Every Student Loan is now "Forgiven" thanks to Trump.

I'll give the Orangutan this... he's finally accomplished something nobody (including Biden) could... he forgave every student loan out there (and then some.)

Disclaimer: This piece mixes analysis, political commentary, and righteous anger. It is not legal advice. I’m not your lawyer. If federal student loan policies impact you, consult a licensed attorney who understands federal contracts, administrative law, and constitutional claims. This article is based on my understanding of publicly available documents, regulatory frameworks, and settled legal doctrine. Everything in here is based on what I believe to be reality, cases cited, and backed by black letter law—but how it applies to your case may vary. If the President goes through with this, there will be legal “hell to pay,” that’s for sure.

Update (3/24/25) - The sequel to this piece if you want to read more. Other updates at the end of the article.

At the heart of the law is the idea of a contract: an exchange of value between two parties under terms both agree to. It’s as old as civilization itself. Contracts can be explicit or implicit, written or oral.

But here’s the thing that makes contracts matter: Legal enforcement.

When you violate a contract, that’s called a breach. A breach typically voids the contract—or, at minimum, makes it unenforceable in court.

Enter the Orangutan—the 47th Orange Orangutan Asshole of the United States.

Here’s the thing, Orangutan: I have a contract. So do millions of student loan borrowers. We signed Master Promissory Notes—legal documents enforceable under U.S. law.

I get it. In the world of “Trump” (Mr. “I built a very good business ripping people off and going bankrupt every 19 seconds,”) a contract is just toilet paper. You don’t follow them. You don’t honor them. You don’t give two flips about them. But this isn’t one of your sleazy real estate deals. This is federal law. Millions of contracts. And you just tore them all up with your sharpie and MAGA bullshit.

You've invalidated the contracts by moving student loans to agencies like the SBA or HHS, agencies with no legal authority to hold or enforce them. You’ve breached the agreement the U.S. Government made with its citizens. At the simplest level, you are attempting to renegotiate contracts without a negotiation. That may be how it works in “Trumpbullshitland,” but that’s not how it works in the rest of the land.

So guess what?

You breached, asshole. It’s lawsuit time or contract recision time; your choice!

Go through with this plan, and you’ve made every student loan in the country legally unenforceable. Student loan debt forgiveness for every contract ever signed. Full fucking stop. Forget Public Service. Forget IDR. Done. Every contract is invalidated.

Let me be clear: This is not legal advice. Like all things with the Orangutan, we need to see the details before the legal challenges begin. But on its face, this appears to be an unprecedented, system-wide breach of the Master Promissory Note—every single one of them.

Pacta Sunt Servanda...

I know the Orangutan doesn’t know Latin—hell, the man barely speaks English—but all of you, dear readers, are about to learn what that means.

Let’s dig in.

Agreements must be kept.

Let’s talk about how the student loan process works—because this isn’t some handshake deal over a lunch tab. This is a formalized, legally binding system with carefully constructed contracts, federal statutes, and strict enforcement mechanisms.

It all begins with the Master Promissory Note, or MPN. Every federal student loan borrower signs one. It’s not optional. Without it, you don’t get a dime in federal aid. It’s a contract between you and the U.S. Department of Education. Not the Small Business Administration. Not Health and Human Services. Education.

The MPN spells out the terms:

How interest accrues

What repayment looks like

Your deferment and forbearance rights

What happens if you default

And critically, who owns and services the loan

You agree to repay the loan under specific conditions. In exchange, the Department of Education agrees to disburse the funds, maintain servicing standards, and follow the law under the Higher Education Act of 1965.

Those terms are not flexible. They’re not vague. They’re not “up for reassignment” to whichever federal agency a rogue president feels like tossing them to this week.

The MPN allows your loan to be transferred between servicers—companies like MOHELA, Nelnet, Aidvantage—but those are just contracted agents of the Department of Education, not owners. You can't be assigned to a totally different federal agency that has no statutory authority under the Higher Education Act. That would be like your mortgage getting transferred to the Parks Department.

If you suddenly find your loan managed by an agency not named in your contract, not authorized by Congress, and not subject to the same legal compliance regime, guess what?

