The app for independent voices

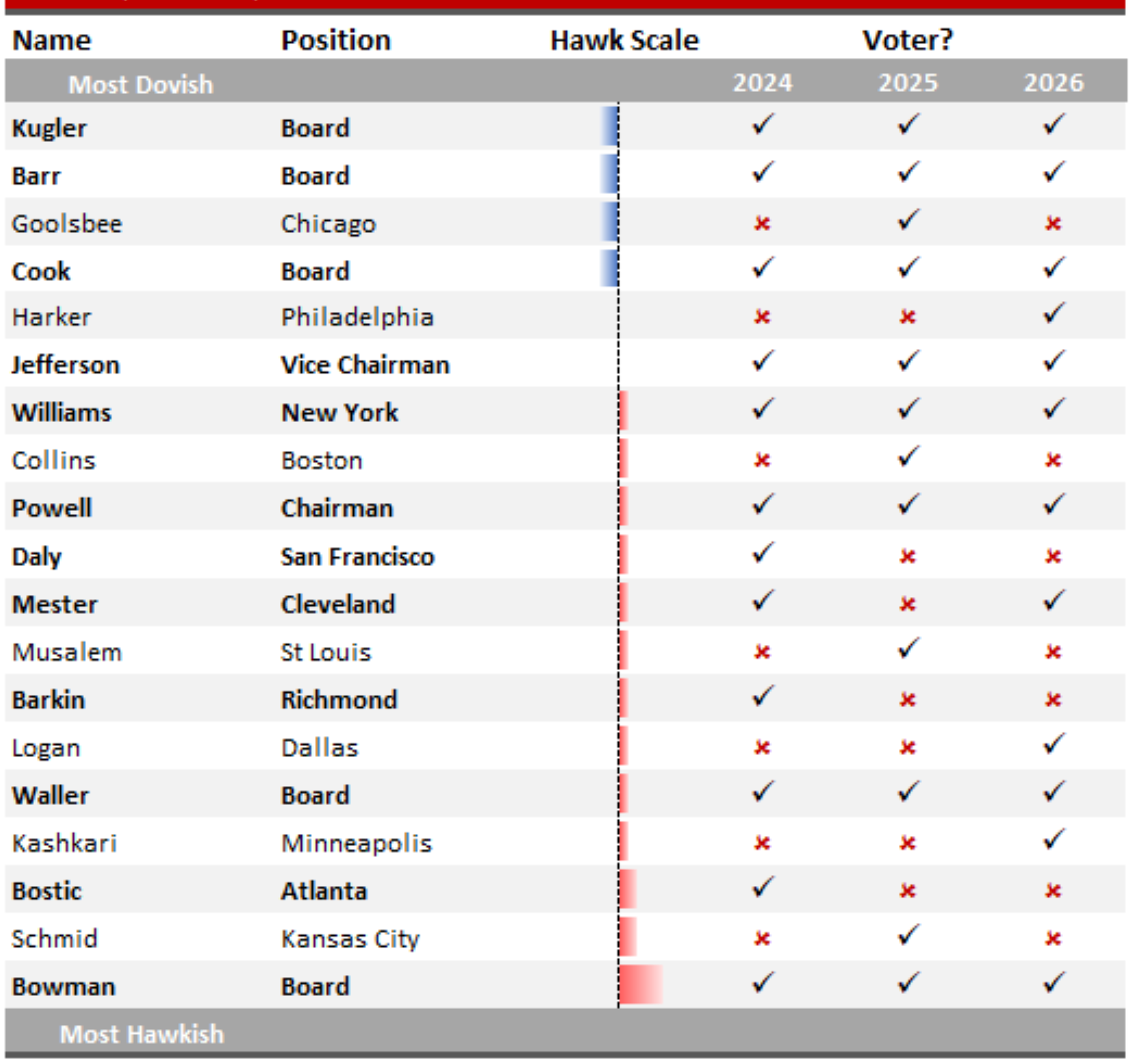

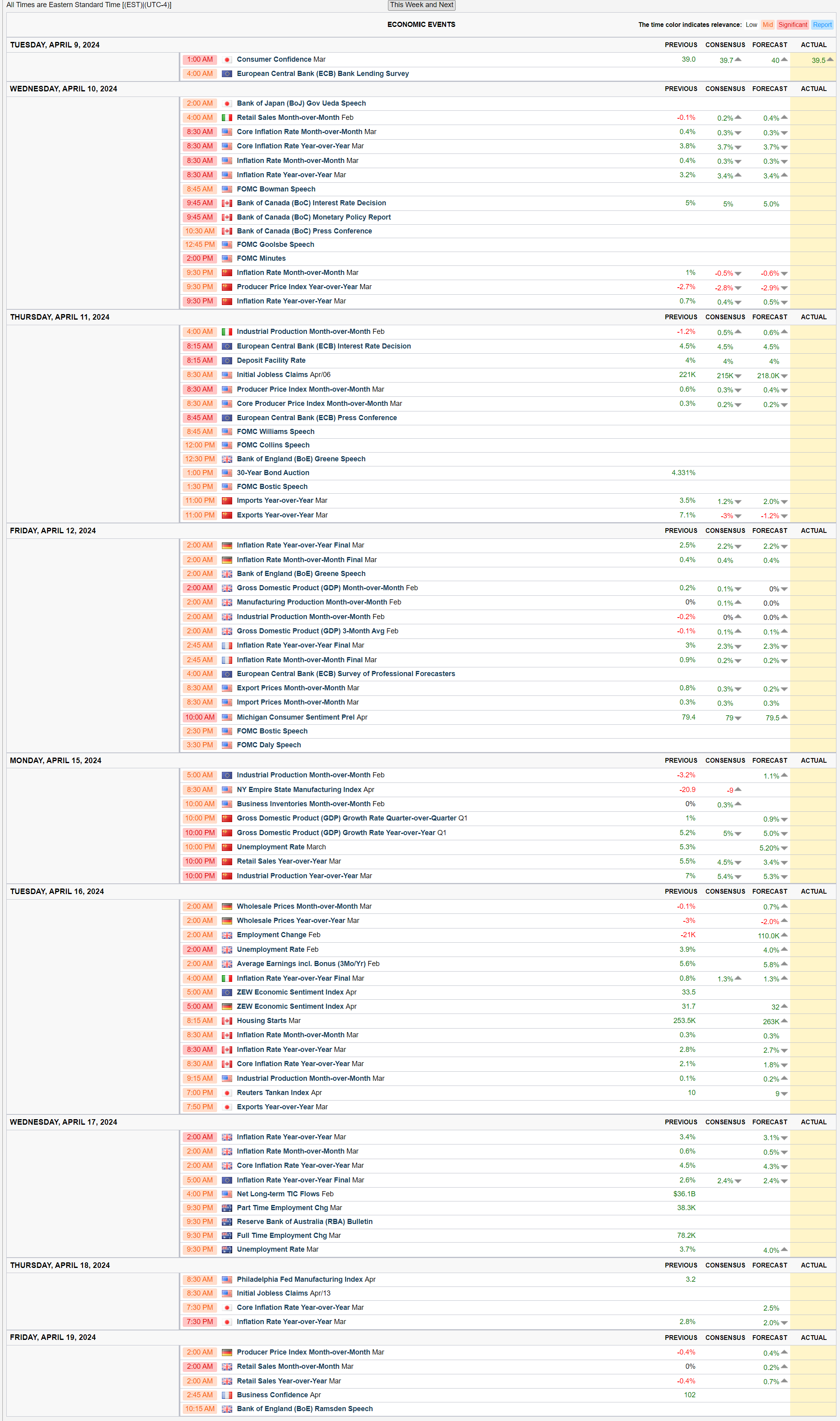

This week's inflation data releases ( quantuanr.substack.com/…) will most likely determine the forward monetary policy path due to the fact that monetary policy is data-dependent. The current monetary policy path remains skewed hawkish, FOMC officials remain attentive to data releases, and their remarks remain hawkish ( reuters.com/graphics/US… ), though some FOMC officials have shifted dovish. I expect a hawkish-nimble stance in the upcoming FOMC Minutes ( quantuanr.substack.com/…).

