BUSD exchange balance drops below 9B as USDT dominance reaches 55%

BUSD exchange balance drops below 9B as USDT dominance reaches 55% BUSD exchange balance drops below 9B as USDT dominance reaches 55%

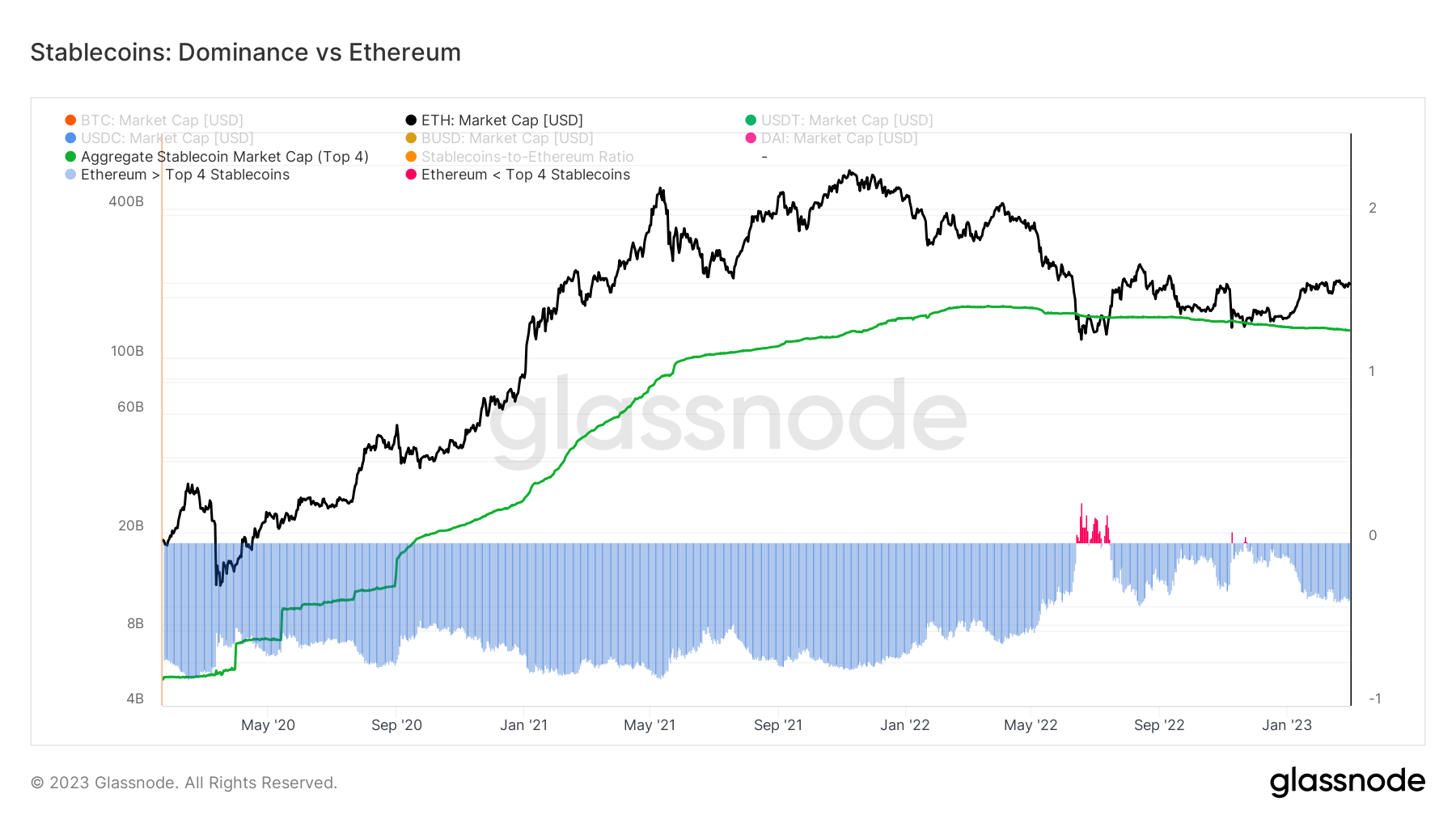

In the meantime, Ethereum dominance over the aggregate market cap of the top four stablecoins continues to increase.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Binance USD (BUSD) balance held on exchanges fell below 9 billion tokens as Tether (USDT) becomes dominant amongst stablecoins by accounting for 55% of the stablecoin market cap.

While balances shift within the stablecoin market, Ethereum’s (ETH) dominance over the aggregate market cap of the top four stablecoins continues its increase.

