Mining

All the Metals We Mined in 2021: Visualized

![]() Subscribe to the Elements free mailing list for more like this

Subscribe to the Elements free mailing list for more like this

View the full-size infographic

All the Metals We Mined in 2021

This was originally posted on Elements. Sign up to the free mailing list to get beautiful visualizations on natural resource megatrends in your email every week.

“If you can’t grow it, you have to mine it” is a famous saying that encapsulates the importance of minerals and metals in the modern world.

From every building we enter to every device we use, virtually everything around us contains some amount of metal.

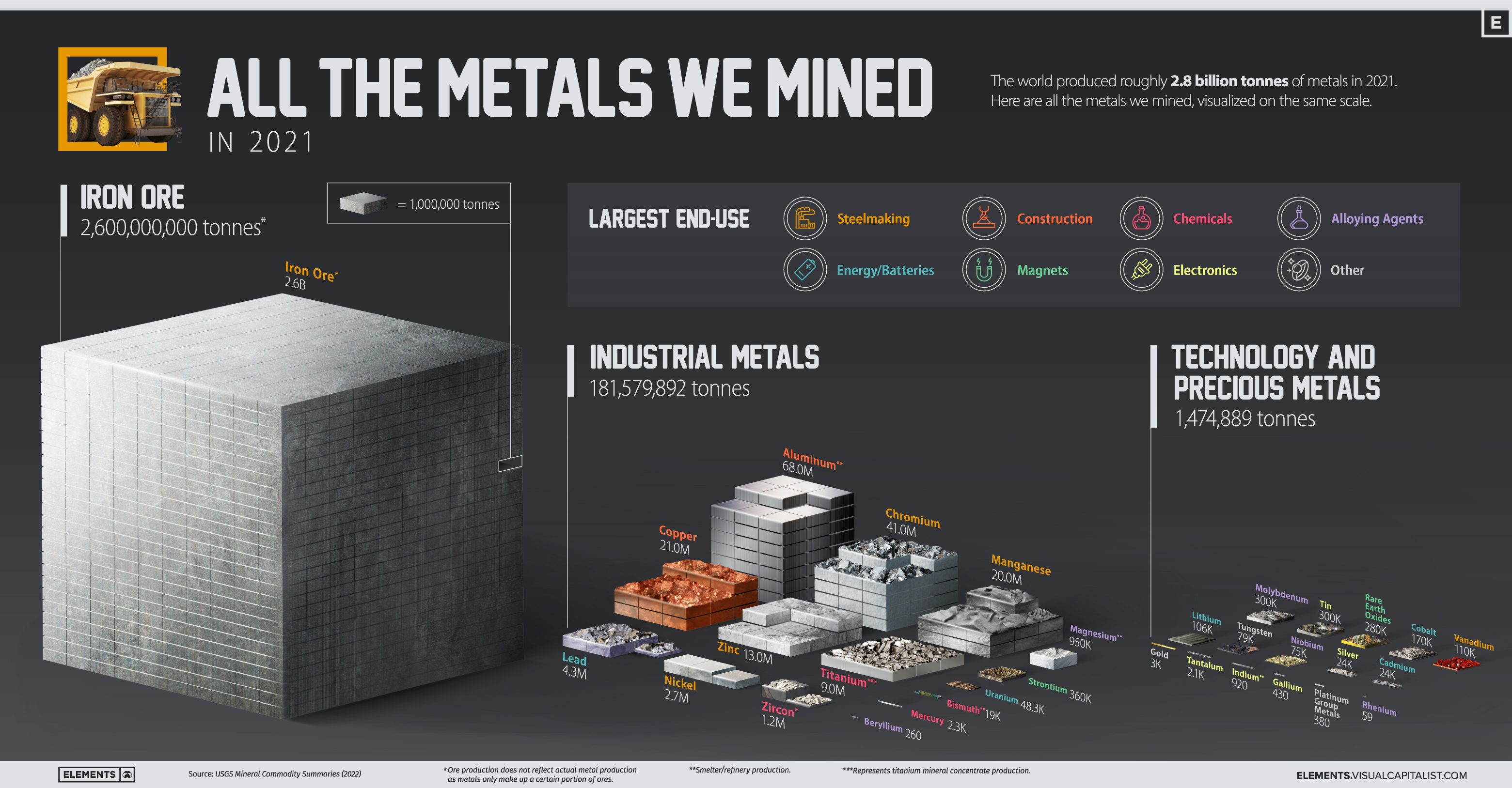

The above infographic visualizes all 2.8 billion tonnes of metals mined in 2021 and highlights each metal’s largest end-use using data from the United States Geological Survey (USGS).

Why Do We Mine So Much Iron Ore?

Iron ore accounted for 93% of the metals mined in 2021, with 2.6 billion tonnes extracted from the ground. It’s important to note that this is ore production, which is typically higher than metal production since metals are extracted and refined from ores. For example, the iron metal content of this ore is estimated at 1.6 billion tonnes.

| Metal/Ore | 2021 Mine Production (tonnes) | % of Total |

|---|---|---|

| Iron ore | 2,600,000,000 | 93.4% |

| Industrial metals | 181,579,892 | 6.5% |

| Technology and precious metals | 1,474,889 | 0.05% |

| Total | 2,783,054,781 | 100.0% |

With 98% of it converted into pig iron to make steel, iron ore is ubiquitous in our lives. Steel made from iron ore is used in construction, transportation, and household appliances, and it’s likely that you encounter something made out of it every day, especially if you live in a city.

Due to its key role in building infrastructure, iron ore is one of the most important materials supporting urbanization and economic growth.