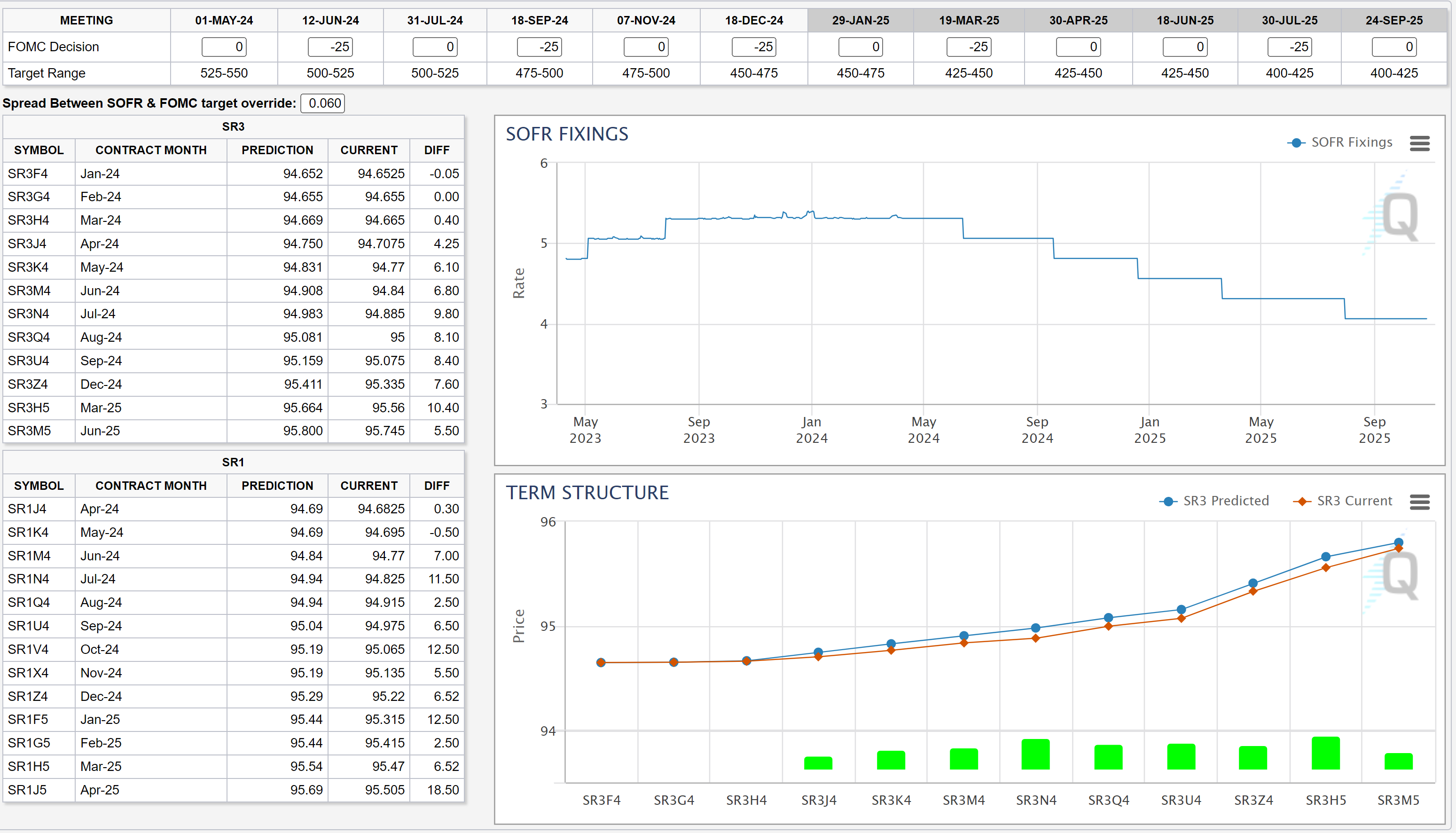

Markets have repriced the previously shown ( quantuanr.substack.com/…) rate path, markets now expect just two 25bps cuts this year. Thus far, data releases have been within expectations ( quantuanr.substack.com/…).

The next figures show the current market priced rate path with market data as of 20 minutes ago, the FOMC officials' hawkish/dovish stance infochart, and this and next week's economic events data release expectations.