Notes

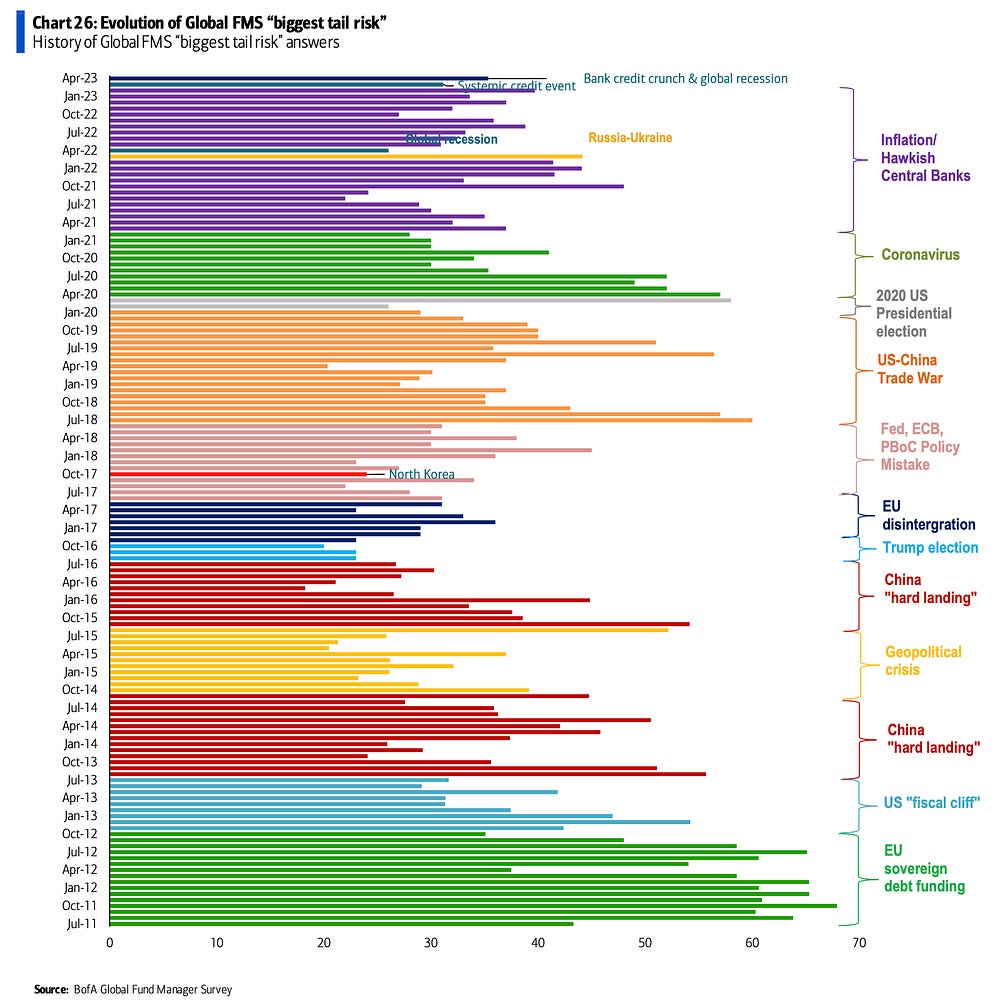

According to Bank of America’s April Global Fund Manager Survey, fund managers identified “bank credit crunch & global recession” as the “biggest tail risk.” It’s a kinda vague, but I think we get the point.

Frankly, aren’t we always worried about recessions? More broadly, aren’t we always worried something bad will happen that’ll be bad for the economy and therefore bad for the risk assets in which we’re invested?

The truth is we’re always worried about something. That’s just the nature of investing. This is TKer’s Stock Market Truth No. 7. More here: tker.co/p/always-risks-uncertainty-in-s…

Dive into your interests

We'll recommend top publications based on the topics you select.