Bitcoin ETFs attract more than $5 billion in net inflows since market debut

Bitcoin ETFs attract more than $5 billion in net inflows since market debut Quick Take

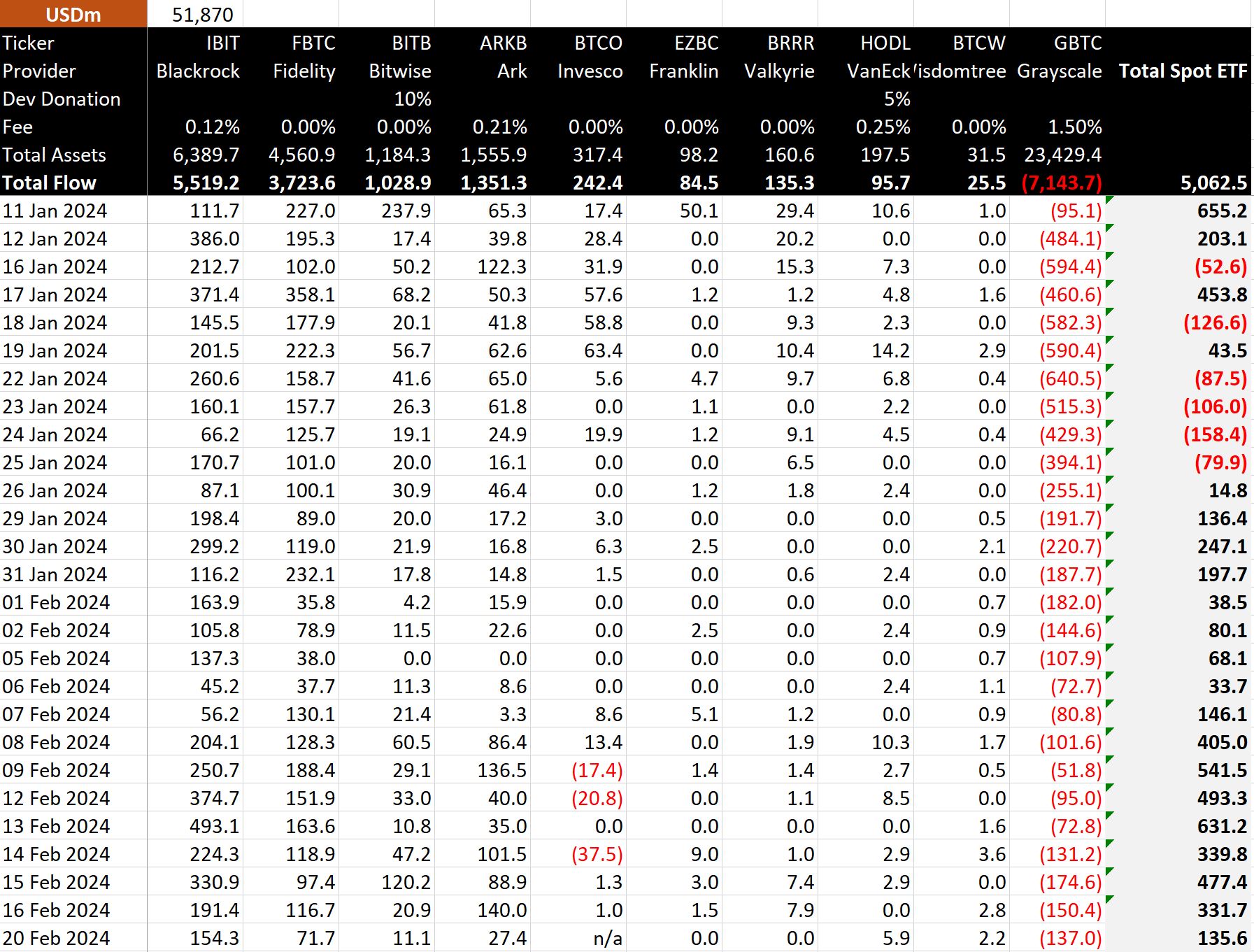

The financial landscape of Bitcoin ETFs saw considerable inflows on Feb. 20, as reflected in recent data from BitMEX, with an influx of $136 million, the equivalent of 2,606 BTC. BlackRock IBIT is at the helm, with an additional inflow of $154 million, raising BlackRock IBIT’s total net inflows to an impressive $5.5 billion.

