The app for independent voices

CLARITY, at Last? The Text Is In

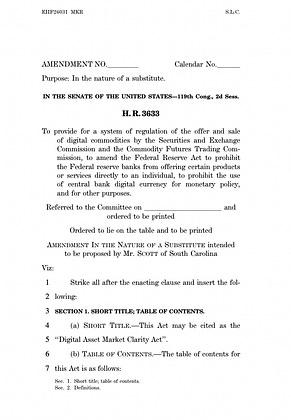

Ahead of this week’s markup, the United States Senate Committee on Banking, Housing, and Urban Affairs released its fact sheets on the Digital Asset Market CLARITY Act. Now the full 278-page bipartisan market-structure text is public.

[ you can find it here: banking.senate.gov/imo/…]

After months of negotiation between Republicans, Democrats, and industry, crypto regulation has moved out of speeches and enforcement actions and into statute. From here on, it lives in definitions, jurisdictional tests, exemptions, thresholds, and supervisory powers — the machinery that actually governs markets.

A long bill doesn’t signal permissiveness.

It signals that trade-offs are explicit:

– what qualifies as a commodity versus a security

– where software stops and intermediaries begin

– how AML attaches to control, not protocol

– which agency gets first -and final

— authority

If this text survives markup, the U.S. is no longer debating whether to regulate crypto. It’s deciding how digital markets are allowed to operate inside the financial state.

What’s embedded in the text:

Jurisdiction is specified, not improvised: a statutory SEC–CFTC split replaces enforcement-by-guesswork.

Disclosure replaces permissioning: tailored regimes instead of one-size-fits-all registration.

Code is treated as speech, not custody: developers are carved out; control is not.

Illicit finance is tied to chokepoints: AML and sanctions follow custody, control, and conversion.

Market structure, not token taxonomy, is the organizing logic.

The open question is whether it survives markup, amendment, and agency turf wars.

From here on, analysis shifts from intent to implementation: how jurisdiction is drawn, where compliance attaches, and which risks are ultimately priced into the system.

Markets don’t run on consensus — they run on rules. This draft attempts to write them. Whether politics allows them to endure is unresolved.

Stay tuned!