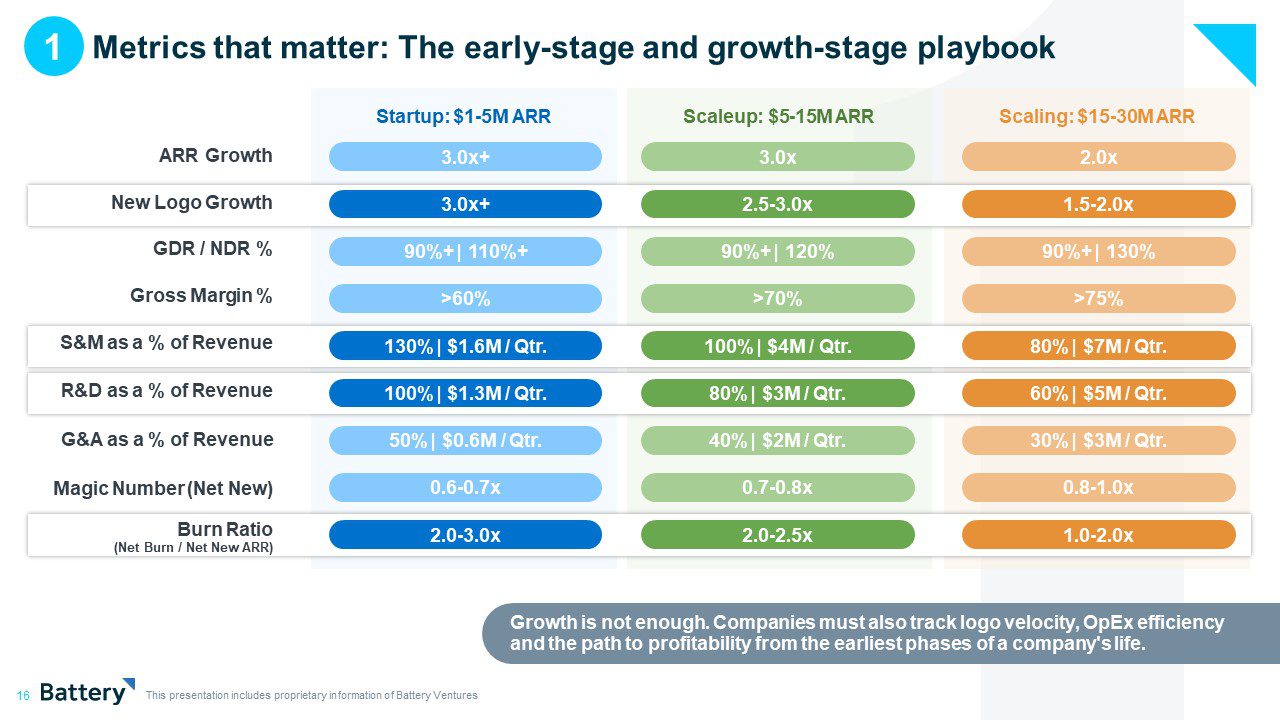

For years, enterprise-software and infrastructure companies relied on the same, tried-and-true metrics to measure success as they scaled: ARR (annual recurring revenue) growth, “magic number,” “Rule of 40,” etc.

But what if the new, more-challenging macroeconomic environment, coupled with powerful new technologies like AI, means we should rethink the metrics we’ve all gotten used to – and encourage companies to reevaluate the right set of benchmarks to survive and thrive?

That’s one of the core takeaways from our 2023 OpenCloud report, which we’re releasing today as the enterprise-tech industry continues its journey out of the woods and, hopefully, spawns stronger, fitter, leaner companies.

