When is hiring coming back? Our predictions for 2024.

EDIT: If you don't like reading, here's me presenting the contents of this blog post in a video. Pick your poison.

Predictions are hard, and, inevitably, most of them turn out wrong. But we’d like to brave the scathing mockery of the internets and try anyway! Our courage is bolstered by some useful data we have (both proprietary and gathered from the internet), which we’ll use to guess what will happen in 2024 and to answer the question foremost in many of our minds: “When is hiring coming back?”

interviewing.io is an anonymous mock interview platform and recruiting marketplace for engineers. Engineers use us for mock interviews. Companies use us to hire top performers. In our lifetime, we’ve hosted over 100k technical interviews, split between mocks and real ones. Data from these interviews helps us get an insider’s perspective on what’s actually going on in the engineering market. For instance, we know how many people are practicing for interviews at Google vs. Meta vs. other FAANGs. Because we offer salary negotiation, we know how often people are negotiating, how successful they are, and what their compensation looks like. We also know what the “bar” looks like in different kinds of technical interviews over time — how well you have to do to pass algorithmic interviews, system design interviews, and so on.

And, finally, we ran several surveys with our users recently (thank you, kind and patient users), to learn about their recent job searches and outcomes. We also asked our users to share some advice based on their experience with the current job market. We’ll include bits of advice as quotes throughout this piece.

Putting all of this data together gives us the kind of clarity that wouldn’t be possible from looking at any one piece individually. For instance, once you realize that most FAANGs are only hiring for backfills, while Meta is on a hiring spree, you start to understand why they’ve been treating candidates poorly and why the market has allowed them to do it. We’ll get to all of that in a bit. First, here’s Nostradamus Corgi with our predictions for 2024.

Predictions for 2024

Those who've owned a touch bar MacBook with butterfly keyboard will appreciate that a hologram-snow-globe provides a vastly superior input device.

Prediction #1: 2024 is the year when hiring comes back.

Whether we like it or not, the FAANGs are driving overall eng hiring volume. As you’ll soon learn, Meta and Netflix are hiring aggressively while the other FAANGs are not, but I’m inclined to think that come next year, most of the FAANGs will follow Meta and Netflix’s lead and start actively hiring again.

Prediction #2: Mid-level & senior eng hiring will pick up significantly, come Jan 2024.

We’re less confident about this part, but we expect that hiring will be back to (or quite close to) H1 2022 levels in the spring of 2024.

Prediction #3: For at least the next 6 months, compensation at a given level will stay flat.

Prediction #4: For at least the next 6 months, down-leveling will continue because of inertia.

Prediction #5: For at least the next 6 months, recruiters are going to be increasingly stretched thin, which means that applying online is going to be an even less effective way to get into companies.

Prediction #6: The hiring bar will NOT return to where it was for a long time.

Of course, anybody on the internet can make predictions about hiring, but ours are supported by actual data (below), which we want you to dive into to see if you agree with us. And at the end of this piece, we’ll include a final bonus prediction and actionable advice and resources you can use to capitalize on these predictions.

First, let’s look at some benchmarks from the broader internet about the state of hiring and layoffs.

Eng jobs are recovering, and layoffs are way down

Below is a graph of open tech jobs over time, from TrueUp. TrueUp indexes open jobs at “tech and tech-ish companies” that have one or both of the following traits: “product + services would not exist without the internet” and/or “raised money from a VC”.

Source: https://www.trueup.io/job-trend

As you can see, tech jobs started to drop in May 2022 (around the time the FAANGs froze hiring) and began to recover slowly in March 2023.

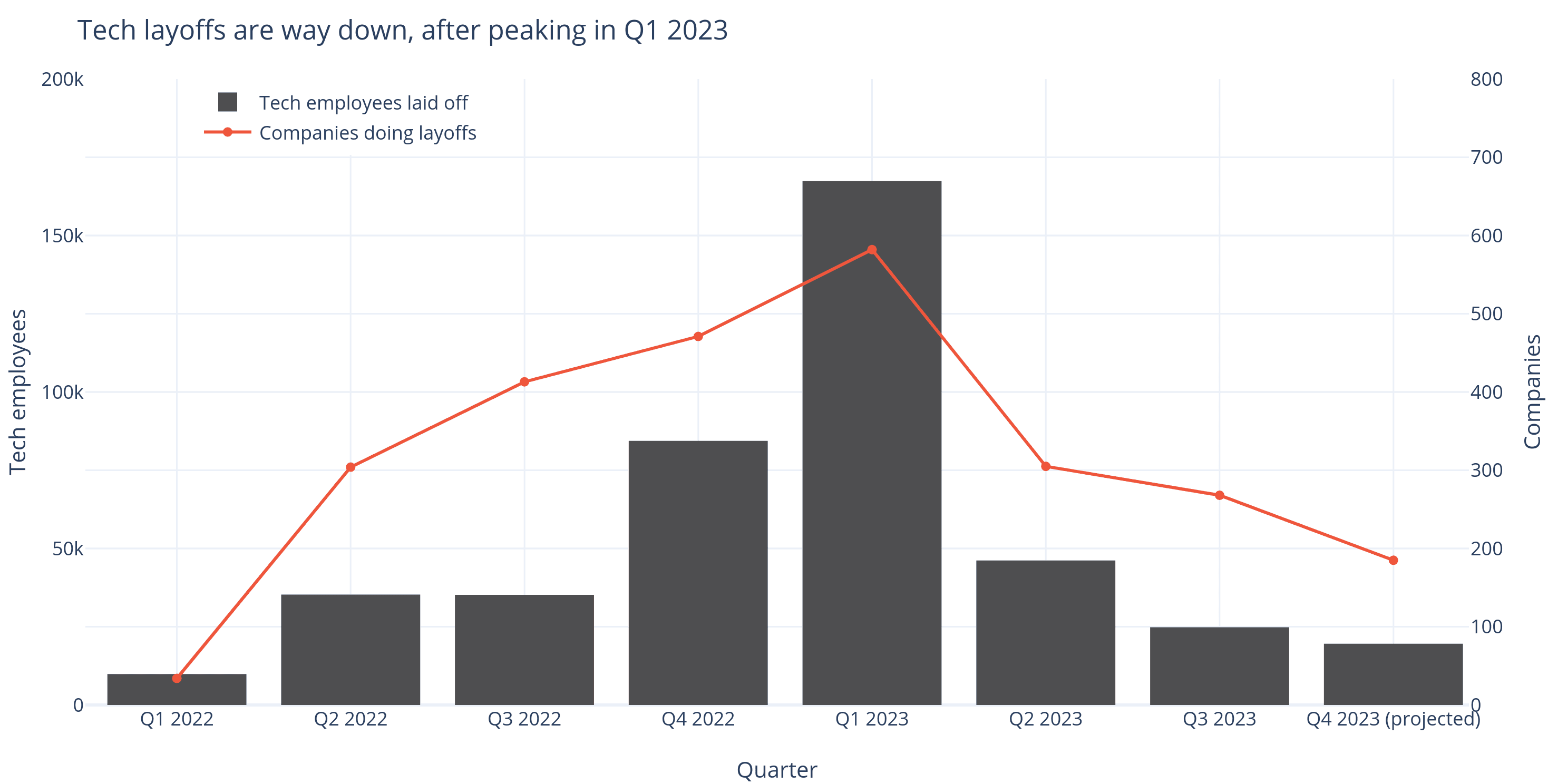

At the same time, layoffs are way down after peaking in Q1 2023. The number of people laid off is down 88%, and companies doing layoffs are down 68%. Most importantly, layoffs have solidly returned to pre-downturn levels.1

Source: layoffs.fyi; Q4 projections are ours

So, tech jobs are recovering and layoffs are way down. Woohoo!

