The app for independent voices

Part 3 - I asked AI: What would happen if the Trump tax cut expire? How will people be affected?

If the Trump tax cuts (TCJA) expire after 2025 as currently scheduled, the effects would ripple across households, businesses, and the economy. Here’s a breakdown of the key consequences:

1. Immediate Impact on Individuals (2026 Onward)

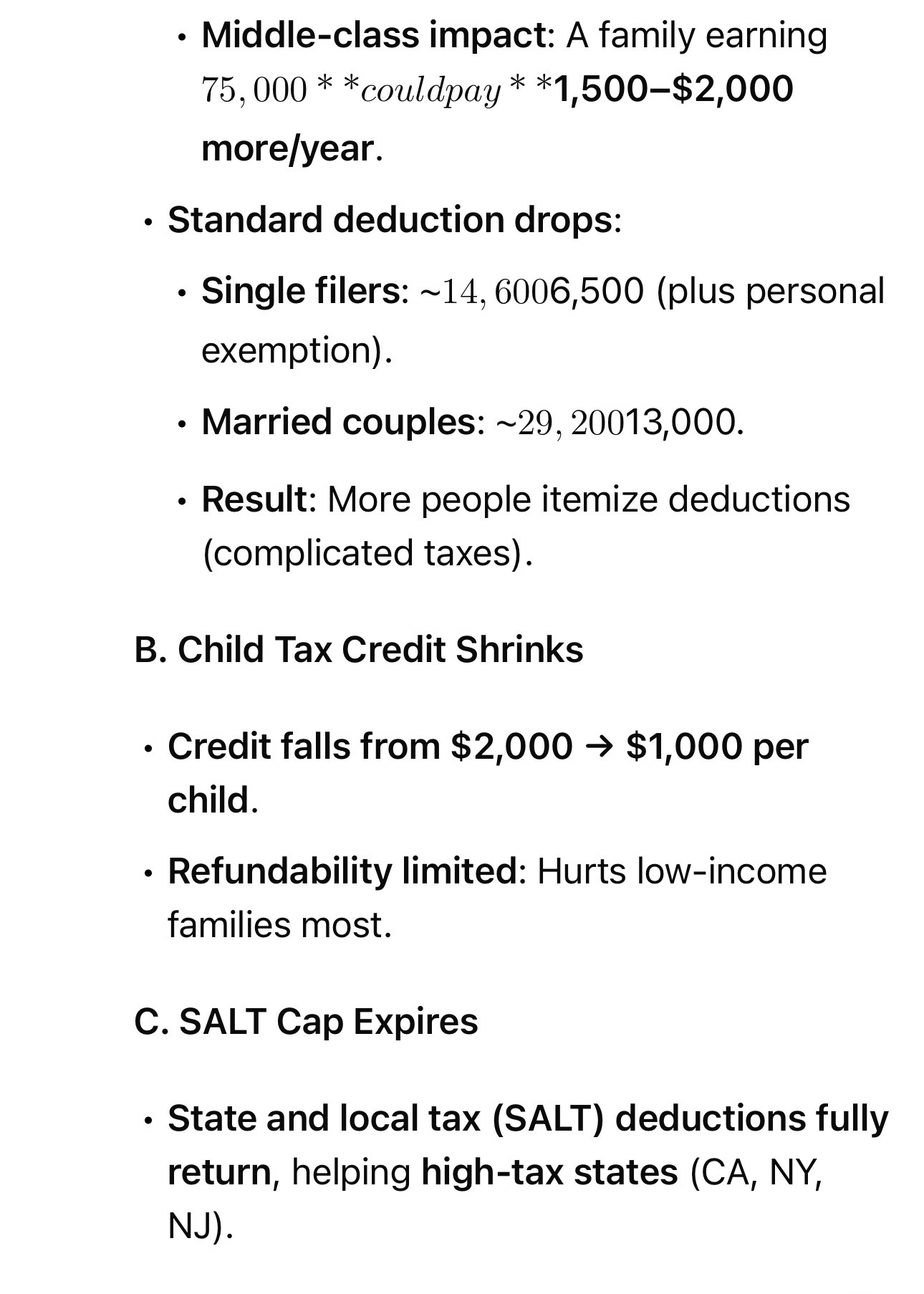

A. Higher Taxes for Most Americans

- Marginal tax rates revert to pre-2018 levels:

- Bottom bracket: Rises from 10% → 12%

- Top bracket: Jumps from 37% → 39.6%

- Middle-class impact: A family earning $75,000 could pay $1,500–$2,000 more/year.

- Standard deduction drops:

- Single filers: ~$14,600 → ~$6,500 (plus personal exemption).

- Married couples: ~$29,200 → ~$13,000.

- Result: More people itemize deductions (complicated taxes).

B. Child Tax Credit Shrinks

- Credit falls from $2,000 → $1,000 per child.