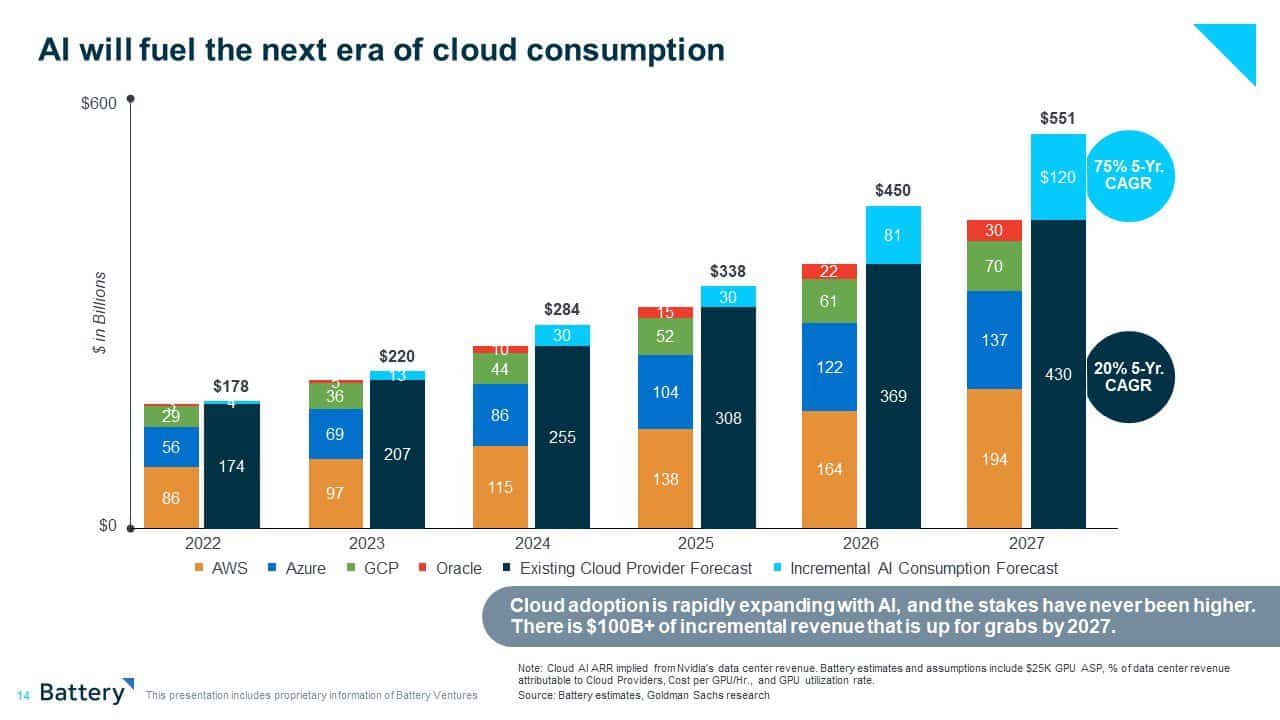

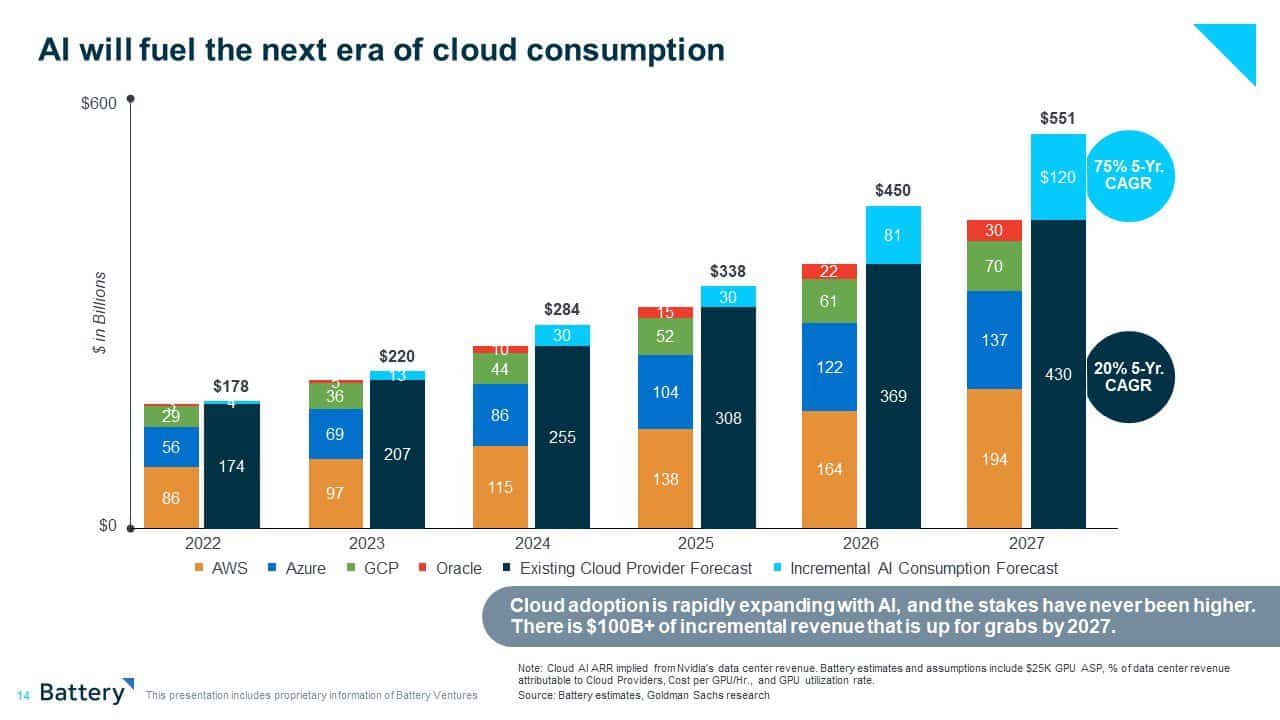

Indeed, in the technology markets, the dust is finally beginning to settle. Growth rates for the big cloud providers are not what they were two years ago, and the IPO market has not yet rebounded. But we see the technology landscape quietly pivoting toward a horizon brimming with promise as more enterprise-tech companies revert to fundamentals, seeking to balance growth and profitability and capture new efficiencies with AI.

