The app for independent voices

SaaS and Earnings Quality: Most SaaS stocks are in a brutal drawdown. They are majorly falling due to AI concerns, but there is another factor - the quality of earnings (& Free Cash Flow).

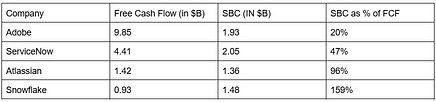

Here’s what we mean - many of these companies are diluting shares to such an extent that if we assume they buy back stock equal to the SBC (stock-based compensation) they give out each year, their actual free cash flow is much lower than what is quoted. Hence, many of these software companies can get much cheaper before they bottom.

Given the huge SBC issued by Atlassian and Snowflake, these companies cannot support their stock prices through stock buybacks (since most of the buybacks will get consumed in buying back stock issued for SBC).

Let us know if you agree with our analysis of the quality of Free Cash Flow for these Software firms. Or are we missing a trick here?