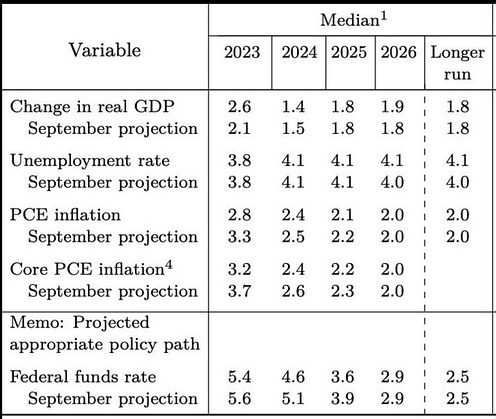

Economics: Monetary Policy: The median FOMC participant’s estimate of the neutral FF rate is now 3.0%/year, up from 2.9%/year. And there is one dissent from the Federal Reserve’s cutting its FF target from 4.5%-4.75%/year to 4.25%-4.5%/year: Beth Hammack, Cleveland Fed Bank President, attending her second FOMC meeting. The only difference in the statement boilerplate is that “in considering additional adjustments to the target range…” has been changed to “in considering the extent and timing of additional adjustments to the target range…” And the FOMC expects the FF rate to average 4.125%/year over 2025.

Jason Furman is on Hammack’s side here:

Jason Furman: A year ago the FOMC projected 2024 real GDP growth would be 1.4%, core PCE inflation would be 2.4% and the FFR would end the year at 4.6%.Instead we're set to have ~2.5% GDP growth, ~2.8% core PCE inflation but end the year with the FFR at 4.4%… <threads.net/@jason.furm…>

Me? There are lots of shocks to the economy in the future behind the veil of time and ignorance, and the shocks you are thinking about are unlikely to be the shocks that come. Unless you are close to the ZLB—which we are not—or unless inflation or unemployment are away from targets, policy should be near neutral. That is what “neutral” is for. I could see a Fed wanting the FF rate to be at 3.5%/year average for 2025—half a %-point above neutral. But I cannot follow the logic behind the now very slow pace of anticipated rate cuts.