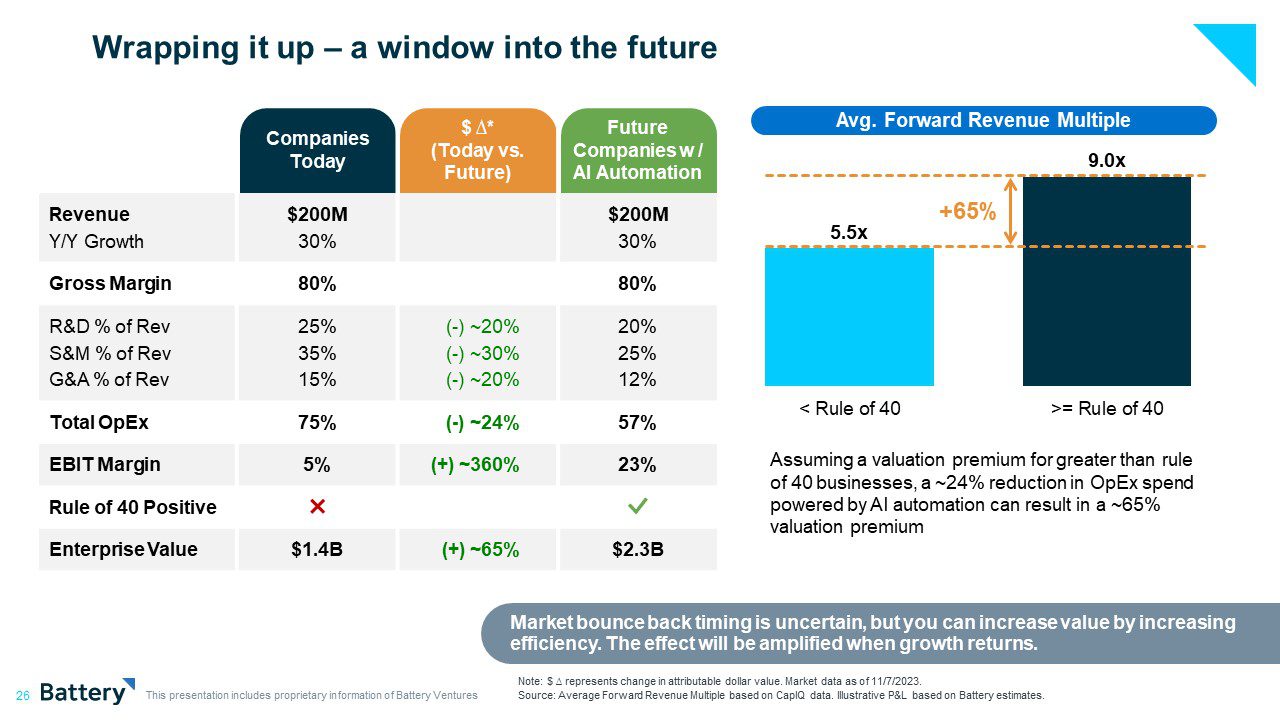

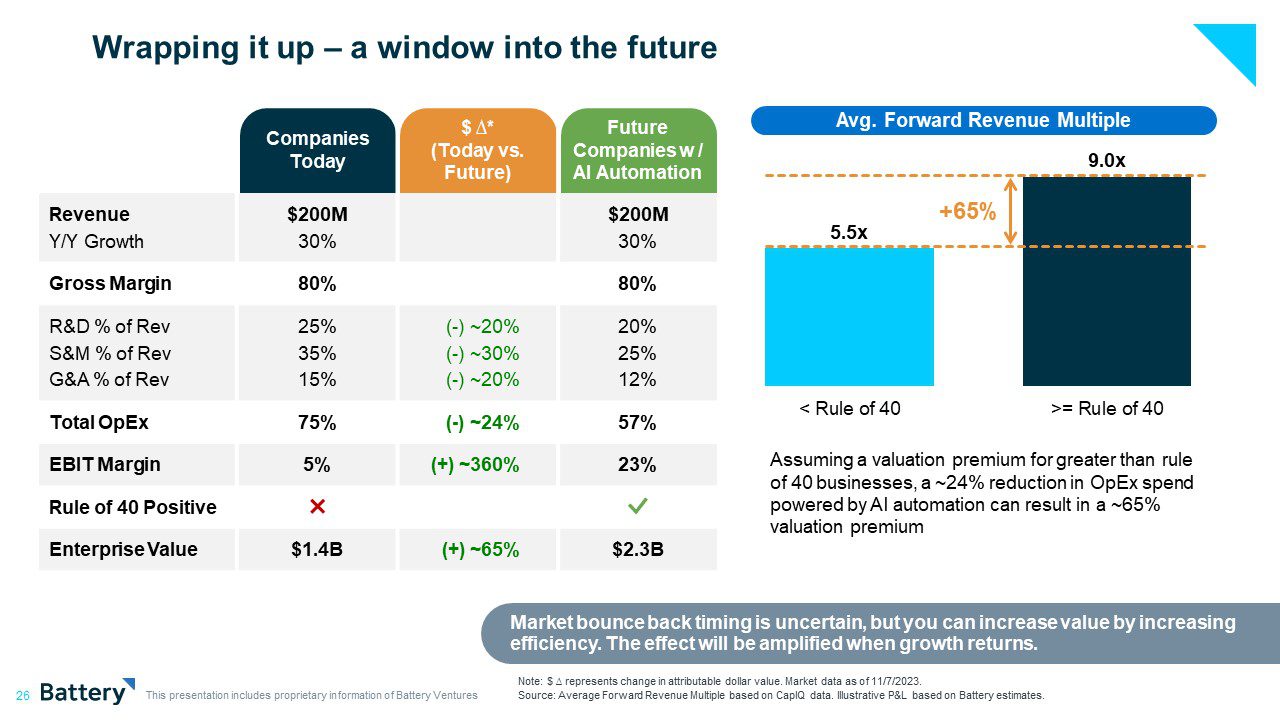

In many ways, this is a watershed moment for the industry, one that will change how software and technology companies are created. The implementation of AI, both in terms of companies being able to offer more AI products and leverage the technology to drive more-efficient internal operations, will allow cloud companies to generate new sources of revenue while meaningfully reducing internal costs.

