As countries around the world, including the U.S. and Europe's largest economies, feel the heat of runaway price inflation, some have claimed Russia has largely evaded the economic pain despite Western sanctions.

From economic experts to laypeople on social media, many are pointing to the recent rebound of the Russian currency.

These comments often juxtapose this apparent success with the economic pain felt across much of the global economy, amid skyrocketing commodity prices since Russia's invasion of Ukraine.

The Claim

Dozens of high-profile accounts have commented on the recent rise of the Russian ruble, which Bloomberg and other finance-focused publications have hailed as the best-performing currency in the world this year.

"Goldman Sachs forecast 30% chance of US economy going into Recession in 2023,up from 15% earlier, due to Record-High inflation & Weak Macroeconomic backdrop due to 'Biden Imposed' Ukraine conflict. Meantime...Russia's Ruble proving Strongest currency in 2022,has jumped 40% Vs USD," (sic.) one Twitter user wrote, gathering more than 800 interactions.

Goldman Sachs forecast 30% chance of US economy going into Recession in 2023,up from 15% earlier,due to Record-High inflation & Weak Macroeconomic backdrop due to"Biden Imposed"Ukraine conflict.

— BhikuMhatre (@MumbaichaDon) June 22, 2022

Meantime...Russia's Ruble proving Strongest currency in 2022,has jumped 40% Vs USD.

"Western sanctions against Russia hurt ordinary people in the US and EU at the gas pump and when shopping for necessities while the Russian Ruble just hit a 7-year high against the US dollar and Russia makes record profits selling oil and gas at sky high energy prices," wrote Kim Dotcom in a tweet with more than 1,900 likes, adding "#Stupidity."

Western sanctions against Russia hurt ordinary people in the US and EU at the gas pump and when shopping for necessities while the Russian Ruble just hit a 7-year high against the US dollar and Russia makes record profits selling oil and gas at sky high energy prices. #Stupidity

— Kim Dotcom (@KimDotcom) June 20, 2022

"Damn anyone notice the Ruble lately. F'n Biden is 100% wrong about everything," said a Reddit post on WallStreetSilver subreddit, with 288 upvotes at the time of writing.

But others have questioned both the official exchange rate and the purportedly insignificant impact of Western sanctions on the economy.

"Real Ruble to US dollar exchange rate is 160 RUB/USD. Exchange rate used by Russian consulates around the world for fees, etc. As you may be aware, one can't even buy dollars in #Russia. The 'market' rate is fake but is likely used to rip off European oil/gas suckers," wrote Igor Sushko, a director at the Wind of Change non-profit, on Twitter.

#SANCTIONS: Real Ruble to US dollar exchange rate is 160 RUB/USD. Exchange rate used by Russian consulates around the world for fees, etc. As you may be aware, one can't even buy dollars in #Russia. The "market" rate is fake but is likely used to rip off European oil/gas suckers. pic.twitter.com/F97iS0qn9T

— Igor Sushko (@igorsushko) June 21, 2022

So is Russia really the big winner from what President Vladimir Putin in his recent address branded an "economic blitzkrieg" by the West? Newsweek spoke to bankers and economists to find out what is really going on.

