Note

The app for independent voices

You made it, you own it

You always own your intellectual property, mailing list, and subscriber payments. With full editorial control and no gatekeepers, you can do the work you most believe in.

Great discussions

Join the most interesting and insightful discussions.

sometimes i wonder how many versions of myself i’ve outgrown without even noticing. i look back at old photos and remember the thoughts i used to carry, the dreams i thought would save me. it’s strange how you can live inside yourself every day and still not realize you’re evolving. it’s only when you look back that you realize how far you’ve come, how many lives you’ve already lived in the same skin.

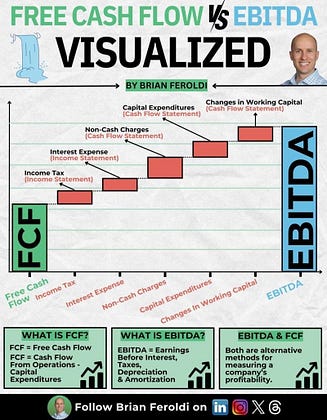

EBITDA is not Free Cash Flow.

Here's why:

1. Working capital changes impact cash flow, not EBITDA.

2. Interest expense impacts cash flow, not EBITDA.

3. Taxes impact cash flow, not EBITDA.

4. Capital Expenditures impacts cash flow, not EBITDA.

FCF tells you how much a company EARNS after all expenses, which is more reliable.

💰 FCF

Stands for Free Cash Flow

It is the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets.

💰 EBITDA

Stands for: Earnings Before Interest, Taxes, Depreciation, and Amortization

It is often used to evaluate a company's operating performance. It focuses on the business's core operations, excluding the effects of financing and accounting decisions.

💡PURPOSE

→ FCF: reveals how much cash is available for dividends, debt repayment, and reinvestment after covering all expenses, including CapEx.

→ EBITDA: provides a view of a company's operational efficiency by excluding non-operating expenses.

🎢 USAGE

→ FCF is crucial for assessing a company's ability to generate cash and fund growth, repurchase stock, pay dividends, and reduce debt.

→ EBITDA is often used by investors to compare companies within the same industry without the effects of financing and accounting decisions.

🔢 CALCULATION

FCF

➡ Cash Flow From Operations - Capital Expenditures

EBITDA

➡ Operating Income + Depreciation + Amortization

Each metric serves a unique purpose in financial analysis, and each offers valuable insights for investors, managers, and stakeholders.

Was this explanation helpful?

***

Want an eBook of my most popular accounting infographics? Grab it here (free):