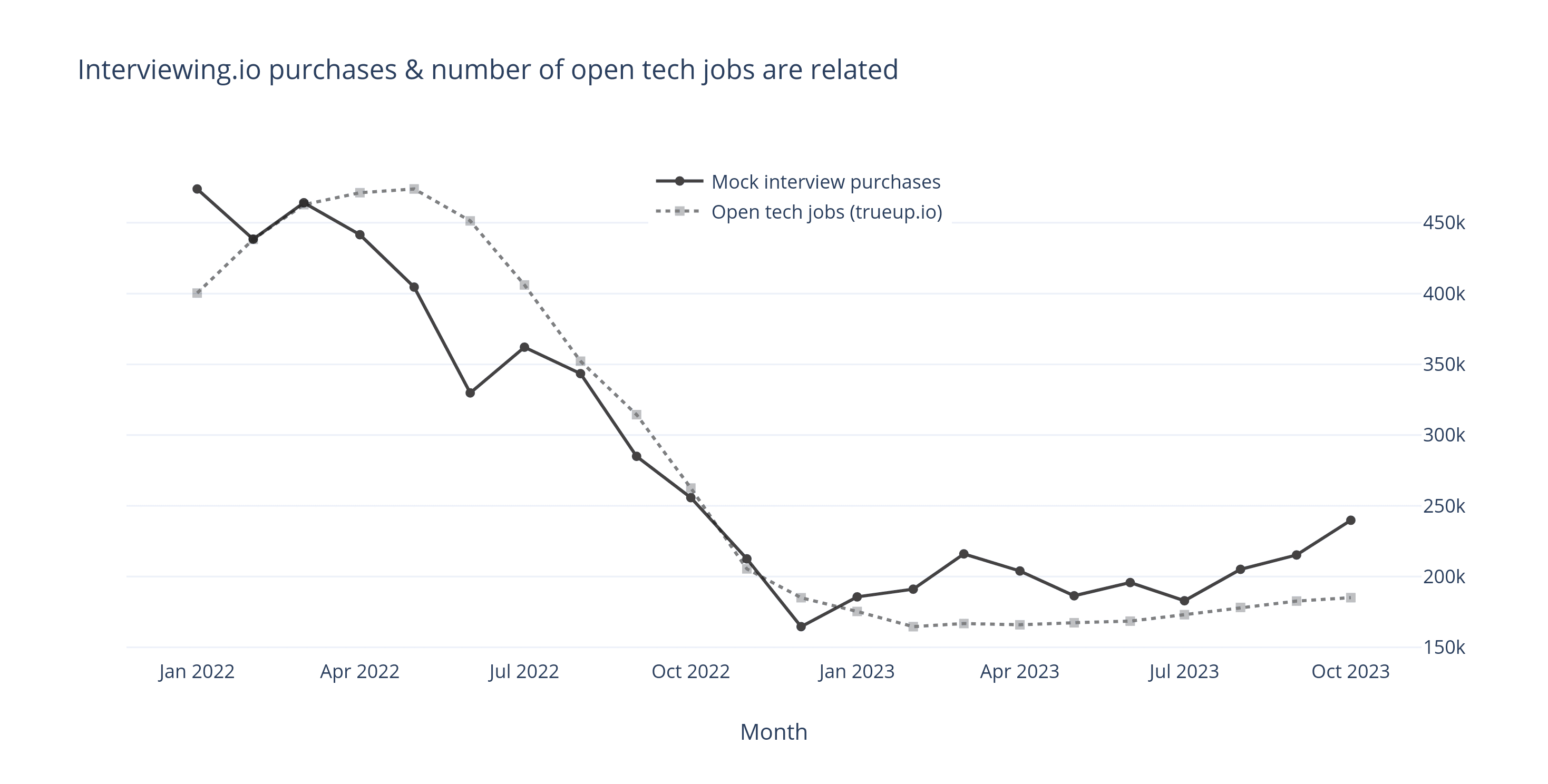

Back to open tech jobs for a moment. When we saw fewer people booking mock interviews in 2022, we started to use the TrueUp graph as a sanity check to learn if it was just us. Turns out… it’s not just us. Here is the same graph from above, overlaid with mock interview purchases on interviewing.io. We’ve hidden the y-axis values because we’re not comfortable sharing our exact sales numbers with the world, but the shape of the graph is what matters most here.

Source: https://www.trueup.io/job-trend and proprietary interviewing.io data

Along with feeling some relief that we weren’t entirely to blame for fucking up our business and could, in good conscience, cast some blame on macroeconomic conditions, we also noticed another interesting thing — purchases on our platform mirror what’s going on in the broader market and effectively give us insight into hiring trends.

If you believe, like we do, that purchase activity is a good proxy, then we can conclude that eng jobs appear to be recovering faster than tech jobs as a whole. In the graph above, hiring started turning around in January 2023 and has grown 58% since then, with most of the growth happening between Q3 and Q4 of this year.

We’ll be using interviewing.io purchase activity as a proxy for open eng jobs for the rest of the post.

What’s going on at specific FAANGs?

As you’ll see in the next few sections, our mock interview purchase data is tightly coupled to events in the outside world. In addition to learning what’s going on with hiring as a whole, our data shows us what’s going on at specific companies, letting us see which ones are actively hiring and how much. We can clearly see when various companies freeze, go on hiring sprees, or just start hiring a little bit. Since many of our users are preparing specifically for FAANGs, we’ll start there.

We’ve done our best to corroborate the trends we’re seeing in our data with insiders at these companies, but that doesn’t mean we haven’t missed something or made mistakes. If something looks incorrect, we want to hear from you, and we’ll fix it. Just email hello@interviewing.io.

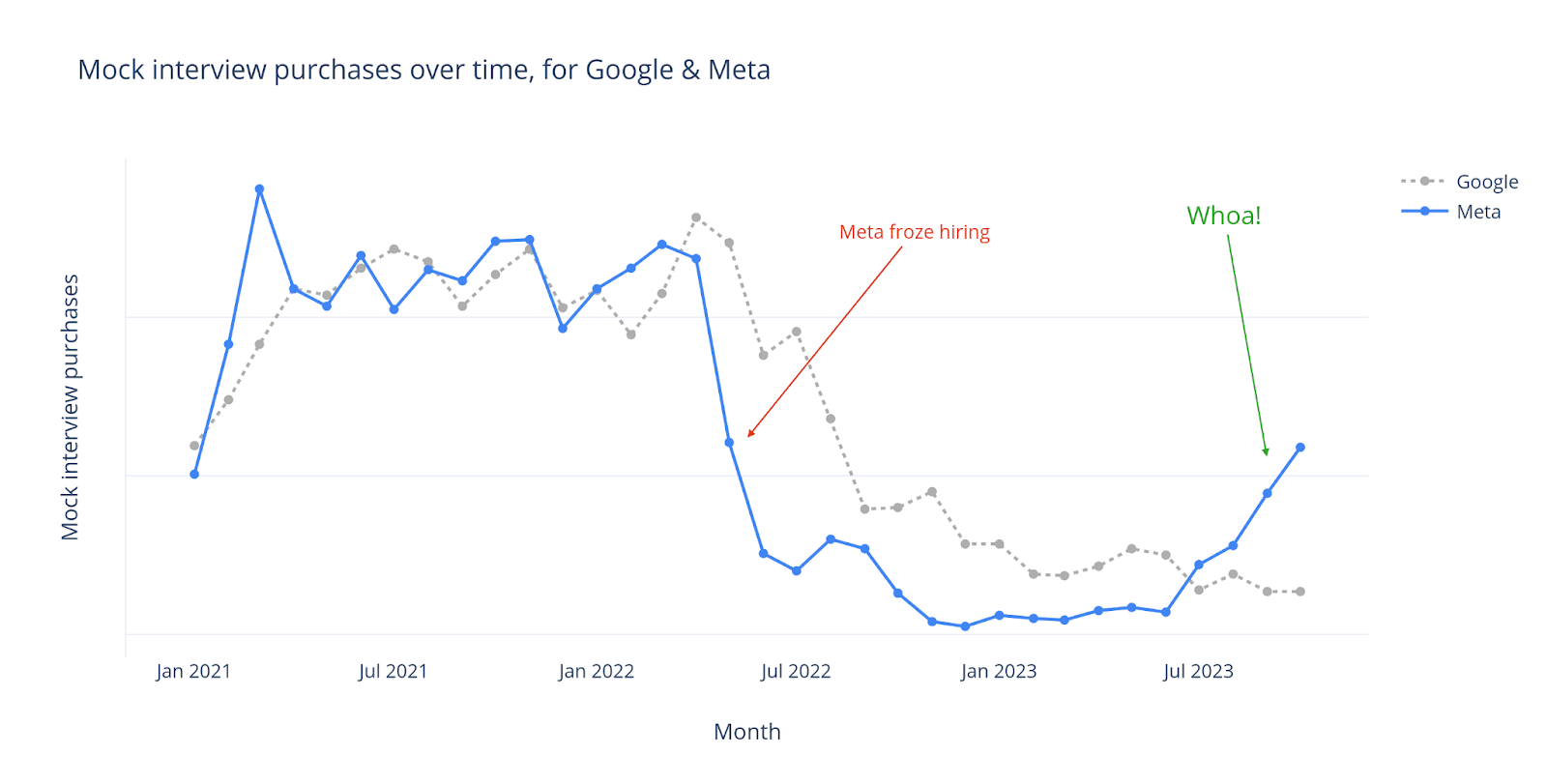

Below is a graph of Google-specific purchasing activity on interviewing.io over time. (As before, we’ve hidden y-axis values, but what matters most is the shape of the graph.) As you can see, it tracks with what was happening in the world — Google slowed their hiring in May 2022, along with other companies like Uber, and officially froze hiring in July.

Source: Proprietary interviewing.io data

Since then, Google’s hiring continued to slow, falling 90% from peak and 50% since January of this year, until it finally leveled out around July. The latest news we’ve heard is that while Google is currently hiring, it’s primarily backfills for attrition rather than new headcount.

Want to know if you’re ready to interview at Google? Do anonymous mock interviews with real Google interviewers, and see exactly where you stack up.

Meta

Source: Proprietary interviewing.io data

Like Google, Meta froze hiring in 2022 (they actually did it before Google – it was officially announced in May). However, unlike Google, they’re currently hiring aggressively, and if you believe that mock interview purchases are a good proxy for hiring volume, they’re up about 800% since January of this year, and are now back to pre-freeze levels (though not yet back to peak).

