Why Do Pre-Seed Investors Ask for Side Letters?

I was recently asked by a founder to explain why early-stage VCs ask for side letters when investing using SAFEs. “Isn’t the point of a SAFE that it’s a standard agreement?”

Let’s dive in, starting with a bit of history…

The History of SAFEs

The SAFE (“Simple Agreement for Future Equity) was introduced by Y Combinator in 2013. Prior to that, startups raised funds using one of two methods:

Equity (Priced) Rounds

Convertible Notes

Priced rounds have the advantage of certainty of terms, but require a lot more detail than might be appropriate for a startup that has not yet achieved product-market fit. Convertible notes “kick the can down the road” in terms of valuation and terms, however, they are a form of debt (which comes with its own risks and drawbacks).

When we raised DataHero’s USD $1M Pre-Seed round in 2012, the SAFE did not yet exist. We executed a full equity agreement that cost ~USD $35K in legal fees.

The goal of the SAFE was simple: to standardize the fundraising documents for early-stage startups in a way that reduced overall costs and complexity, provide clarity for both sides around scenarios that were likely to occur, and avoid the pitfalls of debt.

When we raised DataHero’s Pre-Seed round, we had the benefit of an incredibly founder-friendly lead VC in Foundry Group, so our documents were “clean” and straightforward. Unfortunately, many startups don’t have that luxury. It wasn’t uncommon in those days to see small Pre-Seed rounds done with shareholder agreements filled with predatory terms.

Actual footage of a startup founder trying to avoid predatory investor terms

In addition to limiting the cost and complexity of small rounds, a major (positive) side-effect of the widespread adoption of the SAFE is that the prevalence of damaging and predatory terms in early funding rounds has been significantly reduced (at least, in North America).

The Limitation of SAFEs

The primary focus of the original SAFE was to simplify angel rounds (YC’s stated goal when it introduced the SAFE was to replace convertible notes, as opposed to VC-led equity rounds). Over time, however, investors across the board saw the benefits of this simplified approach for small funding rounds and many Pre-Seed VCs began to adopt the SAFE as their preferred agreement.

Today, Panache Ventures invests exclusively using SAFEs, unless a non-SAFE round has already occurred and/or we are co-investing with a firm that insists on an equity round.

This development was great for startups, as it made it faster, easier and cheaper to raise from Pre-Seed VCs. However, the simplicity of the SAFE was in part due to the removal of clauses that, while not particularly important to angel investors, matter a lot to VCs. As more and more VCs adopted the SAFE for smaller rounds, they needed to find a way to “add back in” key clauses without losing the spirit of the SAFE’s simplicity.

The point of the SAFE was to be a standard legal agreement that could be used without changing anything other than the cap, discount and signees. In order to maintain the standard SAFE template, another mechanism was needed to codify the additional clauses required by VCs. The result was the SAFE “side letter”.

VCs and Founders Adding and Removing Legal Clauses

What is a Side Letter?

A side letter is an amendment to a legal agreement that has the same force as the underlying contract but only impacts the signees to the side letter. Using a side letter along with a SAFE allows additional terms/provisions to be added that apply to the relationship between the VC and the startup without changing the SAFE itself or impacting other investors.

What Clauses Do VCs Put in SAFE Side Letters?

There are three clauses that are commonly found in SAFE side letters:

1. Information Rights

Information Rights grant the investor the right to receive certain types of information (typically, quarterly and/or annual financial reports) on an ongoing basis.

VCs need access to financial information in order to fulfil their fiduciary duties, however, the standard SAFE does not include any such rights (which makes sense, since founders generally would not want to provide detailed, highly-confidential financial information to each and every angel investor).

2. Pro Rata Rights

Pro Rata rights grant the investor the right to invest an additional amount at the next round in order to maintain their ownership percentage.

Angel investors rarely ask for this, as most would not be able to afford to invest in subsequent rounds. For VCs, however, the ability to maintain their ownership percentage as the company makes progress is key to generating a return for their investors. This right is standard in priced rounds but does not exist in the SAFE.

3. Major Investor Rights

Major Investor rights relate to the rights that the investor receives after the SAFE is converted into equity.

Each time an equity round occurs, investors receive a class designation (e.g. “SAFE Investors”, “Seed Investors”, “Seed-2 Investors”, “Series A Investors”, etc.). These designations are used throughout the shareholder agreement to define the rights, privileges and preferences of each class of shares. Class rights are shared by every investor in the class, regardless of how much (or how little) they invested.

A VC who invests $10M in a Series A round will receive the same class rights as an angel investor who contributes $10K as part of that round.

In addition to the shared class rights, shareholder agreements include a set of rights that are reserved for investors (typically VCs) whose shareholdings exceed a minimum threshold (referred to as the “Major Investor threshold”). The most common Major Investor rights relate to actions that cannot be performed without the approval of the Major Investors, including:

Acquisitions, Mergers and IPOs (i.e. a startup cannot do any of these without the approval of the Major Investors)

Diluting the rights and protections of the Major Investors (i.e. the rights of the Major Investors cannot be negatively altered in subsequent rounds without that investor’s approval).

Pre-Seed investors without the protections of Major Investor status can be wiped out by subsequent investors without any recourse

The standard SAFE does not include any reference to Major Investors, so it is common for side letters to include language that grants the investor “Major Investor” status — however that is subsequently defined — when the SAFE is converted into equity.

Why Have I Never Heard of This?

One Canadian founder I spoke to recently about SAFE side letters shared that he had asked an American founder friend about the topic and that founder’s response was, “I’ve never heard of such requests. It must be a Canadian VC thing.”

That perspective couldn’t be further from the truth.

