The Case for $15,000 ETH

.png-a616dc52961c1edd72b0c1fdf5f47e7a.png-d44bdfd9b52d9f76131f38376a1fe385.png) Kraken - See What Crypto Can Be with Kraken

Kraken - See What Crypto Can Be with Kraken

Dear Bankless Nation,

Fundamentals always matter.

As the bear market continues to beat down crypto portfolios, investors are trying to get a clearer picture of what exactly they’re betting on.

As we all know, there are plenty of reasons to bet on Ethereum, but quantifying its present and future value isn’t always so straight forward.

That’s what we want to do today.

We tapped the folks from investment firm Archetype to break down their detailed model for valuing Ethereum and dig into showcasing the model’s most conservative and bullish takes on where the network is headed.

You might be surprised by the conservative case. 👀

- Bankless team

TOKEN THURSDAY

Guest Writer: Danny Sursock and Ash Egan, Principal & General Partner at Archetype

Valuing a Social Supercomputer

Archetype is an early-stage crypto fund investing in protocols and applications enabling a future underpinned by smart contracts.

This is our framework for mapping Ethereum’s role at the forefront of Web3 in order to understand, and ultimately quantify, its value as a network.

The original article has been edited for length and clarity.

Crypto is building towards a future where technology, culture, and finance converge in open digital worlds powered by blockchains.