Some anecdotal data we have backs this up. At interviewing.io, we offer salary negotiation help to our users, which means that we talk to a lot of people, in depth, about where they’re interviewing and how it’s going. Almost every negotiation candidate we’ve had recently has been interviewing at Meta. What’s even more interesting is the volume of possible teams that candidates talk to during team matching. Earlier this year, Meta’s story seemed to be:

We’re primarily hiring for backfills. These are the 1-2 teams that might have open headcount. You gotta decide fast, or those slots will be filled.

Now, our users are regularly presented with more than 10 teams to choose from.

Meta’s hiring boom, relative to most other FAANGs’ conservative hiring, has one notable dark side. Meta’s hiring volume is clearly outpacing all the other FAANGs (Netflix is also up, but Meta’s eng team is more than 10X the size of Netflix’s, so in the absolute, Netflix’s hiring volume isn’t enough to balance Meta out) — for all intents and purposes they’re the only FAANG that’s really hiring at scale — so they’re currently getting away with treating candidates really poorly.

We’ll talk more about this in the down-leveling section, but Meta has capitalized on the market imbalance and has been rampantly down-leveling candidates, presumably because they can — in the pre-downturn market, competition would have made that difficult, but now, given that they’re responsible for much of the FAANG hiring volume, they can rely on their candidates not having many comparable counteroffers and can present candidates with low-ball offers.

Outside of down-leveling, which, in fairness, doesn’t happen to every candidate, Meta also has changed their stance on negotiation.

Before the downturn, it was basically enough to say that you were interviewing at Google to get a signing bonus (or a higher signing bonus). Now, Meta will not lead with signing bonuses unless you’ve been down-leveled, in which case they’ll use them as a consolation prize of sorts (still cheaper for them because it’s a conditional one-time payment). Moreover, Meta will not negotiate unless you can show higher counteroffers (they don’t actually make you show the paperwork, but they ask for details). Recruiters have been trained to say, “I’ll go to bat for you and take this to the compensation committee, but only if you can show me a compelling reason, i.e., other offers.” If you can’t show other offers, they will not budge a dime.

Finally, Meta has gotten much more aggressive with offer deadlines. Recruiters will push you to sign within a day or two of completing team matching and getting your offer numbers.

These kinds of high-pressure, candidate-unfriendly hiring practices would have been unthinkable in a more competitive hiring market, but right now Meta can get away with it. I would argue that their strategy is shortsighted, however, because this kind of market instability can’t last long, and when the other FAANGs are back, Meta will start to see serious attrition from the engineers they’ve down-leveled and low-balled. I’m sure Meta talent execs have made this decision with their eyes open and are prepared to take the hit, but shame on them nevertheless, and I hope that the talent drain they experience next year is swift and brutal. Sorry, reader, I don’t usually insert my opinions in a primarily data-driven piece, but the kind of unnecessary stress and sleepless nights their shortsighted policies have created for our users, who are highly competent, thoughtful, and kind senior engineers, makes my blood boil.

TL;DR: Meta is on a hiring spree, and it’s created an unstable equilibrium, which means that likely the other FAANGs will start hiring again soon. More on that later.

Want to know if you’re ready to interview at Meta? Do anonymous mock interviews with real Meta interviewers, and see exactly where you stack up.

Amazon

Source: Proprietary interviewing.io data

Amazon is an interesting beast. After both Google and Meta froze hiring in summer of 2022, Amazon went on an opportunistic hiring spree, and again, you can see in the graph above that mock interview purchase patterns do indeed reflect what’s going on in the outside world.

Though I couldn’t find mentions of this period in the press, there are many references to it on Blind. Here are a few examples from April 2022 (before Google & Meta freezes had made it to the press) and September 2022.

After a few months of basically a monopoly on eng hiring, Amazon pulled back and froze in November 2022. They’ve been flat since January of 2023 and, from what we’ve heard, are only hiring for backfills and very senior roles.

It is rare to see one FAANG deviate drastically from the others when it comes to hiring, whether aggressively hiring when everyone else has paused or pausing when everyone else is hiring. It creates an unstable equilibrium, one that can’t last very long. We’ll talk a bit more about this later.

Want to know if you’re ready to interview at Amazon? Do anonymous mock interviews with real Amazon interviewers, and see exactly where you stack up.

Apple and Microsoft

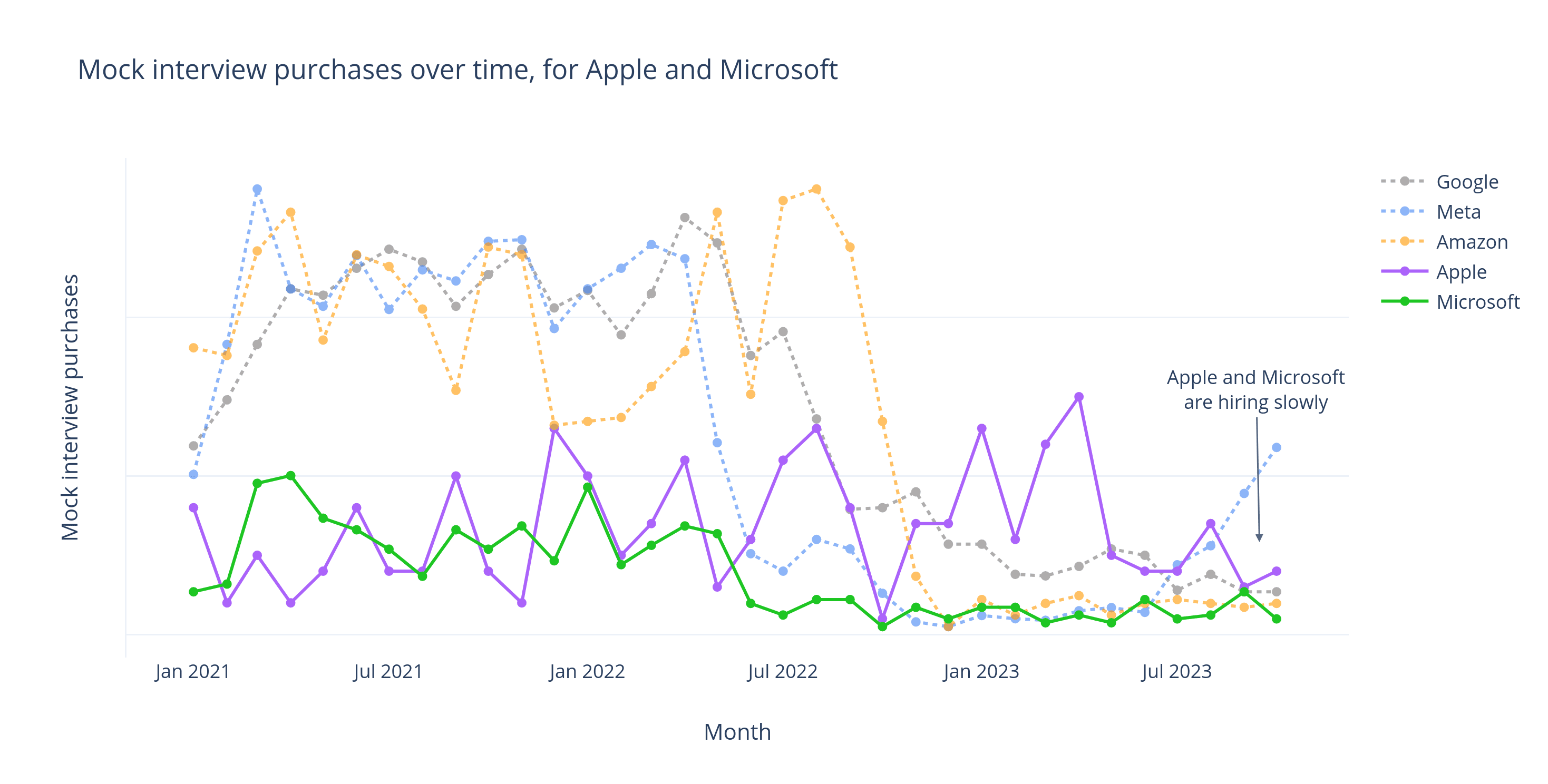

Microsoft officially froze hiring sometime in Q4 of 2022 (though unofficially it seems to have been much earlier, around July). Since then, Microsoft hiring has been flat and, from what we know, limited to backfills.

Apple, on the other hand, did not freeze hiring in 2022 and continued to hire on a “deliberate basis” (headlines about it have been consistently misleading), and they’re the only FAANG that hasn’t done a large-scale layoff. Apple’s hiring has been slow for the past year and a half but has fallen about 70% since January of 2023.

Source: Proprietary interviewing.io data

Netflix

We couldn’t find an official hiring freeze announced by Netflix, but according to Blind and anecdotal reports, they slowed down hiring on a department-by-department basis.

