The app for independent voices

Debits vs Credits Cheat Sheet

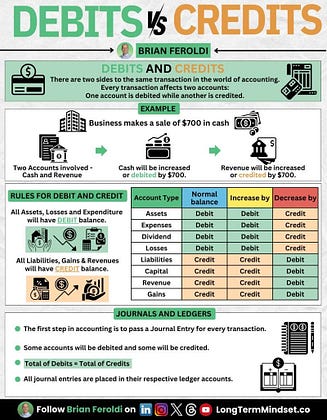

If you want to undersatnd accounting, you must know debits and credits work.

Here's a simplified breakdown:

Account Types and Their Normal Balances:

💰 Assets: Debit (Increased by Debit, Decreased by Credit)

💸 Expenses: Debit (Increased by Debit, Decreased by Credit)

📈 Dividend: Debit (Increased by Debit, Decreased by Credit)

📉 Losses: Debit (Increased by Debit, Decreased by Credit)

📊 Liabilities: Credit (Increased by Credit, Decreased by Debit)

💼 Capital: Credit (Increased by Credit, Decreased by Debit)

💵 Revenue: Credit (Increased by Credit, Decreased by Debit)

📈 Gains: Credit (Increased by Credit, Decreased by Debit)

Key Points to Remember:

• All Assets, Losses, and Expenditure accounts will have a Debit balance.

• All Liabilities, Gains, and Revenues accounts will have a Credit balance.

• All journal entries are placed in their respective ledger accounts.

• The first step in accounting is to pass a Journal Entry for every transaction.

• Some accounts will be debited and some will be credited.

Example:

In accounting, every transaction affects two accounts:

• Business makes a sale of $700 in cash

• Cash account is increased (debited) by $700.

• Revenue account is increased (credited) by $700.

***

Want an eBook of my most popular accounting infographics? Grab it here (free):

→