Economics: Has the Fed moved to a 5.5% per year nominal GDP growth target—or whatever is necessary to push the short-term nominal Treasury interest rate to the level at which the Federal Reserve as 5%-points of monetary ammunition to fight a recession? We have thought so since at least 1992. I think the Fed might agree—but I do not think the Fed will act on this proposal until after we have a year of the annual lookback core PCE chain price index at or below 2% per year:

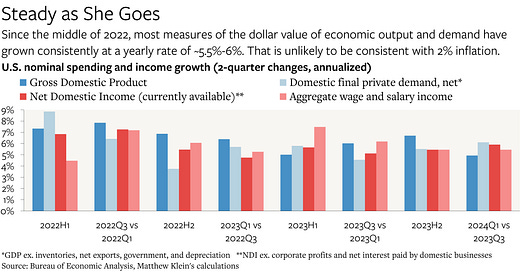

Matthew Klein: The 6% Solution: ’U.S. spending and incomes continue to grow a bit faster than before the pandemic. And that’s okay…. “A monetary framework… should be [one].. that contemplates enough room to respond to a recession… [with] nominal interest rates in the range of 5 percent in normal times.… If I had to choose one framework today, I would choose a nominal GDP target of 5 to 6 percent…”. Larry Summers…. One could be forgiven for thinking that [Summers’s] views have guided [Federal Reserve] actions…. The U.S. economy remains settled in the stable bea.gov/news/2024/gross… it has occupied since theovershoot.co/p/the-6…… <theovershoot.co/p/the-6…>