We have a gap in our Netflix purchase data because we stopped offering Netflix-themed practice for some time, and this gap would make a multi-year graph misleading. That said, we have been offering Netflix practice since the beginning of 2023, and since then, demand (and Netflix hiring) appears to have grown, up almost 300% since January.

Source: Proprietary interviewing.io data

Want to know if you’re ready to interview at Netflix? Do anonymous mock interviews with real Netflix interviewers, and see exactly where you stack up.

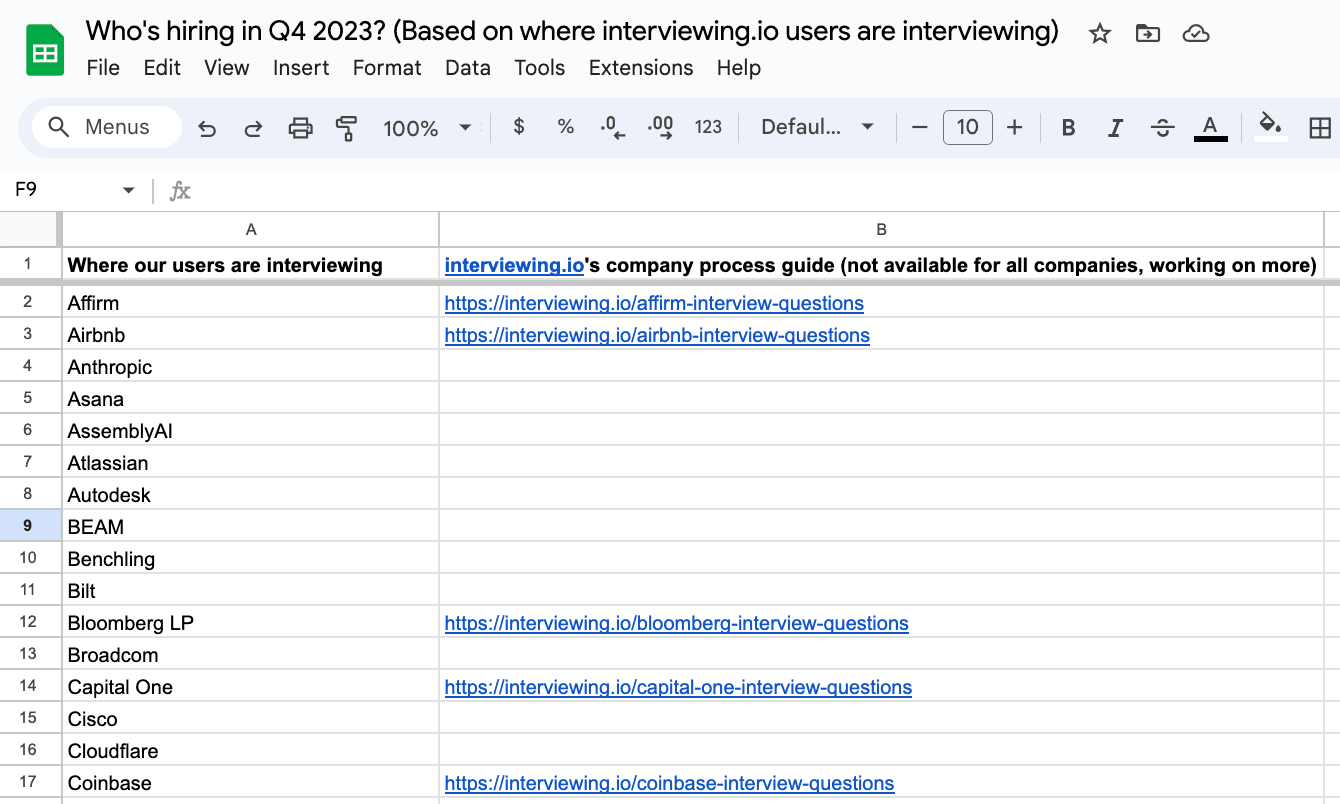

Who’s actually hiring right now?

Here’s a list of all the (larger) companies where our users are interviewing right now (which means they’re actively hiring!), based on our onboarding flow, salary negotiation data, and a recent survey. In cases where we’ve written guides for these companies’ interview processes, I’ve linked to them in the doc as well.

It appears that despite the slowdowns and primarily just hiring for backfills, FAANG is still dominating — over half of our users are interviewing at FAANG companies, with startups comprising only 17% of interview volume.

Salary negotiation: an important trailing indicator

Before we analyze all these disparate FAANG data points and connect them to our 2024 predictions, we have a few more important pieces of data to share with you. One of them is around salary negotiation, a useful and important trailing indicator. At interviewing.io, in addition to providing mock interviews, we provide help with salary negotiation. I do a lot of these sessions myself (it’s one of the most rewarding parts of my job), and leading these sessions gives me a direct line to our users and ultimately an invaluable ear to the ground. Users share with us where they’re interviewing, how it’s going, what their offers look like with respect to both compensation and level, and more.

I’ll talk more about what we’ve learned in these conversations (in aggregate, of course) later in the post, but for now, I’d like to share how our salary negotiation business has changed over time and what insights these changes give us into the broader market.

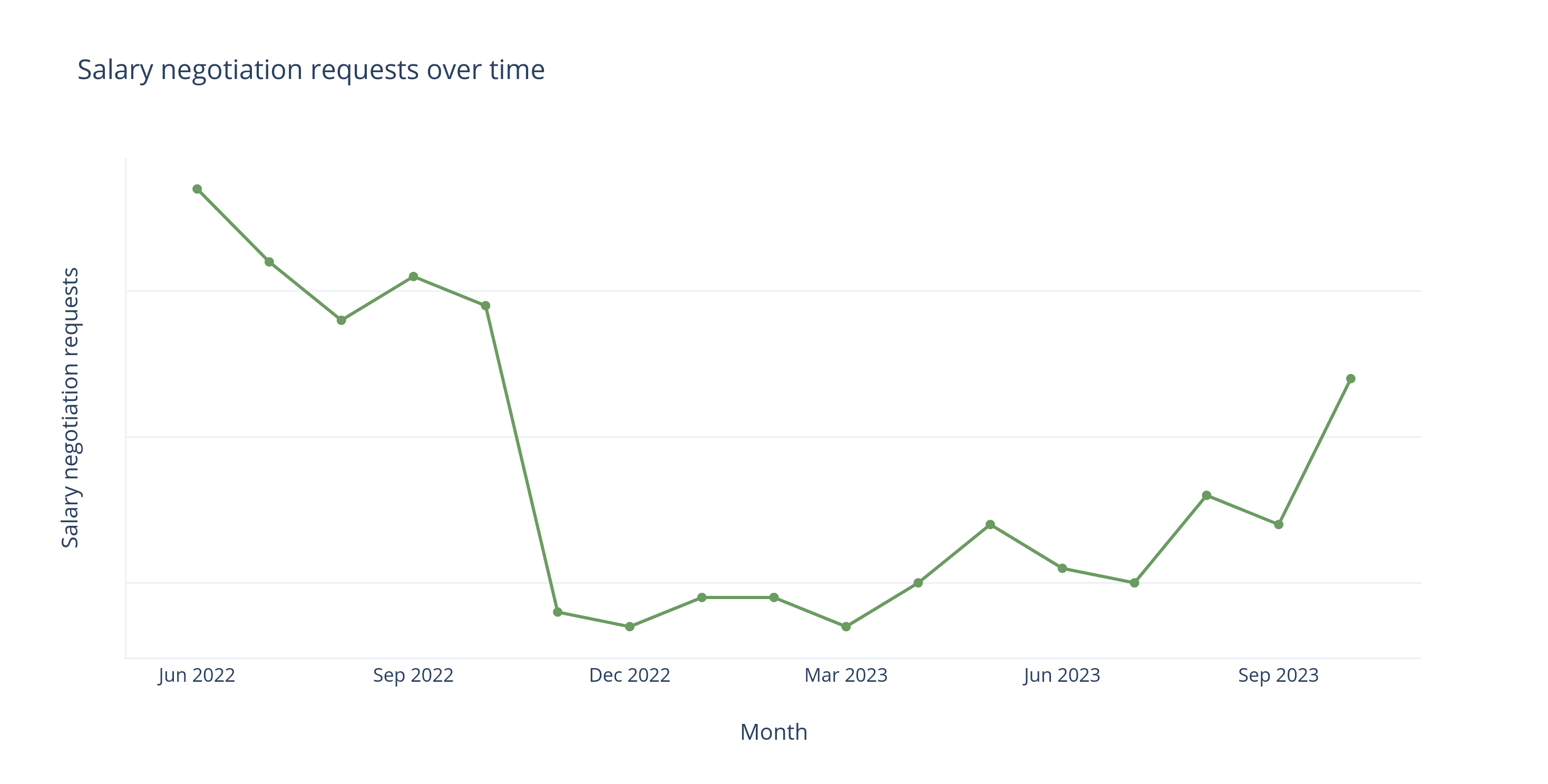

Below is a graph of salary negotiation requests over time on interviewing.io (a request is someone booking salary negotiation help — they put down a credit card but don’t have to pay anything unless the negotiation is successful, so we don’t call them purchases like we did with mock interviews above).