The Facts

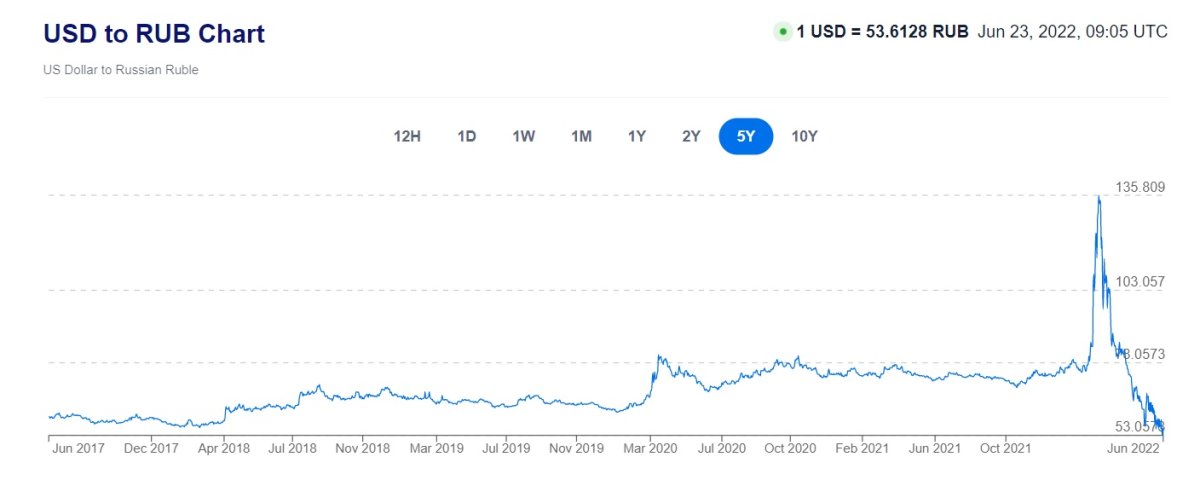

Russia's ruble jumped 6 percent against the euro on June 21, reaching a seven-year high that made it the world's strongest currency at the moment.

After its initial collapse in the days after Russia launched its "special military operation" in Ukraine on February 24, briefly dropping to 138.5 rubles per U.S. dollar, the Russian currency made significant gains in the ensuing weeks and continued to appreciate to the ~80 per USD levels seen on the eve of the war, and beyond.

But as the experts who spoke to Newsweek point out, not all factors driving this recovery are linked to free market forces, nor does the strengthening of the currency translate into economic success.

"The ruble has defied many western predictions that it would become rubble since the imposition of sanctions," Charlie Robertson, global chief economist at the Renaissance Capital bank, told Newsweek.

In part, Robertson attributes that to president Putin's "fortress Russia" economic policy that unties his hands to "wage war and not be stopped by economic vulnerability"—unlike, the economist notes, the U.K.'s invasion of Egypt during the Suez crisis of 1956, when economic pressure from the U.S. forced the British to withdraw.

"The currency has indeed strengthened significantly since Russia's invasion, but this isn't the mark of national strength that a strong currency usually represents," Robertson said. "The ruble is too strong and there have been deep interest rate cuts after the initial massive hike to defend shocked local markets."

Additionally, the official exchange rate may not accurately reflect the currency's true value, according to another economist, who was speaking off the record because the international bank they work for in Russia is currently in media silence mode.

"The official exchange rate is fully valid for exporters and importers, and their cross-border operations," they said.

"For households, the true value of ruble against other currencies is lower than the official rates because of local banks' restrictions on cashing out of FX [foreign exchange], and the high transaction costs of using rubles abroad."

As many analysts have pointed out in recent months, a strong currency is not necessarily the blessing that Russian officials portray it to be.

"I wouldn't judge the state of the economy by the strength of the currency," the economist speaking off the record said. "The ruble dynamic illustrates nothing more than the state of Russia's external trade and financial flows, and the only positive from it is that inflation is now slightly lower than it otherwise would have been."

