Notes

The prospect of stalling and falling interest rates across the yield curve is weighing on the dollar as well.

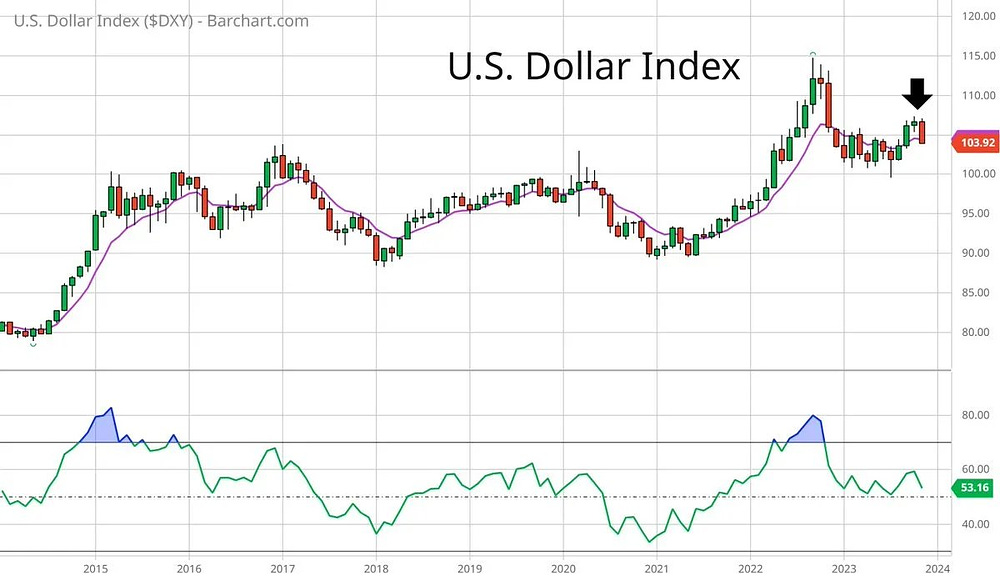

In the chart below, you can see the U.S. dollar index most recently peaked in late 2022.

The dollar has seen a rally since July, but made a lower high relative to last year’s peak and is turning lower again.

If the dollar resumes the downtrend by making a lower low under the 100 level, that has serious implications for several stock market sectors.

A falling dollar boosts the returns of international stocks, and is a tailwind for commodities because they are generally traded in dollars. In other words, a weakening dollar increases the purchasing power of non-U.S. countries.

A declining dollar can also help boost corporate earnings. For companies with international operations, non-U.S. revenues and profits become worth more in dollar terms when foreign currencies are gaining in value.

Dive into your interests

We'll recommend top publications based on the topics you select.