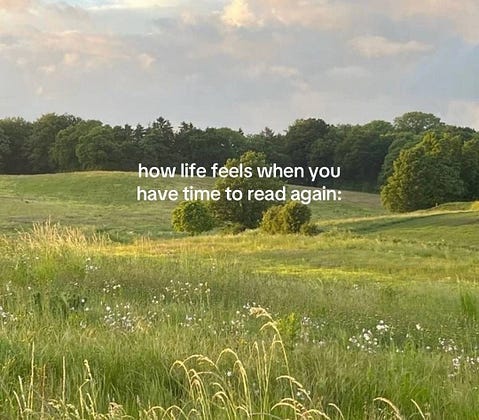

When my needs go unmet,

I’m reminded: God didn’t design a person, place, or title to fulfill me.

He designed my soul to need Jesus.

So if you’re discouraged today by unmet needs,

Maybe you’re not being punished—maybe you’re being invited.

Invited to need the only One who never fails.

If that’s you—

You need to meet my Jesus.