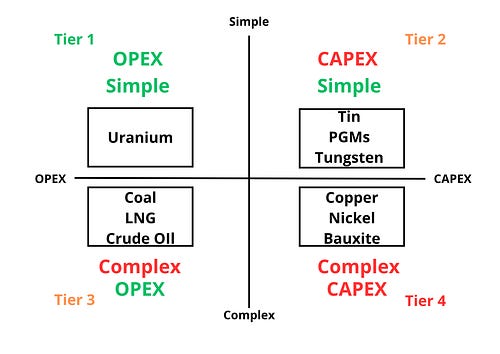

The four categories of commodities:

· Tier 1 (OPEX and simple): uranium

· Tier 2 (CAPEX and simple): tin, PGMs, tungsten

· Tier 3 (OPEX and complex): coal, LNG, crude oil

· Tier 4 (CAPEX and complex): copper, zinc, bauxite, nickel

The chart does not represent all commodities. It aims to illustrate the framework I discuss today. I included those commodities I am interested in.

Preferably stick to Tier 1 and 2. Tiers 3 and 4 are under more consideration, given their complex markets.

This is not to say there is no way to get Alpha from oil, copper, or their corresponding equities. Definitely, they provide tons of Alpha. However, doing so is least to say complicated compared to relatively simple markets in Tier 1/Tier 2.

The more running parts in the system, the more challenging it is to forecast the outcome with plausible accuracy. Hence, our thesis is more prone to errors.

To remind you, I do not state that investing in uranium is superior to investing in oil. This framework is a map of commodity markets. It guides me on where to go and how to prepare if I want to reach the desired destination.