The app for independent voices

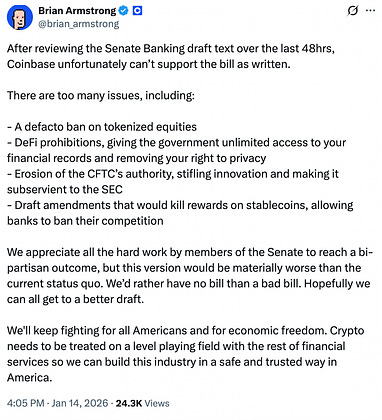

“can’t support the bill as written.”

BREAKING: Brian Armstrong pulls support for the CLARITY Act, citing DeFi privacy, tokenized equities, stablecoin rewards, and SEC–CFTC balance.

That’s not a surprise.

Those are the exact fault lines:

• DeFi privacy → control tests + application-layer AML

• Tokenized equities → economic equivalence in “network token” design

• Stablecoin rewards → amendment risk + delegated discretion

• SEC–CFTC balance → authority on paper vs. rulemaking in practice

This isn’t about whether crypto gets regulated anymore. It’s about where discretion lives once the statute runs out.

📌 The CLARITY Act’s “Known Unknowns” — Part I →

Jan 14

at

9:29 PM

Log in or sign up

Join the most interesting and insightful discussions.