BitMEX data shows that GBTC experienced a significant outflow of $137 million, pushing their total net outflows to a staggering $7.1 billion. Since the Bitcoin ETFs started trading on Jan. 11, they have now seen overall net inflows surpass the $5 billion mark.

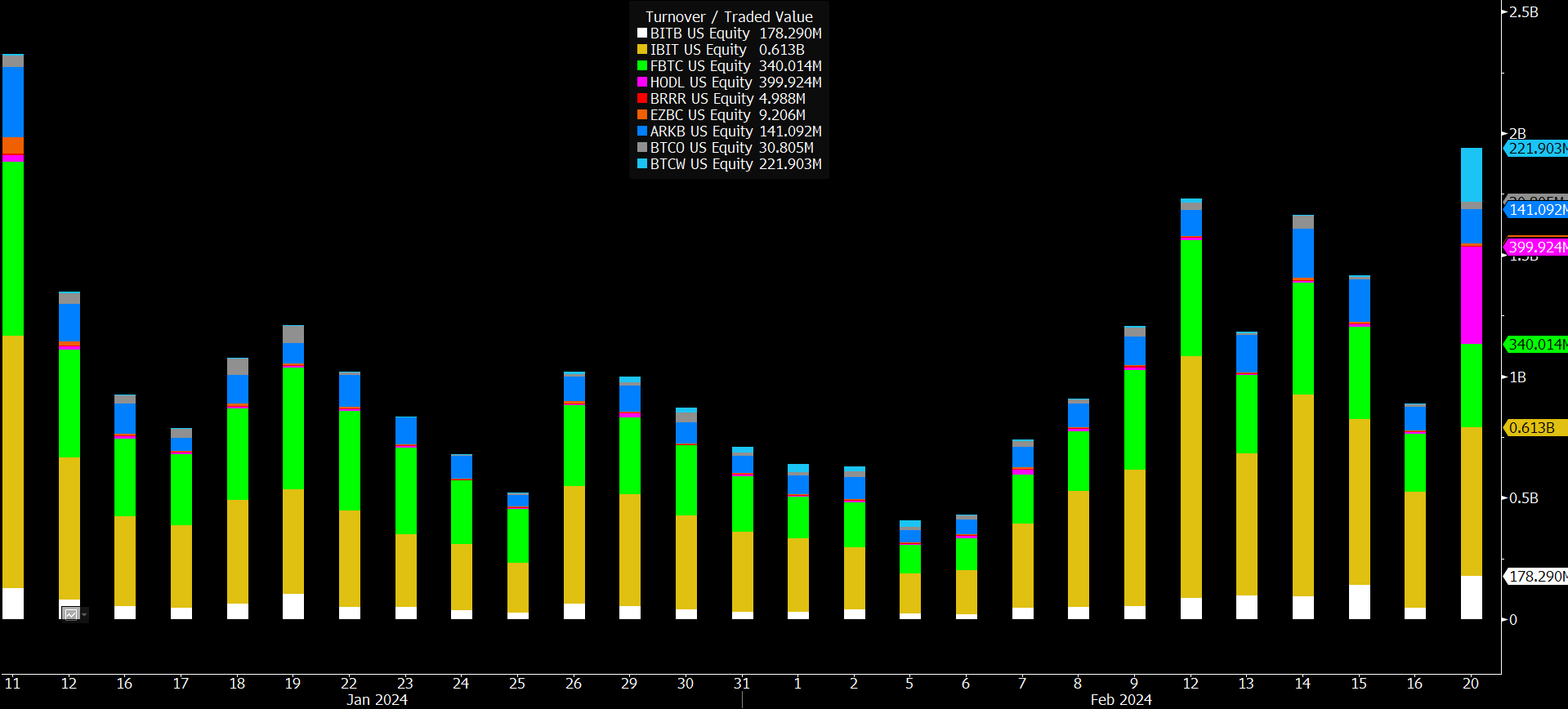

Adding to this robust financial scenery, Senior Bloomberg ETF Analyst Eric Balchunas highlighted a record-breaking day for ‘The New Born Nine‘. He noted that these funds had their largest volume day since day one, with a combined trading contribution of about $2 billion, significant contributions from Vaneck Bitcoin Trust ETF (HODL), Wisdomtree Bitcoin ETF (BTCW), and Bitwise Bitcoin ETF (BITB), according to Balchunas.