Ethereum staking supply crosses 25%, but it’s not the end yet

- ETH’s staked supply has more than doubled since the Shapella upgrade.

- The number of validators looking to enter the network jumped to a 4-month-high.

Ethereum [ETH] staking got a big boost with the launch of Shapella Upgrade last year, and since then, there’s been no looking back.

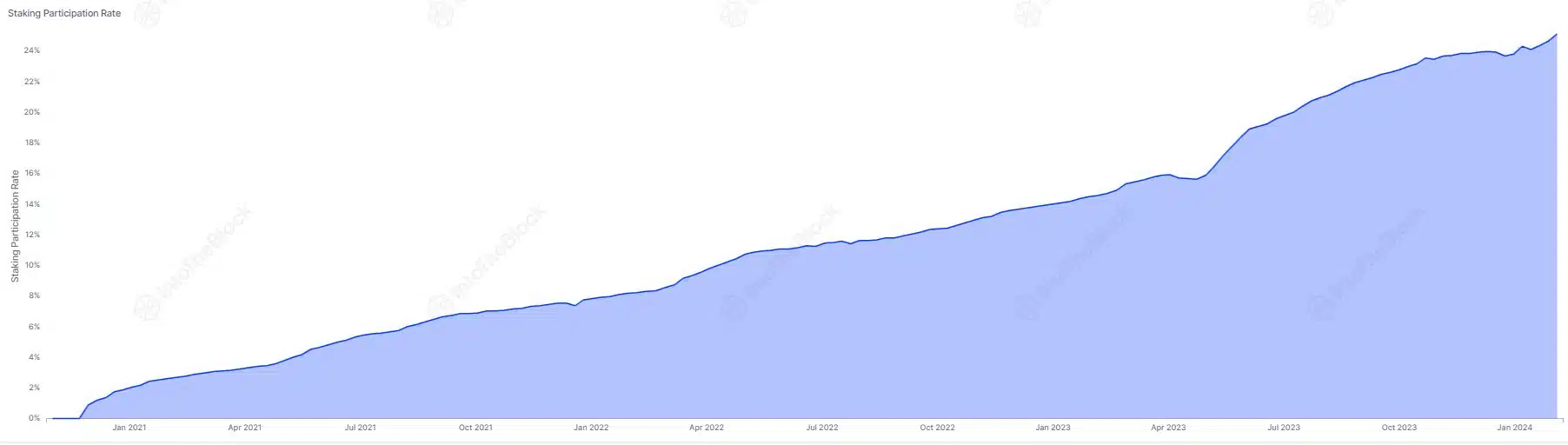

According to on-chain research firm IntoTheBlock, Ethereum’s staking participation rate crossed 25% recently, meaning that around a quarter of ETH’s circulating supply was locked into the network.

This was a welcome development, as the higher the participation, the more decentralized and secured the network becomes.

Note that apart from contributing to network security, Ethereum staking lets users earn passive income on their deposits.

