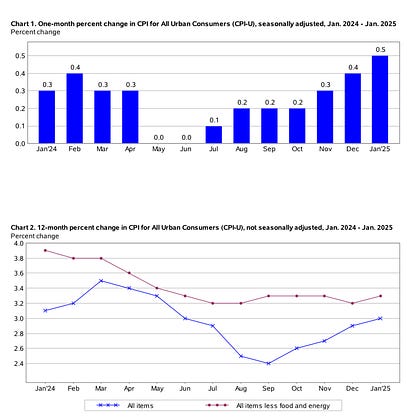

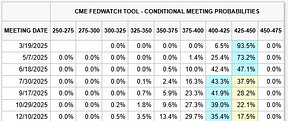

Fed Chair Powell delivers the Monetary Policy Report to Congress today (2/11)

“As the economy evolves, we will adjust our policy stance in a manner that best promotes our maximum-employment and price-stability goals. If the economy remains strong and inflation does not continue to move sustainably toward 2 percent, we can maintain policy …

Here are the limit down circuit breaker rules per SEC: “Market-wide circuit breakers provide for cross-market trading halts during a severe market decline as measured by a single-day decrease in the S&P 500 Index. A cross-market trading halt can be triggered at three circuit breaker thresholds—7% (Level 1), 13% (Level 2), and 20% (Level 3). These triggers are set by the markets at point levels that are calculated daily based on the prior day’s closing price of the S&P 500 Index.

A market decl…