The app for independent voices

Macroeconomics: I am keeping track of analyses of the macroeconomy that recognize that macroeconomic policy needs to promote not just price stability and full employment but also grease the movement of real relative prices to their proper von Hayek resource allocation signalling values. There are damned few of them. Here is one:

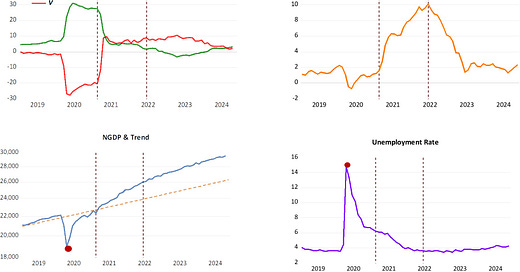

Marcus Nunes: “Inflation & the Macroeconomy”: ‘One effect of the big microeconomic shocks was to significantly disrupt relative prices…. Should the Fed have acted to constrain NGDP [after the plague]? I believe that if the Fed had acted that way, instead of relative prices being “adjusted” by inflation, they would have “adjusted” through a, maybe strong, recession. Inflation would have risen by much less and fallen more swiftly, but unemployment would have lingered much higher. In any case real output would be “stuck” at a significantly lower path!… Sometimes… relative price disruptions can be so large that trying to keep NGDP at the stable path that prevailed before the shock can have significant long term negative consequences. Therefore, there may be situations, hopefully rare, when a higher stable path is desirable…. As to… “why is inflation stuck at 2.5%”, I feel confortable to argue that results from putting a large weight on Owners Equivalent Rent (OER)… an imputed price… no one pays… [that]d suffers from lagged calculations. The Harmonized Index of Consumer Prices (HCPI) differs from the CPI only by not considering OER… [and] has remained very close to the 2% target… <marcusnunes.substack.co…>