Source: Proprietary interviewing.io data

There are a few important things that immediately jump out in this graph. First, you can see that salary negotiation requests were at a relative high in June 2022 (the data we have from before isn’t shown because we were logging activity differently). Then they took a nose-dive in November 2022 (dropping by 4X). Compare that to mock interview purchases over time above. You can see that salary negotiation activity has roughly a 3-month delay on mock interview activity, which makes sense because people tend to start thinking about negotiation around the time it looks like they’re going to get an offer, whereas they start practicing much earlier.

Though negotiation requests are still not up to peak levels, they’ve been growing steadily and have 2X’ed since the start of 2023.

One other bit of anecdotal negotiation data confirms that hiring is on the rise — we have seen our candidates interviewing with roughly 2X more companies in Q3 and Q4 than in Q1.

Because of the delay between practice (and ultimately real interviews) and negotiation, salary negotiation requests are a trailing indicator. In other words, these changes in salary negotiations are only observable after hiring volume has already shifted. Therefore, they don’t predict changes in hiring volume but rather confirm them after they have already occurred and ultimately help demonstrate that the growth we’ve seen in hiring volume is not a fluke.

What about compensation? And are people negotiating their salaries in this climate?

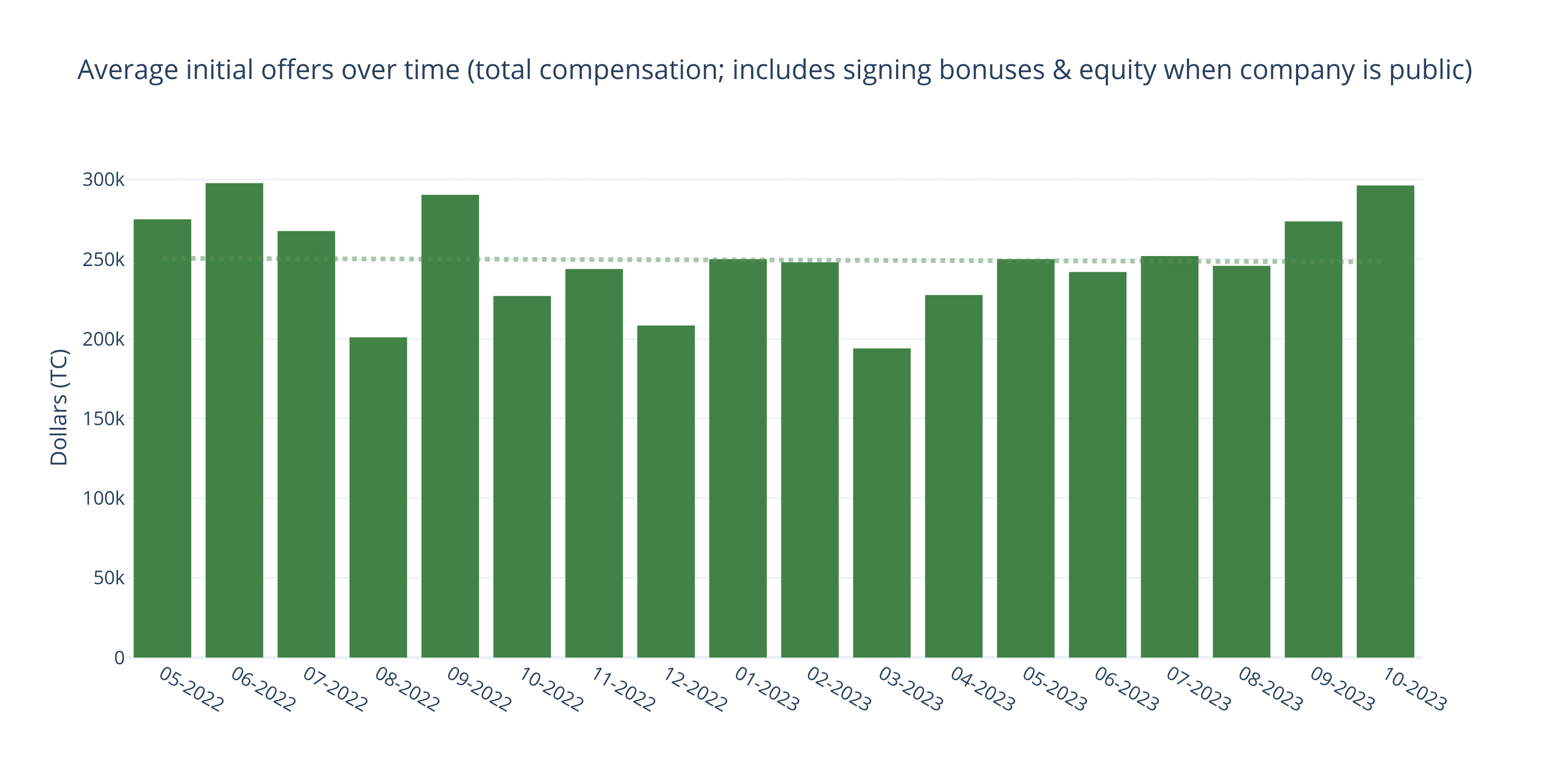

We talked a bit already about the kinds of insights we get from our salary negotiation program, both qualitatively and quantitatively. One of the quantitative pieces is offer sizes, broken down by cash, equity, and bonuses.

Below is average total compensation (initial offers, before negotiating, just for public companies, as we don’t presume to accurately value private company equity) among our users over time. As you can see, it has largely stayed flat, despite the downturn.

Source: Proprietary interviewing.io data

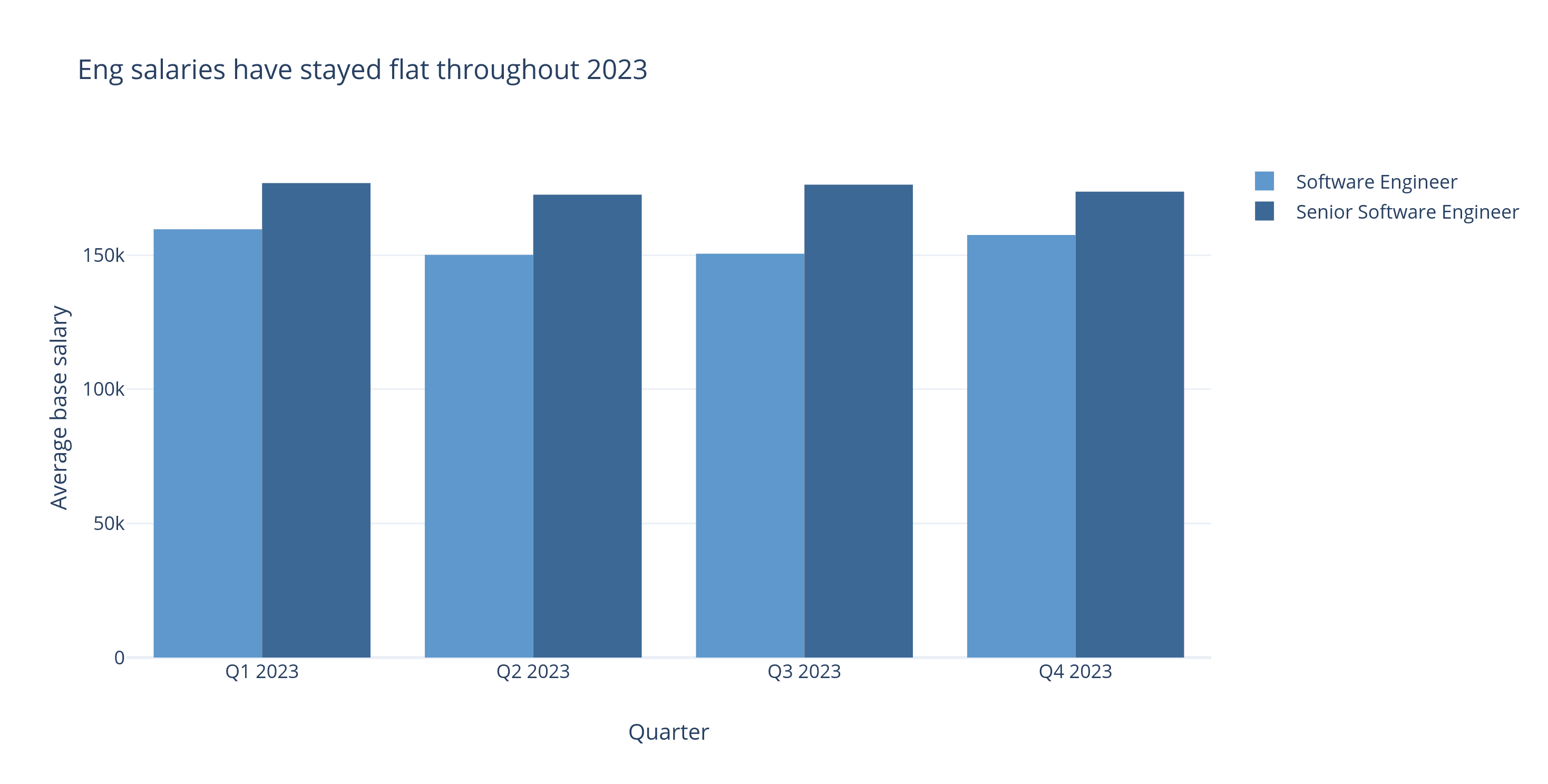

We were also fortunate to get a data set from the folks at comprehensive.io, a source of comp data from the maker of layoffs.fyi. What we really liked about this data set is that it had engineering salaries for the kinds of eng roles that our users were actually targeting, in the locations where they were likely to work (if you look at broader aggregators, you’ll see that the numbers are much lower than you’d expect because they factor in engineering-adjacent positions in non-tech hubs).

