- News

- Business News

- India Business News

- Non-premium credit card spends jump

Trending

This story is from September 7, 2022

Non-premium credit card spends jump

According to the analysis, fast food restaurant and apparel & accessory store spending increased 230%, while fuel station spending increased 140%.

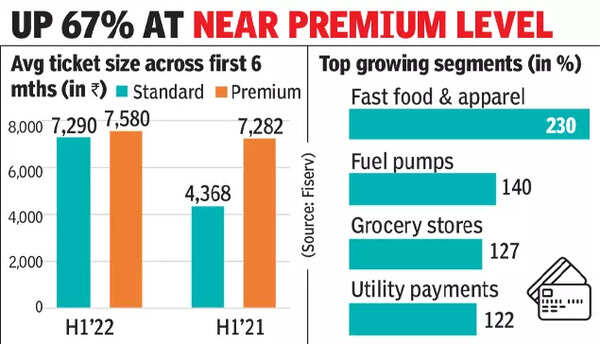

MUMBAI: Users of standard credit cards are catching up with premium credit card holders in terms of spends in first six months of 2022. Average ticket size of standard credit card transactions have jumped 67% to Rs 7,290 in January-June this year from Rs 4,368 last year. In the same period, the ticket size of high-end credit cards has only inched up to Rs 7,580 versus Rs 7,282 last year.

Fiserv (formerly First Data), the largest processor of credit cards for banks, has done an analysis of these transactions that it handles across the first six months of 2022 compared to the same period last year.Fiserv processes card transactions for seven of the top 12 card-issuers and it hosts over 8 crore cards from India on its platform.

“We are seeing higher spends. We believe this to be a combination of factors. It could be cardholders being more comfortable buying on credit, it could also be that things are getting more expensive. For instance, a full tank of petrol would cost much more than it did last year,” said Rishi Chhabra, country head & MD for India & Sri Lanka at Fiserv.

According to Chhabra, the increase in credit card outstanding in India is not necessarily a pointer to growing indebtedness. Data from the RBI had shown that credit card outstanding jumped to Rs 1.63 lakh crore in July this year from Rs 1.26 lakh crore as of July 2021.

“There has been an increase of 36% in the number of cards issued on our platform. Also, people are using cards for some transactions where they were using cash earlier. Plus, there has been an increase in prices,” said Chhabra. One interesting trend is that even after the waning of the pandemic, online continues to grow faster. The credit card spend in point of sales in stores has grown 70% year-on-year, while use of credit card online has grown 103%. “The online transactions include e-commerce purchases and any other payment made using an online payment gateway including utility bills,” said Chhabra.

Fiserv (formerly First Data), the largest processor of credit cards for banks, has done an analysis of these transactions that it handles across the first six months of 2022 compared to the same period last year.Fiserv processes card transactions for seven of the top 12 card-issuers and it hosts over 8 crore cards from India on its platform.

“We are seeing higher spends. We believe this to be a combination of factors. It could be cardholders being more comfortable buying on credit, it could also be that things are getting more expensive. For instance, a full tank of petrol would cost much more than it did last year,” said Rishi Chhabra, country head & MD for India & Sri Lanka at Fiserv.

According to the analysis, fast food restaurant and apparel & accessory store spending increased 230%, while fuel station spending increased 140%. People are using more of their cards for essentials, which has resulted in grocery store and utility payment spending increasing 127% and 122%, respectively.

According to Chhabra, the increase in credit card outstanding in India is not necessarily a pointer to growing indebtedness. Data from the RBI had shown that credit card outstanding jumped to Rs 1.63 lakh crore in July this year from Rs 1.26 lakh crore as of July 2021.

“There has been an increase of 36% in the number of cards issued on our platform. Also, people are using cards for some transactions where they were using cash earlier. Plus, there has been an increase in prices,” said Chhabra. One interesting trend is that even after the waning of the pandemic, online continues to grow faster. The credit card spend in point of sales in stores has grown 70% year-on-year, while use of credit card online has grown 103%. “The online transactions include e-commerce purchases and any other payment made using an online payment gateway including utility bills,” said Chhabra.

End of Article

FOLLOW US ON SOCIAL MEDIA