It’s not good news for renters or potential home buyers right now. Statistics show that across the country in the last 12 months or so:

— Rents have risen an average of 40% in some cities, and “According to an analysis conducted by RedFin, rents in the US jumped 14% in December 2021 to $1,877 a month, the largest rise in more than two years.”1;

— The median home price in the United States, although it varies rather drastically by state, “…was $346,900 in 2021, up 16.9% from 2020, and the highest on record going back to 1999, according to the National Association of Realtors.” 2 ;

— Mortgage interest rates are also headed up with more hikes expected in the coming year, making it more difficult for prospective buyers to qualify for a loan.

With the already precarious financial situation many people are in, this sharp increase in housing costs can mean living on the edge —having a roof over your head one month, eviction and homelessness the next.

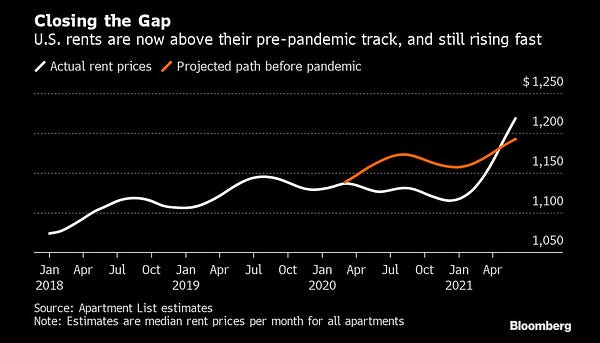

Senator Sanders isn’t the only one alarmed about rising housing costs. Here’s what Bloomberg News is Tweeting about it.

And so is Dan Price, CEO of Seattle-based “Gravity Payments”, who, in 2015, cut his own salary from $1.1 million to $70,000/year while raising his employees’ minimum salary to $70,000/year.

In a post last year, I wrote about what Price highlights in this Tweet—that Wall Street financial firms and individual billionaires are gobbling up both farmland and housing, and either renting or selling these properties at exorbitant prices…

But statistics don’t tell the whole story, and in fact, the numbers can be misleading. One example is this 2022 map of the average rent for a one bedroom apartment in each state. The map itself isn’t misleading, and I assume the calculations of median rents are correct. But the problem is the square footage and location of the rentals for the price range. I live in Columbus, Ohio, and according to this map, Ohio’s rent has gone up significantly in the last two years, but remains quite low compared to many other states: The average rent in Ohio for a one bedroom apartment is $808. This price probably doesn’t include additional upfront, out-of-pocket costs like non-refundable pet fees plus extra money each month per pet, and application and background check fees.

Because I have been searching since last fall for another, larger, apartment, I can tell you that if you find an apartment for $800 a month, it’s probably between 500-650 sq. feet, and lacking in a few basic amenities, like in my case, a dishwasher and microwave. (By the way, my one bedroom also has no central air, terrible plumbing, subpar electricity and is currently renting for $1,035 a month including pet fees.)

A decent two bedroom apartment or single family home, usually between 850-1100 square feet, currently costs between $1,400 and $1800 a month—in the nicer suburbs, a small home can rent for $2,400 a month or more. By comparison then, Ohio’s alleged median rent of $808 gets you a broken down shanty with no appliances, located in a high-crime neighborhood.3

And the soaring home prices and higher mortgage interest rates? According to Nobel Prize winning economist, Paul Krugman, we are probably not headed for a housing bubble like our last one preceding the Great Recession. But there is still much to worry about because millions of Americans are caught between rising rents and overpriced homes. The higher the rent, the less likely current renters will be able to save for a down payment on a home, and many run the real risk of eviction and homelessness. And it may take decades, if ever, for lower income residents to claw their way out of the hole rising housing prices have put them in, and achieve the “American Dream” of home ownership and the wealth building opportunity that comes with it.

This 2021 article in The Guardian argues that millennials do not prefer to rent, unlike the standard refrain, and are being locked out of the housing market by “untrammeled capitalism”. This part of capitalism can be trammeled, though, with a few restrictions or at least disincentives to corporate ownership of single family homes, rent control and substantial government support of affordable housing.

What do you think about soaring rent and home prices? Let your thoughts rip in the Comment section below.

And don’t forget to Subscribe to support this work—thanks!

There are at least two realty companies in the Columbus area that refuse to include any appliances with their apartments. $1,500 a month rent, haul in your own appliances!

How Will Millions Of Americans Keep A Roof Over Their Heads?