Source: comprehensive.io (from the maker of layoffs.fyi)

As you can see, comprehensive.io’s data backs up what we’ve seen among our negotiation users — compensation has indeed stayed flat despite the downturn.

Here are a few tidbits not visible in the graphs above:

- We have NOT seen a difference in the average increase from successful negotiations.

- That said, it’s now much harder to negotiate successfully without multiple offers than in H1 2022. It used to be enough to say that you’re interviewing at a few high-profile companies and that if you get meaningfully more comp, you’ll stop (basically companies would pay you to stop interviewing). Nowadays, companies are less likely to pay to get you off the market and will insist on needing at least one other offer to justify a comp increase (as you saw above with Meta).

- Companies are much less likely to lead with a signing bonus. Instead, they’ll leave them in their back pocket and only pull them out if necessary. One notable exception is scenarios where the engineer got down-leveled (more on that later). In those cases, companies might soften the blow by offering a meaningful signing bonus.

“The market is really making things difficult. Expect things to be a bit harder and the offers to be lower than previous years. Negotiating is going to be absolutely crucial — now more than ever.”

The changing role of recruiters, and the very practical thing it means for you

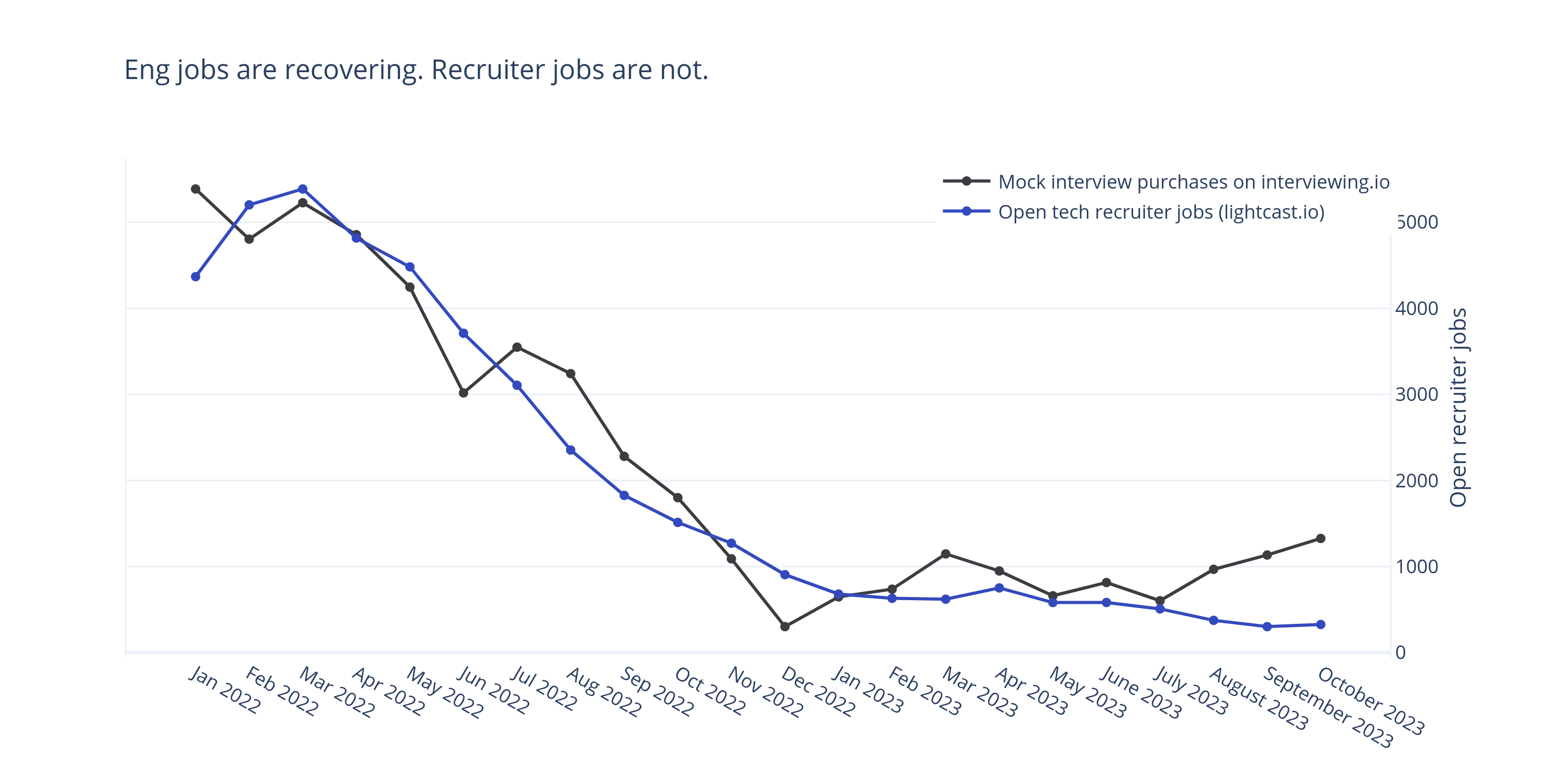

Take a look at the graph below. The black curve is the same one we first shared above, when we graphed it against total open tech jobs — it’s total mock interview purchases on interviewing.io, which we have found to be a good proxy for the state of eng hiring (we’re using this graph and not the one from trueup.io because the latter doesn’t specifically show engineering jobs, and seeing engineering jobs specifically matters for the point we’re about to make). As before, we’ve hidden the y-axis values to protect our business.

Since the start of the year, mock interview purchases (and resulting eng jobs) have grown by 58%.

Source: interviewing.io proprietary data and lightcast.io

The dark blue line is new. It’s the number of open tech recruiter jobs over time. As you can see, engineering jobs are recovering, but recruiter jobs are not (and because this isn’t our proprietary data, we’ve included numbers on the right y-axis). In fact, since the start of the year, open recruiter jobs have shrunk by 52%.

We’ll talk about the implications of this disparity in a moment, but before we do that, let’s look at one more graph:

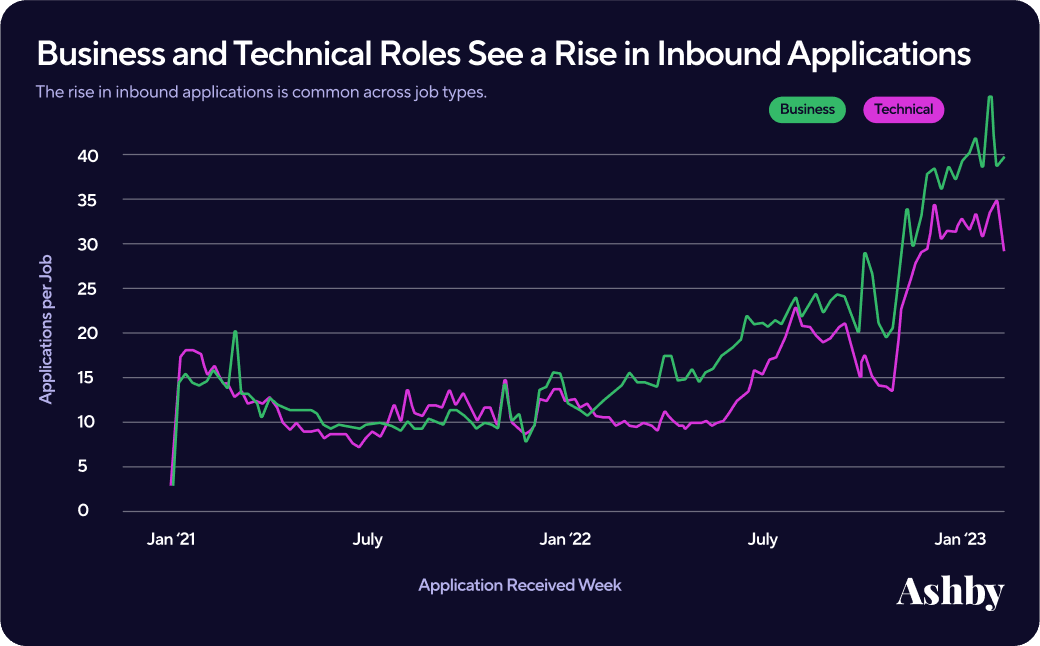

Source: Ashby’s 2023 Trends Report | Applications Per Job

This graph comes from Ashby, a new applicant tracking system (ATS) that’s used by a growing number of startups and tech companies. Because they’re an ATS, they have a treasure trove of data about who applies to what jobs, when. As you can see, the number of applicants for technical roles held steady from 2021 to 2022, and then it began to creep up before it hit a serious growth inflection point at the end of 2022. Though Ashby’s graph only goes up to April 2023, since the start of 2023, inbound applications for technical positions have doubled.