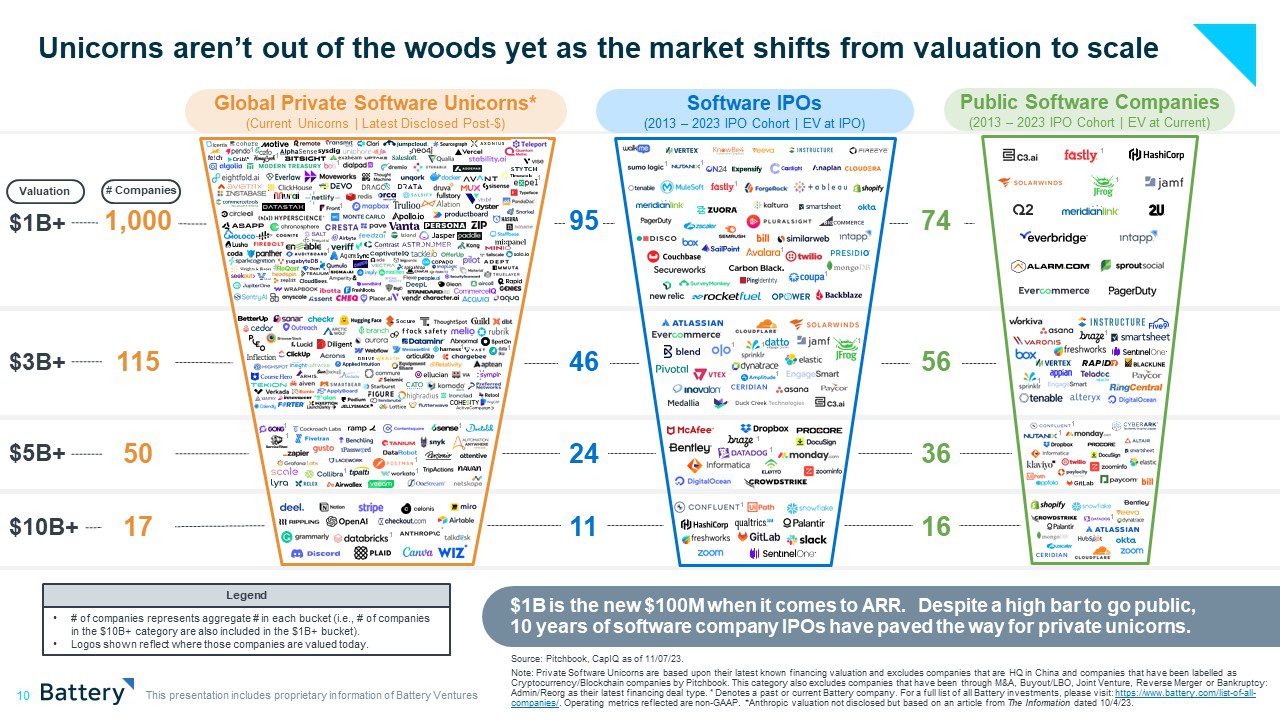

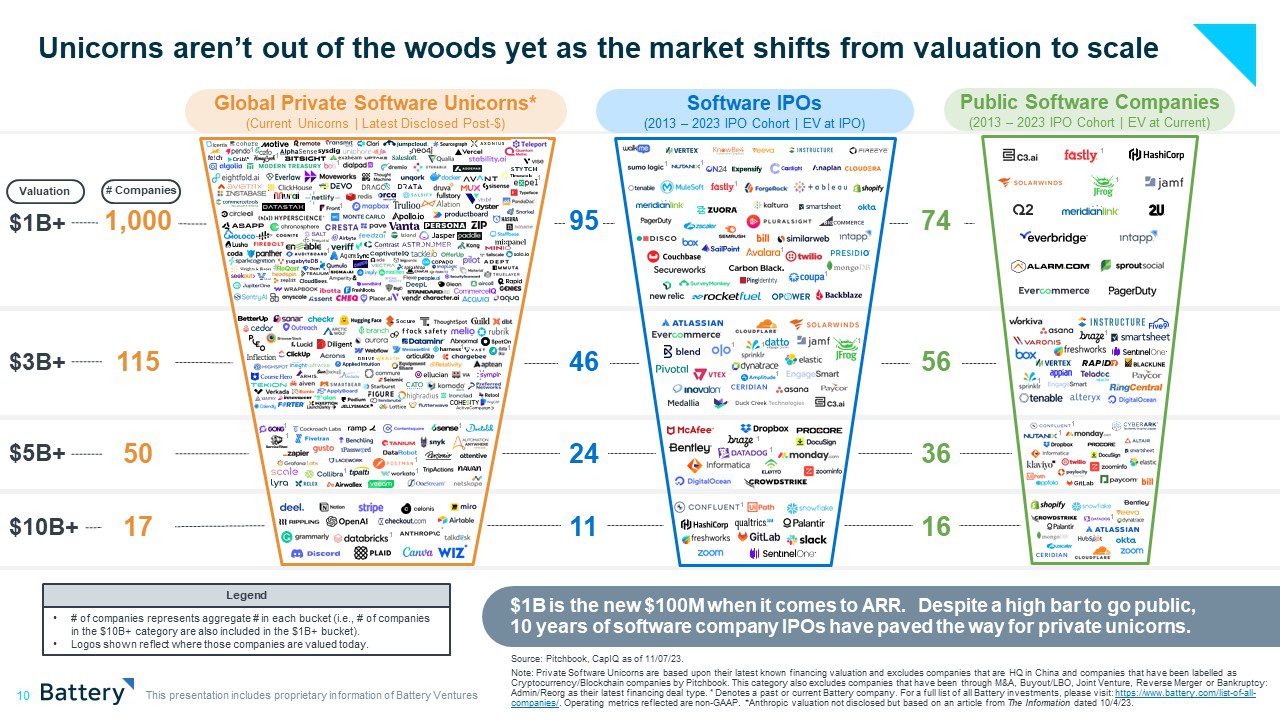

As we wrote in this year’s report, “as growth returns, highly profitable, high-growth companies will return,” ushering in an era of mega-B2B software companies that will gear up for IPOs when they hit $1 billion in revenue, not just $100 million (the old standard). And as these companies evolve and scale over time, the very definition of a healthy software company will change.

Our full 2023 State of the OpenCloud report is available for download here and at the bottom of this post, where we’ll break down some of our key takeaways.

