Tech war: China’s chip imports slump 27 per cent in the first 2 months of 2023 as US sanctions bite

- Chip imports fell to 67.6 billion units in January and February, while the value of imports tanked 31 per cent to US$47.8 billion

- China’s chip industry is facing mounting pressure amid escalating US restrictions, but other manufacturing activity is rebounding after the end of zero-Covid

China’s chip imports slumped 27 per cent in the first two months of 2023 by volume, according to China’s customs data published on Tuesday.

Tech war: Alibaba’s hometown vows to boost integrated circuit industry

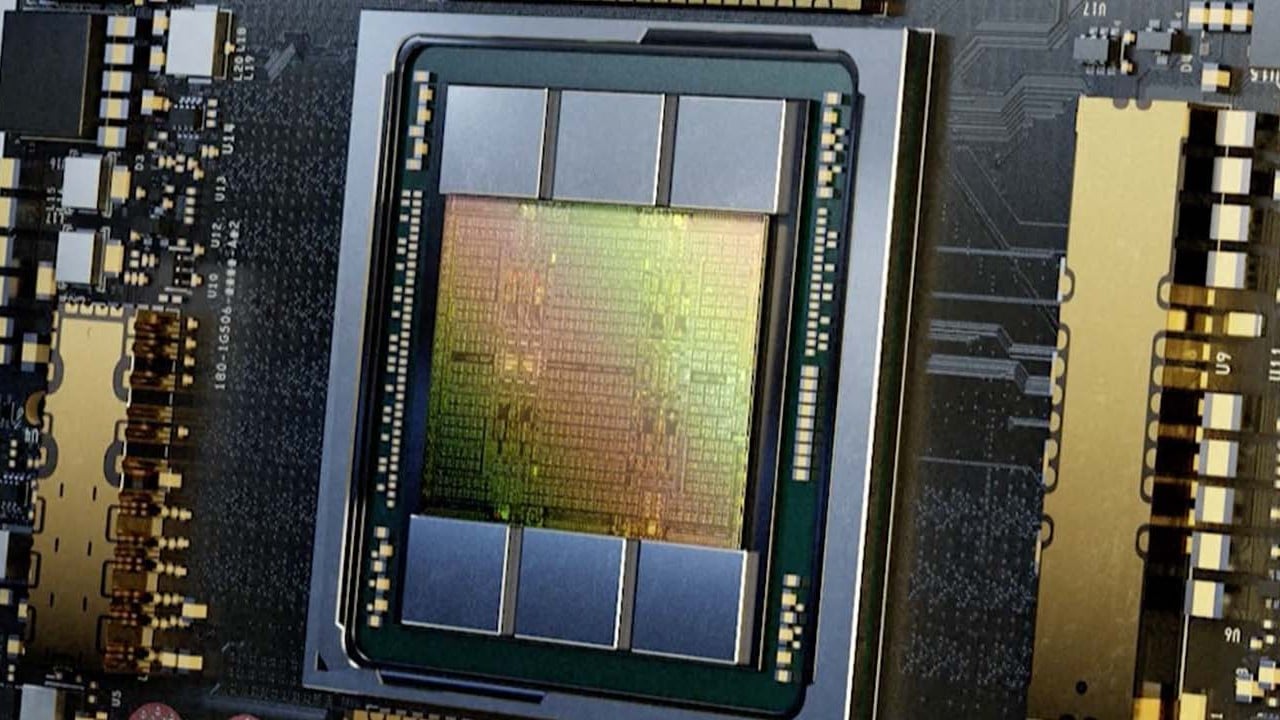

China is also facing fewer options for imports as the US has escalated export restrictions on advanced chips – especially those with artificial intelligence applications such a Nvidia’s A100 graphics processing unit (GPU) – and the country has ramped up domestic production of semiconductors using mature process nodes.

In the first two months of 2022, China’s total volume of chip imports decreased by just 4.6 per cent year on year to 92 billion units, while the total value of imports increased 19.2 per cent. Chinese Customs typically combines trade data for January and February, when trade flows often slow due to the Lunar New Year holiday.

China’s IC exports fell 20.9 per cent year on year to 37.3 billion units in the two months, compared with a 0.5 per cent increase in a year ago. The total value of the exports dropped 25.8 per cent.

The latest figures reflect the mounting pressure on China’s semiconductor industry as the US seeks to curtail its geopolitical rival’s access to and ability to produce advanced chips and chip-making equipment.

Last October, the Bureau of Industry and Security, an agency under the US Department of Commerce, significantly escalated those restrictions with an update that also targeted China’s ability to develop and maintain supercomputers and manufacture advanced semiconductors used in military applications, including weapons of mass destruction.

Meanwhile, other manufacturing activities rebounded in January and February after China relaxed its stringent zero-Covid policies in December, raising hopes for a fast recovery in trade data.

The official manufacturing purchasing managers’ index (PMI) beat expectations last month with a rise to 52.6, up from 50.1 in January and the highest reading since April 2012. The Caixin/S&P Global manufacturing PMI, a private-sector survey, rose to 51.6 last month, up from 49.2 in January.