- Refundability limited-Hurts low-income families most.

C. SALT Cap Expires

- State and local tax (SALT) deductions fully return, helping high-tax states (CA, NY, NJ).

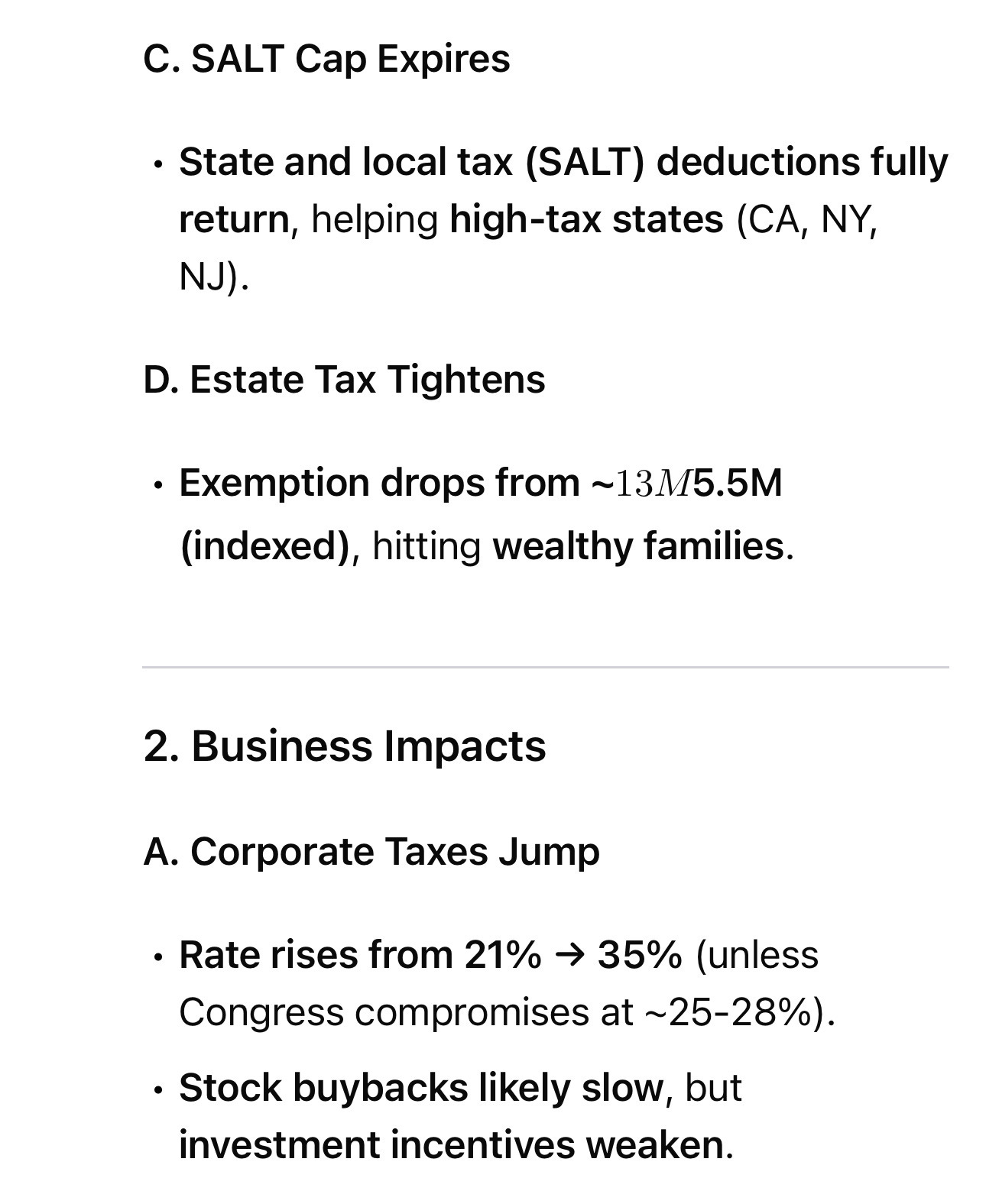

D. Estate Tax Tightens

- Exemption drops from ~$13M → ~$5.5M (indexed), hitting wealthy families.

Business Impacts

A. Corporate Taxes Jump

- Rate rises from 21% → 35% (unless Congress compromises at ~25-28%).

- Stock buybacks likely slow, but investment incentives weaken.

B. Pass-Through Deduction Dies

- 20% deduction for small biz (Section 199A) expires, raising taxes on LLCs, S-corps.

C. R&D and Depreciation Rules Change

- Companies lose full expensing, hurting manufacturing/capital investment.

3. Macroeconomic Effects

A. Deficit Improves (But Risks Recession)

- CBO estimates + $3.5T revenue over 10 years if cuts fully expire.

- But...Sudden tax hikes could reduce consumer spending, slowing GDP.