In reality, there’s an entire generation of founders (in both Canada and the US) who never encountered SAFE side letters. Because for a period of time, they disappeared.

A few years after the original SAFE was introduced and VCs began to adopt it (along with the use of side letters), the economy started heating up. From 2017 onwards, there was an explosion of new funds and new types of funds. At the same time, large multi-stage funds began investing earlier and earlier. Early-stage rounds became more competitive and dedicated Pre-Seed funds found themselves unable to negotiate the rights that they needed. Given the choice between investing without a side letter and losing out on an investment altogether, many of them invested without protections (and against their long-term best interests).

As a result, the majority of founders who raised a SAFE round — particularly in the U.S. — between 2017 and 2021 were never introduced to side letters as a condition of VC investment. Now that the economy has recalibrated, we’re back to a landscape where early-stage funds (in both Canada and the U.S.) are insisting on these rights as a condition of their investment.

Side Letters are Here to Stay

As a Pre-Seed VC, I’m obviously biased when it comes to this topic. The rights contained in SAFE side letters are important to me as an investor and to my ability to generate a return for my LPs. Alongside angel investors, Pre-Seed VCs take the first big investor risk into a company. We’re also the most at-risk when it comes to later-stage investors eliminating our rights down-the-road.

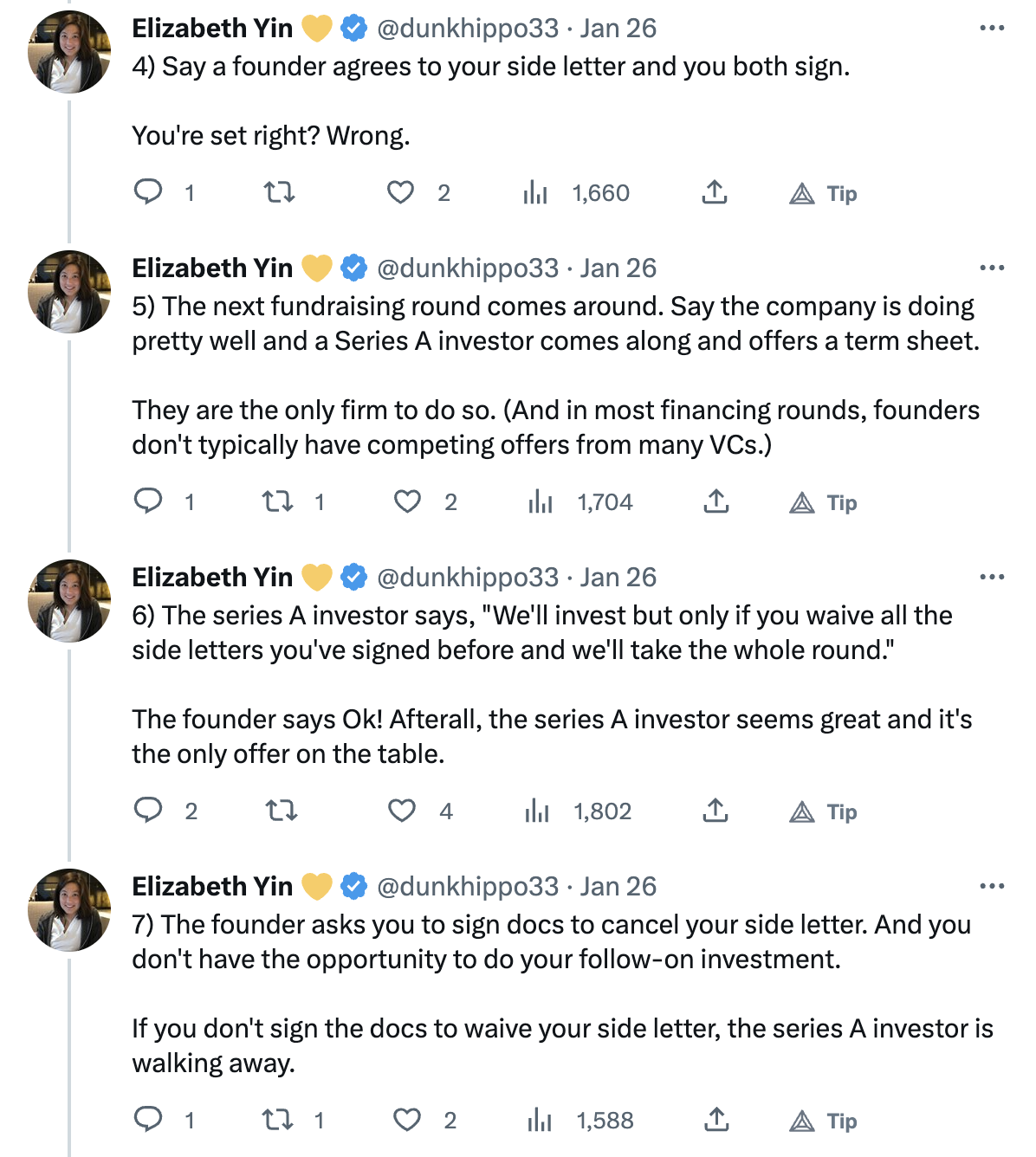

That said, side letters are by no means a silver bullet. Elizabeth Yin recently wrote an excellent thread detailing some of the situations in which the protections of side letters can be nullified by later-stage investors:

Elizabeth makes the point (one which I agree with) that side letters are but one aspect of a relationship that early-stage investors must work hard to cultivate before, during and after an investment is made. At the end of the day, venture capital is a customer service business and we need to earn the right to continue to invest in the startups we back.

Ultimately, our goal as early-stage VCs is to support the founders we invest in all the way to the finish line, while ensuring that we can generate a return for our investors should you win. SAFE side letters are one tool that helps us to do so.