One of the great generally overlooked positive dynamics in the world economy is the recovery of monetary velocity in response to rising efficiency in the way savings are invested as we exit the terminally dysfunctional world of zero/near zero interest rates.

Today gives us another illustration: in the US real GDP was revised up to an annualized 3.4%, with final sales to domestic purchasers up 3.9% (though private up only 3.3%). Nominal GDP came in at an annualized 5.1% (or 6.6% on a 12ma). Meanwhile, the GDP deflator retreated to just 1.6%, with personal consumption deflator at 1.8% (durable goods down 3.5%, services +3.4%).

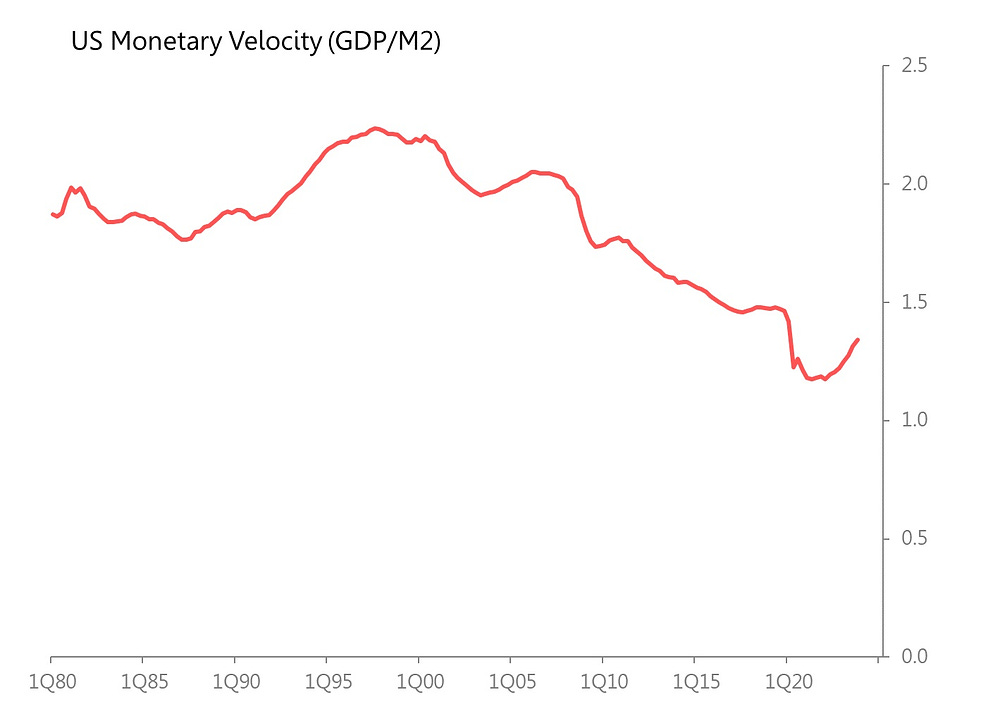

How could this genuinely healthy growth have happened, given that money supply (M2) has been in continuous contraction since Dec 2022; and fell 2.5% yoy in 4Q, and fell 3.4% for the whole year?

The answer is that monetary velocity is in recovery from its pandemic-slump. The longer term chart shows velocity basically in decline since the world hit a financially-driven set of perma-crises in 1997/98, to which the response was the force-feed money into the system, to ever-lower economic effect.

The great hope of the global economy in the next decade is that this fall in monetary velocity can be not only halted, but reversed. It’s happened before - and we called in the 1950s and 1960s!

Dive into your interests

We'll recommend top publications based on the topics you select.