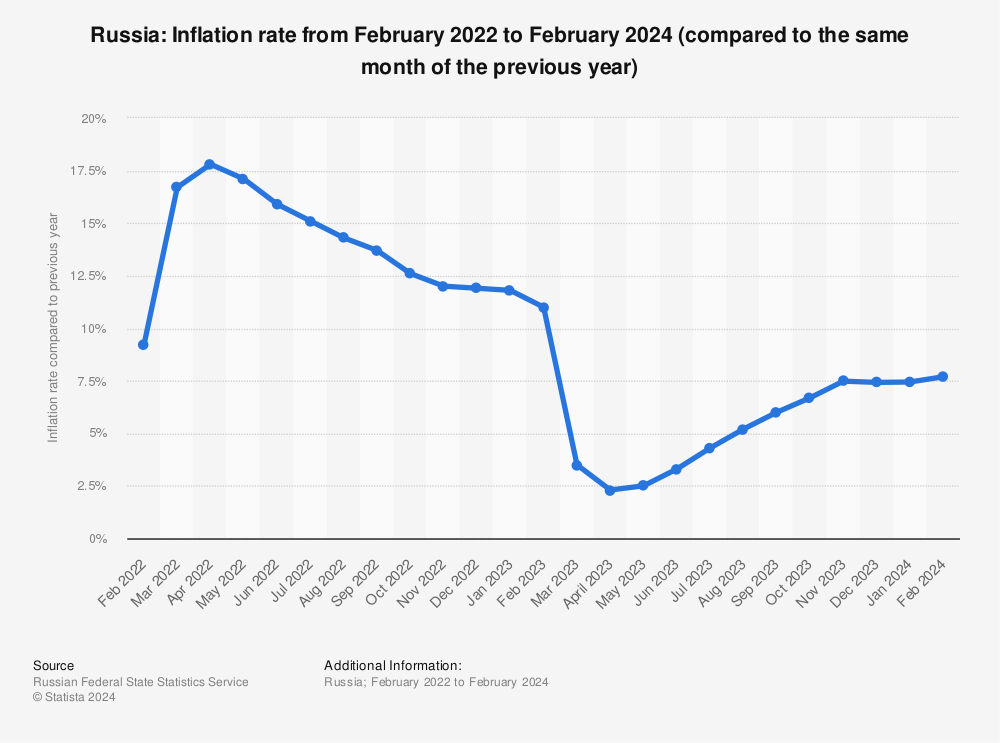

Indeed, the annual inflation rate in Russia was at 17.1 percent in May of 2022, slightly down from 17.8 percent in the previous month—the highest since January of 2002, according to Statista.

The graph below, provided by Statista, shows the rate of inflation in Russia over the past year.

The trade embargo Russia has faced since the start of the war, with dozens of Western companies leaving the country and closing their operations, has in fact helped cushion the inflationary pressures, as in many cases their assets were either sold on the cheap to local firms or taken over by the state, which is able to regulate the price of goods.

Some goods, especially in the high tech sector, are either running out or no longer available for purchase due to the external embargos, also softening the inflationary dynamics that would have otherwise occurred.

The ruble's value has also to some extent been propped up by Russian companies that need to pay taxes in the coming weeks. For the country's exporters that means converting dollar and euro revenue into local currency, which appreciates as a result.

But for an export-driven economy, a strong local currency poses a dilemma.

"Normally, the excess hard currency (mostly U.S. dollars and euros) that Russia would receive via trade (as exports exceed imports) would be sterilized through the fiscal rule, which entails government buying extra foreign currency for its sovereign fund, and through private capital outflow—mostly companies and households buying international assets," the bank economist said.

Put simply, exporters converting their dollar and euro revenues into rubles drive up the value of the Russian currency. To balance that out, the Russian government would buy additional dollars and euros to hold in reserve, keeping the ruble's value in check. Russian people and businesses buying foreign assets also helped to cool ruble growth.

"As a result, the ruble was tending to depreciate. But with the imposition of Western sanctions, imports to Russia dropped, leading to a higher trade surplus," the economist said.

"The fiscal rule was abandoned as the government can no longer buy excess petrodollars and petroeuros, and private capital stopped flowing out of Russia as Russian cash is no longer welcome in most of its usual destinations."

Russia's financial regulators, too, have imposed a series of emergency measures to prevent currency devaluation and capital flight amid the ruble's initial drop, including caps on residents transferring money to foreign bank accounts, a temporary ban on trading ruble-denominated assets on the Moscow Stock Exchange, and halted payments on some external debt.

The latter measure was solidified this week with a presidential decree allowing companies to pay off their dollar-denominated debt in rubles—without the loan or bond holder's consent.

While typically such measures tend to exacerbate capital flight, this time it coincided with numerous external restrictions, including cutting Russia from the SWIFT payment system and shunning of Russian clients by Western banks. This "perfect storm" of measures has, ironically, made the central bank's intervention more efficient.

"The reason behind the ruble's seemingly impressive performance is simply the isolation of the foreign exchange market in Russia, both by domestic and international regulators," Alexander Bulgakov, a Moscow-based investment banker, told Newsweek.

"The combination of the still robust export revenues, which are comparable with pre-war levels due to the rise in commodities prices, and the rapid fall in imports meant that the demand for hard currency assets has evaporated.

"So much so that Russian banks are ditching their dollar assets and products en masse, forcing customers out of their FX holdings through draconian commission and transaction fees."