Plainly put, the number of eng positions recruiters are responsible for filling is increasing, and the volume of applicants is growing, while the number of recruiters among whom that work is distributed is shrinking.

You might argue that recruiters might not end up having to do more work because this disparity will force them to rely even more on automated filtering of applications. This may very well be true. However, whether increasingly harried recruiters will take less time to review inbound applicants or whether this is an opportunity for a new wave of resume-filtering solutions, one thing is clear. While applying online has always been a pretty BAD IDEA — because it’s the moral equivalent of shouting into a black hole — it’s more true now than ever before.

In addition to the market data above, we have some anecdotal info and survey results. In our survey that preceded this post, 17% of senior engineers cited that getting in the door was the hardest part of their job search, even harder than technical interviews.

Finally, eng leaders we’ve spoken to have confirmed their recruiting teams (and sometimes their eng teams) are overwhelmed with inbound applications.

So, do not apply online in this climate, full stop. Instead, reach out to hiring managers — recruiters are not incentivized to break rules and will likely not get back to you, especially if you don’t look perfect on paper. Moreover, the numbers will be on your side, as relatively few candidates are targeting hiring managers directly. We plan to write a full blog post on how to do this kind of outreach well, but this CliffsNotes version will get you started:

- Get a LinkedIn Sales Navigator account

- Make a target list of hiring managers at the companies you’re interested in

- Figure out their emails (you can use a tool like RocketReach), and send them something personalized. Do not use LinkedIn. The same way that you don’t live in LinkedIn, eng managers don’t either.

Some advice from our users about getting in the door:

“Be prepared, and also be proactive. Don't just wait for the recruiters to contact you.”

“Networking is key. If you know the name of the person who will be interviewing you, research them online to try to get a feel for who they are and what types of questions they might ask.”

Down-leveling

As I mentioned above, Meta has been brazen in their down-leveling of candidates. It usually manifests as a down-level (e.g., you interview for an E5 role and then end up at an E4). This kind of down-leveling has happened to almost every negotiation client we've had who has interviewed at Meta.

Making matters worse, we've found that it's virtually impossible to negotiate without another offer on the table. It doesn't necessarily have to be from another FAANG, but it needs to be from a notable FAANG-adjacent company.

Basically Meta's approach post-downturn has been as follows:

- Interview someone

- Down-level them, citing poor performance in system design interviews

- Make them a lowball offer even for that band but compensate for it with a decent signing bonus (~$50-70k) as a way to soften the blow and make it more likely candidates will accept quickly

- Refuse to negotiate unless candidates show them other offers: "I can't take this to the compensation committee without a compelling reason, i.e., another offer."

Though we’d argue Meta has drawn the hardest line with respect to negotiation, as discussed above, they’re not the only company that’s down-leveling candidates. According to our survey, of the people who got offers in 2023, 33% were down-leveled.

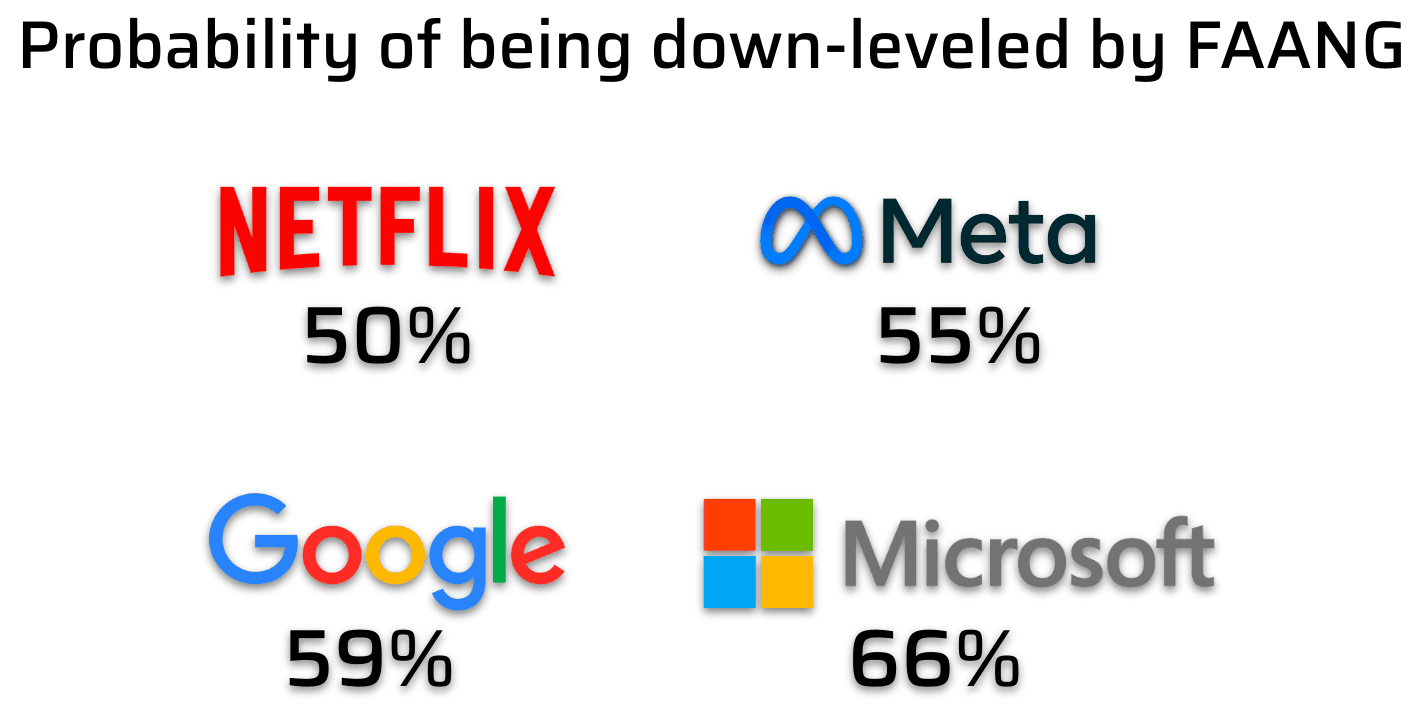

We didn’t have enough data for Apple and Amazon, but using our survey results, we’ve computed the probability of getting down-leveled at the rest of the FAANGs, given that you receive an offer there. At Netflix, it’s 50%. At Meta, it’s 55%. At Google, it’s 59%, and finally at Microsoft it’s a whopping 66%. Again, although Meta’s down-leveling percentage isn’t as high as Microsoft’s, they’re hiring far more engineers, so their actions have a much greater effect on the marketplace.

Source: interviewing.io survey data

For all other companies (small startups, large startups, and FAANG-adjacent), the probability of getting down-leveled is about 37%. Almost everyone we heard from was down-leveled by just one level, but we saw a handful of people drop by two levels.

As you’d expect with the rise down-leveling, the bar for interview performance has been going up as well, and this rising bar accounts for some of the down-leveling we’re seeing (though we expect that cost savings for the employers who are doing it accounts for much of the rest).