BUSD supply

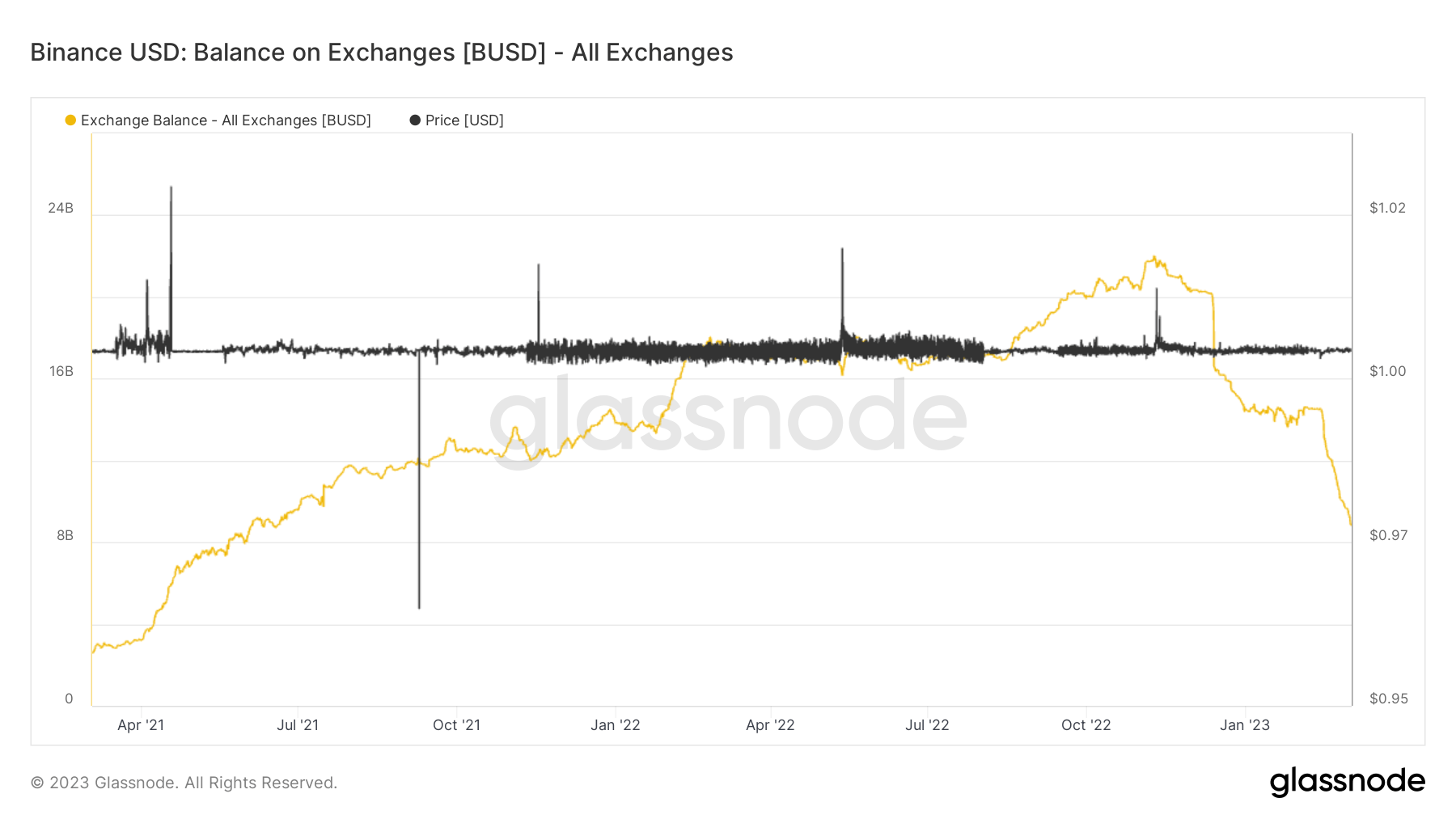

The chart below represents the total BUSD supply held on crypto exchanges with the orange line and shows a sharp decline in the BUSD supply since mid-Feburary. As of Mar. 3, the amount of BUSD held on exchanges sits at just below 9 billion.

The popularity of the BUSD took a hit on Feb. 13, when the U.S. Securities and Exchange Commission (SEC) issued a warning to BUSD issuer Paxos and requested it stop further BUSD production. Hours later, Paxos announced it would suspend BUSD minting starting from Feb. 21, 2023.

Between Feb. 13 and Feb. 17, Binance lost over 16% of its BUSD holdings, while the BUSD market cap decreased by 15% and fell to $13.7 billion. The current 9 billion held on exchanges marks a 38% drop from the 14.5 billion recorded on Feb. 12.

According to CryptoSlate analysis, the BUSD supply on exchanges has been shrinking since mid-November 2022. The data indicates that over 3 billion BUSD tokens were withdrawn from the exchanges in December 2022. This number had just decreased to 40 million on February 2022, when the SEC issued a warning to Paxos. Taking notice of the recent events, Coinbase announced that it would suspend BUSD trading starting Mar. 13.