Bulgakov says that both corporates and retail clients are now largely blocked from opening hard currency accounts abroad in most jurisdictions (apart from the likes of Uzbekistan) and face restrictions on sending currency abroad. This pushes them to sell their foreign currency at more or less the market rate, contributing to the ruble's strengthening.

"But it's a kind of 'twisted' market rate, formed by the near-impossibility of putting these dollar export revenues to any kind of use," he said. "So these dollars and euros are like a hot potato, which is being passed around in the hope that something may change further down the line."

The experts that spoke to Newsweek all gave credit to the Central Bank of Russia and other market regulators for acting swiftly to cushion the blow from what could have been a series of devastating shocks to the economy, and steering it through the tumultuous few weeks that followed Russia's military action.

"Thanks to the fast reaction of the government and the central bank, Russia has avoided a banking crisis, a liquidity crisis and a currency crisis," the Russia-based bank economist told Newsweek off record.

"The budget is also in pretty good shape. Economic activity is so far relatively stable thanks to the previously accumulated inventories, stable employment, state support to income, inertia in household consumption."

But market analysts and the underlying economic data indicate that the sanctions against Russia are already beginning to bite, and many of the measures against Russia specifically target the economy's long-term prospects.

The graph below, provided by Statista, shows the current and predicted GDP growth rate for Russia.

Official figures published by Rosstat forecast a fall in GDP of around 7.8 percent this year; unofficial estimates by external analysts put that figure as high as 30 percent, followed by years of anemic growth.

Import substitution, which the government has touted for years, has largely failed to materialize. A number of key industries are still heavily dependent on foreign suppliers—at least 51 percent based in nations that sanctioned Russia, according to the CEO of Sberbank, the country's biggest lender.

That, according to a Moscow-based Higher School of Economics study, includes manufacturing components (46 percent), medicines (67 percent), auto parts (95 percent) and telecoms equipment (86 percent). The country's pharmaceuticals market is already reeling from the restrictions and trade bans.

"Investment is at best on hold and is at worst impossible as high-tech machinery and equipment becomes as hard to source in Russia, as it has been in sanctioned Iran," says Robertson.

"Meanwhile Russia's minimum wage has risen by more than 20 percent in US dollar terms, making its non-commodity exports less attractive and the country more sensitive to long-term problems of Dutch disease."

Tightening currency controls and the flight of foreign companies and investors also spell bad news for the country's capital markets, where activity has reduced to a trickle.

"This dog's dead, as the Russian saying goes," says Bulgakov, referencing the international markets, from which Russia has been cut off.

"The internal, local currency market will tick along as it does now, there is still some deal flow. Even as the external default looms, it is unlikely to have much impact, as Russia's investment climate is already non-existent. It's become another Iran."

He noted that some operations, as well as technical procedures such as transactions and clearing, may shift to neighboring countries, namely Kazakhstan, which has already become a hub for Russia-linked financial market activity.

And other partners, especially China and India, will continue to cushion the blows of losing key trading agreements and export markets, as they have done in recent months—albeit at a generous discount.

But, experts agree, as the real impact of sanctions permeates deeper into the economic realities, the country's long-term prospects will become increasingly bleak.

"As inventories of now sanctioned imported components will become depleted, exports will decline due to the E.U. embargo, while Asia will be buying Russian oil with increasingly large discounts," the economist speaking off record said.

"Household income will fall, the sophistication of the Russian economy will keep degrading, and potential growth will be close to zero. The biggest challenge is Russia's technological isolation, which means Russia's will lag further behind competitors."

Robertson says that the need to balance the budget will push Russia to cut interest rates further and give up on the currency controls imposed in February and March: "But even that may not be enough to keep Russia's industrial base competitive globally; it looks likely it will end up supplying just one economy—Putin's."

The Ruling

Mostly False.

While it is true that on paper the ruble has been one of the world's best-performing currencies this year, in large part its appreciation was driven by restrictions on foreign currency circulation and other types of currency controls. As experts told Newsweek, its rise is not so much a sign of the economy's strength, as of its growing isolation from the global economy due to sanctions.

FACT CHECK BY NEWSWEEK

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

Yevgeny Kuklychev is Newsweek's London-based Senior Editor for Russia, Ukraine and Eastern Europe. He previously headed Newsweek's Misinformation Watch and ... Read more

To read how Newsweek uses AI as a newsroom tool, Click here.