That’s a breach. A big one.

And in contract law, a breach that goes to the heart of the agreement—like changing the party responsible for enforcement or management—is what courts call a material breach. That means the contract is no longer valid. And if it’s not valid, they can’t enforce it.

So yes, if Trump goes through with this, we’re talking about millions of legally unenforceable loans. Essentially, “loan forgiveness” for every student who ever signed the MPN, now, today, yesterday, and in the future. The government would lose its legal standing to collect. Servicers would be stuck in limbo. Every borrower would have a legitimate argument that the contract they signed is no longer binding—because the government breached first. And abrogation of responsibilities of a loan originator typically gives rise to making the entire debt unenforceable.

This isn’t just bad policy. It’s contractual suicide.

And that’s the funny part. Trump may have just accidentally forgiven the entire student loan system. Not through legislation. Not through executive mercy. But through everything, the Orangutan does, pure incompetence.

So let’s keep going. Let’s look at what the MPNs say—and why the SBA can’t legally enforce them no matter how much the Orangutan wants to play musical chairs with federal agencies.

What the MPNs “Say”

I realize most students never read anything. I did.

The devil isn’t just in the details—the details are the contract.

For a while, I worked at a law firm that specialized in litigation around financial contracts. The kind of place where the difference between “shall” and “may” could mean millions. In that world, the language isn’t decoration—it’s doctrine. What a contract states are the terms. Period.

Justice Alito doesn’t get to pull out a cookbook from 932 BC and say,

“Well it says here that contracts mean whatever the orange asshole says they mean.”

If they do that—if the courts go along with this—then the entirety of Western jurisprudence literally goes out the fucking window. Centuries of common law, contract law, and constitutional protections tossed aside because one orange guy is too dumb, lazy, or reckless to understand the basics of legal enforcement.

You can’t freelance this. You can’t just “reinterpret” the terms. There is over 200 years of American contract law, and another 500 years of English contract tradition that ours is built on.

And all of it agrees on one thing:

The terms of the contract are the terms of the contract. Full stop. Mic drop.

So now that we’ve cleared that up, let’s take a look at the actual student loan contracts—the Master Promissory Notes (MPNs)—and what they say. Because Trump just blew through them like they were printed on diner napkins, it will cost the government everything (or America is irretrievably broken.)

The Master Promissory Note—the MPN—is the legal spine of the federal student loan system. It's not fluff. It's not optional. It's a binding contract enforceable under federal law. And if you’ve ever taken out a federal student loan, you’ve signed one—whether you remember it or not.

So, let’s go straight to the source.

Here’s a key clause from a standard Direct Loan MPN, used for decades:

“I understand that the U.S. Department of Education may transfer my loan to another servicer without my consent.”

Let’s pause there.

Servicer. Not agency. Not new department. Not “whatever federal office happens to exist after Trump’s latest tantrum.”

A servicer is a private contractor—like MOHELA, Aidvantage, or Nelnet—who collects payments, answers your questions, sends you threatening letters when you forget a bill, etc.

But here’s what the MPN doesn’t say:

It doesn’t say the Department of Education can reassign your loan to the Small Business Administration, or to Health and Human Services, or to Space Force or the Department of Agriculture or the Trump Organization.

Why?

Because those entities are not authorized by law to own, manage, or enforce federal student loans. The Higher Education Act of 1965 gives that power exclusively to the Secretary of Education—and only the Secretary, or their lawful agents, can administer your loan.

Here’s another clause from the MPN:

“I promise to repay to the U.S. Department of Education all loans made under the terms of this MPN.”

That’s not ambiguous.

You didn’t agree to repay SBA.

You didn’t agree to repay HHS.

You didn’t sign a contract with a vague “federal government” umbrella.

You signed with EDUCATION—capital E, capital Department of.

Any change to the party that holds and enforces your loan without your consent—especially to a party not named or empowered under federal statute—is not just a bureaucratic shuffle.

It’s a material breach of contract.

That’s not a conspiracy theory. That’s Contract Law 101.