Industrial Metals

Industrial metals are largely used in steelmaking, construction, chemical manufacturing, and as alloying agents. In 2021, the world mined over 181 million tonnes of these metals.

| Industrial Metals | 2021 Mine Production (tonnes) | % of Total |

|---|---|---|

| Aluminum* | 68,000,000 | 37.4% |

| Chromium | 41,000,000 | 22.6% |

| Copper | 21,000,000 | 11.6% |

| Manganese | 20,000,000 | 11.0% |

| Zinc | 13,000,000 | 7.2% |

| Titanium (mineral concentrates) | 9,000,000 | 5.0% |

| Lead | 4,300,000 | 2.4% |

| Nickel | 2,700,000 | 1.5% |

| Zirconium Minerals (Zircon) | 1,200,000 | 0.7% |

| Magnesium* | 950,000 | 0.5% |

| Strontium | 360,000 | 0.2% |

| Uranium | 48,332 | 0.03% |

| Bismuth* | 19,000 | 0.01% |

| Mercury | 2,300 | 0.001% |

| Beryllium | 260 | 0.0001% |

| Total | 181,579,892 | 100.0% |

*Represents refinery/smelter production.

Aluminum accounted for nearly 40% of industrial metal production in 2021. China was by far the largest aluminum producer, making up more than half of global production. The construction industry uses roughly 25% of annually produced aluminum, with 23% going into transportation.

Chromium is a lesser-known metal with a key role in making stainless steel stainless. In fact, stainless steel is usually composed of 10% to 30% of chromium, enhancing its strength and corrosion resistance.

Copper, manganese, and zinc round out the top five industrial metals mined in 2021, each with its own unique properties and roles in the economy.

Technology and Precious Metals

Technology metals include those that are commonly used in technology and devices. Compared to industrial metals, these are usually mined on a smaller scale and could see faster consumption growth as the world adopts new technologies.

| Technology and Precious Metals | 2021 Mine Production (tonnes) | % of Total |

|---|---|---|

| Tin | 300,000 | 20.3% |

| Molybdenum | 300,000 | 20.3% |

| Rare Earth Oxides | 280,000 | 19.0% |

| Cobalt | 170,000 | 11.5% |

| Vanadium | 110,000 | 7.5% |

| Lithium | 106,000 | 7.2% |

| Tungsten | 79,000 | 5.4% |

| Niobium | 75,000 | 5.1% |

| Silver | 24,000 | 1.6% |

| Cadmium | 24,000 | 1.6% |

| Gold | 3,000 | 0.2% |

| Tantalum | 2,100 | 0.1% |

| Indium* | 920 | 0.1% |

| Gallium | 430 | 0.03% |

| Platinum Group Metals | 380 | 0.03% |

| Rhenium | 59 | 0.004% |

| Total | 1,474,889 | 100.0% |

*Represents refinery/smelter production.

The major use of rhenium, one of the rarest metals in terms of production, is in superalloys that are critical for engine turbine blades in aircraft and gas turbine engines. The petroleum industry uses it in rhenium-platinum catalysts to produce high-octane gasoline for vehicles.

In terms of growth, clean energy technology metals stand out. For example, lithium production has more than doubled since 2016 and is set to ride the boom in EV battery manufacturing. Over the same period, global rare earth production more than doubled, driven by the rising demand for magnets.

Indium is another interesting metal on this list. Most of it is used to make indium tin oxide, an important component of touchscreens, TV screens, and solar panels.

The Metal Mining Megatrend

The world’s material consumption has grown significantly over the last few decades, with growing economies and cities demanding more resources.

Global production of both iron ore and aluminum has more than tripled relative to the mid-1990s. Other metals, including copper and steel, have also seen significant consumption growth.

Today, economies are not only growing and urbanizing but also adopting mineral-intensive clean energy technologies, pointing towards further increases in metal production and consumption.

Mining

Gold vs. S&P 500: Which Has Grown More Over Five Years?

The price of gold has set record highs in 2024, but how has this precious metal performed relative to the S&P 500?

Gold vs. S&P 500: Which Has Grown More Over Five Years?

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Gold is considered a unique asset due to its enduring value, historical significance, and application in various technologies like computers, spacecraft, and communications equipment.

Commonly regarded as a “safe haven asset”, gold is something investors typically buy to protect themselves during periods of global uncertainty and economic decline.

It is for this reason that gold has performed rather strongly in recent years, and especially in 2024. Persistent inflation combined with multiple wars has driven up demand for gold, helping it set a new all-time high of over $2,400 per ounce.

To put this into perspective, we visualized the performance of gold alongside the S&P 500. See the table below for performance figures as of April 12, 2024.

| Asset/Index | 1 Yr (%) | 5 Yr (%) |

|---|---|---|

| 🏆 Gold | +16.35 | +81.65 |

| 💼 S&P 500 | +25.21 | +76.22 |

Over the five-year period, gold has climbed an impressive 81.65%, outpacing even the S&P 500.

Get Your Gold at Costco

Perhaps a sign of how high the demand for gold is becoming, wholesale giant Costco is reportedly selling up to $200 million worth of gold bars every month in the United States. The year prior, sales only amounted to $100 million per quarter.

Consumers aren’t the only ones buying gold, either. Central banks around the world have been accumulating gold in very large quantities, likely as a hedge against inflation.

According to the World Gold Council, these institutions bought 1,136 metric tons in 2022, marking the highest level since 1950. Figures for 2023 came in at 1,037 metric tons.

See More Graphics on Gold

If you’re fascinated by gold, be sure to check out more Visual Capitalist content including 200 Years of Global Gold Production, by Country or Ranked: The Largest Gold Reserves by Country.

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business1 week ago

Business1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc1 week ago

Misc1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes