The app for independent voices

It’s not about using many different investment risk measures, it’s about using the right ones.

I often come across libraries that offer portfolio optimization with many different risk measures.

However, if the essence is the same, for example, path- and horizon-dependent tail risk, the addition of multiple risk measures usually does not make a significant difference.

But which should we objectively prefer? I argue those that:

1/ Are meaningful for fully general distributions and focus on tail risks (disqualifies variance)

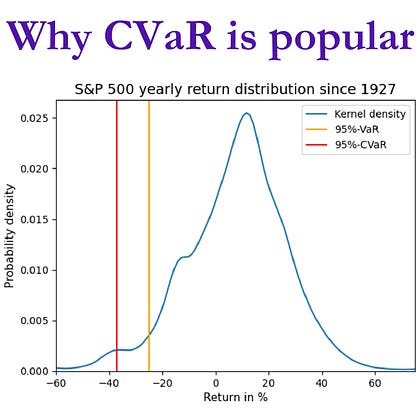

2/ Adhere to the diversification principle (disqualifies Value-at-Risk)

3/ Are easy to explain and understand

4/ Can be optimized reliably in practice

Conditional Value-at-Risk (CVaR) is popular because it satisfies all the above.

There might be other risk measures that lead to essentially the same portfolios as CVaR, but that does not really matter if they are much harder to interpret and use for risk budgeting.