Mapping the Landscape of Web3 Venture Capital (Part 1/2)

(A Look Into Portfolios, Competitive Dynamics, Post-Investment Support, Fundraising Activity, and more.)

Part I:

Overview

The web3 venture capital landscape has morphed into a complex and differentiated space over the last cycle— you have traditional thesis-driven funds, corporate venture capital (CVC), DAO VCs, world class exchanges & trading firms with booming venture arms and funds investing across every lifecycle of companies for equity and tokens.

It was a year ago when this list was circulated ranking the crypto VC landscape on a number of high level and somewhat shallow merits from “diamond hands” to “value add”. This list shows us that just as the markets these funds invest in evolve dynamically, so does the VC landscape and power players within it.

This report will offer a comprehensive and up-to-date analysis into the Top 10 web3 venture capital firms and broader industry activity— measuring funds on a number of areas including: Portfolio, Competitive Differentiators, Platform Strategy, Community & Reputation, 2022 Deals and more.

Additionally, I created a database for the expanded ranking of the Top 50 web3 funds that were examined for this report. This is a new tool that aims to map out the expanding landscape for founders, investors and LPs active in the space.

Web3 VC Ranking Database // Top 50

Methodology

There is no precise science to ranking such a fluid and dynamic market– where one fund may sit today could be completely altered by their next investment, hire, writing or strategic initiative. That’s where this ranking is different from most. In a world where AUM rules all, an interesting dynamic has emerged in the last 24 months — economic policy has promoted an era of investing where capital has increasingly become a commodity and top firms have to differentiate themselves in unique ways to be allocated spots on competitive cap tables. Because of this, the intellectual moats that funds have built outside of AUM alone holds the most weight in this methodology.

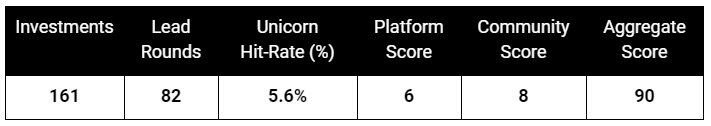

- Data was pulled from Crunchbase for the following categories:

- Total Investments: [weight: 7/10] # of investments since 1st fund was launched

- Lead Rounds: [weight: 8/10] # of rounds as the lead investor

- 2022 Deals: [weight: 7.5/10] # of investment deals closed in 2022

- Unicorns: [weight: 9/10] # of unicorns ( >$1B private valuation) in the funds portfolio

- Diversity Investments: [weight: 4/10] # of investments into women and minority founded or led companies

- Notable Deals: [weight: 3/10] selected investments into well known web3 & crypto companies

- Unicorn Hit-Rate: [weight: 9.5/10] a metric that evaluates the number of portfolio unicorns as a percent of total investments made by a fund.

- Unicorns / Total Investments = UHR

- Note: Funds may have made multiple rounds of investments in the same Unicorn

- Platform score [weight: 9.5/10] evaluates the quality of hands-on post-investment support that the fund provides portfolio companies through a dedicated Platform team or strategy. This includes technical support in protocol design, crafting tokenomics or whitepaper, allocating engineering resources to the build, as well as in-house platform teams assisting with GTM, talent, business development, events and other formal operating partnerships outside of capital allocation

- Community score: [weight: 7.5/10] measures something uniquely important to web3 — community — and the fund’s ability to design, nurture and scale community both as a fund looking for space on competitive cap tables and for their portfolio companies. This includes writings, social media reach, podcast appearances, conference panels, twitter spaces and general community engagement and thought leadership. We look at the volume, quality and reach of these community-driven initiatives in order to identify a score via social and traditional media sources as well as the funds website and/or medium

- Reputation score [weight: 6.5/10] measures the funds reputation in media, among builders & founders in the space, and the web3 community more broadly as they invest, interact and provide infrastructure to consumer-centric products, platforms and protocols. This category is based on public sentiment across social and traditional media sources

- Non crypto-native funds [weight: 5/10] were evaluated only on their crypto investments with an emphasis on more recent deal activity. This leads to natural biases towards crypto-native funds around deal volume, lead rounds and # of unicorns. More weight is given to the funds who operate natively in the web3/crypto sector

- Female Partner [weight: 5/10] category data sourced through individual fund website’s team pages.

