The Big Four plan to cut 1,800 jobs – but are there more layoffs to come?

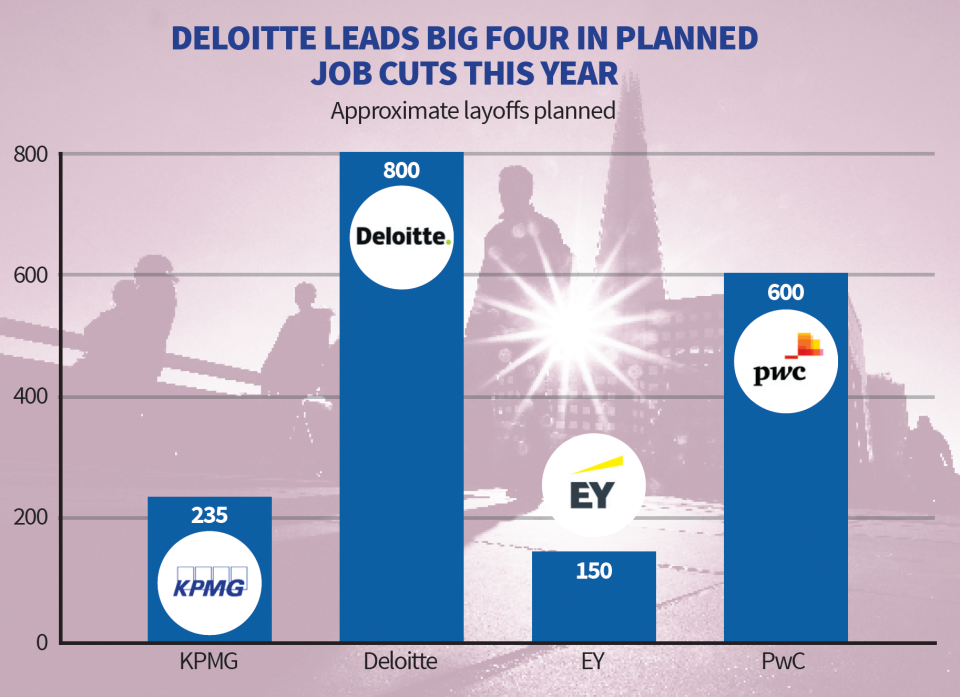

The Big Four have put some 1,800 jobs on the chopping block this year, alongside other cost-cutting measures such as pay freezes and cutting bonuses.

Many of the cuts have been targeted at the firms’ advisory units amid a huge slump in dealmaking, both in the UK and globally.

In the UK, mergers and acquisitions have cratered to a 14-year low this year as rising interest rates and volatile prices scuppered a predicted wave of takeovers.

Deloitte has planned the most job cuts of the Big Four this year, announcing plans for 800 layoffs. The firm’s chief executive, Richard Houston, said in September that the cuts followed “a slowdown in growth, which, combined with the ongoing economic uncertainty, means we have to consider the shape of our business”.

KPMG has planned to cut 235 jobs across its deals and consultancy divisions, while also freezing some staff’s pay.

“A challenging economic environment has driven a softening in a number of markets. These conditions have impacted demand in certain areas, as some clients have chosen to pause or delay projects,” a KPMG spokesperson said.

City A.M. revealed last month that KPMG UK is also merging its consulting and deal advisory units following the cuts, although the firm has stressed the move was not linked to the layoffs.

EY has made preparations for 150 layoffs. “We continually assess the resourcing needs of our business and, in some parts of our business, we are consulting on proposals to align current resourcing requirements with market demand,” a spokesperson said.

Until Tuesday, PwC was the only one of the Big Four not to publicly announce any job cuts. But now the firm is set to slash up to 600 jobs.

“Decisions about jobs are never taken lightly,” a spokesperson for the company said, adding that it had seen “lower than normal attrition rates and subdued growth in parts of the business”.

James O’Dowd, founder of recruitment consultancy Patrick Morgan, told City A.M. that the Big Four have been hit by a “perfect storm”.

“Over the last two years, firms overhired when there was a boom in transactions, and a lot of them would have compromised significantly on standards in their hiring,” he said. “But starting late last year, the lights went off quite quickly and firms switched from aggressive hiring and meeting client demand to the reality of the market.”

O’Dowd said his firm’s data shows that attrition rates – people leaving each firm – have also fallen sharply this year and that salaries and headcount are flattening, pushing the need to cut jobs.

He estimated that some firms’ deals businesses were overstaffed by as much as 30 per cent, and said further layoffs at the Big Four were likely in the near term.

“There’s a significant uptick in staff being placed on performance improvement programmes, which firms typically use as a prelude to removing employees.”

James O’Dowd, founder of recruitment consultancy Patrick Morgan

“There’s a significant uptick in staff being placed on performance improvement programmes, which firms typically use as a prelude to removing employees,” he said. “And we reckon that in deals around 15 to 20 per cent are currently on those – last year, there were barely any.”

Merrill April, a partner at law firm CM Murray, agreed that further cuts could happen.

“Businesses are wary of cutting too deep in initial redundancy rounds, because people are so expensive to recruit and because of the damage to corporate culture and the effect on the ‘survivors’ – so it would not be unexpected if more cuts were to follow, dependent on the economy and any uptick in deals,” she said.

Fiona Czerniawska, the chief of Source Global Research, which produces research on the management consulting market, said the probability of more cuts depends on the outlook going forward.

“What we’re seeing here is firms trying to improve profits and adapt to changing client buying behaviour,” she said. “Neither of these issues are likely to disappear in the next 1-2 years, so we should expect to see more cuts in the future, but probably in more targeted areas.”

Additional reporting by Maria Ward-Brennan

Yahoo Finance

Yahoo Finance