The app for independent voices

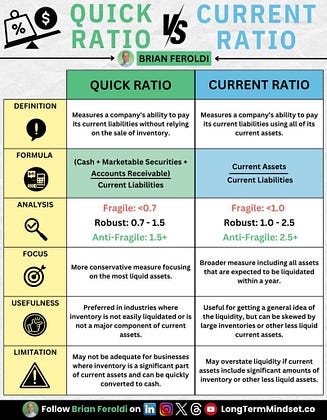

Quick Ratio vs. Current Ratio 📊

What's the difference?

QUICK RATIO:

Definition:

Measures a company’s ability to pay its current liabilities without relying on the sale of inventory.

Formula:

(Cash + Marketable Securities + Accounts Receivable) / Current Liabilities

Analysis:

- Fragile: <0.7

- Robust: 0.7 - 1.5

- Anti-Fragile: 1.5+

Focus:

More conservative measure focusing on the most liquid assets.

Usefulness:

- Preferred in industries where inventory is not easily liquidated or is not a major component of current assets.

Limitation:

- May not be adequate for businesses where inventory is a significant part of current assets and can be quickly converted to cash.

CURRENT RATIO:

Definition:

- Measures a company’s ability to pay its current liabilities with all of its current assets.

Formula:

Current Assets / Current Liabilities

Analysis:

- Fragile: <0.1

- Robust: 1.0 - 2.5

- Anti-Fragile: 2.5+

Focus:

- Broader measure including all assets that are expected to be liquidated within a year.

Usefulness:

- Useful for getting a general idea of the liquidity, but can be skewed by large inventories or other less liquid current assets.

Limitation:

- May overstate liquidity if current assets include significant amounts of inventory or other less liquid assets.

Was anything confusing? Please let me know below. I'll be happy to explain further.

***

Want an eBook of my most popular accounting infographics? Grab it here (free):