- Negative news [weight: 8/10] sources from open source web searches and social media. This ties into Reputation score

- Dollars Raised [weight: 4/10] was sourced via Crunchbase and Messari Fundraising Database (formerly Dove Metrics)

- Year Founded [weight: 2/10] helped highlight the enduring nature of a fund through multiple cycles

- Aggregate score combines weighted metrics outlined above to provide an aggregate ranking score out of 100

TOP 10 : DEEP DIVE

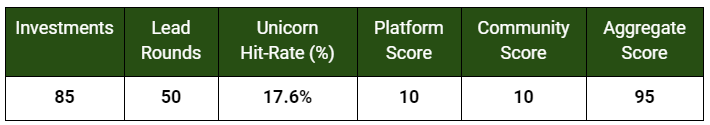

#1 / Paradigm

Links: Twitter // Portfolio // Team — Tier: Chad

Key People: Fred Ehrsam // Matt Huang // Dan Robinson

Overview

Paradigm was launched in 2018 by Coinbase co-founder Fred Ehrsam and former Sequoia partner, Matt Huang— the only web3 fund on this list whose founders are both alums from two other firms featured in the Top 10— both with established track records among the best in the space. Paradigm leverages a team of expert researchers, blockchain security professionals and white hat hackers to leverage both capital deployment and technical expertise at every stage of their portfolio companies growth.

Portfolio

Paradigm has been collecting portfolio unicorns like an Ohio mom collected beanie babies in 1996— with deep technical research, and calculated, concentrated bets. They invest broadly from seed rounds of $1M to growth rounds that exceed $100M. This stage agnostic reach is unique vs many other top crypto-native funds that focus solely on early stage investments.

Their portfolio includes 15 unicorns include over ten of the industries top liquid and non-liquid names: Coinbase, Chainalysis, Uniswap, Compound, Cosmos, Fireblocks, FTX US, Opensea, Magic Eden, Amber, Gauntlet, MoonPay, Phantom, Optimism, Sky Mavis and Starkware to round out the diverse group.

Competitive Differentiators

Paradigm is a fund full of technical giga-Chads who have created one of the industries most unique moats as a firm. While every VC can provide capital and promised post-investment support to their port co’s, Paradigm has the technical chops to truly build alongside founders in a technical capacity that most in the space simply cannot provide:

- A teenage engineering prodigy that openly roasts his boss on Twitter

- An elite team of white hat hackers and blockchain security researchers that design novel token mechanisms

- Developer competitions, such as the recent CTP 0xMonaco game that pitted top engineers in the space against each other

- Deeply technical thinkers who build along side their portfolio companies

2022 Deals

Armed with a massive and timely raise— a $2.5B fund in late 2021 before the market downturn— Paradigm hasn’t seen much regression in capital deployment unlike the rest of the industry. With 25 deals announced through the first week of September, Paradigm is on track to dwarf its 29 total from 2021. These deals are flowing into their biggest winners, doubling down on Opensea, Magic Eden, Phantom, Optimism, and Fractional, along with new seed rounds into a number of companies that they believe will become household names in the next cycle.

#2 / a16z Crypto

Links: Twitter // Portfolio // Team — Tier: Chad

Key People: Chris Dixon // Marc Andreessen // Arianna Simpson // Ali Yahya

Overview

Andreessen Horowitz, or a16z, is not just a web3 behemoth, but a global force in the technology investing landscape. A16z’s founder, Marc Andreessen, is the author of Mosaic, the world’s first internet web browser. Chad move, inventing the modern internet. The firm has moved much of its focus to the crypto landscape— with web3 lead, Chris Dixon, emerging as #1 on the Forbes Midas List in 2022. They raised a whopping $4.5 billion crypto-focused fund in May 2022, in addition to launching a $5B growth fund in January 2022, a $2.5B fund for biotech and another $600M fund for the gaming sector. It’s worth noting that many competitors think deploying this kind of size could have negative impacts on fund returns, but I’m not one to fade Marc, Chris and the world class team at a16z. Others, such as Chamath Palihapitiya, believe the a16z business model is to become the ‘Blackstone of the technology sector’— creating a publicly own-able, institutional security, indexed to technology via absorbing hundreds of billions of dollars in sector equity, opposed to focusing on massive returns for their LPs like a traditional fund. They simply are playing a different game than the rest of the industry. Chads.

Portfolio

The a16z portfolio is one that speaks for itself. The firm has deployed a force of strategic capital into scaling some of the industry’s most dynamic and defining companies. We could write an entire report on this portfolio (and maybe we will ?) but for now we’ll let 14 unicorns do the talking— spanning across the protocol level, both centralized and decentralized infrastructure, consumer application and established NFT projects. These include Anchorage, Dapper Labs, Coinbase, Opensea, LayerZero, Yuga Labs, Phantom, and many others.

Competitive Differentiators

Aside from a16z’s monolithic name recognition and track record in the world of investing and technology, one key aspect that sets it apart from the purely crypto-native funds is its 200+ person post investment platform team. They have created an internal consulting machine of experts across go-to-market, operations, biz dev and partnerships, marketing, talent, and capital formation to bring a new meaning to working hands on with every company in their portfolio. This elite platform team is unmatched by both crypto-native funds as well as the global VC landscape more broadly.