If you took out a car loan and your lender suddenly said, “We sold your debt to the local animal control office,” you’d laugh. Because that office has no authority to hold or enforce financial instruments. And more importantly, that wasn’t a term you and the lender agreed to.

Now—sometimes, contracts do allow for assignment. Sometimes they do include survivability clauses. Sometimes they do spell out how the parties can change, or how the obligations can be transferred. That’s normal. For example, your mortgage? That contract usually includes commoditization and resale rights. It’s built to be sold between banks or bundled into securities. That’s part of the deal.

But you know what you don’t agree to?

You don’t agree that the next bank in line can say,

“Well, the interest rate is now 920%. Sure, it was 4% before, but screw that—pay me 920%.”

Contract language matters. If the agreement allows one party to assign or alter terms, it has to say that. Explicitly. If the agreement allows for a change in the payment structure, it has to say that. Explicitly.

And that’s the point: That’s not what happened here.

You made a deal with the government. A specific department. Under specific statutory authority. The MPN doesn’t say, “We can sell this debt to the butcher, the baker, or the local animal control office.” The same logic applies here. You cannot reassign legal obligations to a party without the right to enforce them, and even if you can, you cannot change the terms of the loan without renegotiating the contract itself.

And no, the President can’t just wave his orange hand and magically transfer entire financial systems across federal agencies like he’s playing Monopoly with real people’s lives.

That’s not how contracts work.

That’s not how the law works.

That’s not how any of this works.

So let’s be blunt:

If Trump goes through with this announcement—and if student loans are reassigned to the SBA, HHS, or anyone other than the Department of Education—then every borrower in America has the beginnings of a powerful legal defense:

“This loan is no longer enforceable. It is void. The contract was breached—by the government—and is now legally worthless. I don’t owe you doodly-ass dick. And if you come after me? I have the right to sue your ass and collect attorney’s fees while I’m at it.”

And in that moment, the so-called “deal maker” will have done what no president before him could do—not Biden, not Obama, not even Sanders:

He will have broken the student loan system. With a Sharpie and a smirk.

This is not “rage posting.” This is “the law.”

Let’s talk about why this isn’t just some wackadoo posting internet tantrums with extra sarcasm (not that I’m not damn good at that shit, I am. But there is a real problem and argument here.)

This is a legitimate legal basis for claiming these contracts are now void—and possibly for striking down the entire enforcement regime if Trump goes through with his idiotic plan.

Here’s why:

Contracts Are Enforceable Only If They’re Followed (Pacta Sunt Sevanda)

It sounds obvious, but it matters: A contract is only enforceable if both sides uphold their obligations.

When the government agreed to lend you money, it did so under the terms of the Master Promissory Note (MPN)—a binding contract that specifies who the lender is (the U.S. Department of Education), who manages the loan, how repayment works, and under what legal authority it’s all handled.

If the government violates that agreement—by assigning your loan to an agency not named or authorized in the MPN—it is engaging in a material breach of contract.

And in contract law? A material breach kills enforceability. Not just kills it, it effectively ends the contract, and the breach provides remedies for the “victim,” of the breach to be made whole. In this case, the recission (ending the contract) is the remedy.If the government persists, then enforcement of the rights under the contract also have legal consequences.

Federal Agencies Can’t Enforce What Congress Has Not Granted Authority Over

Let’s be crystal clear: The Small Business Administration and the Department of Health and Human Services have no statutory, inherent, or apparent authority to hold or enforce federal student loans. It’s as fucking stupid as the hypothetical I said before of getting a car loan and having then the local animal shelter attempt to collect it.

Student loan origination authority lies exclusively with the Department of Education, under the Higher Education Act of 1965.

If an agency without that authority tries to collect on your loan?

They lack standing in court.

They can’t legally garnish your wages or take your tax refund.

Any enforcement action they take is ultra vires—beyond their legal power—and can be challenged and stopped.

And if they try it anyway? That’s where things get spicy...

“SUE THE MOTHERFUCKERS!”

Yes, Trump’s favorite tactic. Act like an ass, pay nobody, and either wait to be sued and grind them down, or alternatively, sue the guy and make them bleed. It’s Trumpland 101. Sue the motherfuckers! He may be best known for “You’re fired,” but the “Trump way” is either suing people, or dodging litigation.

