The app for independent voices

Dear friends of NFTBC!

A quick note about WPP following some news developments over the weekend. With the intention of not making my deep dive longer or more boring than necessary, I neglected to mention that WPP retains a 40% stake in market research firm Kantar, having sold the other 60% to Bain five years ago. Bain, being a private equity firm, levered Kantar up as part of the original arrangement - so WPP’s 40% stake came from minimal equity investment.

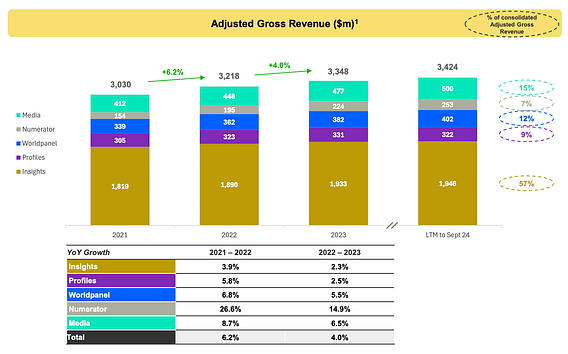

Over the weekend the FT reported that Bain and WPP are considering breaking up Kantar rather than doing an IPO, while Sky News reported that they’re considering selling Kantar’s Numerator business for £5bn+. With that in mind, I tweeted earlier:

Sky News reporting Kantar looking to sell Numerator + Worldpanel at £5bn valuation- seems unlikely at 10x revenue. But $5bn could make sense (typo?). Having already agreed Media sale at $1bn (2x), they could likely get >$2.3bn for the rest (1x). Net debt $4.4bn. WPP owns 40% of equity. Quite a bit of value in there - irrespective of how it’s released.

All things told, probably within the next 1-2 years WPP could have in the order of £900m of excess cash on a post-tax basis available for distribution to shareholders, amounting to around 13% of the current market cap. Going on past form, such a shareholder return would be via a buy back. While I don’t think WPP shares will really get going unless/until they start showing more visible business momentum, a shareholder return of this nature could be quite potent.

All the best,

Crashkolnikov