MARCH BOJ: UNCHANGED (no hike)

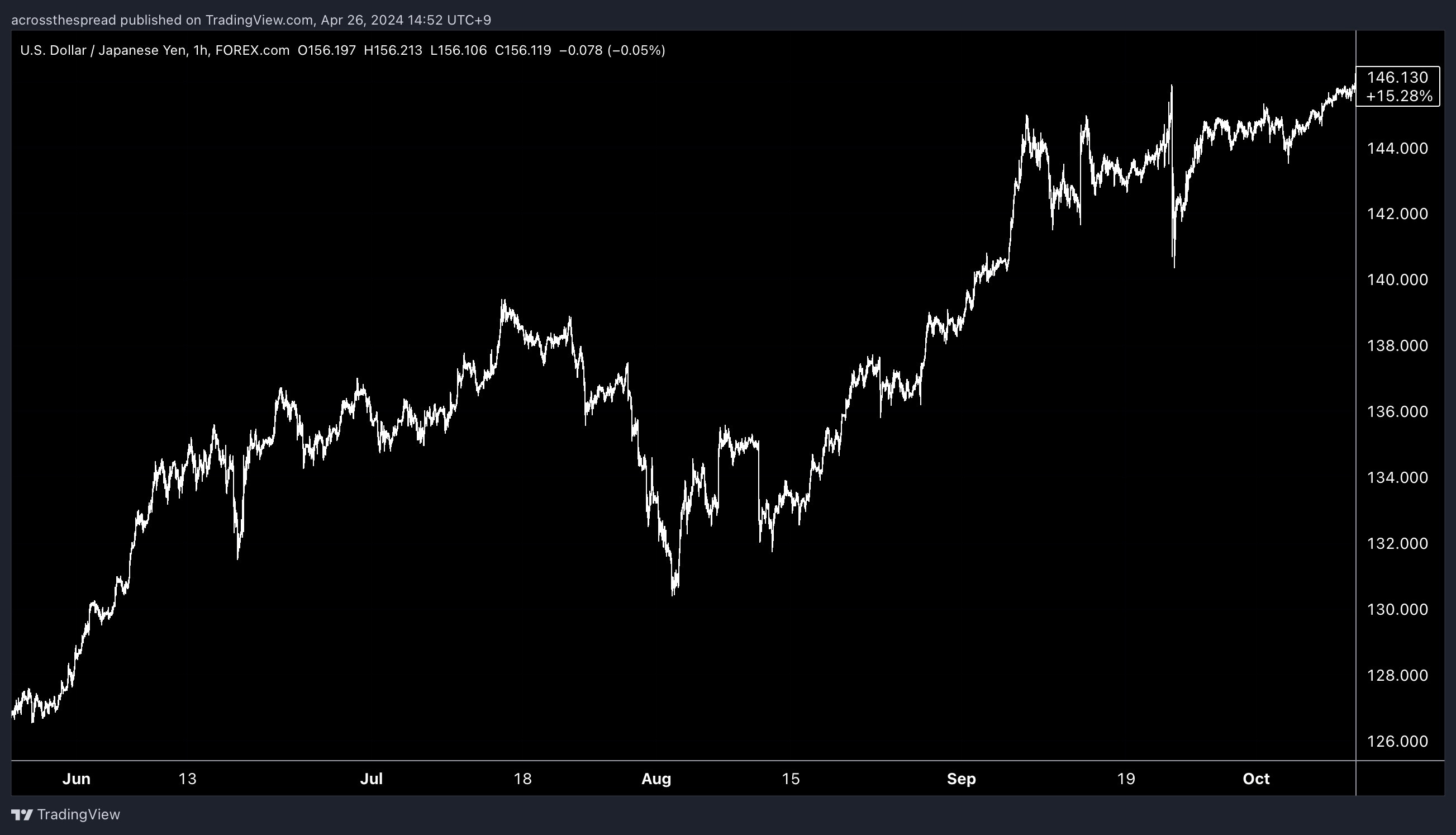

USDJPY jumps through 156 handle

Extremely empty policy statement (attached) - to put in context, even when it’s a policy unchanged meeting, they still just cut and paste from the previous meeting statement (over and over again). Why they didn’t do that this time - I don’t know, and I’m trying to figure out if it means anything. Mind you, for such an empty policy statement, the release time was just before 🇯🇵12:30PM market open, which trails the usual release time by a good 30-45 mins.

Meaning- this wasn’t a “we all good with unchanged? Cool. What’s for lunch?” type of unchanged- there must have been some debate going on.

And again- this is a meeting with no press leak (for once) - so there is no watching markets / deciding in real time going on to explain the delay (as per in April ‘23 BOJ with 1PM on the dot release after Nikkei preannounced at 10am that very morning: policy unchanged + launch of comprehensive 25 year policy review watching, & BOJ board watches markets into 🇯🇵AM session close + first 30 mins of PM open)

Gov Ueda press conf in a few minutes - this time, given the lack of both media leaking policy + empty policy statement itself + long meeting, Ueda press conf will be a different type of important - we (markets) need info/guidance, sir.

Oh, right, and also important because JPY is getting slammed.

Reminder of the precedence from Sept ‘22 yentervention, in which (then) BOJ policy unchanged had also continued to cripple JPY, and 15 minutes after BOJ press conf end- MOF slams USD ↓

USDJPY 158 is my yentervention potential level

BUT, if USDJPY keeps the 12:30pm post-BOJ statement release momentum going and USDJPY hits say 157 during Ueda, be on high alert for (actual) MOF yentervention in spot market imminent - though they may wait until 🇺🇸PPI later

And note that as of now, this is Japan closed for entire next week Golden Week

Will publish on BOJ after all info & Ueda presser market reaction & analysis is done