In addition to this massive internal consulting machine, a16z hosts a top web3 podcast and launched a media arm that, while has been slow to take off by a16z standards, still offers a lucrative distribution angle for the fund.

2022 Deals

With $4.5B in dry powder to deploy over the next few years, it’s no surprise that a16z has had an active 2022. According to Crunchbase, the firm’s crypto arm has invested in 14 deals year-to-date, leading nearly every round that they have participated in. The firm’s commitment to deploy SIZE in web3 has been hard to ignore with a massive $450M seed round for Yuga Labs, $50M going to VeeFriends, $70M to FlowCarbon, as well as on the protocol level with rounds into NEAR and Morpho Labs.

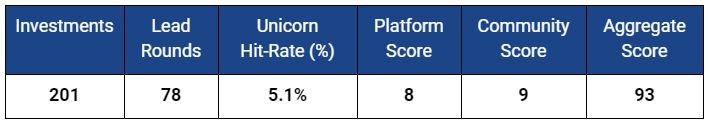

#3 / Pantera Capital

Links: Twitter // Portfolio // Team — Tier: Chad

Key People: Dan Morehead // Joey Krug // Paul Veradittakit

Overview

Founded in 2013, Pantera Capital is billed as one of the first institutional-grade crypto asset managers in the industry. With five unique funds trading in both liquid assets as a registered hedge fund and private companies from seed to growth, Pantera’s capital has backed many of the industry’s most defining projects. Few people had the foresight into the crypto industry like founder & CEO, Dan Morehead, whose famed Summer 2013 Investor Letter called a $65 bottom on Bitcoin and urged clients to begin accumulating the asset. Being among the first to bet on crypto with institutional size at those prices gives you certified Chad status.

Portfolio

Pantera’s hands have been on this industry since the early cyberpunk days— long before your Williamsburg barista was shilling CryptoDickButts and even before a young Vitalik’s beloved World of Warcraft character was hobbled by the developers leading to the creation of Ethereum. They wrote the first $1.4M check into Ripple’s seed round in 2013, seeded Polychain Capital—an industry giant now in their own right, and an array of consumer and infrastructure plays spanning the spectrum from media outlet, The Block’s, seed round, NEAR and Bakkt’s Series A, and virtually every growth round in Circle since 2014. On top of this impressive portfolio of name brands, the fund has amassed 22 diversity investments (>10% of investments since fund inception) in women & minority founded companies. Pantera’s portfolio, track record and enduring reputation put them in an elite league.

Competitive Differentiators

Mentioned already but perhaps the clearest differentiator for Pantera versus most of the funds in this space is its long track record of successful investments at every stage spanning nearly a decade. Very few funds on this list, if any, can say they invested $1.4M in a seed round in 2013 for a now $10B+ mega-unicorn. Imagine that sales pitch to any founder debating on who to take their first check from.

2022 Deals

Pantera, like many of the other top firms, has continued to pour capital into investments in 2022, with 43 investments, the fourth most for crypto-native funds this year and one of only a few funds to surpass 200+ investments since its inception. This year, they have invested in 18 seed rounds, 9 Series A rounds and 16 growth stage rounds, demonstrating its commitment to a stage agnostic portfolio. Q1 was the most active venture quarter in the firm’s history with 24 investments.

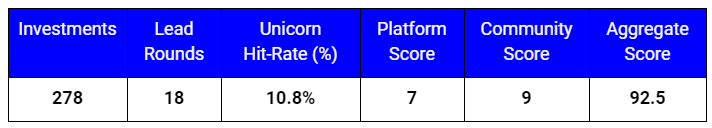

#4 / Coinbase Ventures

Links: Twitter // Portfolio // Team — Tier: Chad

Key People: Emilie Choi

Overview

Founded in the pits of the 2018 bear market, with just a $15M allocation at its inception, Coinbase Ventures’ tentacles now wrap around the industry perhaps more than any other investor in the space — with over 275 investments to date and a roster of 30 unicorns that would make Peter Thiel and Bill Gurley blush. For its first 3 years stretching into mid-2021, the Ventures team was deploying industry leading size without a single full time Venture employee, just a bunch of corporate development Chads moonlighting as VC’s.

Portfolio

There are many ways to construct a strong portfolio in VC. On one end you have a concentrated, thesis driven approach like we will visit with Variant. Then there is Coinbase Ventures’ approach, whose portfolio is maximized for reach across every sector, geography and stage of the space. They show a demonstrated mission to provide transparency to the industry with early rounds into virtually every well-known data provider in crypto: CoinMetrics, Messari, Flipside Crypto, Dune, Nansen, CoinTracker, & Moralis. They’ve also showed their commitment to maximizing portfolio company value by acquiring Bison Trails, the crypto cloud infrastructure provider outright for $450M+ in cash and stock after leading their Series A – all while continuing to seed investment firms, protocols, consumer applications and DeFi infrastructure from Silicon Valley & Miami to Paris and Chennai.

