Macroeconomics: The belief that r* is elevated because right now expansionary fiscal policy is stimulating the economy and so boosting economic growth makes no sense! Remember to take appropriate derivatives!:

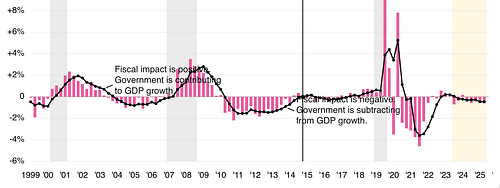

Eli Asdourian, Georgia Nabors, Lorae Stojanovic, & Louise Sheiner: Federal, State & Local Fiscal Policy & the Economy: ‘Fiscal policy increased U.S. GDP growth by less than 0.1 percentage point in the first quarter of 2024, the Hutchins Center Fiscal Impact Measure (FIM) shows. The FIM translates changes in taxes and spending at federal, state, and local levels into changes in aggregate demand, illustrating the effect of fiscal policy on real GDP growth. GDP increased at an annual rate of 1.4% in the first quarter of 2024, according to the government’s latest estimate. A decline in tax collections since 2022 and the increase in investment from the Inflation Reduction Act and Chips Act (which we include as negative taxes) increased the FIM by 0.6 percentage point in the first quarter. This was offset by the waning effects of pandemic-era transfers and subsidies, which decreased the FIM by 0.6 percentage point… <brookings.edu/articles/…>

If you want to believe that r* today is higher than the very low values it was stuck at for the entire decade of the 2010s, you need to find another, different argument. Once such argument is that the growing stock of safe national debt issued by nations with exorbitant privilege has finally repaired the global safe-asset shortage. Another is that the industrial transformation subsidies now in train are uniquely effective in having strong multiplier-accelerator effects in boosting investment. A third is—there is no third.