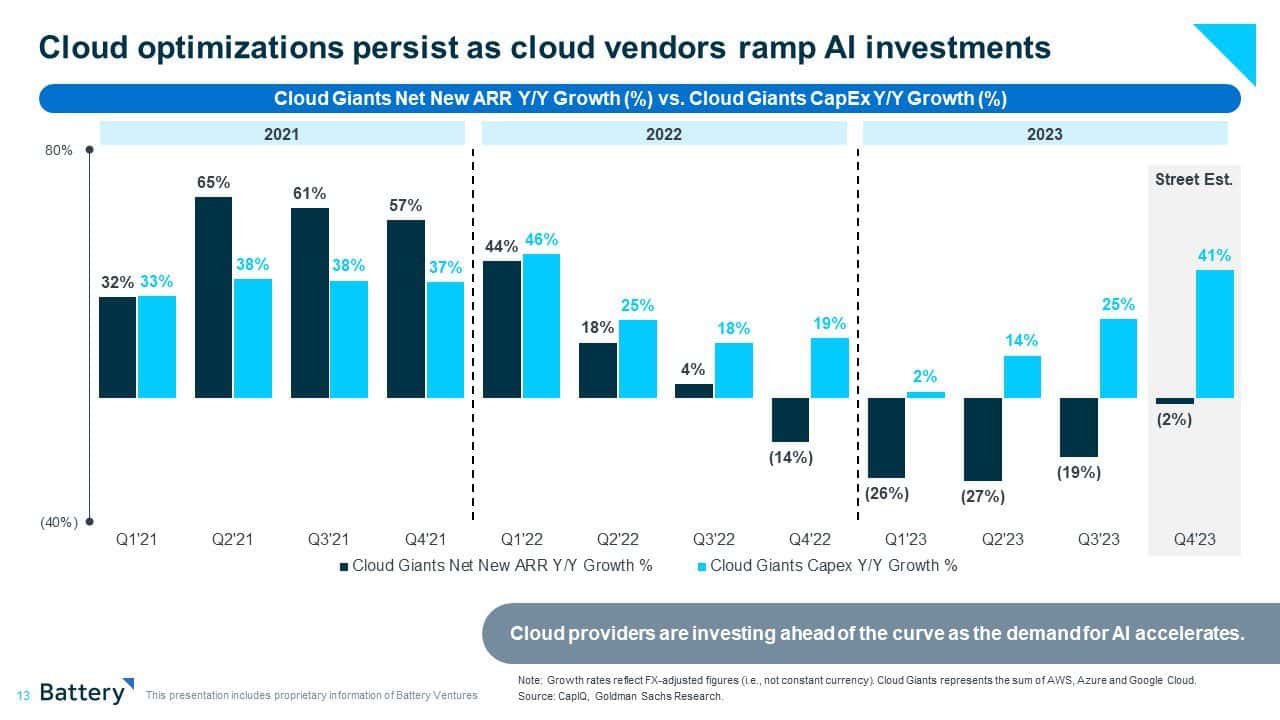

Cloud Providers Invest Ahead of the AI Curve

Pain in the market has affected every software company, public and private. The world’s largest cloud providers — AWS, Microsoft Azure and Google Cloud, which generate a collective $200B in annual revenue — are no different. These companies have seen growth slow down significantly in the past year and have been forced to cut headcount and other costs.

Importantly, however, these companies are leaning heavily into capital expenditures related to new businesses: major, long-term investments into the future of software, particularly in AI. We interpret this as a leading indicator for building customer demand, conveying a sense of optimism for the market recovery and a high-growth, high-profitability future enabled and necessitated by automation.

