Notes

Very interesting article by Bain & Company on how companies got better in their M&A activity.

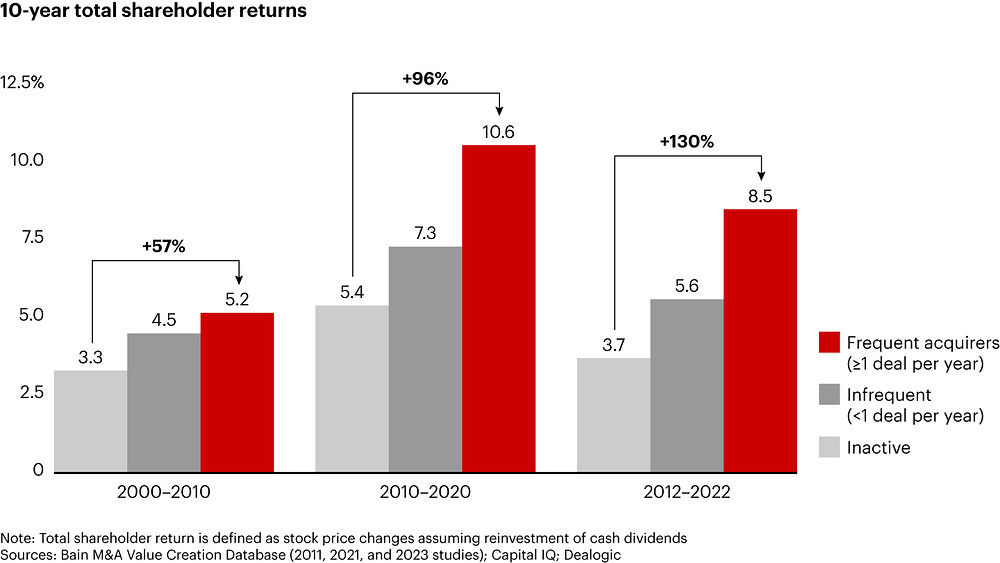

Agree with the main conclusions and take-aways why M&A is generating more value to the acquirer (better due-diligence, broader scope, more small deals, avoid big one-shots, a derivative of corporate strategy, creation of dedicated teams for M&A and integrations phases, etc...).The only question mark is the control groups of graphic 1, are we comparing similar companies or the ones with inactive or infrequent are companies that have a worse starting point, thus no access to funding to perform M&A, thus naturally with lower TSR on the long-run? Were the control groups streamlined so we are comparing properly the 3 groups, i.e. sound companies that could have done M&A and decided not to do it?

Dive into your interests

We'll recommend top publications based on the topics you select.