USDT claiming the space

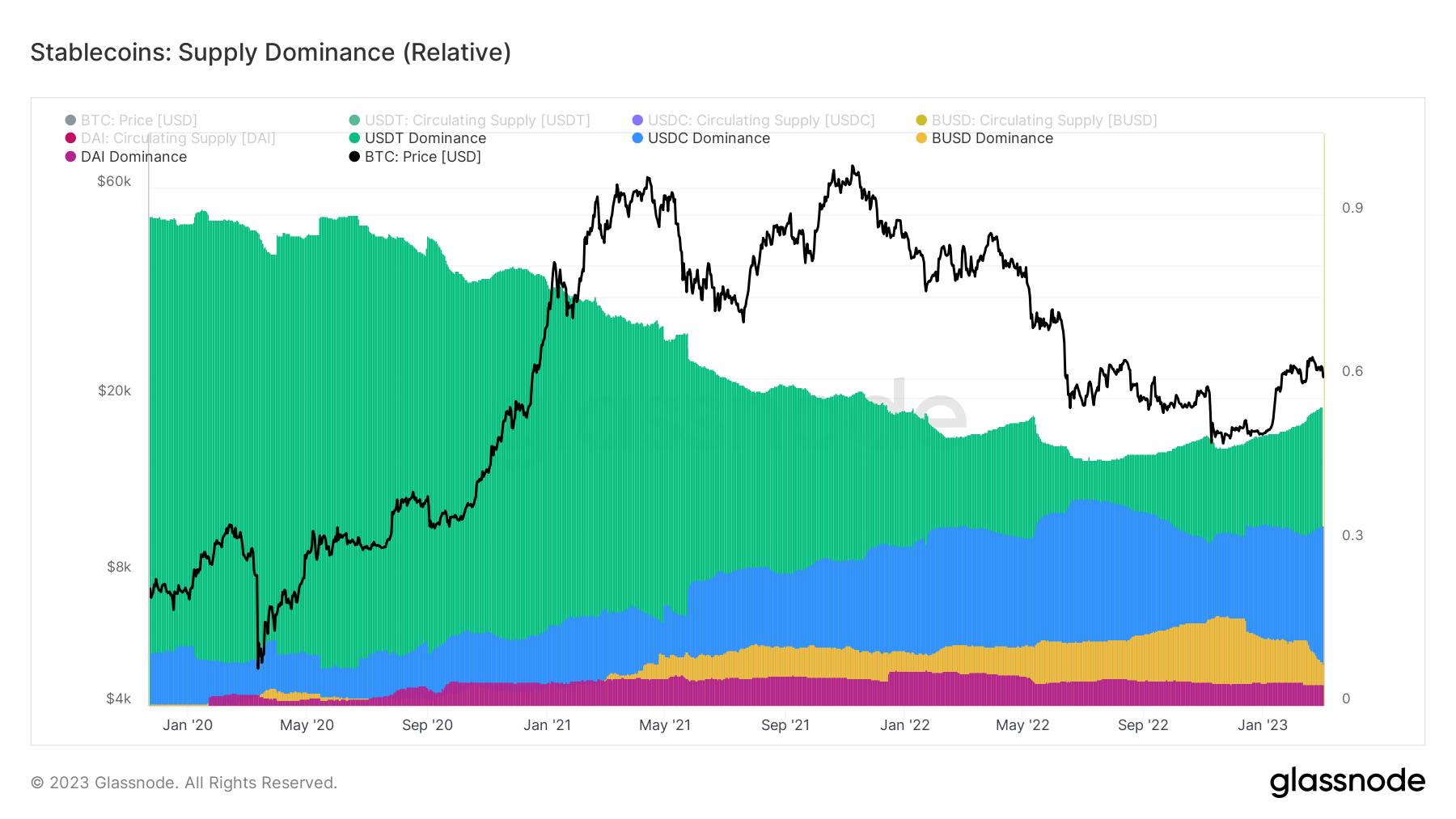

Numbers from November 2022 indicated that the USDT supply was dropping while the BUSD dominance increased. At the time of writing, the narrative turned in the opposite direction as the BUSD supply shrinks while USDT dominance grows.

The chart above represents the market shares of the top four stablecoins – BUSD, USDT, USD Coin (USDC), and DAI (DAI). USDT currently dominates over the remaining three by accounting for 55% of the aggregate supply of the top four stablecoins.

Binance’s CEO Changpeng Zhao (CZ) noticed the balance shift amongst stablecoins on Feb. 17. He noted that the USDC was dropping along with the BUSD and tweeted:

“BUSD market cap dropped -$2.45B (from 16.1B to 13.7B as of now), and most of it has moved to USDT.

USDT marketcap + 2.37B (From 67.8B to 70.1B)

USDC also declined -739M (from 42.3B to 41.5B)

Landscape is shifting.”

Ethereum dominance over stablecoins

Regardless of the shifts among stablecoins, ETH’s dominance over the aggregate supply of the top four stablecoins remains strong.

The chart below represents the ETH market cap and the combined value of the stablecoins with the black and green lines, respectively.

ETH held absolute dominance over the top four stablecoins since the beginning of 2020, except for a short period in the summer of 2022, when stablecoins triumphed over ETH. However, after briefly experiencing a similar stablecoin triumph in November 2022, ETH strengthened its position against the stablecoins and has remained resilient since.