Competitive Differentiators

Coinbase has paved a way for exchange CVCs to become power players in the venture landscape and compete with the industry’s most elite funds. With a globally recognized brand, a team of hundreds of engineers to tap into and experts across product, marketing, and corporate & business development, founders feel they have a unique machine behind their company’s growth with Coinbase Ventures on the cap table.

2022 Deals

Coinbase Ventures ranks #2 across the industry in terms of 2022 activity, with 85 deals this year to date — 47 Seed, 21 Series A and 17 across various Growth stages. This focus on smaller deals makes sense knowing most of their sidelined capital was deployed in 2021. It is worth noting Coinbase Ventures reportedly deployed 90% of it’s capital in 2021. Many of these investments are likely to be marked down, and competing funds with hundreds of millions of dry powder may be able to better capitalize on the 2022 class of bear market builders— a cohort that has historically performed well in bull market expansions. That said, this doesn’t seem to have slowed Coinbase Ventures’ investment volume in 2022.

Coinbase Ventures’ reach has remained incredibly diverse, with rounds into well known capital allocators like Valkyrie & AllianceDAO, data providers CoinTracker & Moralis and Aptos, Sei, Euler and LayerZero at the protocol level.

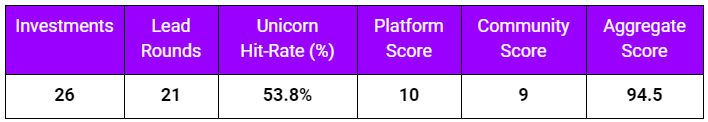

#5 / Polychain Capital

Links: Twitter // Portfolio // Team — Tier: Chad

Key People: Olaf Carlson-Wee

Overview

Founded in 2016 by Olaf Carlson-Wee, the first employe at Coinbase, and seeded by a16z, Pantera and Union Square Ventures— the fund had quite a 2nd cycle since the depths of the 2018 bear market with SEC filings showing a growth from $591.5M AUM in late 2018 to over $6.6B in March of 2022 (note: this last filing occurred before the market downturn and is likely significantly lower at today’s prices). Olaf and his team of industry OGs have more than half a decade of investing as both a liquid asset hedge fund and venture capital firm. Tell me right now with a straight face that this man, overseeing $6.6B isn’t a Chad’s Chad. Don’t let that picture fool you though— he’s also a calculated thinker who has successfully deployed institutional-grade size into the crypto industry.

Portfolio

Polychain has been investing in the infrastructure and protocol level of DeFi since its inception, funding a number of protocols & platforms at their earliest stages — with seed rounds into Polkadot, dYdX, Starkware, Compound, Avalanche, Gauntlet, Acala, Solana, Maple Finance and many others since2017. Sticking to its roots in Bitcoin, the firm continues to be a leader in pushing novel technology forward with investments in next-gen mining and clean energy companies with growth stage investment in Crusoe Energy (Series C) and seed rounds to Vesper Energy and Vespene Energy.

Competitive Differentiators

Polychain is another fund to emerge in a bygone era of crypto — long before jpegs flooded our Crypto Twitter feeds when BitConnect & MaidSafeCoin still sat among the industry’s top ranked projects. Scaling the fund by 10x AUM through the peaks and troughs of crypto’s volatile cycles, returning investors’ capital and reinvesting into winners during existential times is exactly the kind of consistency and conviction that founders and LPs want in an otherwise hyper-volatile arena.

2022 Deals

A trend that we’ll continue to see on this list is the commitment of these top funds to continue deploying capital around uncertain macro conditions. With 26 investments to date this year with 15 of these in early stage seed rounds, Polychain has also demonstrated a commitment to reinvesting in their winners with four rounds of capital into unicorn, Gauntlet, from an October 2018 Seed through its most recent Series B in May 2022.

Evidenced in this report, the top VCs in crypto & web3 are more than just capital allocators boasting high multiple returns– they are pushing the industry forward with deep technical acumen, noval design frameworks that endure cycles and define sectors, and in some cases an army of diverse SMEs ready to supercharge your products and brands in addition to the capital. This is what separates the industry defining Chads from other Tier 1 firms blazing the trail in their own right.

In Part II, we’ll visit the next five funds that round out the Top 10 with yet another batch of elite Tier 1s. These funds offer founders world class technical prowess, help portfolio companies scale in unique, sector defining ways, and have brought in unbelievable returns over multiple cycles that would make the TradFi suits squirm in their Gucci loafers. Any guesses who makes the list?

[End Part 1]

Written by: Cody Garrison // In collaboration with: Global Coin Research

Updated: 9/15/2022