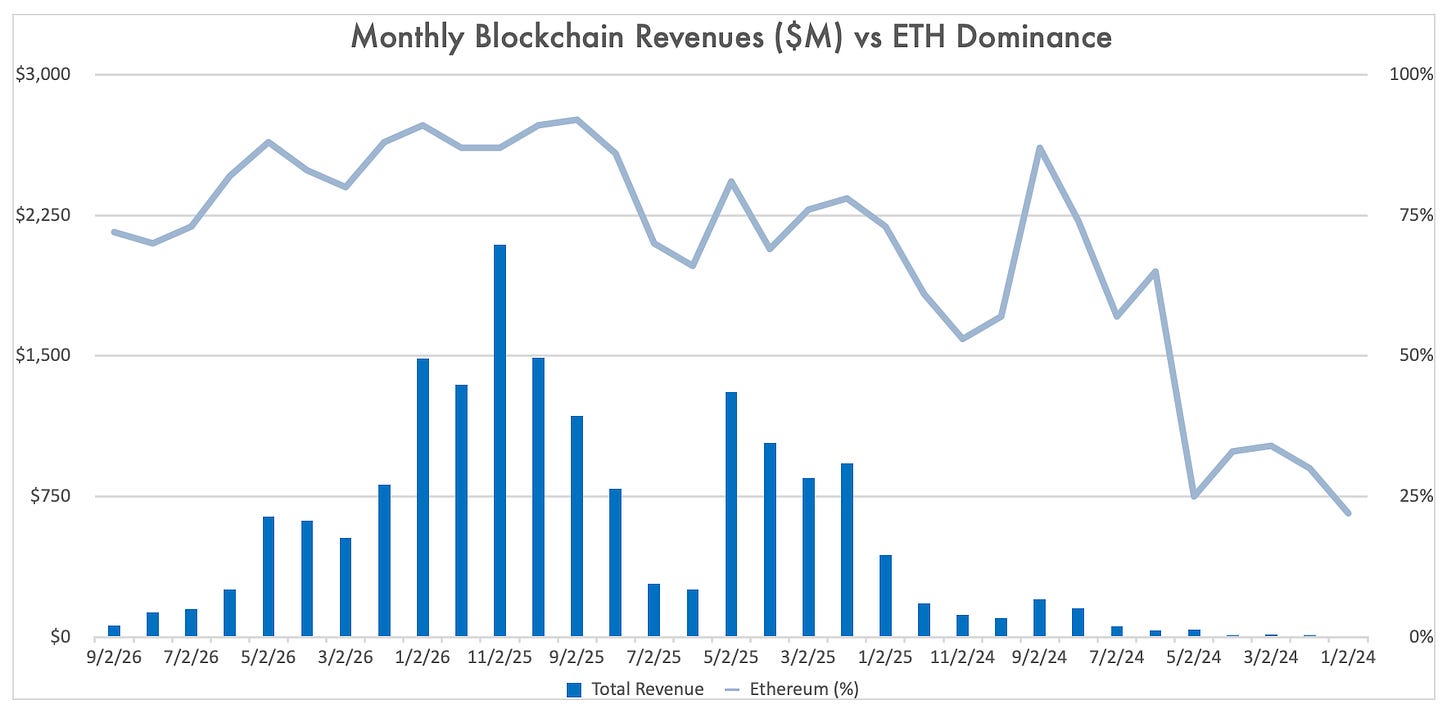

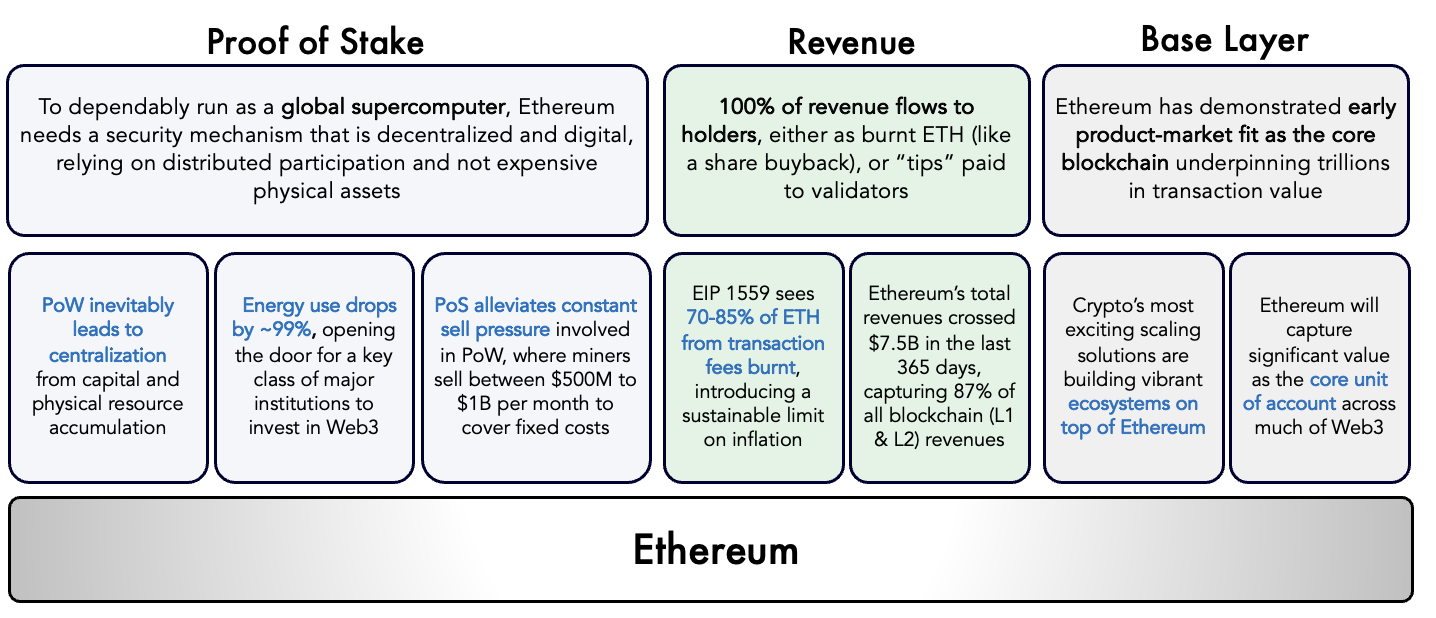

Ethereum is the dominant blockchain because it enables unparalleled symbiotic relationships across its vast ecosystem thanks to several fundamental components…

1. First Mover Advantage

Unquestionably, Satoshi Nakamoto made history with the launch of Bitcoin. The consolidation of work by pioneer cryptographers to introduce a peer-to-peer digital currency tied to a distributed ledger laid the initial foundation for decentralized, alternative economies.

Ethereum went a step further in its design as a universal computing machine able to support a wide range of diverse applications. As a result, Ethereum has been the primary domain where much of crypto’s innovation has taken place.

2. Flywheel & Network Effects

Its early dominance has yielded a vibrant ecosystem of tools and applications that sustain a flywheel effect for technical talent, along with widespread Solidity fluency.

Blockchains enable true, positive-sum network effects, with Ethereum the standout leader. This means that even in a down market, the number of active developers on Ethereum is 6x larger than the average across any other major ecosystem.

3. Optimized for Security & Reliability

Ethereum’s architecture is purpose built to prioritize security and decentralization. This has encouraged a wave of rival L1s to fight for market share by optimizing for high throughput or more flexible systems design.

But Ethereum’s approach has positioned it to be the most reliable blockchain, capable of hosting thousands of applications and settling trillions in economic value.

As Crypto further penetrates the mainstream, the highest value transactors will settle on Mainnet. Meanwhile the most compelling scaling infrastructure is also being built on Ethereum in order to serve higher frequency, lower value actors.

4. Unmatched economic capacity (both for the network & asset)

Its unrivaled economic capacity (as well as its shift to an eco-friendlier profile) will reinforce Ethereum’s position as the preferred Web3 asset & settlement layer for institutions and companies representing trillions in potential transaction value.

The EVM ecosystem’s L2s and Sidechains will also drive demand for ETH as a core unit of account and medium of exchange, while furthering demand for Ethereum’s blockspace.

The Ethereum network has plenty of advantages, but how do you quantify its current value?

Quantifying the Value of Ethereum

Ethereum is introducing powerful new tools fit for a digital age built on the most secure settlement layer.

Ethereum’s cash flows and durable moat ultimately allow us to examine its value using conventional frameworks.

Model Assumptions

Growth Rate and Value Capture

- To forecast growth, we leveraged widely-respected research while using on-chain data to quantify existing Web3 penetration. In projecting future value capture, we used conservative forward metrics that don’t reflect crypto’s remarkable growth to date, nor its implied trajectory.

- We’ve also taken a conservative approach by using large discounts in 2022, 2023, and 2024 to capture prolonged macro, regulatory, or crypto-specific uncertainty.

- Crypto remains in its infancy, with countless use cases & sub-sectors likely to emerge in the coming years. Our approach is therefore designed to capture overall expansion without getting caught up in which current use cases will endure, or trying to predict what each core market will look like at maturity.

- We delineate between stakers (capturing value from ETH’s burn, tips, and MEV) and non-stakers whose direct value capture is limited to burnt ETH (share buyback), while present value is sensitized across a range of ETH supplies. Estimates vary for steady state burn, but our research suggests 100M by 2030 is a reasonable forecast

Monetary Premium

- Digital assets are unique from traditional equities. With ETH, a vibrant ecosystem of protocols, dApps, and users is being built on top of it. Though many will launch their own tokens, ETH will serve as the primary unit of account and medium of exchange, as well as a core balance sheet asset, commercial intermediary, and hedge

- Additionally, people in Emerging Markets will increasingly look to borderless assets like ETH and BTC to counter currency debasement and institutional corruption. Ethereum’s dynamism and utility will position it as the logical choice for millions, though consumers will diversify into other crypto assets too

Terminology

- Web3 and Crypto aren’t perfectly synonymous, but we’ll leave the delineation for a different exercise

- The Metaverse is an obscure ”catch-all” phrase often used in place of any substantive definition. We avoid the term, preferring to use our own definitions:

Web2’s virtual worlds will primarily be composed of isolated segments including:

- Virtual Hardware (VR/AR)

- Gaming Worlds (Mobile and Cloud)

- Virtual E-Commerce (Cosmetic Digital Assets)

- Traditional Gaming Hardware (Consoles and PCs)

Web3’s frontiers will largely be interoperable, compounding value across areas like:

- Virtual Land

- Web3 Gaming

- The Creator Economy (Incl. Music, Art, & Social)

- Fashion/Cosmetic NFTs

- NFT Collectibles/Avatars/Identity

Ethereum Valuation Model

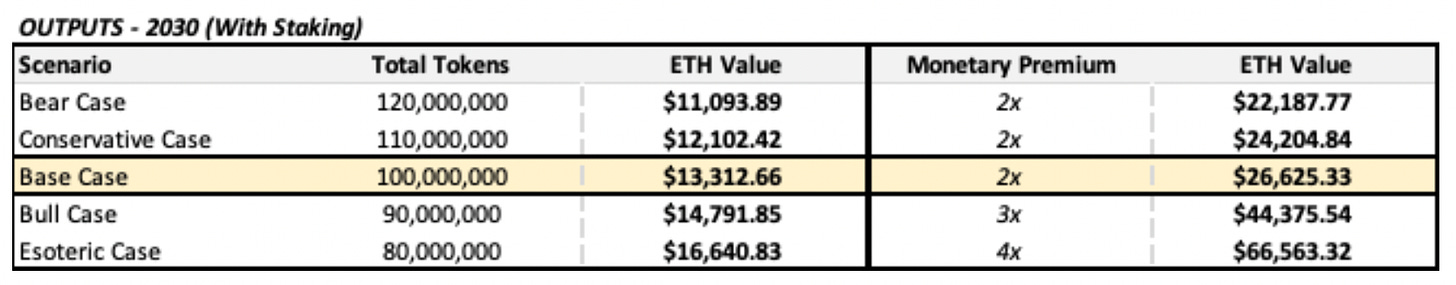

With all of this in mind, we can now begin to build out a detailed model that accounts for Ethereum’s cash flows when factoring in the Total Addressable Market (TAM) across different verticals.

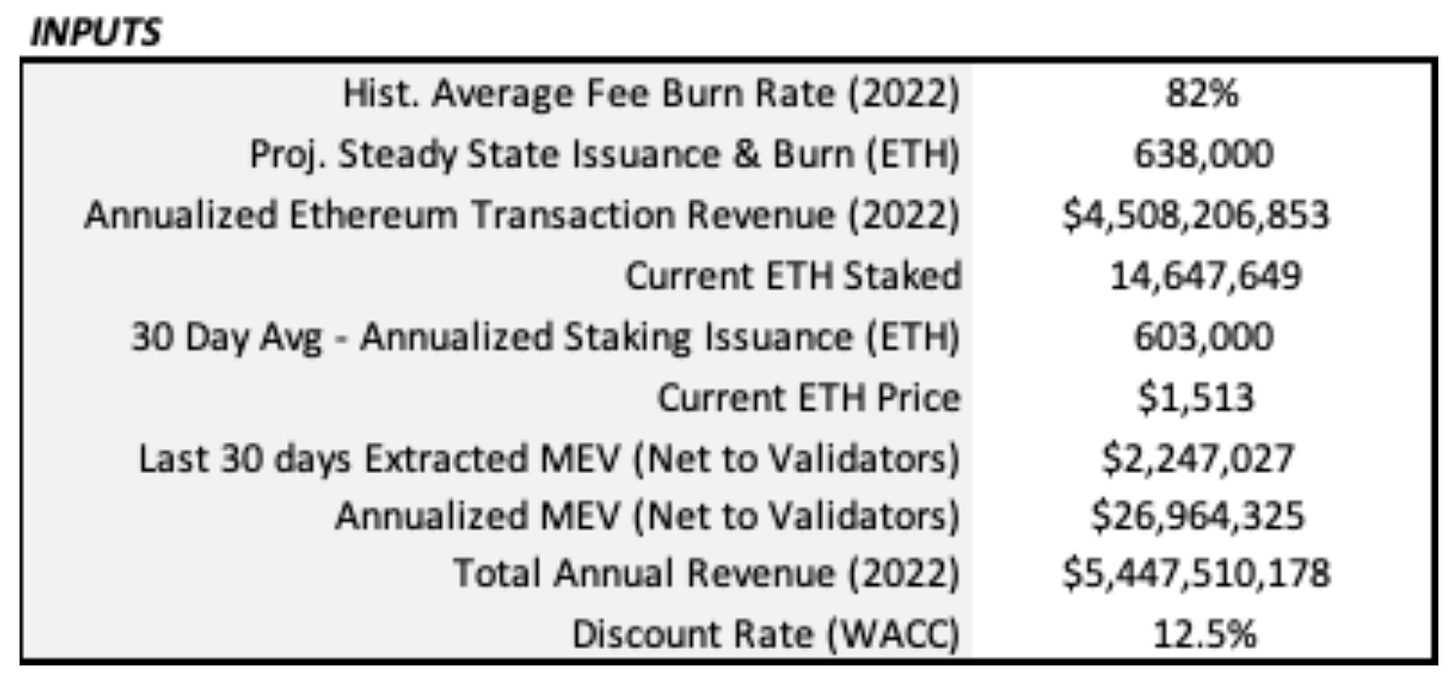

Here are our model’s inputs based on today’s statistics.

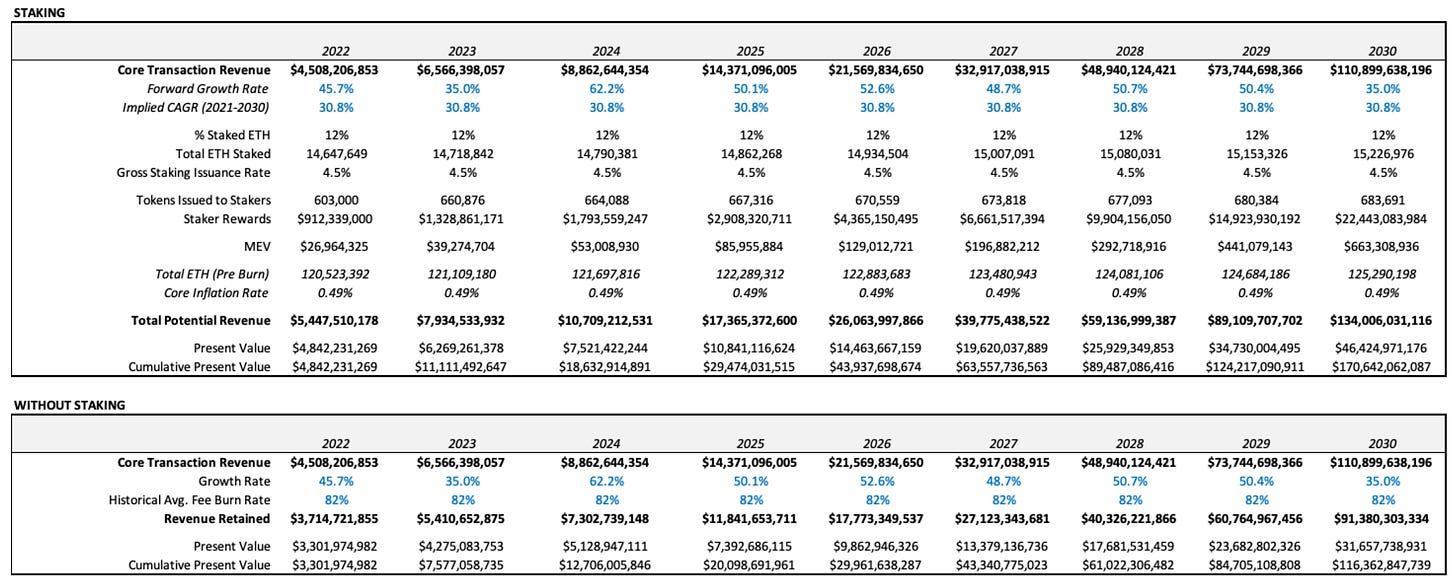

From there, we can take these inputs and starting building out our model based on the compounded annual growth rate (CAGR) derived from our bottoms up analysis.

It’s worth noting that in this model, the percentage of total ETH staked stays constant overtime, providing a more conservative baseline for our forecasts. In practice, the rate should steadily increase over time, creating a stronger case for a monetary premium (we’ll touch on that later).

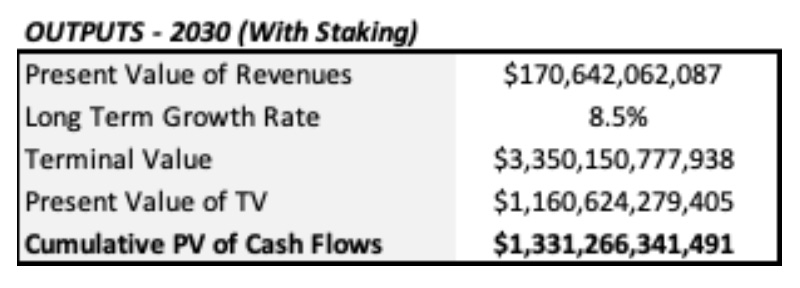

All said and done, here are what the key outputs look like from the above model.

Finally — we can now take those outputs and put price projections based on the total supply of ETH and the prospective monetary premium.

For those that don’t check prices religiously, ETH is currently sitting at ~$1500 as of writing. Archetype’s base case provides a 10x return by 2030 if the model holds true.

Reminder that this base case price projection is strictly based off cash flows from Ethereum’s core business of selling secure blockspace for the range of applications built on top of it.

When we factor in a monetary premium, which accrues when ETH has an increasing amount of demand for it across different mechanisms (think ETH locked in DeFi, ETH burn rate, ETH staking, ETH used for NFT purchases, etc.), the numbers start to scale to substantially higher numbers.

A 10x return is the base case. 👀

Supporting Exhibit

Dig into this lengthy model to see how Archetype evaluates Ethereum’s various market verticals.

Risks & Considerations

Competition

- While the future may ultimately be multi-chain, we believe Ethereum will remain the standout leader. As trillions in value migrate to Web3, a substantial portion of the highest value will continue to transact on Ethereum’s mainnet as they optimize for reliability and security

- Further, blockchains naturally experience network effects as entrenched traction (users, developer mindshare, regulatory recognition, institutional acceptance) invites additional inflows of activity and investment

- That said, we are excited about Ethereum’s L2 scaling solutions as they relate to everyday users, while we also recognize the value in select competing blockchains As a result, we’ve been highly conservative in modeling a decline in Ethereum’s dominance, from over 80% today to 60% by decade’s end, even as we continue to believe Ethereum is likely to retain a materially larger portion of the market

Risks

- Regulatory threats, ranging from reasonably minimal to extreme censorship. That said, regulatory clarity (if and when it ever arrives) should ultimately be beneficial to adoption

- Increasing headwinds (both macro and crypto-specific) tend to drive liquidity towards staked ETH, which is perceived as offering better risk-adjusted returns. As a result, liquidity across DeFi may continue to move towards the safer yields offered by staked ETH, which could challenge Ethereum’s ecosystem in the near term. Innovation around liquid staking may alleviate much of this pressure.

- Competing blockchains may capture significantly larger portions of the overall market as high value users optimize for speed/cost over decentralization/security

Our belief remains that scaling solutions built on top of Ethereum will ultimately offer a much more compelling value proposition to users and projects. - Over 60% of current ETH staked is done through 5 platforms and service providers, with Lido capturing 30% of the total. Ownership of Lido’s governance token is concentrated across <10 holders who could be vulnerable to censorship

Post-merge, Ethereum has significant work to do in continuing to decentralize its validator base

📚 References

- https://ultrasound.money/

- https://tokenterminal.com/terminal/projects/ethereum

- https://explore.flashbots.net/

- https://beaconcha.in/charts/staked_ether

- https://ethereum.org/en/upgrades/merge/issuance/

- https://dune.com/queries/877691

- https://messari.io/asset/ethereum/charts/network-activity

- https://etherscan.io/charts

- https://www.mckinsey.com/industries/financial-services/our-insights/global-banking-annual-review

- https://www.coinbase.com/institutional/research-insights/research/monthly-outlook/post-merge-metrics-october-2022

⚠️ Disclaimer

THIS DOCUMENT IS FOR DISCUSSION PURPOSES ONLY AND DOES NOT CONSTITUTE ADVICE OF ANY KIND, INCLUDING TAX, ACCOUNTING, LEGAL OR REGULATORY ADVICE, AND ARCHETYPE IS NOT AND DOES NOT HOLD ITSELF OUT TO BE AN ADVISOR AS TO TAX, ACCOUNTING, LEGAL OR REGULATORY MATTERS.

THIS DOCUMENT WAS PREPARED SOLELY FOR DISCUSSION PURPOSES. THE INFORMATION CONTAINED HEREIN WAS OBTAINED FROM PUBLIC SOURCES AND WAS RELIED UPON BY ARCHETYPE WITHOUT ASSUMING RESPONSIBILITY FOR INDEPENDENT VERIFICATION AS TO THE ACCURACY OR COMPLETENESS OF SUCH INFORMATION. ANY ESTIMATES AND PROJECTIONS ARE PUBLICLY AVAILABLE, AND INVOLVE NUMEROUS AND SIGNIFICANT SUBJECTIVE DETERMINATIONS, WHICH MAY NOT BE CORRECT. NO REPRESENTATION OR WARRANTY, EXPRESS OR IMPLIED, IS MADE AS TO THE ACCURACY OR COMPLETENESS OF SUCH INFORMATION AND NOTHING CONTAINED HEREIN IS, OR SHALL BE RELIED UPON AS, A REPRESENTATION OR WARRANTY, WHETHER AS TO THE PAST OR THE FUTURE.

THE INFORMATION CONTAINED HEREIN WAS DESIGNED FOR DISCUSSION PURPOSES ONLY AND ARCHETYPE ASSUMES NO OBLIGATION TO UPDATE OR OTHERWISE REVISE THESE MATERIALS.

Action steps

- 🤓 Review the model and inputs by Archetype

- 📚 Read our State of Ethereum Q3 Report

Author Bio

Danny Sursock, Principal, and Ash Egan, General Partner at Archetype, an early-stage crypto fund investing in protocols and applications enabling a future underpinned by smart contracts.

Bankless

Bankless

.png-a616dc52961c1edd72b0c1fdf5f47e7a.png-8359976fdb0656215e306b0de9208da8.png)