The rising bar

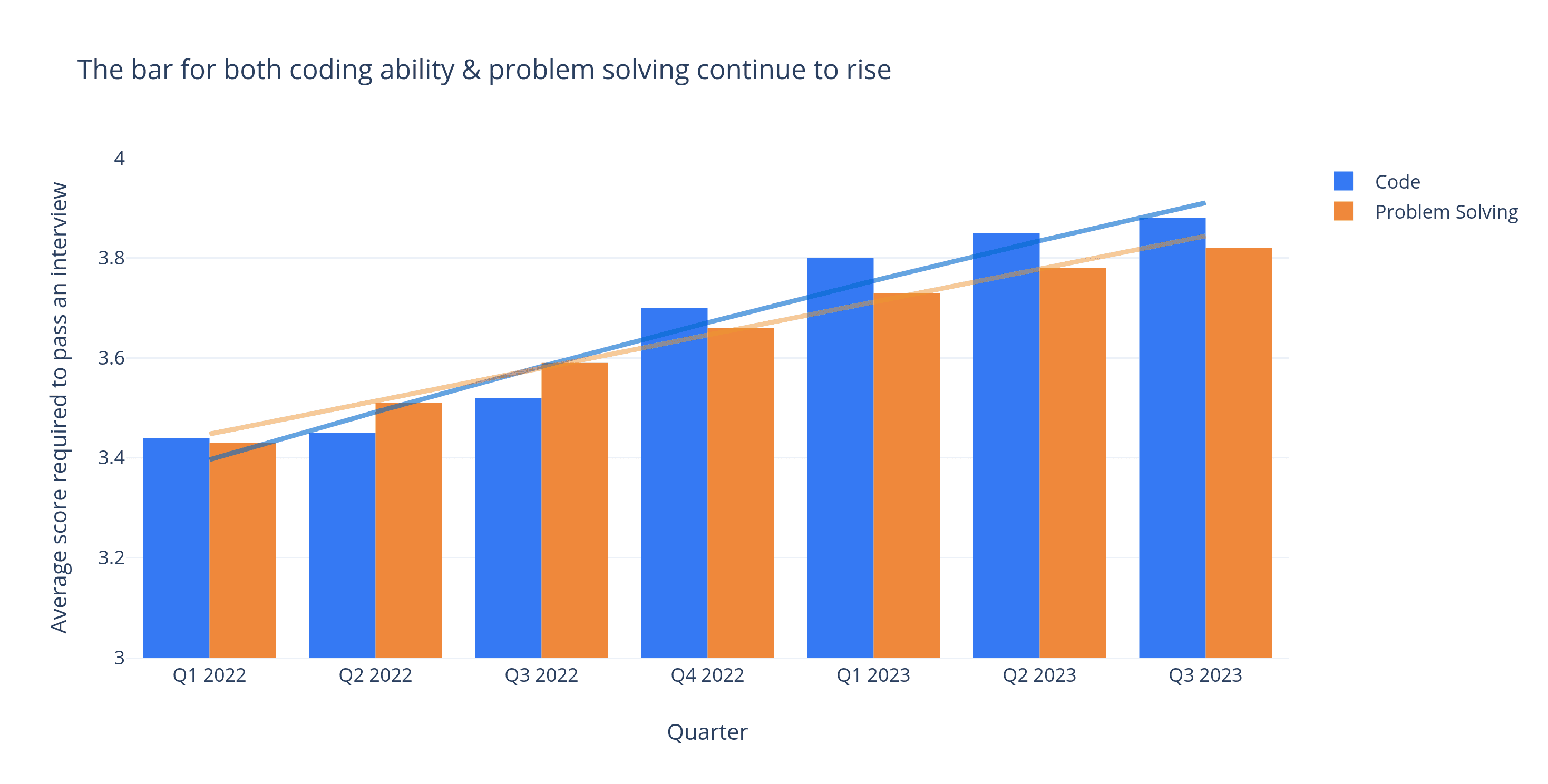

The rising bar makes sense — after all, more engineers are competing for relatively fewer positions. Because we have a bunch of interview data, we are actually able to quantify the increase.

Specifically, after every interview on our platform, whether it’s a mock or a real one, the interviewer leaves feedback. The feedback form looks like this, and it includes a yes/no question for whether they’d move the candidate forward, as well as star ratings of their performance on a scale of 1 to 4, where 4 is best. These star ratings cover 3 areas: coding ability, problem-solving ability, and communication skills.

To track how the bar has changed, we can look at the average coding and problem-solving ratings for successful interviews over time (we haven’t focused on communication ability because we previously discovered that it doesn’t significantly affect interview outcomes except for very senior roles).

Source: Proprietary interviewing.io data, based on tens of thousands of interviews

As you can see above, the coding and problem-solving scores for successful interviews have risen steadily since the start of 2022. To make these numbers concrete, you now need to perform 22% better in technical interviews than you did at the start of last year (with respect to both coding and problem solving). The last time we wrote about the rising bar was in November 2022, and back then you had to do 15% better. The bar has only continued to go up.

We came up with these numbers after bucketing interview performance into percentiles (more realistic than just looking at average raw scores because relative differences in raw scores may amount to much larger or smaller differences when competing against other engineers). At the start of 2022, you had to be in the 65th percentile to pass interviews, namely outperform 65% of engineers. At the end of 2022, you had to be in the 78th percentile, and now you have to be in the 83rd.

This data is corroborated by our users’ experience with the job market. In our survey, we asked our users if they felt that the bar was higher and/or the interview process was more difficult than the last time they were interviewing, 77% said yes.

Bonus prediction about AI

Prediction #7: For a long time in the future, we won’t see major changes to interview styles, despite the advent of ChatGPT. We will, however, see changes to interview questions. Specifically:

- Companies will have to move away from asking verbatim LeetCode questions because of how easy it is to cheat.

- Similarly, we expect that async coding tests will go away for the same reason.

- There will be a premium on good human interviewers.

This final prediction might feel a bit random, as we haven’t discussed AI at all till now, but we’ve been doing some experimentation on how tools like ChatGPT are going to change technical interviewing. We’ll publish details soon, and we decided to include the AI predictions in this post because the topic is too salient not to.

Predictions recap

We’re currently in the eye of an unstable period. It’s simply not sustainable for most FAANGs to just be backfilling while Meta and Netflix plow ahead with 2022-level hiring volume. Though Amazon did something similar in 2022, unstable equilibria like this don’t last. Sure, you could make the argument that Meta and Netflix will just freeze again (like Amazon did, after their hiring spree), but between the recent rise in mock interview bookings overall, the increase in salary negotiation requests, and the huge drop in layoffs, it seems likelier that next year the other FAANGs will join Meta and Netflix in actively hiring again.

Here are some key data points that support our predictions:

- Meta and Netflix mock interview bookings, and subsequent hiring, are way up (+800% and +300% respectively). Again, having only 2 FAANGs hiring is untenable because this type of unstable equilibrium can’t last long.

- Open tech jobs are growing (+14% since Feb 2023).

- Tech layoffs are down, and specifically the number of people laid off is -93% since Jan 2023.

- Mock interview bookings are growing (+58% since Jan 2023).

- Salary negotiation is up 100% (trailing indicator).

Even though hiring is going to come back, it’s not going to feel quite like the heady days of 2021 and early 2022. The bar is going to stay high for the foreseeable future — as you saw, it’s up 22% over the start of 2022, and walking that kind of thing back takes a long time.

Similarly, until most of the FAANGs are back to their pre-downturn hiring velocity, which will probably take at least 6 months, we will continue to see down-leveling, not just because of the rising bar but, frankly, because companies can get away with it while candidates have less leverage. For the same reason, salaries will continue to stay flat — they’ve been flat for so long, despite market changes, that until we’re firing on all cylinders again, inertia will keep them there.

Finally, as hiring recovers, more recruiters will get hired back, but that, too, will take some time. For at least the next 6 months, recruiters will continue to be overworked, which means that, for the foreseeable future, applying online is going to be a fool’s errand.

Actionable advice and resources

We have every reason to believe that by H2 of 2024, hiring will be back to normal, or close to it. In the meantime, though hiring is coming back, it’s not back to normal quite yet. During this liminal period, you can’t approach your job search the same way you did during the boom.

As such, even though this was a very long post, the main takeaways are surprisingly short: It’s more important than ever to have to get creative with how you get in the door (so you don’t get lost in the shuffle), to be even more prepared for interviews than before (especially system design), and to do your best to get multiple offers (if you don’t, it will be much harder to negotiate. Here are some specific resources and tips to help you do these things:

- If you’re targeting specific companies but don’t have connections there, don’t apply online and don’t wait. Instead, reach out to hiring managers directly. And don’t do it on LinkedIn; email is a much better channel.

- Use our Company Intros feature if you have access — we get you in front of a decision-maker human immediately.

- Use our company process guides to help you plan your job searches and to prepare for specific companies. And use our Learning Center too. It has technical topic explanations, a bunch of interview replays, and a whole lot more.

- Prepare for your interviews. You don’t have to use us. Just find a way to do some mock interviews before your real ones.

- Our AI Interviewer is a great, free resource that’s more effective than LeetCoding on your own — it lets you practice algorithmic questions with a human-like interviewer in CoderPad and gives you feedback at the end.

- If you don’t have an interviewing.io account, you can also try out our Technical Interviewer custom GPT (it does system design interviews as well!).

- Study system design (we have the best system design guide that’s out there). Lackluster performance in system design interviews is the main reason people are getting down-leveled.

- In this climate, negotiating is harder. Don’t set yourself up to fail. Read this post immediately to set yourself up for success and to prevent making mistakes at the beginning of the process.

We’ll close this post with some more independent advice from our users:

"Make sure to practice system design as much or more than ds/a.”

“Learn what the process involves at each company you're applying to. Aggressively plan and prepare for each. Do a lot of mock interviews, and be ready for the unexpected.”

“After waves of layoffs, there are so many candidates with great experiences and skills who are looking for jobs. Even if you ace the interview, they may fill the position with someone else who did better, so don't be too discouraged if that happens, and keep trying!”

“Be honest with yourself about how much you actually need to prepare. And give yourself that time. Prepare prepare, prepare!”

Footnotes:

Footnotes

-

Though we didn’t have data on what portion of layoffs were engineers specifically, we did some unscientific spot checking, and generally engineers comprised 20-30% of layoffs at a given company. ↩

Related posts

Have interviews coming up? Study up on common questions and topics.

We know exactly what to do and say to get the company, title, and salary you want.

Interview prep and job hunting are chaos and pain. We can help. Really.