Child Poverty in America More Than Doubled in 2022

The U.S. Census Bureau recently released the updated 2022 measures of poverty: the official poverty measure and the Supplemental Poverty Measure (SPM). The official poverty measure only considers families’ pre-tax cash earnings, while the SPM considers a broader set of resources, such as in-kind benefits, safety net benefits and, when applicable, stimulus payments. The SPM allows experts to better assess the effectiveness of interventions to reduce child poverty.

In 2022, the official poverty measure threshold was $29,678 for a family of two adults and two children. Families can earn well over this amount and still not make ends meet, especially in high-cost areas. Unlike the official poverty measure, the SPM factors in regional variation in cost of living. For all these reasons, the Annie E. Casey Foundation advocates using the SPM.

What Is the Current Child Poverty Rate in the United States?

In 2022, the SPM child poverty rate jumped to 12%, more than twice the 2021 rate of 5%. This equates to about 9 million kids in 2022 living in families who do not have enough resources for basic needs such as food, housing and utilities.

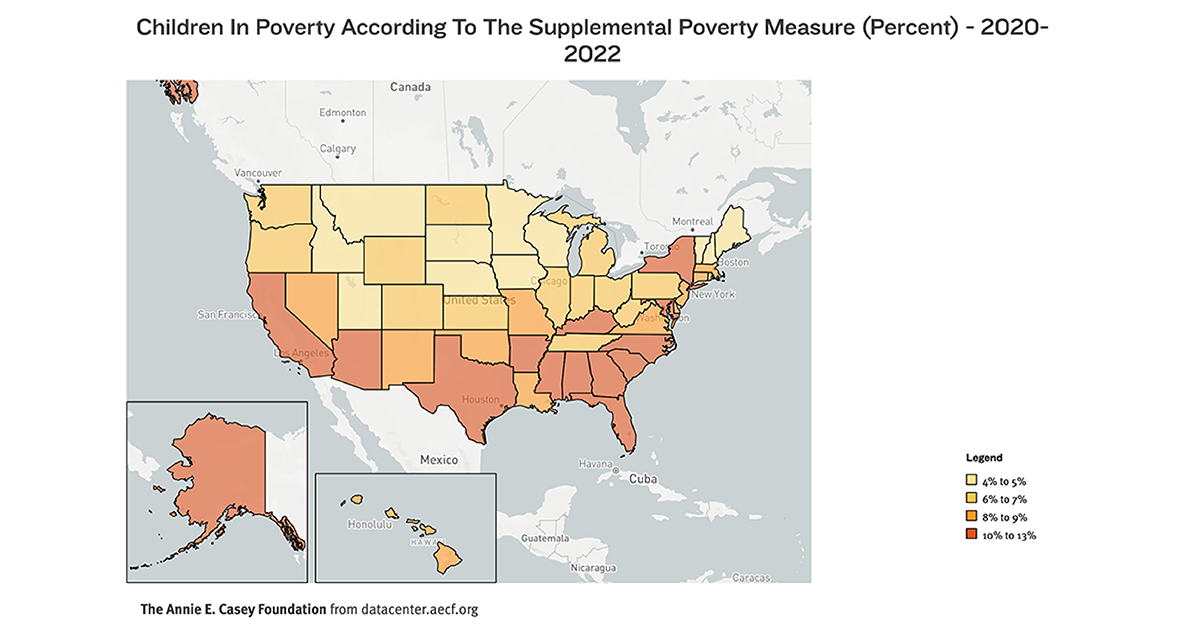

See the SPM child poverty rate in your state

The highest rates of poverty occur for the youngest children — under age 5 — kids in single-mother families, children of color and kids in immigrant families.

Sign up for newsletters to get the latest data, reports and resources from the Casey Foundation

The Effects and Cost of Child Poverty

Growing up in poverty is one of the greatest threats to healthy child development. The effects of economic hardship, particularly deep and persistent poverty, can disrupt children’s cognitive development, physical and mental health, educational success and other aspects of life. These effects reverberate throughout adulthood. Researchers estimate the total U.S. cost of child poverty ranges from $800 billion to $1.1 trillion per year based on lost productivity and increased health care and other expenditures.

The alarming rise in child poverty in 2022 reverses the progress made in the past two years, with millions of children slipping back into poverty. Their health and well-being currently is at risk. Now more than ever, children need security and stability. Decisions by policymakers today will have lasting impacts on children’s lives.

What Is the Main Cause of Child Poverty?

Child poverty is connected to family poverty. While there is no single cause of poverty, families may fall into financial hardship due to a job loss, expenses that become too high — such as housing, health care and groceries — a transition from a two-parent to a single-parent household or another destabilizing event. Among children and families of color, the picture is further complicated by generations-long inequities and discriminatory policies and practices that have led to income inequality and disparate access to economic opportunities and resources.

