Cost Of The Green Energy Transition: Who You Gonna Believe, Some Research Assistants From Oxford Or Your Lyin' Eyes?

/Over in Europe, and particularly in those countries in the vanguard of the green energy transition, the enormous costs of this folly have begun to hit home. In the UK, average annual consumer energy bills were scheduled to rise as of October 1 to £3549/year, from only £1138/year just a year ago. (The figure may now get reduced somewhat by means of massive government subsidies, which only conceal, but do not obviate, the disastrous cost increases.) Germany’s regulated consumer gas bills are scheduled for an average annual increase on October 1 of about 480 euros, about 13%, from an already high 3568 euros.

Anyone with a pair of eyes can see what has happened. They thought they could get rid of fossil fuels just by building lots of wind turbines and solar panels, which don’t work most of the time. Then they suppressed fossil fuel production, because that is the virtuous thing to do. Somehow they lost track of the fact that they needed full backup for the wind and sun, and have no alternative to the suppressed fossil fuels. With supply of fossil fuels intentionally and artificially constrained, prices spiked.

And they have not even yet gotten to 50% of electricity, or 15% of final energy consumption, from wind/sun on an annualized basis.

Is anybody learning a lesson here? Doubtful.

Into the mix has just arrived on September 13 a big new paper from a group of geniuses at Oxford University, with the title “Empirically grounded technology forecasts and the energy transition.” The lead author is named Rupert Way. For your additional reading pleasure, here is another link to some 150 pages of “Supplemental Information” that go along with the article. The release of the Oxford paper was immediately followed by some dozens (maybe hundreds) of articles from the usual suspects in the press exclaiming the exciting news — Switching to renewables will save trillions!!!!!

Could anybody really believe this? A few examples:

From the BBC, September 14: “Switching to renewable energy could save trillions - study.” “Switching from fossil fuels to renewable energy could save the world as much as $12tn (£10.2tn) by 2050, an Oxford University study says.” The BBC interviewed one of the study’s co-authors: “[T]he researchers say that going green now makes economic sense because of the falling cost of renewables. ‘Even if you're a climate denier, you should be on board with what we're advocating,’ Prof Doyne Farmer from the Institute for New Economic Thinking at the Oxford Martin School told BBC News. ‘Our central conclusion is that we should go full speed ahead with the green energy transition because it's going to save us money,’ he said.”

From MSN, September 13: “Going green could save world "trillions" - study.” “The Report says predictions that moving quickly towards cleaner energy sources was expensive are wrong and too pessimistic. Even without the currently very high price of gas, the researchers say that going green now makes economic sense because of the falling cost of renewables.”

Nature World News, September 14: “Due to the Increase of Oil Prices, Switching To Renewable Energy Could Save Trillions Than Using Fossil Fuels.” “An Oxford University study claimed that switching from fossil fuels to renewable energy might save the world $12 trillion (£10.2 trillion) by the year 2050. . . . However, the researchers asserted that the declining cost of renewable energy means that going green currently makes financial sense.”

There are dozens more of these out there should you care to do an internet search.

My main response is: This paper and others like it are exactly why we citizens and taxpayers need to demand a working and fully-costed demonstration project before we allow ourselves all to be used as guinea pigs in the implementation of these preposterous wind/solar fantasies. As I wrote in a post just a few days ago, if this is so easy and will save so much money, then California and New York should show the rest of us how it’s done before everyone else is forced to go along.

The basic technique of the authors here is to snow anyone who attempts to read their work with mountainous piles of sophisticated-sounding mumbo-jumbo. Example (from Summary): “[W]e use an approach based on probabilistic cost forecasting methods that have been statistically validated by backtesting on more than 50 technologies. . . . “ Clearly the hope is that nobody will be able to penetrate the thicket, and all anyone will come away with is “We’ll save $12 trillion!”

Well, the Manhattan Contrarian is not quite that easy to snow. Based on the waste of several valuable hours of my time, here are what I believe to be the main problems with the work:

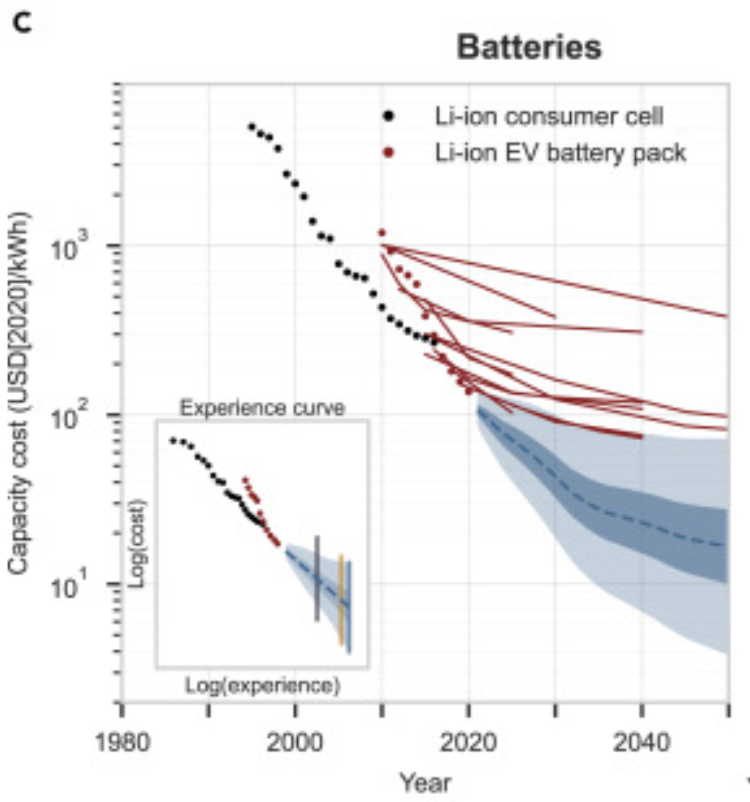

The principal driver of the whole thing is a forecast of rapid and continuous declines in the cost of wind turbines, solar panels and batteries. The assumption is that costs of these things will continue to decline exponentially without limit indefinitely into the future. From the “Results” section: “We know of no empirical evidence supporting floor costs and do not impose them . . . “ Of the three technologies at issue (wind, solar, and batteries), the one I know the most about is batteries. Here is the Way, et al., chart of price history of batteries and the projection they use for the future:

That’s a logarithmic scale over at the left. So the chart is showing the cost of Li-ion batteries going down from about $100/[k]Wh in 2020 to something between $2/[k]Wh and about $80/[k]Wh by 2050, with a mid-point of the forecast around $20/[k]Wh.

And in the real world? In June 2021 the government’s National Renewable Energy Laboratory put out a document called its “Cost Projections for Utility-Scale Battery Storage: 2021 Update.” NREL’s figure for the 2020 cost of utility-scale Li-ion batteries (page iv of the Executive Summary) is $350/kWh, compared to the $100/kWh of Way, et al. The difference appears to lie mainly in elements of a real-world battery installation other than the core battery itself, like a building to house it, devices to convert AC to DC and back, grid connections, “balance of plant,” and so forth. So let’s say that we begin with a small discrepancy in the starting point. NREL also forecasts declining costs going forward, but only to a mid-point of about $150/kWh by 2050, which would be 50% above Way et al.’s starting point and well more than an order of magnitude greater than the mid-point of the Way, et al. 2050 forecast.

And we are a couple of years beyond 2020 now, so how is it going? Utility Dive has a piece from April 12, 2022, reporting on the progress of New York in acquiring grid-scale batteries to advance its highly-ambitious Net Zero agenda. Excerpt: “The cost of installing retail, non-residential projects that recently won awards was an average $567 per kWh, according to an April 1 storage report by DPS. In 2020-21, the average installation costs of such projects was $464 per kWh.” In other words, instead of going down, the costs are rapidly going up. Reasons, from Utility Dive: “Crimped supply chains, rising demand for batteries and higher costs of lithium used in ubiquitous lithium-ion batteries make for a steep climb ahead, experts say.” Utility Dive then quotes New York regulators as saying that they expect the costs to go way down by the end of the current decade. Sure.

As to continuing rapid declines in the prices of wind turbines and solar panels, I’ll believe it when I see it. Yes there have been substantial declines to date. But at this point these strike me as mature technologies. The main issues in getting them built and operational are mining and processing huge quantities of metals and minerals, forming the metals and minerals into the devices, transporting the (very large and heavy) devices to their sites, and installing them. How are those things going to get cheaper by any substantial amount, let alone another order of magnitude?

The treatment of the energy storage problem in this paper is wholly inadequate, and bordering on the fantastical. The cost fantasies as to short-term storage are discussed above. As to longer term storage, from the Supplemental Information, pages 38-45, it appears that the proposed solution is almost entirely hydrogen, supposedly to be produced by electrolysis from water. (Here, they mostly.call the proposed storage medium “P2X fuels,” somehow implying that it might be something other than hydrogen, much like with New York and its “DEFR” fantasy.). There is currently essentially no existing prototype or demonstration project of this so-called “green hydrogen” anywhere in the world from which realistic cost projections can be derived. (From the 2022 JP Morgan Asset Management Annual Energy Paper, page 39: “Current green hydrogen production is negligible. . . .”). Way, et al., do cite some costs of existing electrolyzers, but I can find no discussion in the paper of the issue that producing hydrogen on a scale sufficient to back up the entire world electricity system is going to require electrolyzing the ocean. And the millions of tons of toxic chlorine gas thereby produced are going to go — where? The problems of dealing with enormous amounts of hydrogen — like explosiveness, embrittlement of pipelines, and the like — are dealt with with a wave of the hand. The creation of a massive green hydrogen infrastructure as the backup for wind and sun hasn’t even been begun by the most fanatical of the green energy crazies like Germany, California or New York. They take one look at the real costs and balk.

The answer of Way, et al., to any of these objections is, you just have to start building the facilities in large enough quantities, and we can assure you that costs will promptly drop like a stone. After all, we have “probabilistic cost forecasting methods” that have been “validated by backtesting on more than 50 technologies. . . .”

Perhaps I should mention that the authors of Way, et al. consist of one senior professor and a bunch of research assistants and post-docs. The senior professor (J. Doyne Farmer) is a mathematician and economist. Way himself is a “Postdoctoral Research Officer.” Matthew Ives is a “Senior Reseach Officer” who previously worked on implementing the Net Zero plans of South Australia. Penny Mealy is an economist at the World Bank with a title of “Associate” at Oxford. All four are part of something at Oxford called the Institute for New Economic Thinking. Lead author Way looks to be under 30. All four specialize in mathematical modeling, and none appears to have any expertise (at least none they are willing to admit to) in how to engineer an electrical grid that works.

We can all see in Europe what happens when you try to suppress fossil fuels and replace them with wind and sun, without having the alternative plan for storage and backup fully costed and engineered and in place for when you need it. But in the face of the ongoing disaster, Way, et al., say, double down! We assure you that if you just spend enough now on renewables and an untried hydrogen system, costs will drop and it will all save you trillions in the end. And after all, they are a bunch of really smart people who work for Oxford. Who are you gonna believe, them or your lyin’ eyes?

[This post has been edited to correct a few typos where MWh should have been kWh.]