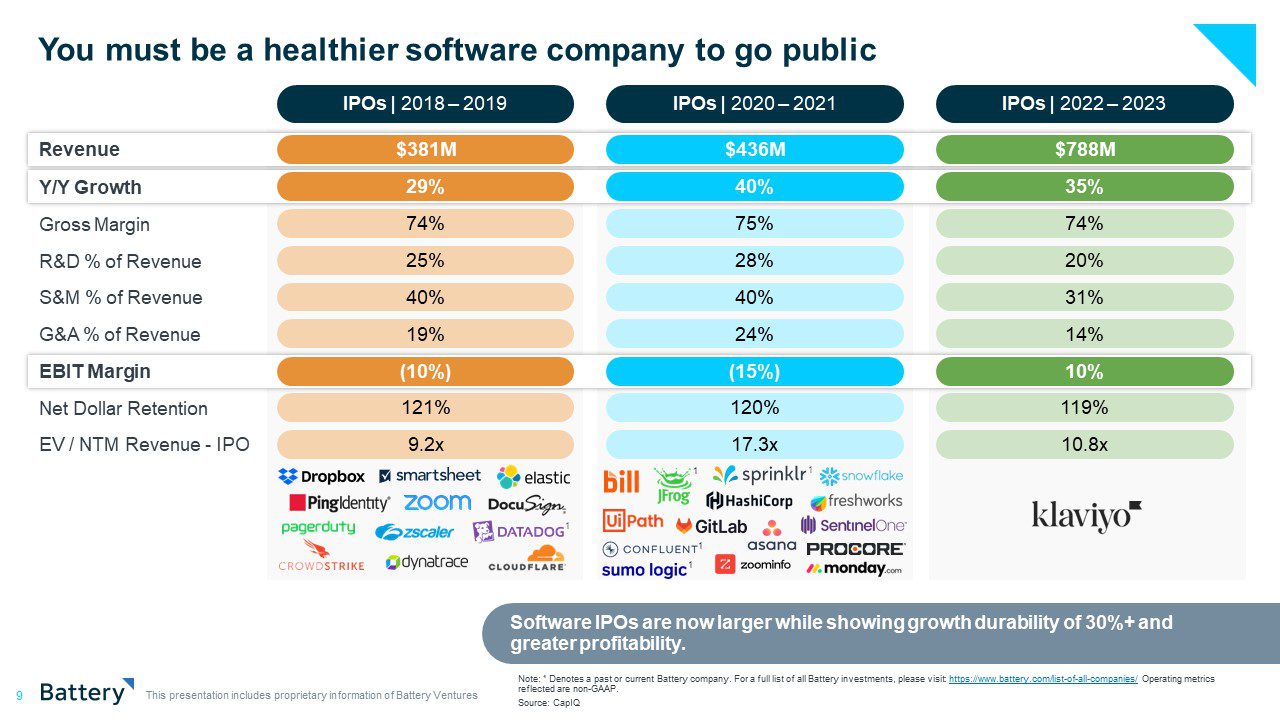

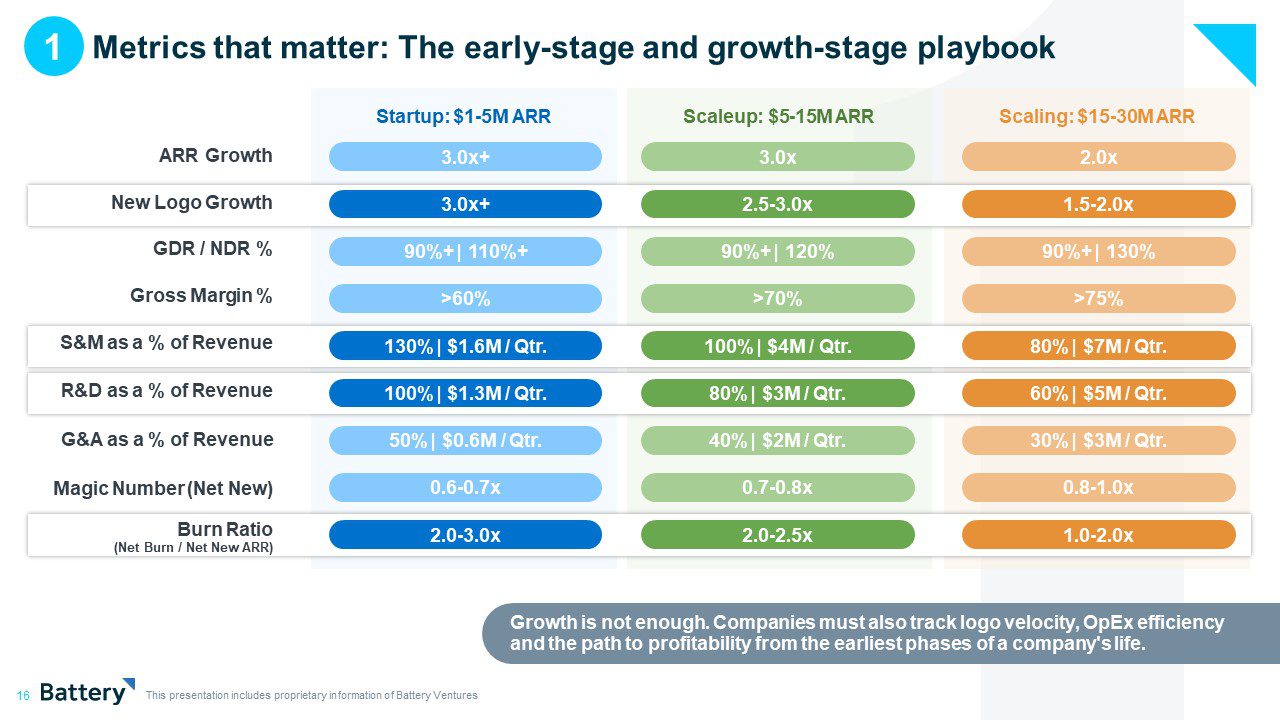

Redefining Healthy Software Company Metrics

As research-driven, enterprise-technology investors, we have a deep appreciation for metrics and ratios but the assumptions that guided us in years past may not hold for the next cloud generation. While valuations have come back closer to long-term historical averages, the profile of public companies today is far from average – in many ways, they are stronger than ever.

It’s also important to distinguish valuations from business fundamentals. A company generating $1 billion in revenue today might not be valued as highly as it once was, but reaching such a revenue milestone is still a monumental achievement. And we think these companies will be well positioned as we enter an era of more profitability, more efficiency, and ultimately, higher valuations over the long term.

Starting from the top line, we recommend that early-stage and growth-stage software companies focus closely on logo velocity. We know that as companies mature, they rely on expansion revenue to drive growth. However, logo velocity helps to ensure that there is a large enough customer base to fuel future growth, but also aligns sales to balance new ARR and expansion ARR from day one.

The Path Ahead for Private Unicorns

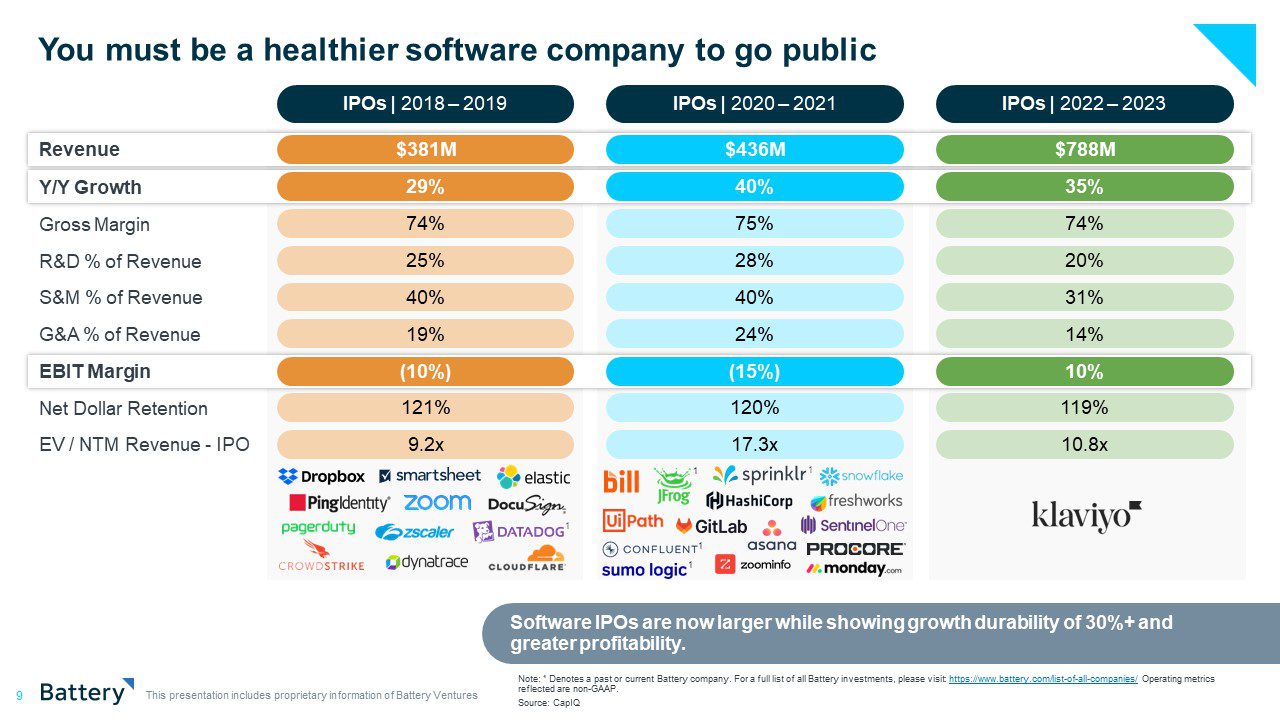

Navigating the public markets is always challenging, but the current climate is particularly unforgiving. In our 2022 State of the OpenCloud report, we predicted there was pain ahead for private companies who faced a very high bar to IPO. Cut to today, we have seen only one software IPO in the past year — Klaviyo.

While we’re not out of the woods yet, the software ecosystem at large can support a path to IPO for many private software unicorns. And, paradoxically, the tougher macro environment has created a new class of pre-IPO companies that are stronger and more resilient than those in the past.

Conclusion

While we are still in the early innings for OpenCloud, our team is more optimistic than ever about the potential for cloud and open-source companies, with AI as a new growth lever. There is a significant opportunity at hand for software leaders to recalibrate and improve their companies’ operational efficiency through automation. The implementation of AI across customer offerings and internal processes promises not only cost savings but also enhanced capabilities, paving the way for resilient and future-proofed enterprises.

For more insights, please see our full 2023 State of the OpenCloud report below.

The information contained herein is based solely on the opinions of Dharmesh Thakker, Danel Dayan, Jason Mendel, Sudheendra Chilappagari, Patrick Hsu and Payal Modi and nothing should be construed as investment advice. This material is provided for informational purposes, and it is not, and may not be relied on in any manner as, legal, tax or investment advice or as an offer to sell or a solicitation of an offer to buy an interest in any fund or investment vehicle managed by Battery Ventures or any other Battery entity.

This information covers investment and market activity, industry or sector trends, or other broad-based economic or market conditions and is for educational purposes.

Content obtained from third-party sources, although believed to be reliable, has not been independently verified as to its accuracy or completeness and cannot be guaranteed. Battery Ventures has no obligation to update, modify or amend the content of this post nor notify its readers in the event that any information, opinion, projection, forecast or estimate included, changes or subsequently becomes inaccurate.

A monthly newsletter to share new ideas, insights and introductions to help entrepreneurs grow their businesses.