The app for independent voices

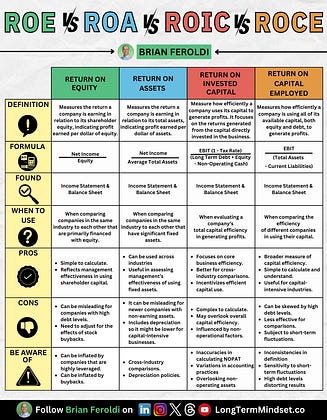

ROE vs ROA vs ROIC vs ROCE

What's the difference?

RETURN ON EQUITY (ROE)

DEFINITION:

Measures the return a company is earning in relation to its shareholder equity, indicating profit earned per dollar of equity.

FORMULA:

Net Income / Equity

WHEN TO USE:

When comparing companies in the same industry to each other that are primarily financed with equity.

PROS:

- Simple to calculate.

- Reflects management effectiveness in using shareholder capital.

CONS:

- Can be misleading for companies with high debt levels.

- Need to adjust for the effects of stock buybacks.

BE AWARE OF:

- Can be inflated by companies that are highly leveraged.

- Can be inflated by buybacks.

RETURN ON ASSETS (ROA)

DEFINITION:

Measures the return a company is earning in relation to its total assets, indicating profit earned per dollar of assets.

FORMULA:

Net Income / Average Total Assets

WHEN TO USE:

When comparing companies in the same industry to each other that have significant fixed assets.

PROS:

- Can be used across industries

- Useful in assessing management’s effectiveness of using fixed assets.

CONS:

- It can be misleading for newer companies with non-earning assets.

- Includes depreciation so it might be lower for capital-intensive businesses.

BE AWARE OF:

- Cross-industry comparisons.

- Depreciation policies.

RETURN ON INVESTED CAPITAL (ROIC)

DEFINITION:

Measure how efficiently a company uses its capital to generate profits. It focuses on the returns generated from the capital directly invested in the business.

FORMULA:

EBIT (1-tax) / (Long Term Debt + Equity - Non-Operating Cash)

WHEN TO USE:

When evaluating a company’s total capital efficiency in generating profits.

PROS:

-Focuses on core business efficiency.

- Better for cross-industry comparisons.

CONS:

- Complex to calculate.

- May overlook overall capital efficiency.

BE AWARE OF:

- Inaccuracies in calculating NOPAT

- Variations in accounting practices

RETURN ON CAPITAL EMPLOYED (ROCE)

DEFINITION:

Measures how efficiently a company is using all of its available capital, both equity and debt, to generate profits.

FORMULA

EBIT / (Long Term Debt + Equity)

WHEN TO USE:

When comparing the efficiency of different companies in using their capital.

PROS:

- Broader measure of capital efficiency.

- Simple to calculate and understand.

CONS:

- Can be skewed by high debt levels.

- Less effective for comparisons.

BE AWARE OF:

- Inconsistencies in definition

-Sensitivity to short-term fluctuations

***

Want an eBook of my most popular accounting infographics? Grab it here (free):