The app for independent voices

some thoughts & charts into 2026

US long term breakeven inflations are well anchored around 2%, and are slowly drifting lower. Concerns about Fed independence? I don’t know.. If that narrative were truly working, breakevens should be trading above 3%+.

ISM PMI has been sitting below 50, which implies there is ample room to move higher. I am fairly confident it will soon move back into expansionary territory (50+). Historically, equities have performed very well when PMI is rising from the 40s. The only notable exception was 2002.

Is a lower VIX regime coming? Since the Trump inauguration, VIX futures have been steadily trading above 15+. This level still looks elevated versus historical norms. During the last Trump presidency, VIX marked a bottom around 10+. That suggests true complacency has yet to arrive.

Looking ahead to TMT issuance next year, I am skeptical it will be as large as the market expects. ORCL is unlikely to collect budgets from jumbo deals like it did this year, as IG investors are already avoiding adding ORCL to their portfolios. The market is already punishing reckless leveraging, so TMT issuers are likely to be more cautious than participants currently assume. And consensus says total 2026 IG issuance is expected to be around $2tn, which is close to a record high.

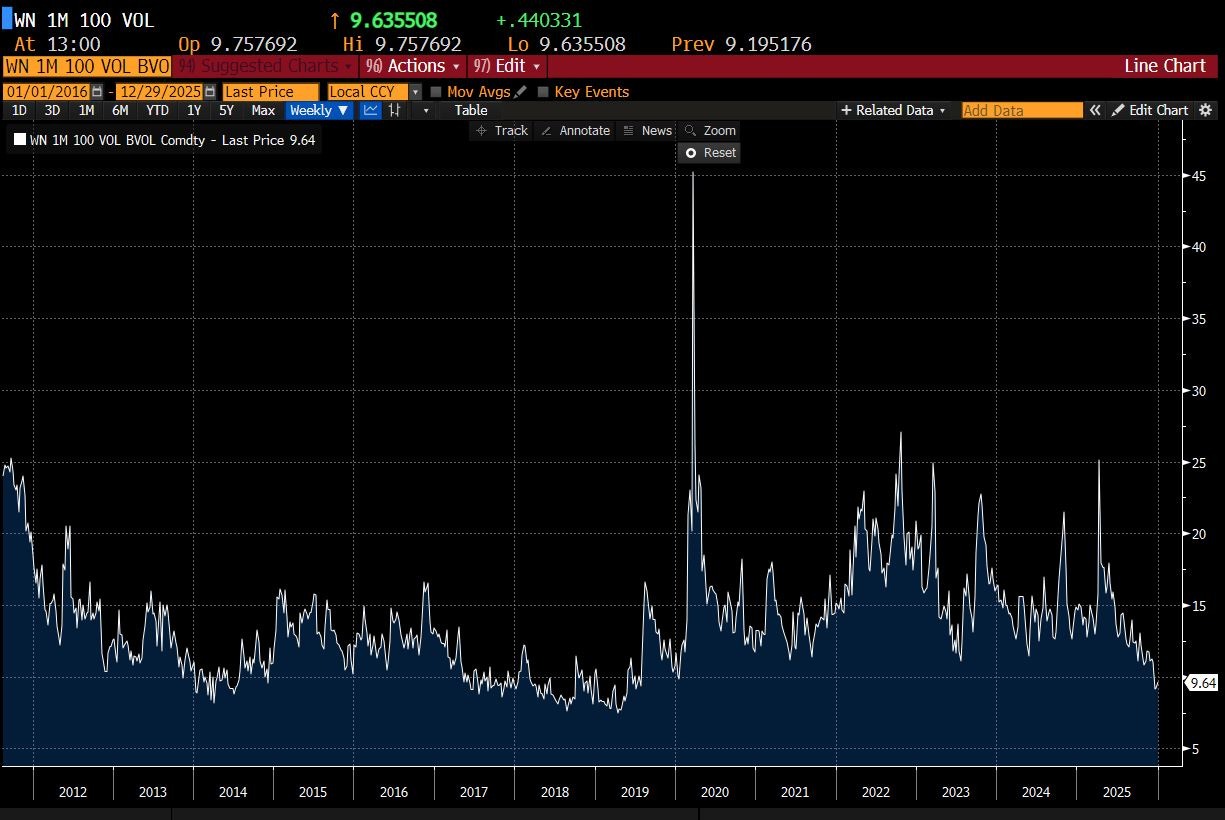

Where should we stay alert for the next volatility spike? US Treasuries are high on my watchlist. Since Liberation Day and throughout 2025, concerns around the long end of the US Treasury curve have been widespread. However, in Q4 the Fed leaned dovish and effectively capped yields. As a result, WN (30yr Ultra futures) implied volatility has approached historical lows. At the same time the US has yet to fully price the end of the cutting cycle, unlike EU, NZ, AUS, and CAD.