B. Political Firestorm

- GOP will blame "tax hikes" (even though it’s just expiration).

- Dems may extend middle-class cuts, creating a messy fight.

C. Markets React

- Stocks dip short-term (higher corporate taxes = lower profits).

- Bonds rally slightly (lower deficits = less Treasury supply).

5. Most Likely Outcome?

- Full expiration is unlikely, Congress will probably:

1. Extend middle-class cuts (to avoid voter backlash).

2. Let corporate/wealthy cuts expire (or compromise at ~25-28%).

3. Tweak offsets (e.g., new loophole closures).

Bottom Line

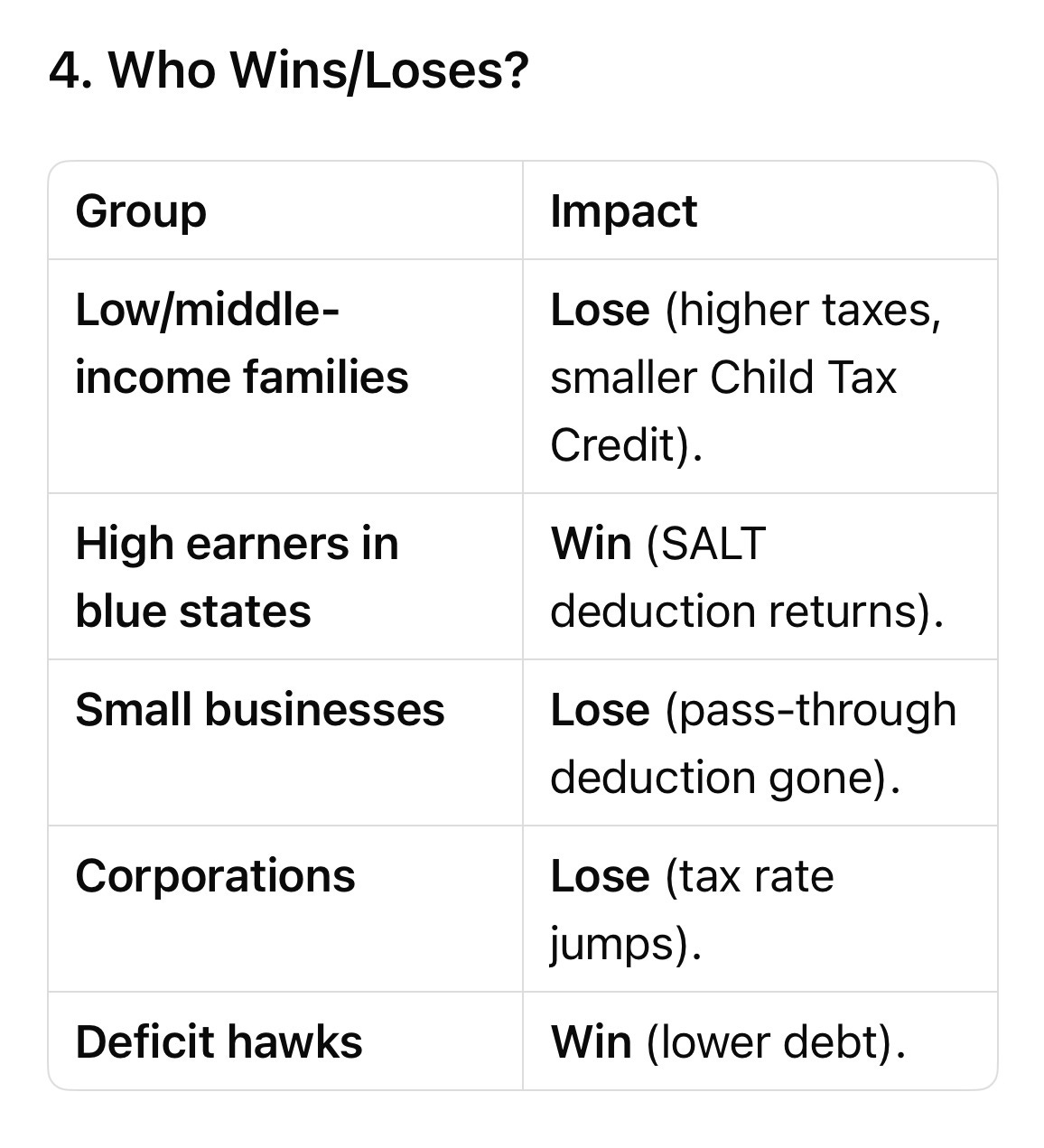

If the Trump tax cuts fully expire:

- Most Americans pay more, but the deficit shrinks.

- Business investment slows, risking short-term economic pain.

- Congress likely steps in to soften the blow

Best-case scenario? A balanced reform that keeps middle-class relief while raising revenue from the top (e.g., Biden’s plan to hike corporate/minimum taxes).