Neighborhoods matter, too. Communities with concentrated poverty, which are often racially segregated, tend to have fewer job opportunities for parents and youth, underfunded schools and fewer resources in general. When children grow up in these neighborhoods, it can take generations to move out of poverty.

Additionally, larger economic forces, labor markets and public policies affect child poverty. For instance, parental unemployment and child poverty increase during economic recessions, and labor market factors — such as minimum wage levels — affect poverty rates.

Demographics play a role as well, with older, more educated parents generally able to obtain higher wages. Child poverty rates are also affected by the strength of government safety net programs, such as the extended child tax credit discussed below.

Where Does Child Poverty in America Exist?

Every state in America has children living in poverty, but higher rates generally exist in the southern region of the country (see map below) as well as in rural areas and urban neighborhoods of concentrated poverty.

- The District of Columbia has the highest SPM child poverty rate in the country, at 15%, followed by Florida and New York, both 13%, according to 2020–2022 data available in the KIDS COUNT® Data Center.

- Six states share the lowest SPM child poverty rate in the nation, at 4%: Iowa, Maine, Minnesota, Nebraska, Utah and Wisconsin.

- Approximately 8% of kids live in neighborhoods of concentrated poverty, according to a report by the Foundation. Black and American Indian and Alaska Native children are seven times more likely to live in these communities compared to white kids, and Latino children are about five times more likely.

- According to the USDA Economic Research Service’s Rural Poverty & Well-Being report, in 2019, about 21% of children in non-metro (rural) areas were considered poor compared to 16% of kids in metro areas. The same report looked at counties with high child poverty rates of 40% or above during 2015–2019 and found that 127 of the 138 counties were rural, largely in the southern region and concentrated in Georgia, Kentucky, Mississippi and Texas.

Poverty in America Disproportionately Affects Children of Color

For decades, children and families of color have borne a disproportionate burden of poverty in the United States, and the latest Census SPM poverty data show a continuation — and worsening — of this sobering trend.

- Latino children: One in 5 (20%) now live in poverty according to the 2022 SPM, a substantial spike from 8% in 2021 and the largest increase of all racial and ethnic groups with available estimates. (Note that American Indian and Alaska Native child poverty rates showed an even bigger jump from 7% to 25%, but the 2022 estimate was considered unreliable due to a large margin of error.)

- Black children: The poverty rate rose by a concerning 10 percentage points, from 8% in 2021 to 18% in 2022, the second-largest increase.

- Two or more races: The SPM poverty rate also jumped from 5% to 12% for these children.

- Asian and Pacific Islander children: The poverty rate increased from 6% to 10% for this broad group as well. However, the category of “Asian and Pacific Islander” represents dozens of highly diverse populations, and disaggregated data from other indicators show that wide socioeconomic disparities persist among these different populations.

- White children: This group has the lowest poverty rate, at 7% in 2022, up from 3% in 2021.

How to Reduce Child Poverty in America

Adequately investing in safety net programs — particularly the expanded child tax credit — is one of the most effective ways to reduce child poverty. According to Census Bureau data, in 2021, expanded tax credits and stimulus payments lifted 5.2 million children out of poverty. That year, the nation was looking at a policy success story: America’s SPM child poverty rate had dropped by half, from 10% in 2020 to a historic low of 5%. The Census Bureau reported that the 2021 expanded child tax credit (CTC) alone removed 2.9 million kids from poverty, one-third of whom were under age 6. These policies clearly worked.

However, the expanded tax credits and payments were temporary pandemic-relief measures, and when they expired in 2022, the number of kids in poverty soared by more than 5 million.

2021 Child Tax Credit Expansion

In addition to lifting millions of kids out of poverty, the 2021 expanded CTC corrected a problem in the existing CTC that allowed high-income families to receive the full tax credit while preventing low-income families from receiving the same. In other words, families with the greatest needs received the least assistance. Now that the expanded CTC has expired and has gone back to its previous version, and the full credit is no longer available to all low-income families.

Dramatically reducing child poverty in America is an achievable policy goal. Naturally, the temporary pandemic relief measures were not meant to be long-term policies. But now that we know what works to reduce child poverty, lawmakers can move forward with confidence to implement effective, lasting solutions. Strong safety net programs are essential to ensuring that all children have equitable access to the opportunities and resources they need to thrive.

Policymakers should prioritize expanding the child tax credit, strengthening other safety net programs to meet the basic needs of all low-income children and addressing root causes of income inequality and poverty disparities by race.

Access More of the Foundation’s Child and Family Poverty Resources

- Economic Well-being Indicators on the KIDS COUNT Data Center

- Most Common Uses of 2021 Child Tax Credit Payments: Food, Utilities, Housing, Clothes

- Children Living in High-Poverty, Low-Opportunity Neighborhoods

- Child Poverty

- Racial Equity and Inclusion

- Economic Opportunity

- 2023 KIDS COUNT Data Book

- Also see: New Census Tool With Child Poverty Rates in Every U.S. School District