Shapella boosts staking like never before

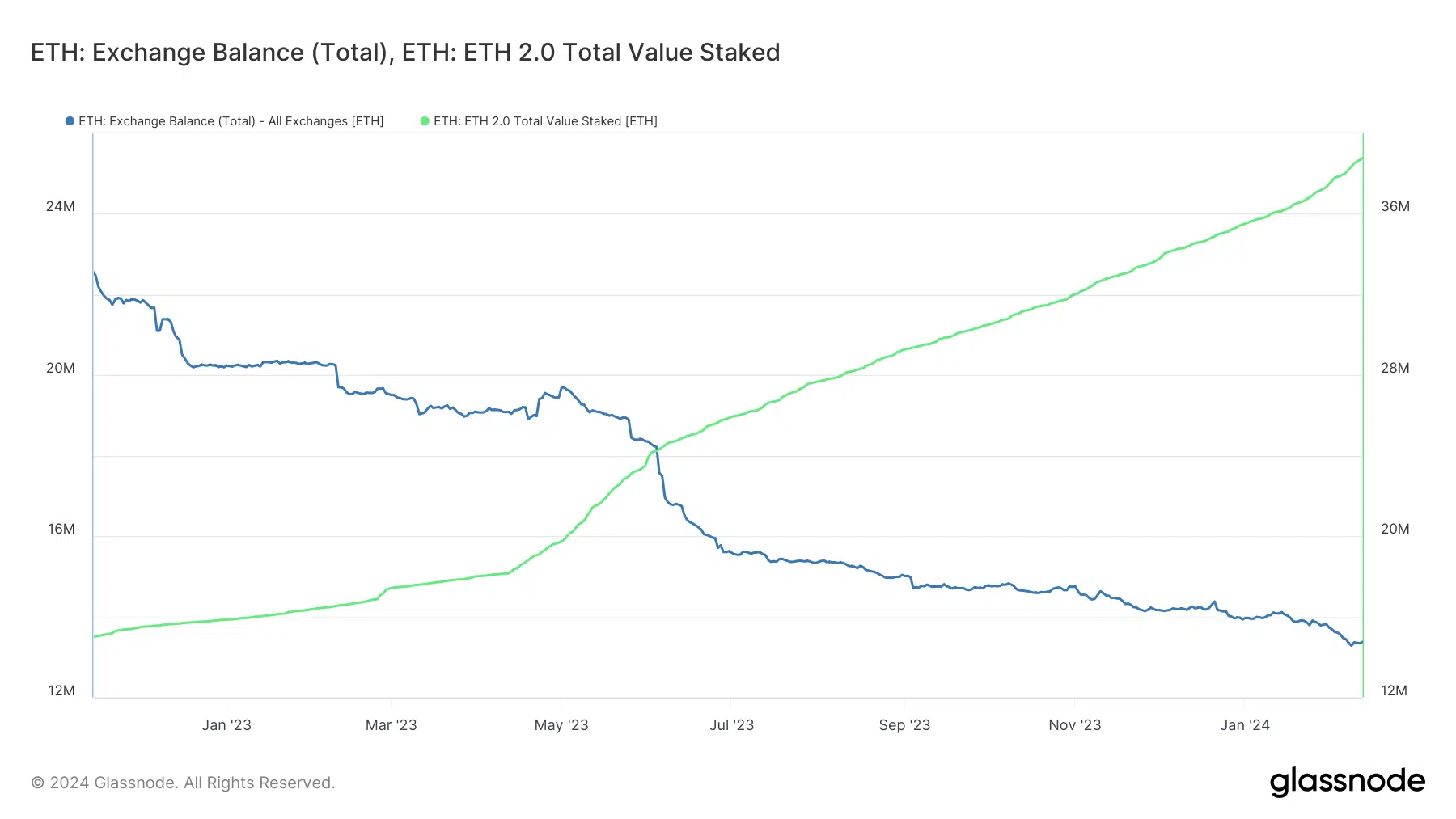

Staking, which was considered a risky proposition owing to withdrawal ambiguity, got a boost after the unlocking of ETH was permitted in April 2023.

Since then, the staked supply has more than doubled, sitting at 38.7 million as of the 12th of February, AMBCrypto discovered using Glassnode’s data.

At the same time, ETH supply on exchange fell to multi-year lows, accounting for just 11.1% of the total circulating supply.

The biggest takeaway from these trends was that ETH holders were prioritizing guaranteed, stable returns over risk-laden market trading.

It was also reflective of ETH’s changing perception as a long-term yield-bearing asset rather than a means for making quick gains in the secondary market.

Moreover, there was no sign of saturation in sight.

The number of validators looking to enter the network jumped to its highest level in four months on the 12th of February, AMBCrypto detected using data from validatorqueue.com.

What does this mean for ETH?

A higher chunk of ETH becoming illiquid over time could also have positive implications for its market stability.

The high volatility of cryptos has restricted traditional investors’ participation over the years. However, with less number of coins trading in the market, ETH could see less volatility.

Is your portfolio green? Check out the ETH Profit Calculator

This could lead to increased demand from conservative traders.

As of this writing, the second-largest cryptocurrency was exchanging hands at $2,662, according to CoinMarketCap, ushering in a 6.78% growth in the last 24 hours.