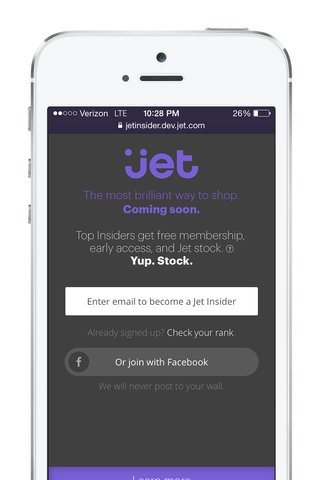

More than 250,000 people have signed up for a Jet.com membership even though the audacious e-commerce startup hasn't set a launch date yet, the company says.

Those quarter million are all technically competing for an ownership stake, under the terms of its Insider plan that will give 100,000 shares of stock options to the person who secures the most signups via word of mouth.

The reason I say "technically competing" is that the vast majority aren't trying very hard. The nine referrals I've driven since I signed up in November (all the while making it clear I wouldn't accept any prizes) are good enough to put me at No. 1,091 — higher than 99.5 percent of all users.

Jet.com marketing chief Sumaiya Balbale says that was expected. Like most consumer-facing businesses, Jet.com will always depend on a relatively small group of hard-core fans driving most of the conversation alongside a long tail of casual fans.

"What's been interesting is, we've had a different group of people coming in and out of the top 10, so there's a little more competition at the top than I had originally anticipated," she told me.

She won't say who's winning, or how many referrals the top 10 folks have generated so far. When the competition ends Feb. 6, the first place winner will get those 100,000 shares, which Balbale calls the equivalent of what a mid-level employee could earn after four years working there. The rest of the top 10 will get 10,000 shares each.

The ownership shares at stake in this competition are coming from the pool of equity typically reserved for employees, apart from shares sold to venture investors, she said. They will only be able to be exercised if the company goes public or is acquired.

And while it's been easy for me to rise close to the top 1,000, it's a tall order to get into the upper echelon, she said. "To actually get the equity, the amount of activity that's required, the amount of social marketing and energy that has to go into that is significant," Balbale said. "That's part of the reason why we think these people justly deserve a stake in Jet."

Jet.com and CEO Marc Lore were inspired by startup Mailbox and Robinhood's super-long wait list strategies, she said, but included the equity idea on their own to build buzz and reward the customers who are most important in the company's early days.

Sign up for New York Business Journal's free email newsletter delivering exclusive news scoops and local business intelligence.