Well, “dodge this”: “Ever heard of the Tucker Act?”

Let’s say it louder for the people in the back—and the ones in the SBA who just got handed a portfolio they legally can’t touch:

You can sue the federal government for breach of contract. And “sovereign immunity” doesn’t stop us from suing for contractual remedies, only as a shield against tort liability claims.

The federal government doesn’t get a free pass just because it’s the government. It doesn’t get to say, “Oops, we broke our agreement, but too bad, peasant!” (as the Orangutan loves to do in Mr. “I built a very good business,” Trumpbullshitland.) That’s not how the law works. That’s not how due process works. That’s not how contract enforcement works.

The legal mechanism that makes this possible?

The Tucker Act (28 U.S.C. § 1491)

Passed in 1887, the Tucker Act gives individuals the right to sue the United States for breach of contract—including financial agreements like federal student loans. It waives the government’s sovereign immunity when it enters into a contract, which means the government can be sued like any other party when it breaks its promises.

The Tucker Act is clear: you can sue if the government signs a contract and then breaches it. Sovereign immunity applies to tortious liability only, not contractual liability. Full stop.

And yes, that includes your Master Promissory Note.

What the Tucker Act Covers:

Express or implied contracts with the U.S. Government

Claims founded on statutes, regulations, or the Constitution

Claims for monetary damages exceeding $10,000

And yes—violations of loan contracts administered by federal agencies

So if the Trump administration moves your loan from the Department of Education to, say, the SBA—an agency that:

Isn’t a party to the contract

Lacks statutory authority to enforce it

Was never mentioned in the MPN

...that’s a textbook breach, and the Tucker Act gives you standing to sue the federal government for that breach in the U.S. Court of Federal Claims.

“But can I win?”

Under the Tucker Act? Yes, I’d argue. If the contract was breached and you suffered financial or procedural harm, I assert that the parties have a viable claim (at least one that survives a motion to dismiss or summary judgment.)

Even better? When combined with the Equal Access to Justice Act (which I will describe below), if the government’s position is found to be unreasonable or not “substantially justified,” they have to pay your legal fees.

Trump breaks the contract. You sue. They lose. They pay.

So to recap:

The MPN is a contract.

The government can be sued for breaching that contract.

The Tucker Act gives you that right.

The Equal Access to Justice Act may make the government pay your legal bills too.

This isn’t a hypothetical. This is settled law, and it’s sitting there like a ticking time bomb under the entire student loan system if Trump goes through with this nonsense. Now, let’s discuss the next idea, attorney’s fees (hey “Clique” lawyers, get your pencils out, this is the biggest payday since “Tobacky.”)

Plaintiffs Are Likely Entitled to Attorney’s Fees

This is where the Equal Access to Justice Act (EAJA) comes in.

Under 28 U.S.C. § 2412, the government's position was not substantially justified if you sue the federal government (or successfully defend against their improper enforcement), plaintiffs can recover legal fees if their net worth is under $2 million.

So if some Trump-appointed clown at SBA or HHS tries to come after you for a loan, they don’t have legal authority to enforce?

You can not only shut them down—you can get paid for your time.

Courts Have Tossed Out Debts for Far Less

There’s already a mountain of legal precedent in the private sector where courts have dismissed debt collection suits because:

The wrong party was trying to collect

The chain of title was broken

The assignment paperwork was missing or defective

The collector couldn’t prove legal standing

If that happens in the private sector over a $2,000 credit card, imagine what happens when the federal government violates the loan contract with 40+ million borrowers.

This isn’t some fringe legal argument.

This is Contract Law 101. This is literally black letter law. This isn’t some novel idea.

Mortgage banks got their asses handed to them for this type of behavior.

(In my best “John Houseman” impression)

Do you have your contract? Meester HAAAAAAAAAART? No contract? Then you cannot expect us to listen to your drivel about what you think you…are… OWED.

Do you think this is just some clever legal theory? Some fringe academic take?

Ask the mortgage industry. Ask the debt buyers. Ask the banks that tried to foreclose on homes when they couldn’t prove they owned the loan.

The courts have been slamming lenders for this exact crap for over a decade.

Remember the fallout from 2008? The foreclosure crisis? Millions of loans got sliced, diced, repackaged, and shipped off like frozen pizzas—only for servicers to show up later with garbage paperwork and say, “Yeah, we totally own your mortgage now, pay us.”

And what did the courts say?

“Where’s the contract?”

“Where’s the assignment?”

“Prove you have the legal right to enforce this.”

And if they couldn’t? Case dismissed. Foreclosure denied. Sometimes, damages are awarded. Contracts ended. Sometimes, debtors get paid for harassment by the alleged “lender.”

There’s an entire body of case law now where judges have told servicers, banks, and third-party collectors:

“If you can’t prove legal ownership of the debt, you can’t collect it.”

Sound familiar?

It should. Trump’s plan is doing the exact same thing—but on a massive, federal scale: taking student loans legally held by the Department of Education and tossing them over to agencies with zero legal authority to enforce them.

In the mortgage world, we called this “broken chain of title.” In the student loan world, we call this “breach of contract.”Same principle. Same outcome.

A few real-world parallels:

Bank of America v. Bassman FBT, L.L.C. (Illinois Appellate Court, 2012)

→ Dismissed because the bank couldn’t prove it held the loan.U.S. Bank v. Ibanez (Massachusetts Supreme Court, 2011)

→ Foreclosures voided because the bank couldn’t show proper assignment.In re Veal (Bankruptcy Appellate Panel, 9th Cir. 2011)

→ Debt enforcement was blocked due to failure to prove ownership.

In all these cases, the rule was simple: No legal standing = No enforcement.

That same hammer is sitting there—ready to drop—if this administration tries to offload 40 million student loans to agencies that were never part of the contract, never authorized by law, and have no business holding your debt.

The Orange Orangutan May Have Just Done the One Noble Thing—By Accident

So here we are. After decades of hand-wringing, political theater, and endless debates about whether student loans should be forgiven, Donald Trump—the man who bankrupts casinos and stiffed plumbers—may have accidentally done it for us.

Not out of principle. Not out of compassion. Not out of some high-minded economic philosophy. But out of sheer ignorance and raw contempt for institutions, law, and the idea that agreements should mean anything.

He broke the system—not to liberate us, but to serve himself. And in doing so, he may have finally handed student loan borrowers the most powerful legal weapon imaginable: a breached contract.

This isn’t some clever workaround. It’s not a loophole. It’s a fundamental rule:

When you break the contract, you lose the right to enforce it.

If the Department of Education no longer holds the loan, the contracts collapse if they are handed to an unauthorized agency with no statutory power.

Game over.

So what now?

Every borrower in America should start reading their MPN.

Every lawyer worth their bar card should be prepping for class action discovery.

And every federal agency with a sudden dump of student loan files in their inbox should be calling their general counsel in a cold sweat.

Because here’s the thing Trump doesn’t understand:

We read the contract. (Well, I did, now you know it too.)

And I intend to enforce it.

Not with guns. Not with slogans. But with the thing that terrifies the Orangutan most: the rule of law.

Postscript: What You Should Do Right Now

✅ Download your MPN from StudentAid.gov — if it’s gone, document that. Screenshot everything.

✅ Email your servicer and request a copy of your original, signed Master Promissory Note. By law, they have to have one. They don’t? See the final idea below.

✅ File a Privacy Act request with the Department of Education for your entire loan file.

✅ Lawyer up if any agency besides the Department of Education attempts to collect from you. Trust me; lawyers will be looking for clients for this one.

✅ If you’re a lawyer, this is your “tobacco moment.” The class actions write themselves. Do I have to draw you a map?

And most importantly?

No note. No contract. No enforcement. Get out of court. Game over.

The Orange Orangutan outdid himself on this one. Truly.

UPDATE (3/22/2025):

So, two things: One, many of you are fans of Orangutans. Okay, whatever. I’ll find another nickname.

Second, I beat nearly everyone to the punch on this by a few hours, and thus far, I’m the only one to explain in detail why this is nuts.

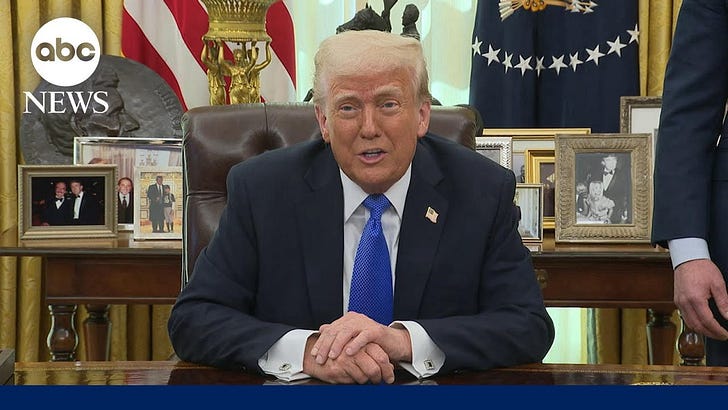

However… here’s a quote from an article from ABC News…

No kidding.

Yes, because as I’ve explained now… IDR, percentage repayment, how much it can be, is also spelled out in your MPN. They can’t just change the terms. It’s both statutory and contractual.

Reported by The Hill:

The SBA is cutting its workforce by nearly half. Really? You just got 40 million loans plopped into your lap. Is this the time to cut?

That said…

The Holes in My Argument I Did Consider (But Why the Outcome Will Still Be Bullshit)

A few folks asked: Where are the weaknesses in this argument?

Some of you even asked the law firm of ChatGPT & Associates. Fair enough.

I did consider the problems. While this piece was written to be a little provocative, I think it’s on serious legal ground. That said, I might’ve been born at night — but it wasn’t last night. I fully expect the Supremes to put the pin back in the grenade. I don’t expect that suddenly 40 million loans will become unenforceable.

Here’s why:

Legally, the case is solid. If you sign a contract with the Department of Education, and the government later tries to hand that contract off to the SBA or HHS without your consent, that’s a textbook violation of:

Due Process (Fifth Amendment)

The Administrative Procedure Act (APA)

Contract enforcement norms

You can’t just swap out the lender and pretend the agreement still holds. That’s not how contracts work — not in private law, and not in public law. There’s no statutory authority for these assignments. There’s no valid enforcement chain. And federal courts should be tripping over themselves to block this on basic rule-of-law grounds.

So What’s the Hole?

👉 The Supreme Court.

That’s it. The biggest risk to my argument isn’t legal — it’s institutional self-preservation in a judicial robe. I fully expect SCOTUS to swoop in and say, “The President can’t do that. The reorganization is invalid. We’re back to how it was.”

They won’t address the contract.

They won’t address standing.

They won’t address borrower rights.

They’ll just reset the chessboard and pretend nothing happened.

And yes — that’ll technically kill the theory. But it won’t be because the argument failed. It’ll be because the Court decided the rule of law is secondary to preserving institutional order and federal enforceability.

Rule of law once again takes another unqualified blow to the marbles.

Which is ironic. Because the only real legal question is:

Do contracts with the government still mean anything?

If the answer is no, the loans should be void.

If the answer is yes, then only ED can enforce them.

Either way, they’ll find a way to dodge it — and call it constitutional.

“But Can’t Congress Just Pass a Law?”

Nope. Congress can’t fix this retroactively.

They may try — I hear GOPers already getting all giddy about screwing everyone over and ramming through more legislation that Schumer will absolutely bend over for.

But…

They can’t rewrite the terms of a private contract after the fact and pretend it was always enforceable by someone else. That would violate:

Due Process

The Constitution’s protections against arbitrary interference with existing legal obligations

Even if they pass a law saying “SBA can now enforce these loans,” it doesn’t rewrite the Master Promissory Note you signed with ED. Contracts don’t work that way. The borrower didn’t agree to those new terms — and Congress doesn’t get to just say, “Well, now you do.”

Nothing in the Constitution says, “The U.S. Government can just do whatever it wants and bend everyone over.”

Quite the opposite, actually.

And nothing in contract law allows one party to unilaterally rewrite terms either.

“But It’s All the Same Government!”

Some of you are trying to argue what’s known as Implied Sovereign Substitution — though you're not calling it that.

The argument goes: “Uncle Sam is Uncle Sam, doesn’t matter if it’s ED, SBA, ABC, QRS, IRS, or the Park Service…”

That’s ridiculous.

Of course it matters. It matters under federal law, and it matters under contract law. The creditor isn’t “The Government™” in some abstract sense. It’s the specific legal entity named in the contract.

Now yes, the Supremes could (unlawfully) exploit this and say:

“The creditor was always the U.S. Government, and ED was simply its agent.”

But to do that, they’d have to invent new law — and that’s the point. There is no precedent for a unilateral executive branch restructuring of binding legal obligations with no statutory foundation. And trying to fix it after the fact is equally absurd.

Is it “ex post facto”? Technically no — that’s limited to criminal law.

But it is a violation of:

Due Process

The Contracts Clause (Article I, Section 10)

Courts have repeatedly ruled that Congress cannot retroactively impair or rewrite private contractual obligations unless there’s a compelling national interest — and even then, the fix has to be narrow, specific, and not self-dealing.

And let’s be clear: if Congress tries this, the “public interest” test gets obliterated — because it directly benefits states and their agents (like MOHELA) and financially benefits federal agencies (like SBA). That destroys any claim of neutrality or public good.

Whether SCOTUS would accept that argument — in other words, whether they’ll actually apply the law — remains to be seen.

It’s Also a Takings Issue

This is a taking without compensation and without notice.

The government would be seizing the borrower’s obligation — the right to collect and the right to enforce — and handing it to another entity. That’s a transfer of economic value.

Under any fair reading, that’s a taking.

And under the Fifth Amendment, takings require just compensation.

In contract terms: if you’re going to renegotiate, you need new consideration.

You can’t just unilaterally alter the deal.

And Don’t Forget Standing

Even if Congress tries to rewrite the law — standing still exists.

The new agency still has to show it has the legal right to enforce the contract. Given that the MPNs are between the borrower and the ED… good luck with that.

You can’t just wish standing into existence with a statute.

In the End…

I expect Roberts to stand up there — with the same dead-eyed sincerity he had when he said the President can unilaterally kill his enemies, his opponents, or a U.S. citizen abroad, all without consequence (immunity even)— and say:

“I looked to the law and found this too legit to quit.”

Whatever.

ONE LAST POINT (AND IT’S IMPORTANT)

DO NOT — I REPEAT, DO NOT — take this article as a reason to default, stop paying, or ignore student loans.

I don’t think I can say this loudly enough.

Student loans are federal debts. Choosing not to pay will almost certainly trigger default. That comes with serious, long-term consequences — wage garnishment, damaged credit, collections, and more.

DO NOT JUST STOP PAYING.

As I said earlier: get your paperwork. Talk to a lawyer. If lawsuits start to emerge, then evaluate whether you want to participate. But that’s a legal process — not a unilateral decision to walk away from a loan just because you read a compelling Substack post.

Even in standard contract law, you can’t just stop performing because the other party breaches. You go to court. You get a ruling. You handle it legally.

You can’t say: “Well, this article made a lot of sense… so screw it, I’m done.”

That’s not how any of this works.

I am not advocating default, nonpayment, or protest.

I’m raising a legal question — one that may become relevant if courts intervene.

Until then: don’t do anything stupid. Handle it the right way. Or you’ll get crushed.

If you found this useful, this is just the beginning. The Long Memo exists to decode precisely this kind of institutional fuckery—where power bends the rules and bets you won’t read the fine print. I do. And I write to help you fight back.

This post is free because everyone needs to understand what just happened. But if you want to stay ahead of the next breach, the next lie, and the next loophole disguised as policy? 👉 Subscribe here. Free & Paid options are available. Because the contract says what it says. And I’ll keep reading it—for all of us.

New update for those interested:

https://www.thelongmemo.com/p/is-every-student-loan-about-to-be

As I started to read I was suspicious but then I smirked. I like this. Made my day!