ... [OP please insert date = 1 year after entry into force of this Regulation].

Those guidelines shall be adopted in accordance with Article 16 of Regulation (EU) No 1093/2010.’

(2) Article 5 is amended as follows:

(a) point (3) is replaced by the following:

‘(3) ‘expected loss’ or ‘EL’ means the ratio, related to a single facility, of the amount expected to be lost on an exposure from any of the following:

(i) a potential default of an obligor over a one-year period to the amount outstanding at default;

(ii) a potential dilution event over a one-year period to the amount outstanding at the date of occurrence of the dilution event;’;

(b) the following points (4) to (10) are added:

‘(4) ‘credit obligation’ means any obligation arising from a credit contract, including principal, accrued interest and fees, owed by an obligor to an institution or, where the institution serves as a guarantor, owed by an obligor to a third party;

(5) ‘credit exposure’ means any on-balance sheet item, including any amount of principal, accrued interest and fees owed by the obligor to the institution, or any off-balance sheet item that results, or may result, in a credit obligation;

(6) ‘facility’ means a credit exposure arising from a contract ▌between an obligor and an institution;

(7) ‘margin of conservatism’ means an ▌add-on incorporated in risk estimates, adequate to account for the expected range of estimation errors stemming from identified deficiencies in data, methods, models, and changes to underwriting standards, risk appetite, collection and recovery policies and any other source of additional uncertainty, as well as from general estimation error;

(8) ‘small and medium-sized enterprise’ or ‘SME’ means a company, enterprise or undertaking which, according to the last consolidated accounts, has an annual turnover not exceeding EUR 50 000 000;’

(9) ‘commitment’ means any contractual arrangement that an institution offers to a client and is accepted by that client, to extend credit, purchase assets or issue credit substitutes. Any arrangement that can be unconditionally cancelled by the institution at any time without prior notice to the obligor or any arrangement that can be cancelled by the institution where the obligor fails to meet conditions set out in the facility documentation, including conditions that must be met by the obligor prior to any initial or subsequent drawdown under the arrangement, is a commitment;

Contractual arrangements that meet all of the following conditions shall not be commitments:

(a) contractual arrangements where the institution receives no fees or commissions to establish or maintain those contractual arrangements;

(b) contractual arrangements where the client is required to apply to the institution for the initial and each subsequent drawdown under those contractual arrangements;

(c) contractual arrangements where the institution has full authority, regardless of the fulfilment by the client of the conditions set out in the contractual arrangement documentation, over the execution of each drawdown;

(d) contractual arrangements where the institution is required to assess the creditworthiness of the client immediately prior to deciding on the execution of each drawdown;

(e) contractual arrangements that are offered to a corporate entity, including an SME, that is closely monitored on an ongoing basis.

(10) ‘unconditionally cancellable commitment’ means any commitment the terms of which permit the institution to cancel that commitment to the full extent allowable under consumer protection and related legislation where applicable at any time without prior notice to the obligor or that effectively provide for automatic cancellation due to deterioration in a borrower's creditworthiness.’;

(3) in Article 6, paragraph 3 is replaced by the following:

‘3. No institution which is either a parent undertaking or a subsidiary, and no institution included in the consolidation pursuant to Article 18, shall be required to comply on an individual basis with the obligations laid down in Article 92, paragraphs 5 and 6, and Part Eight.’;

(3a) in Article 7, the following paragraph is added:

‘3a. By 31 December 2026, the Commission shall report to the European Parliament and the Council on the possibility of allowing for the application of paragraph 1 also to a subsidiary that is subject to authorisation and supervision by a Member State other than the Member State that authorises and supervises the institution which is the parent undertaking. The Commission shall pay particular attention to progress made on completing the banking union, and more particular to improvements made to the banking crisis management and deposit insurance framework which can address potential financial stability concerns resulting from applying paragraph 1 on a cross-border basis.

The Commission shall also consider whether or not additional prudential safeguards and technical modifications could further address any potential financial stability concerns resulting from the waiver from the application of individual requirements on a cross-border basis.