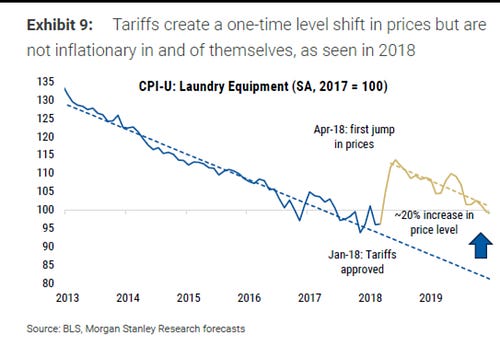

I posted this question on tariffs and got some really good responses. Here is my explanation of why the chart’s conclusion is erroneous (while the chart is correct):

External Validity: The case discussed here - inflation of laundry equipment - is not externally valid. That is, the example cannot be applied how the economy will respond to broad tariff increases. Laundry equipment is a very small component of US consumption and thus, any price changes in the real marginal cost of production of laundry equipment will not really impact the ‘real marginal of cost’ of national production (i.e. all good/services). So we cannot use this microscopic scenario and extrapolate it to the wider economy. Not to mention, given the downward trend of prices for laundry equipment, the authors of this chart are unable to actually show whether the downward trend ‘slowed’ due to the tariffs. If it did, then even in this small example, tariffs would increase inflation of laundry equipment (by making deflation slower).

Holding All Else Constant Assumption: Separately, as we emphasize in our Newsletter, one of the most often ignored assumptions is the holding all else constant. Although this won’t be is impactful here, the authors of the conclusion forget that there are responses to inflation. To focus on the global tariff example - imposing blanket tariffs increases the real marginal cost of production. A higher real cost of production implies a higher rate of inflation (holding all else constant). However, since the Federal Reserve targets a 2% inflation, they will respond by increasing interest rates. Higher interest rates reduce economic activity which results in higher unemployment and lower wages. Lower wages reduce the real marginal cost of production, which brings back inflation to 2% level. Thus, it may look like tariffs didn’t do anything, but in reality, they reduced real wages.

A short chart of the mechanism:

Inflation at 2% -> Tariffs imposed -> Higher Real Marginal Cost of Production ->Inflation at 3% -> Federal Reserve Raises Rates -> Higher Unemployment/Lower Wages -> Real Marginal Cost of Production falls back to previous level due to lower wages -> Inflation at 2%.

The key outcome:

Tariffs imposed -> Higher Unemployment/Lower Wages